Introduction

The U.S. dollar’s reign as the reserve currency of the world could be coming to an end. CryptoSlate’s latest market report explores the de-dollarization of the world to find what role Bitcoin will play in the global economy.

The U.S. dollar has been the chosen medium for international trade and the global reserve currency for 79 years. The Bretton Woods Agreement of 1944 established gold as the basis for the U.S. dollar and pegged other currencies to the dollar’s value.

It was the first time in history that a group of nations negotiated a global monetary order, which proved successful in the years following World War II. The system was secured because the U.S. owned over half of the world’s gold reserves.

However, economic recovery in Europe and Japan decreased the U.S.’s dominance in global trade. In addition, an overvalued dollar caused by inflation and growing public debt pushed the U.S. to suspend the dollar’s convertibility into gold in 1971.

As the dollar’s value was no longer tied to gold, the Federal Reserve was tasked with maintaining the currency’s value. The central bank, however, failed to preserve the dollar’s value and began increasing the money supply, which caused the currency to lose two-thirds of its value in the following decade.

The devaluation of the dollar has continued well into the 21st century.

In 2023, the dollar’s position as the global reserve currency is in jeopardy, And while its dominance over the worldwide market has been shaken in the past, the danger has never been so great.

This report explores the macroeconomic events causing the dollar’s fragility, the consequences of a weak dollar, and Bitcoin’s place in a de-dollarizing global economy.

A hot potato: nobody wants the dollar

The global financial crisis in 2007 exacerbated the growing trend of de-dollarization. In 2007, China launched the China International Payment System (CIPS), which enabled cross-border payments to be settled in yuan. In 2010, China and Russia signed a bilateral currency swap agreement, allowing them to trade in their own currencies.

In 2014, BRICS countries, which include Brazil, Russia, India, China, and South Africa, created the New Development Bank. The novel financial institution was launched to provide alternative sources of financing for developing countries, reducing their dependence on the dollar. In addition, the E.U. created an SPV to facilitate trade with Iran in euros, bypassing U.S. sanctions on the country.

Last month, China and Russia reaffirmed their 2020 agreement to increase the use of the ruble and yuan for trade. The deal is set to increase the use of the ruble and yuan, which already account for two-thirds of the trade deal payments between the two countries.

Foreign trade isn’t the only way countries are looking to ditch the dollar.

