JHVEPhoto

US providers for kidney dialysis and renal solutions enjoyed marked gains in the recent past despite investor dissatisfaction with Novo Nordisk’s (NVO) Ozempic. DaVita Inc. (NYSE:DVA) has gained 77.57% (YoY) while NVO is up 87.97% (YoY). It was anticipated that the kidney disease progression using Ozempic would be reduced by more than the 24% recorded by NVO’s phase 3 FLOW clinical study. However, chronic kidney disease (CKD) has a “prevalence rate of between 30% and 40% in the US” alone, affecting more than 37 million Americans with about 800,000 struggling with kidney failure. In my view, the results from Ozempic are impressive considering the company is preparing to apply for approvals to expand the drug’s label in the US and EU in 2024. It indicates significant progress in its commercialization goal. These views notwithstanding DVA had back in October 2023 raised concerns on Ozempic stating that it had “limited application of the FLOW study to the overall CKD patient population.”

Thesis

DaVita’s decision to expand its renal care operations in Latin America, particularly in Brazil, Columbia, Ecuador, and Chile will help grow revenues while cementing its foothold away from the US. At the moment, CVA’s main revenue stream is from US dialysis patients accounting for 89% of the consolidated revenue (as of the FY ended on December 31, 2023).

More than 10 years have passed since DaVita announced its agreement to offer various “pharmacy services to Fresenius Medical Care (FMC)” a move that has seen both companies dominate the US dialysis space. Despite being competitors, the two companies have partnered on various projects. I believe DaVita is right in considering FMC in kidney disease treatment-related deals since the latter not only owns and operates its renal systems but also manufactures them, a factor that helps in lowering the cost of supplies.

The recent decision to make 4 dialysis-related acquisitions from FMC for $300 million is a welcome move for DVA. I believe the deal is a pathway to unlocking Latin America with the company expecting at least 60,000 kidney care patients and an upside of 270 clinics (in addition to its enterprise in the region). This deal alone is giving DVA “154 dialysis clinics, a workforce of more than 7,100, and at least 30,000 dialysis patients.” While DVA was already operational in Latin America, this acquisition will increase its presence manifold. The company explained that out of the four countries considered only Chile’s had been closed leaving out Brazil, Colombia, and Ecuador pending regulatory/ business approvals expected later in 2024.

As a global entity, FMC operates about 3,925 dialysis centers with almost 333,000 patients. From the four countries where it intends to sell its operations to DVA, FMC reported pro-forma revenues of about€370 million ($402.9 million) in FY 2023. Earlier on, in FY 2022, revenue from the entire Latin America reached €797 million ($867.8 million). This means that the four countries accounted for almost half the revenue collected from the entire Latin American region. It is no wonder that FMC indicated that the transaction would cause the company to lose almost€200 million (in netbook losses) for FY 2024. This amount includes nearly €140 million expected to be lost in Q1 2024. This portfolio optimization plan is not as cheap as it would appear since DVA is getting the better end of the bargain. It appears, that for FMC to make a profit from these four Latin America sales, it had to raise the stake in the upside of €550 million. Meanwhile, I expect DVA to make at least €450 million by Q1 2025 from transactions in these Latin American countries.

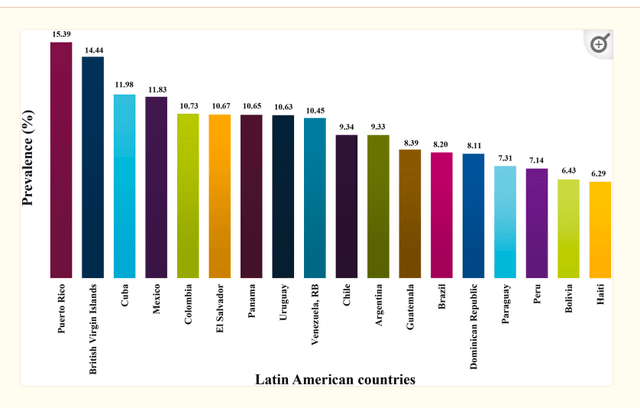

Still, Latin America remains a strategic location for offering CKD treatment. As of 2021, the mean prevalence rate of CKD stood at 9.9%

National Library of Medicine

Among the four countries included in the DVA-FMC deal, Colombia appears to have the highest CKD prevalence rate of 10.73% while Chile is at 9.34%- with DVA operations already ongoing.

