onurdongel

Investment Thesis

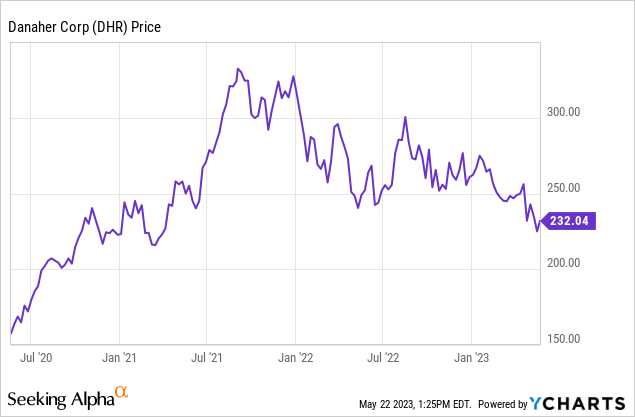

Danaher (NYSE:DHR) has declined another 13% since my last coverage in January and the premium compounder is now down over 30% from its all-time high in 2021. I believe the company should continue to perform well in the long run, supported by the fast-growing bioprocessing market amid the ongoing shift to biologics.

However, I am not too optimistic about the near-term outlook due to the drag from COVID and the drop in R&D (research and development) funding. The weakness is shown in the latest earnings with the top line down by high single digits and the bottom line down by double digits. The valuation looks more reasonable after the recent drop but is still not necessarily cheap by any means. Therefore I rate the company as a hold and will continue to be patient and wait for a more compelling entry point.

Bioprocessing Is A Huge Growth Driver

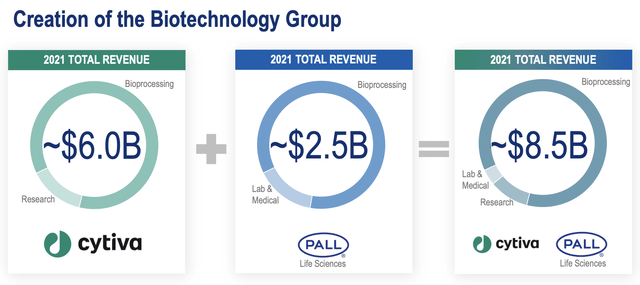

Danaher had been mainly operating in the diagnostics and life-science space but it has recently expanded into the bioprocessing market through the $21.4 billion acquisition of Cytiva (previously known as GE biopharma) in 2020 and the $13.8 billion acquisition of Pall Corporation in 2015. For those who are unfamiliar with bioprocessing (also known as biological manufacturing), it can be generalized as the process of creating advanced therapies through the use of living cells or their components (eg. bacteria and enzymes)

Cytiva mainly provides consumables and equipment upstream, while Pall operates mostly downstream with filtration and clarification products. The two company has now combined as Danaher’s biotechnology segment which contributes roughly 25% of the company’s total revenue. I believe the company targeting the bioprocessing space should turn out to be very accretive as it presents a massive growth opportunity.

Danaher

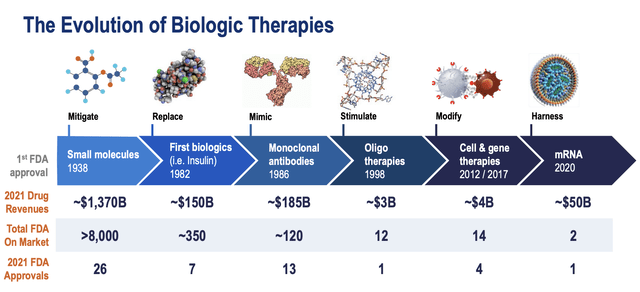

According to Grand View Research, the market size of bioprocessing is forecasted to grow from $27.9 billion in 2023 to $80.1 billion in 2030, representing an excellent CAGR (compounded annual growth rate) of 16.2%. There are multiple catalysts driving the market expansion. The most notable one is the ongoing transition from small-molecule drugs to biologics. Small-molecule drugs are generic everyday drugs that can be manufactured easily on a large scale. While biologics are usually more advanced therapies that require a much more complex and costly manufacturing process.

From the graph below, you can see that small-molecule drugs accounted for nearly 80% of total drug revenue in 2021. However, the popularity of biologics should continue to grow in the future as they offer more targeted and personalized therapies, especially for complex diseases. For instance, both mRNA therapies and gene therapies are considered biologics.

Danaher

Another catalyst is the increasing adoption of biosimilars, which are also created through bioprocessing. Biosimilars are clinically equivalent alternatives to branded biological products. They have been gaining popularity rapidly as they are a lot more affordable compared to the original drug. For context, the NCSL (National Conference of State Legislatures) said that the prices of biosimilars are typically cheaper by 15% to 35%.

Their penetration rate are also very low at the moment, which leaves ample room for expansion. According to Cigna (CI), only 7% of specialty drug spend is currently on biosimilars, but the figure is forecasted to reach over 25% by 2026. Considering these catalysts, I believe bioprocessing should continue to provide strong tailwinds for Danaher in the long run.