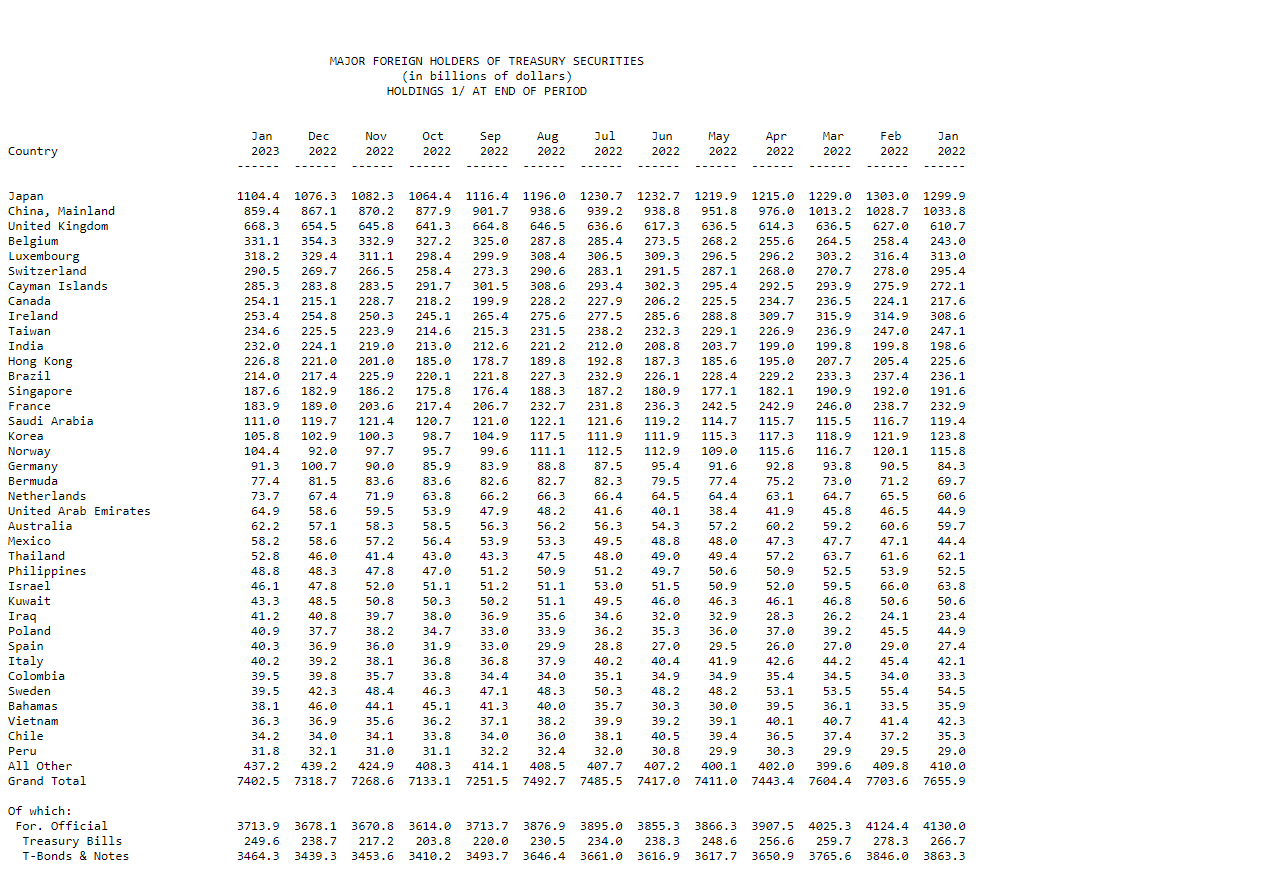

U.S. Treasury holdings once considered the safest and most liquid assets in the world, have become a geopolitical hot potato.

Last year, foreign demand for treasuries dropped by around 6%. This represents a notable decrease in demand following two years of aggressive buying after the COVID-19 pandemic.

However, rising interest rates have made these bonds less profitable. Almost every major country sold off its treasury holdings over the last year,

Data from the Federal Reserve showed that foreign holders sold off over $253 billion worth of treasuries in the past year.

Ballooning balance sheets spell trouble for the dollar

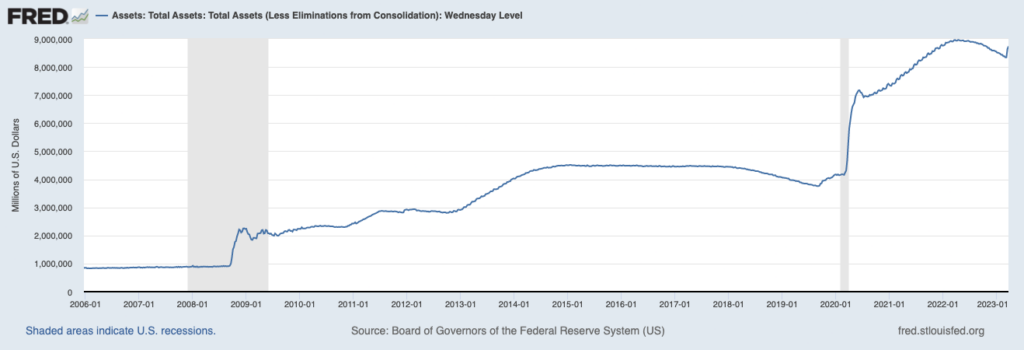

While central banks worldwide have been increasing their balance sheets in response to the COVID-19 pandemic, nowhere was this as aggressive and dangerous as in the U.S.

In the four months since the beginning of the pandemic in March 2020, the Federal Reserve increased its balance sheet by over 72%, adding over $3 trillion to its assets.

The aggressive liquidity injection into the financial system proved to be unsuccessful. The quantitative easing spree took less than two years to turn into inflation, with goods and services in the U.S. seeing record growth into 2023. In a country with as much debt as the U.S., inflation can quickly erode the value of government bonds and cause interest rates to soar.

A declining value of government bonds pushes domestic and foreign bondholders to sell off their holdings and even suffer losses to place the capital into more profitable investments.

Foreign holders of U.S. treasuries have sold off their holdings to ditch their dependence on the dollar and turned to other currencies like the yuan and ruble. Domestic holders, on the other hand, moved away from long-term bonds into short-term treasuries, as they provide a better yield that outpaces the growing inflation.

All roads lead to Bitcoin

Bitcoin has long been touted as a safe haven asset.

However, it wasn’t until a full-blown banking crisis began looming over the U.S. that the global market began noticing.

Bitcoin’s fixed supply and decentralized infrastructure put its holders in control of their funds. With the ability to independently verify transactions, self-custody coins, and facilitate uncensorable, cross-border transactions, it’s slowly becoming an asset of choice for many looking to hedge against government interference.

