Alex Wong

The job report shocker wasn’t as strong as it appeared at first blush. What is clear, of course, is that wage growth is still well above trend, and this will not only push back on calls for rate cuts but, when coupled with the trend in jobs, smells a lot like stagflation.

Overall, the headline nonfarm payroll came in at 216,000, ahead of expectations for 175,000, while unemployment remained unchanged at 3.7% vs. estimates for 3.8%. However, wage growth rose by 0.4% month-over-month vs. estimates of 0.3% and rose by 4.1% year-over-year, hotter than estimates of 3.9%.

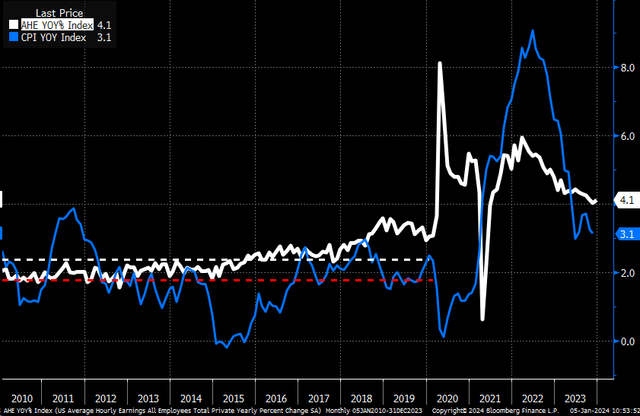

Wage Data Remains Hot

The wage data continues to stick with last month’s theme of the “market,” as in the collective mispricing rate cuts. Wage growth remains too high, inconsistent with a 2% inflation rate. Before the pandemic, CPI averaged 1.8%, while average hourly earnings averaged 2.4%. So, the current wage growth number is significantly higher than the historical average over the last decade. It probably suggests we need to see wage growth return to around 3% to be more consistent with a 2% inflation.

This wage data will make cutting rates in January or March tough for the Fed.

Bloomberg

This creates a huge problem for the Fed because wage growth is not only not coming down, but in December, it accelerated for the third month in a row, after three months of sitting just below 0.3% m/m.

Bloomberg

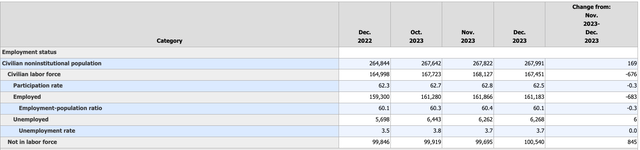

Unemployment Rate Too Low?

The jobs report, specifically the household survey, had many more questions than answers regarding the health of the labor market. Because there’s a lot of noise, and is going to take a look at next month’s report to figure out where any meaningful trends are forming.

The household survey showed that the population grew by 169,000, but the civilian labor force fell by 676,000. Meanwhile, 683,000 people lost jobs in December, with only 6,000 going to the unemployed pool. The other 845,000 people suddenly just left the labor force altogether.

BLS

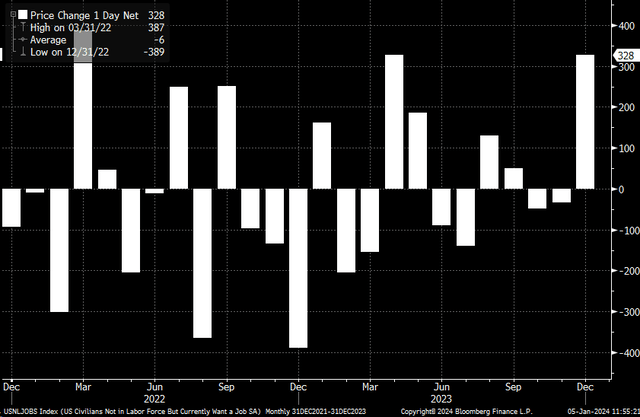

Overall, the number of people not in the labor force has risen by around 5 million since the pandemic’s start but has oscillated since March 2022. However, since August 2023, the number of workers not in the labor force has started to show signs of trending higher. The big question, of course, is whether this number comes back down. Then, all those workers not in the labor force in December suddenly re-enter the labor force in January and go into the employed or unemployed category.

Bloomberg

Surely, an additional 845,000 into the unemployed poll from the not labor force pool would push the number of unemployed workers up to 7.1 million from 6.26 million, and that would push the unemployment rate up to 4.2%. This makes this month’s job number, at least based on the households, seem like a bunch of fuzzy math and raises more questions than answers.

In December, 328,000 workers were counted as not in the labor pool and wanted to work. Add 328,000 to the number of unemployed workers, and it climbs to 6.6 million, an unemployment rate of 3.9%.

Bloomberg

It suggests that the December job report may give a false sense of optimism around the unemployment rate and that the rate may begin to move higher again in January, perhaps as workers return from holiday breaks and become available to work or start to look for work again.

This continues to point to a two-fold problem, the threat of the unemployment rate moving up and sticky inflation, and it seems like the more data pours in, the more the case for stagflation grows stronger. If that remains the case, it means the Fed will be forced to hold rates higher than they will probably want to, and more importantly, it will keep rates on the back of the curve elevated, causing the yield curve to steepen, all while the market is stuck once again repricing Fed rate risk.