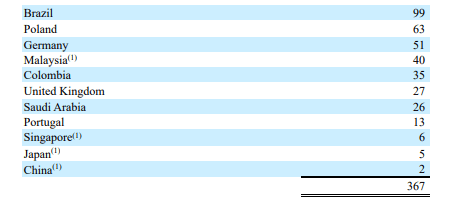

DaVita Inc. Q4 2023 report

As of December 2023, DaVita had a total of 367 international outpatient dialysis centers with Brazil having the bulk of the number at 99 (26% of the total outpatient dialysis centers) and Colombia with 35. Overall, DVA’s presence will be felt in about 12 countries apart from the US, especially if these transactions are successful. With this consideration, DVA’s international patient base since 2017 is expected to grow by more than 240% from 23,000 to 79,000 having stood at 49,400 in 2023.

Need to Improve Model of Care

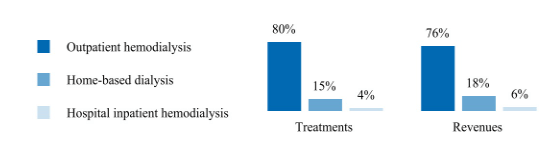

DVA’s revenue performance by treatment modality in the US as of December 31, 2023; indicated a massive disparity.

DaVita Inc.

As stated earlier 89% of DVA’s 2023 total revenue emanated from its dialysis business in the US. This fact makes this business the most essential element of the company’s current portfolio. I can deduce that out of the $3.15 billion collected in Q4 2023 (as total quarterly revenue), about $2.8 billion was derived directly from this business.

First of all, the market size of the US dialysis service was estimated to jump from $26.63 billion in 2023 to $27.47 billion (+3.15%, YoY) in 2024. The value of this market is projected to reach $43.67 billion by 2032 (growing at a CAGR of 6%). Already, DVA is controlling more than 10% of the current market value. Still more needs to be done especially on the home-based dialysis and hospital in-patient hemodialysis fronts. Only 15% of DVA’s treatments were attributed to home-based dialysis contributing to only 18% of the revenue. Treatments under inpatient hemodialysis took up a mere 4% of the treatment and contributed only 6% of the revenue. These figures coincide with the occurrence of 2021, post-COVID when about “15% of end-stage kidney disease (ESKD) patients in the US we enrolled for home-dialysis.” Even more peculiar is that at the time, medical research indicated that about 1 out of every 10 people (globally) had been diagnosed with CKD (at a certain point in life) with at least 10.5 million people having “advanced kidney disease.

In my view, I would expect to hear of individualized home-based care from DaVita to cater to each home’s needs since this primarily handles ESKD patients. However such amenities can be considered expensive since they involve personal nursing/ monitoring services including dialysis facilities and training within community centers. However, DVA participated in an ESKD Treatment Choice (ETC) model launched in 2021 by the Center for Medicare and Medicaid Innovation (CMMI) whose goal was to encourage home-dialysis treatment/ transplants. One main aspect of the model test was to look at the issue of cost.

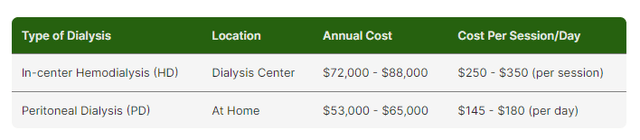

Here is a breakdown of the cost of dialysis.

TalktoMira

This table shows the average cost for in-patient dialysis without insurance.

TalktoMira

Uninsured patients will have to part with at least $500 in the US to cater for one dialysis treatment/ session which can hit north of $10,000/ session in emergency cases. Of these choices, only outpatient dialysis services cost less than $250 (deducted annually). It clearly explains why 80% of DVA’s revenue is from this segment.

In its Q4 2023 quarterly report, DVA stated that it was implementing CMMI payment models that would help to establish incentives and promote the increased use of home-based dialysis. The statement read in part, and I quote

“Centers for Medicare & Medicaid Services (CMS) has stated these payment models are aimed to prevent or delay the need for dialysis and encourage kidney transplantation. Certain of these payment models, such as the First Performance Period for the Kidney Care Choices Model CKCC Options (the CKCC Model) commenced on January 1, 2022. As described above, we have invested substantial resources, and expect to continue to invest substantial resources in these models as part of our overall plan to grow our integrated kidney care business and value-based care initiatives.”

Many will argue that market disruption is necessary to drive down costs since at the moment Fresenius and DaVita are the main players in the dialysis business. Additionally, government data indicated that the number of home-dialysis patients increased to 13.5% in 2021 from 7.5% in 2011. “In patients with Medicare as a secondary payer,” the adoption of home dialysis at the time rose 34.3%. There was also a marked increase in home dialysis patients when the ETC clinics were factored in. These clinics denoted a 15% patient population under home dialysis as compared to 14% patients in non-ETC clinics (as of Q1 2022).

