celsopupo/iStock via Getty Images

Investment Summary

From the Portfolio Manager’s desk

Following its Q3 numbers, I’ve noted a large correction in market data suggesting that DarioHealth Corp. (NASDAQ:NASDAQ:DRIO) is now seriously worth considering on the tactical allocation side. There are selective opportunities for tactical alpha within small-cap med-tech stocks, given the corroboration of market and fundamental data. DRIO is converging in this respect. I’m seeking price objectives of $5.50 and then ~$7/$7.50 as a speculative buy in DRIO shares to wind up exposure in our equity risk budget. If successful, we’ll clip c.50% upside to these levels [$4.90 to $7.50]. We’re sizing in small on the initial position, with the idea of scaling in with more trend confirmation. I’ll close the position with a >8% pullback from entry price as primary risk management.

Investment conclusion

In our last DRIO analysis, we argued to wait “for more tangible value creation before re-rating to the upside.” This data has now arrived in DRIO’s latest numbers. The company accelerated new accounts and clipped another $61mm in contract revenue to be recognized at the top in FY23. Meanwhile, we now see double-digit EPS upside [whilst still unprofitable] over the coming quarters, which the market might look to favourably. Net-net, we rate DRIO a buy.

Exhibit 1. DRIO 12-month price evolution

Data: Updata

B2B transformation finally recognized in Q3 numbers

DRIO’s Q3 numbers came in strong with upsides versus consensus at the top and bottom lines. Third quarter revenue grew 17.3% YoY to $6.6mm, driven by growth in B2B turnover.

In fact, the company’s transformation to a B2B [from B2C] looks to finally have come through to the P&L. Service revenue grew 486.5% YoY to $4.55mm [$0.195/share]. Thus, growth in the B2B segment easily offset the YoY decline in B2C sales, and was 63.5% of turnover in Q3, up from 46% last year.

Unpacking the B2B growth [where the future value in DRIO lies], whilst murky, the company booked first revenues from Aetna this quarter. Meanwhile, growth was consistent across all other B2B segments as more accounts came into production.

Gross margin decompressed to 27% from 14.6% YoY, and management expect FY22 gross margin to be 50%, up from 39%. Net CFFO was in-line with a $39.9mm outflow, and it pulled this down to a net loss per share of $0.64.

It was a high pace quarter for DRIO. Last quarter, it signed 14 new accounts, and had 61 B2B accounts on the book [80% had launched at the time]. In Q3 the company increased B2B contracts to 85, with total value now exceeding $61mm per annum when implemented.

As such, DRIO is on track to double the number of accounts it had last year from 50 to 100. Management confirm it is on target to reach these numbers, and expect to hit the $61mm run-rate by FY23. With the growing list of strategic partners DRIO is now working with, it’s not an unreasonable assumption for it to double accounts again in FY23.

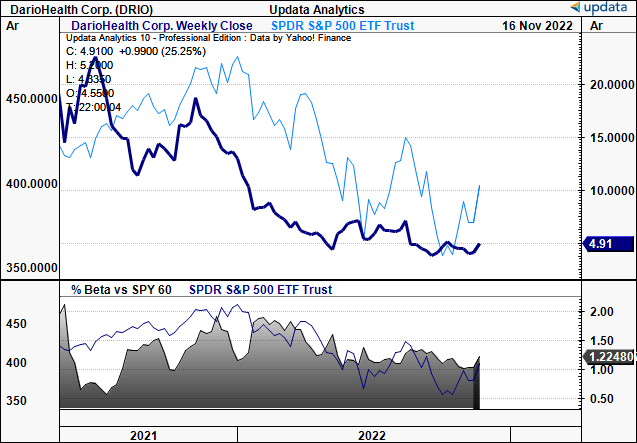

Revised guidance, double-digit EPS upside into FY24

The pace of new contract wins has us more constructive on DRIO’s earnings growth looking ahead. We now see double-digit non-GAAP EPS growth each period [quarterly, annual] into FY23, as seen in Exhibit 2. Driving this growth is a 67% forecasted YoY gain in revenue across FY23, and 50% top-line growth in FY24, underscored by its B2B segment.