Near-Term Headwinds

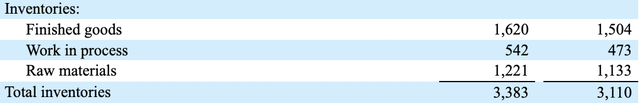

While Danaher’s long-term growth prospects are strong, the company’s near-term outlook remains quite gloomy due to the overhang from COVID and the decline in R&D activity. Due to the unprecedented COVID incident in 2020 and 2021, many life science and biotechnology companies have piled up heavily on inventories as they fear the pandemic and supply chain will continue to deteriorate. However, this did not happen as COVID cases started to drop drastically last year while the supply chain also eased.

This resulted in many companies now having elevated inventory levels. For instance, Danaher’s inventories increased by 8.8% to $3.38 billion in the first quarter, even though revenue is forecasted to continue its decline throughout the year. COVID also created a tough comparability for FY23, as it contributed a meaningful amount of revenue in FY22 but is now declining rapidly.

Danaher

Due to the rise in funding costs and the pulled-forward spending from 2020 to 2021, R&D activity has also been very weak across the board, which continues to impact demand for Danaher. According to Deloitte, R&D spending for the top 20 global pharmaceutical companies combined was $139 billion last year, down 2% from 2021. For instance, AbbVie’s (ABBV) and Bristol-Myers Squibb’s (BMY) R&D budgets declined by 6% and 6.7% respectively.

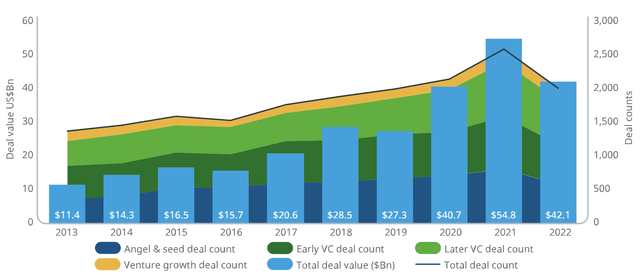

Deal activity and investment flow were especially weak among earlier-stage companies, as investors are becoming increasingly cautious about their spending amid the rising cost of capital. According to IQVIA (IQV), the number of life science deals declined by 25% from 2,500 in 2021 to 2,000 in 2022, while the total deal value also dropped 23.2% from $54.8 billion to $42.1 billion, as shown in the chart below. I believe the recent weakness in R&D activity alongside the elevated inventory levels and ongoing decline in COVID-related revenue will continue to put meaningful pressure on Danaher’s financials in the near term.

IQVIA

Q1 Earnings

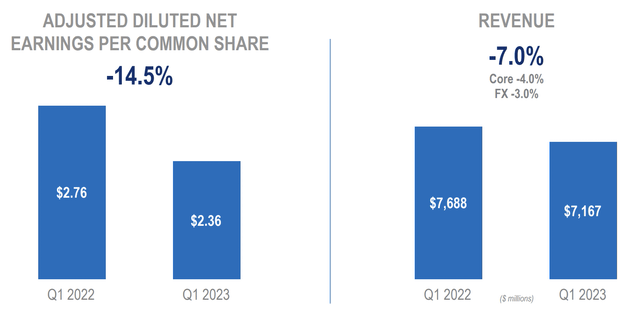

Danaher releases its first-quarter earnings last month and the results are very underwhelming, as COVID-related revenue continues to be a meaningful drag.

The company reported revenue of $7.17 billion, down 7% YoY (year over year) compared to $7.69 billion. On a constant currency basis, revenue was down 4%. The decline is mostly attributed to the biotechnology segment, which declined 16% from $2.22 billion to $1.86 billion, accounting for 25.9% of total revenue. This was due to plummeting demand for COVID-related therapeutics and vaccines. The same was seen in the diagnostic segment, which declined 10% from $2.64 billion to $2.38 billion, accounting for 33.2% of total revenue. The weakness was partially offset by the life science and environmental segments, which grew revenue by 2.5% and 5% respectively.

The bottom line was also weak, as spending remains elevated. SG&A (selling, general and administrative) expenses as a percentage of sales increased 280 basis points from 27.2% to 30%, largely due to higher labor costs and marketing spending. R&D as a percentage of sales also increased 30 basis points from 5.7% to 6%. This resulted in the net income down 14.9% YoY from $1.68 billion to $1.43 billion. The net income margin also dipped 200 basis points from 21.9% to 19.9%. The adjusted diluted EPS was $2.36 compared to $2.76, down 14.5%.

Danaher

Investors Takeaway

Danaher has further declined in the past few months, but it is still hard to call its valuation compelling in my opinion. The company is currently trading at an fwd PE ratio of 24.3x, which is not cheap as both its EPS and revenue are set to drop this year. I am confident in the company’s long-term growth prospects, especially when considering the huge opportunities in bioprocessing. However, the near-term headwinds in regard to COVID and slowing R&D activities will likely put pressure on growth. The tough COVID comparability will be gone in FY24 but whether the industry will rebound remains highly uncertain, especially if we enter a recession in the coming months. Considering its valuation and headwinds, I believe the near-term upside potential should be muted. Therefore I rate the company as a hold.