Risks

There is still a need to expand the accessibility of certified home dialysis treatment for ESRD patients in the US. Back in 2020 (at the height of COVID-19) about 8,808 Medicare dialysis clinics were certified in the US. However, about “45.6% of these clinics were not certified to do peritoneal dialysis/ home dialysis with another 10% of the clinics lacking active patients by the end of 2020.” As of December 31, 2023, there were about “18 ESRD network organizations in the US serving 7,609 dialysis centers (and 228 kidney transplant centers).” This data (from 2020 to 2023) indicates a difference of -13.6% in the number of certified dialysis centers in the US.

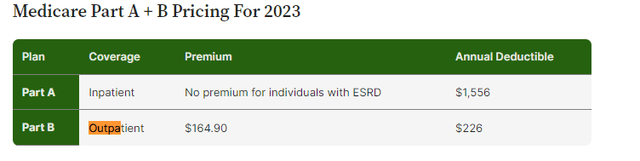

Unlike FMC, DVA does not manufacture all its dialysis supplies and related equipment. This idea also explains why it opted to spend $300 million to make the 4 Latin America acquisitions. DVA’s increased purchases/ expenses are passed on to the consumers or patients thereby making its products somewhat expensive. From an annual revenue of $12.14 billion, DaVita’s net income stood at $691.5 million. DVA’s annual revenue has always exceeded $10 billion since 2016, but its net profit has never crossed the $1 billion mark showing growing operating expenses over the years.

Seeking Alpha

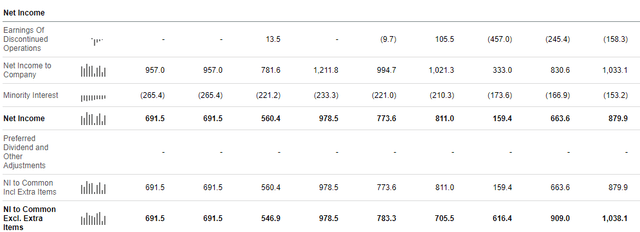

Total operating expenses also increased 1.42% (YoY) to $9.162 billion from $9.034 billion in the year ending on December 31, 2023, boosted by a 6.2% (YoY) surge in administrative costs. Assuming the 4 transactions go through in 2024, then the GA costs will be replicated in FY 2024.

DaVita Inc. FY 2024

Valuation

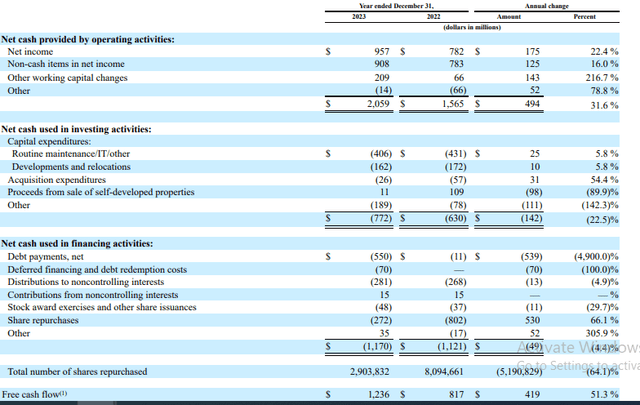

DaVita’s forward price-to-earnings ratio is X15.82 against the industry average of X27.95 (a difference of -43.40%). Additionally, DaVita’s forward price-to-cash flow is 7.04 against the industry average of 15.44 (a difference of -54.41%). In retrospect, DVA’s free cash flow (FCF) is $1.287 billion against a cash balance of $397 million exemplifying a progressive business performance. The increase is also attributed to DVA’s 31.6% (YoY) growth in the net cash provided by operating activities.

DaVita Inc.

DaVita

DVA’s forward price-to-cash flow is 7.04 against the industry average of 15.44 showing a difference of -54.44%. These metrics show the stock is undervalued and we may witness an increase in stock price in H2 2024. Despite this FCF, DVA does not pay dividends to shareholders and I believe it first intends to deleverage since it has a debt of $11.12 billion.

Bottom Line

DaVita’s four acquisitions from Fresenius are strategic for the company’s growth into the future. It has expanded its chain of clinics and hospitals in a bid to maintain its grip on the dialysis business. However, failure to manufacture most of its medical equipment has seen it raise prices on vital services such as home dialysis and inpatient hemodialysis leading to low revenues in the sector. Still, I believe the overall sectoral changes will be adopted to ensure more patients are enrolled in these treatment plans. For these reasons, I recommend a hold rating for the stock.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.