Exhibit 2. DRIO Revised forward estimates [quarterly, annual] FY22–FY24

- Double-digit EPS upside into FY24 not an unreasonable estimate with latest updates

Data: HB Insights Estimates

Market data corroborates potential breakout

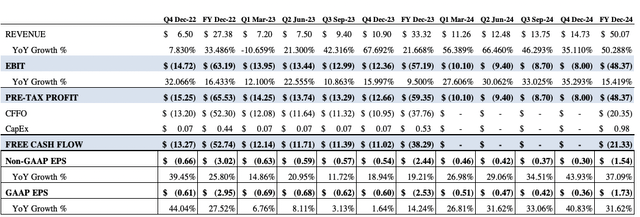

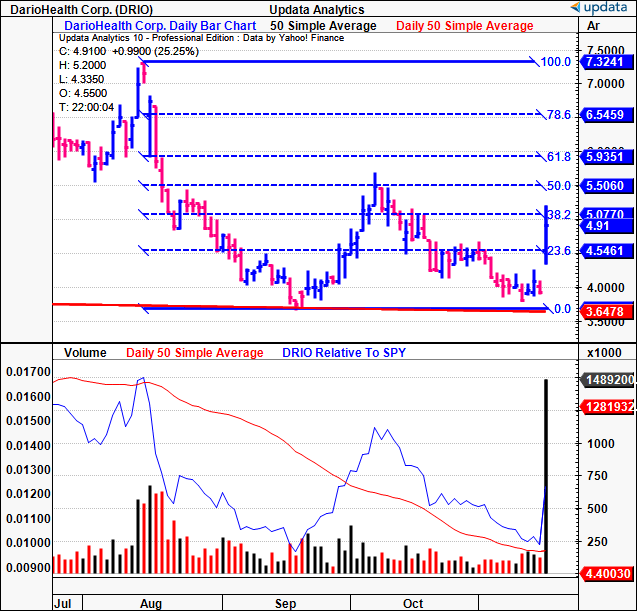

It’s important to look at the numbers, and not the narrative in names like DRIO. Exhibit 3 summarizes the last 24 months of DRIO’s weekly price action to date nicely.

The stock has remained within a deep, 91-week downtrend that began in February FY21 [not shown]. The key move was the 50DMA/250DMA cross a month after. As noted, the overall volume trend then declined rapidly.

Each back-and-fill with sideways consolidation in FY22 has been met with tightening volume [resistance] despite several volume spikes, thus invalidating each move. Alas, the stock’s faced heavy resistance at the 50DMA line for the entirety of 2022.

The setup is different with this next move. There’s fundamental momentum underscoring the buying volume for one. Second, there’s been a volume breakout and reversal, whilst the 50DMA and 250DMA look to cross back to the upside. Volume dried up before the volume breakout, a key data point in my understanding. The stock has tested its previous lows 3x with tight closes, and last weeks close above the 50DMA with volume is very interesting indeed.

Exhibit 3. Reversal in DRIO weekly volume and price action with volume breakout after first drying up.

Data: Updata

However, there’s been a lack of institutional buying momentum over the last 6 months. Registered investment funds accumulated a net total of just 610,000 shares last month [at today’s price of $4.91, just $2.99mm of net-long exposure].

We’ll be looking to the next few weeks at the pattern of volume and price action, along with the data set in Exhibit 4, to check institutional buying momentum for DRIO looking ahead. Should the order book continue to fill with corresponding volume and price action, my bet is that it won’t the average retail investor doing the buying.

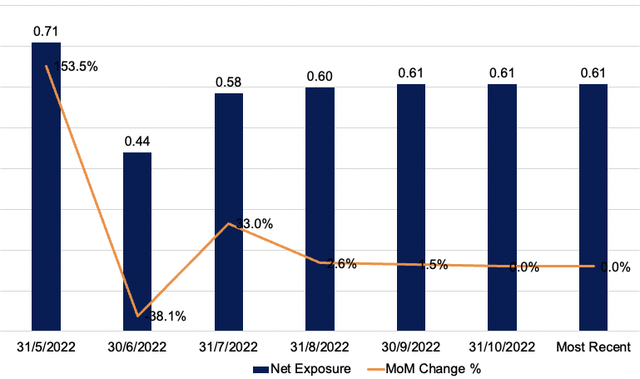

Exhibit 4. Lack of institutional buying volume for the past 6 months of trade. Just 610,000 shares net-long from registered funds in October.