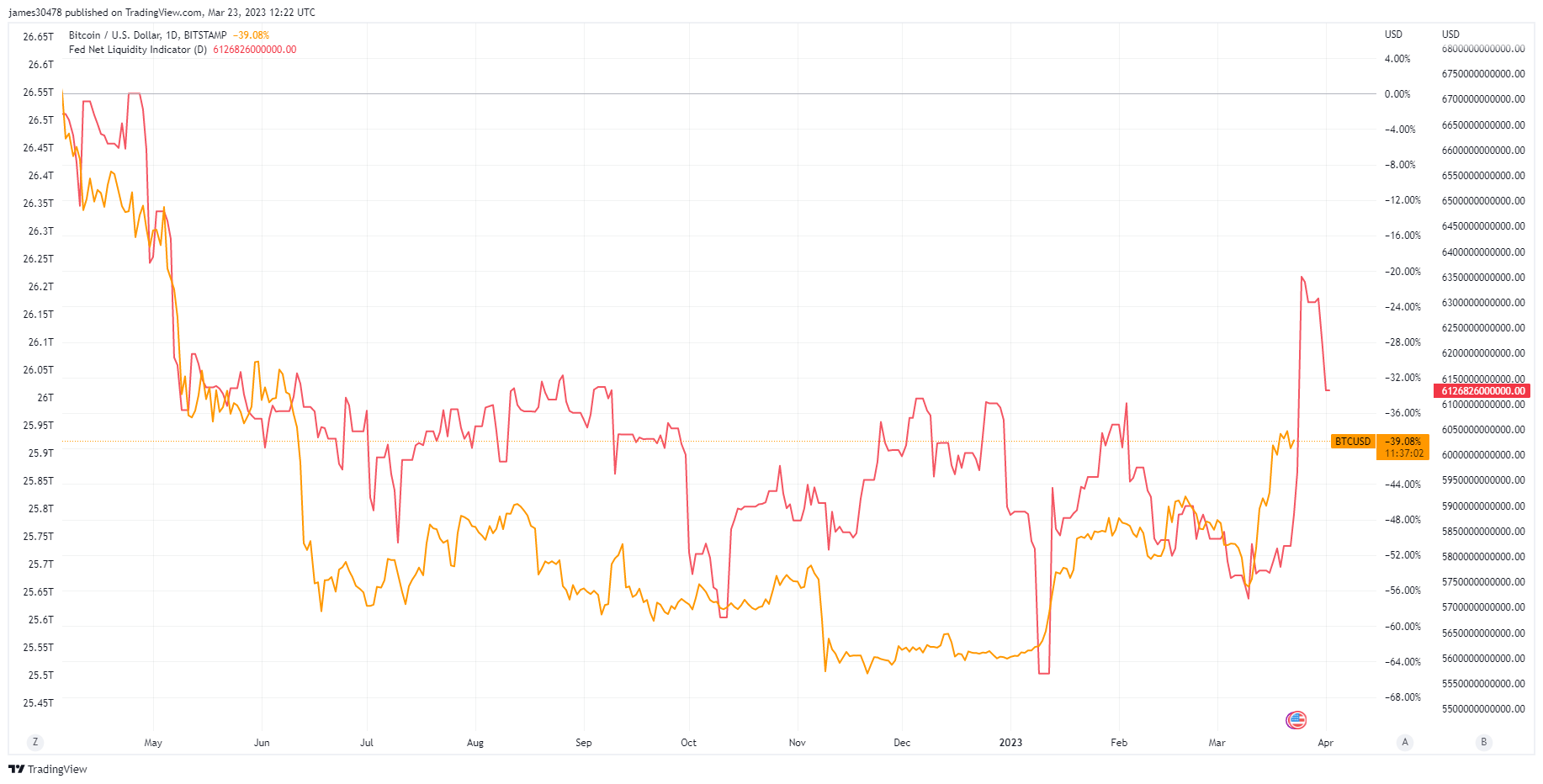

Its volatility seems to be worth the cost for many investors. This is evident in its growing correlation with the market’s liquidity. Data analyzed by CryptoSlate showed that Bitcoin’s price followed the rises and drops in the Federal Reserve’s net liquidity — meaning that a significant chunk of the market’s newly injected liquidity keeps flowing to Bitcoin.

Bitcoin’s role in the global economy will continue to increase as more weaknesses in traditional markets are revealed. However, while its use in developing countries has already been proven, developed markets like the U.S. are yet to see its value.

Continued dollar erosion will push many retail and institutional investors to Bitcoin. However, the asset’s dominance over the market will depend on the U.S. government’s regulatory pressure, as many expect a fierce battle to stifle its spread.

When inflation points the way, all roads indeed lead to Bitcoin. The question is how long the market needs to reach the finish line.