- DRIO Institutional Fund Net Exposure, monthly change [6mo–date].

Data: Refinitiv Eikon

Estimated price distribution: $5.50–$8.85

Let’s run a scenario where we assume DRIO did in fact move out of a double-bottom last week. As seen below [now showing daily bars], tracing the fibs’ down from the August high show DRIO has tested 50% of the recovery at $5.50 and failed last month.

That reversal rally had legs and lasted 13 weeks from the bottom, before the benchmark completed its 2nd down-wave in the FY22 bear market.

The base is wide and loose coming into this current upside move. Hence, we’d like further evidence of more volume before scaling in with size, as risk management.

Nevertheless, shares have broken through the 38% bar and are looking to test $5.50 again. Should it break $5.50, we’d be looking to $5.90 and then $6.50, with 3rd price objective of $7.30 if successful.

The market is trending again and with DRIO’s latest numbers, our opinion is to remain constructive on the stock.

Exhibit 5. Latest rally = wide, loose run then straight up, with enormous volume breakout [bad base]. Question is, will DRIO break $5.50?

Data: Updata

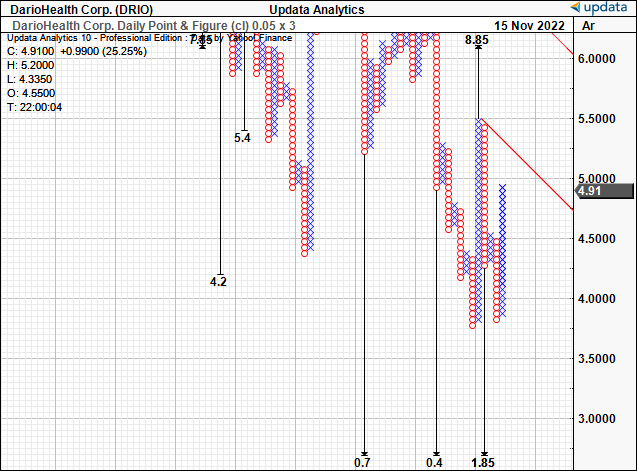

Alas with the latest price action we have long-term and mid-term [weekly and daily] upside targets of $7.75 and $8.85, respectively.

In the absence of profitability this market data is quintessential in gauging the market’s objectives for the stock.

Exhibit 6. Upside targets of $7.75 [not shown] to $8.85

Data: Updata

Risks

The main downside risk to the investment case is if the buying volume dries up for DRIO. I firmly believe institutional buying momentum needs to creep higher over the coming months in order for the thesis to play out correctly. If this doesn’t eventuate, I’m not sure there’s enough retail activity in the stock to see it re-rate towards my price objectives. In addition, we can’t ignore the wider macroeconomic landscape, and the risks present there. With policy rates continuing to rise, the cost of capital has increased substantially for unprofitable companies in the growth spectrum. This includes DRIO.

Alas, this may impact the company’s ability to access financing or capital looking ahead. It also compresses the value of DRIO’s future cash flows, potentially impacting its corporate value. With the discount rate increasing, there’s equal risk growth-type stocks will continue to be punished looking ahead. This would bode in poorly for the company’s share price in our estimation. Therefore, we encourage investors to pay close attention to market fundamentals [particularly, treasury yields] over the coming weeks to months, in order to adapt accordingly. Moreover, it needs to match its guidance for FY22. If DRIO’s next earnings display a weaker than expected growth profile, we’ll be removing our bullish view completely.

In short

DRIO’s latest quarterly numbers suggest a change in sentiment for the stock. Investors now have more clarity on the company’s growth engine looking ahead. Market data implies a reversal in price action, although institutional buying volume hasn’t arrived yet. Net-net, we rate DRIO a speculative buy for tactical allocation in equity portfolios, seeking a 3–6 month price objectives of $5.50 and then ~$7. Risk weighting should be kept small with the idea of sizing in with trend confirmation. We advocate to exit the position with a >8% pullback from entry price as risk management.

Editor’s Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.