jetcityimage/iStock Editorial through Getty Photographs

Introduction

Between December 2021 and January 2022 we noticed two necessary spin-offs within the development equipment and heavy vehicles business that gave delivery to Daimler Vehicles (OTC:DTRUY) and IVECO Group (OTC:IVCGF). The main target of each was to unleash the potential of the 2 by making them pure-plays with a view to create added worth. I plan on protecting these two firms, together with their main friends. That is the primary article of the sequence by which I have a look at Daimler Vehicles and present why I at the moment price it a maintain, given some uncertainties on how the corporate will enhance its profitability.

The Context

With the most recent spin-offs, the market sees now 4 giant unbiased European truck and bus producers. To the 2 firms talked about, now we have the truth is so as to add TRATON (OTCPK:TRATF), whose spin-off by Volkswagen occurred in 2019 and the established Volvo Group (OTCPK:VOLAF). The profitability of IVECO Group, Daimler Truck, and TRATON was not the principle precedence once they had been components of their former mom teams. All of them have instructed the market that they’ll give attention to bettering margins.

Daimler Vehicles

On December tenth, 2021, Daimler Vehicles was spun off from Daimler AG that grew to become Mercedes-Benz Group AG (OTCPK:DDAIF). The newly unbiased firm stands now by itself and produces vehicles and buses which might be marketed below the BharatBenz, Freightliner, FUSO, Mercedes-Benz, Setra, Thomas Constructed Buses and Western Star manufacturers. Daimler Vehicles is split into 5 enterprise models: Mercedes-Benz, Vehicles North America (Freightliner, Western Star, Thomas Constructed Buses), Vehicles Asia (FUSO, BharatBenz) and Buses (Mercedes-Benz & Setra), Monetary Companies. In 2021, the corporate offered 455,445 automobiles, with a income simply shy of €40 billion and an EBITDA of €2.5 billion. Its present market cap is $26.1 billion.

These are the targets it introduced to traders, that we should fastidiously remember to guage how the corporate is working its enterprise:

Daimler Truck’s ambition is to realize greater than 10% Return on Gross sales (Industrial Enterprise, adjusted) by 2025, assuming robust market circumstances. Based mostly on its “each section should ship” method, Daimler Truck’s high administration in the present day introduced margin vary ambitions for its particular person segments reflecting totally different macroeconomic circumstances. In a 2025 situation with robust market circumstances, Daimler Vehicles North America (DTNA) is aiming for a 12% adjusted Return on Gross sales, Mercedes-Benz for 10%, Truck Asia goals for an adjusted 9% Return on Gross sales and Daimler Buses for 7.5%.

Daimler is the business chief in North America for vehicles and the worldwide chief for buses. Daimler Buses, nonetheless, as we are going to see, regardless that it has a robust management, it’s nonetheless struggling tremendously from the pandemic since buses gross sales had been strictly linked to journey.

Amongst its targets, the corporate additionally acknowledged that it desires to realize by 2023 a 15% discount in fastened prices and that it’s anticipating for 2022 an adjusted return on gross sales of the economic enterprise between 7% and 9%. With volumes rising, fastened prices also needs to develop into decrease on a proportion foundation. Moreover, the corporate is taking motion since 2021 to cut back staff, with a €70 million profit within the EBIT of 2021 and one other €70 million that will likely be seen between 2022 and 2023.

The corporate is clearly targeted on creating electrical vehicles and buses, however it’s also specializing in hydrogen automobiles and autonomous driving. This final focus sees the corporate, so far as we might know, properly positioned to develop into a future market chief.

Financials

Daimler Vehicles was awarded a Moody’s first issuer score of A3 (outlook steady), whereas Fitch Rankings assigned it an A- (outlook steady). The corporate has $7.73 billion in money and bears a complete debt of $18.60 billion. It’s managing to cut back SG&A bills, attaining a 6% discount from 2019 to 2021, which is kind of a outcome, contemplating the atmosphere we’re in, characterised by robust inflation and value will increase all around the provide chain. In consequence additionally of this price management, Daimler Vehicles’ web earnings from 2019 to 2021 elevated by 38%.

As we have seen, as traders we should preserve observe of Daimler Vehicles’ means to extend its return on gross sales, making it a extra worthwhile firm. For the reason that firm is kind of new, we are able to solely have a glimpse of what’s taking place by the Q1 2022 outcomes.

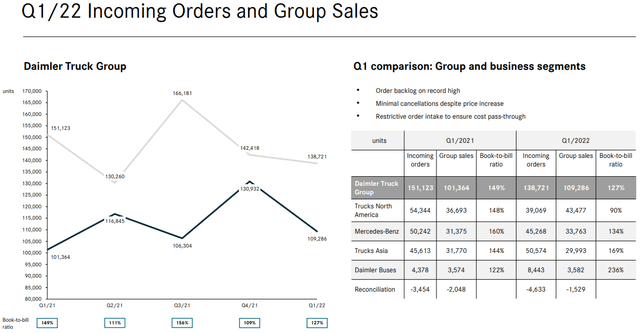

Throughout the Q1 earnings name, Jochen Goetz, CFO of Daimler Truck, introduced a optimistic growth, exhibiting that the corporate’s EBIT elevated to €651 million versus €580 million in Q1 2022. Nevertheless, the return on gross sales was of 5.9% versus 6.3% final yr, exhibiting a lower which traders wouldn’t need to see. Free money stream was additionally very low, coming in at €73 million, as a result of excessive stock ranges and elevated investments. To this, the standard seasonality of the enterprise should be added, which normally tends to have increased orders and decrease gross sales in Q1. Within the graph proven under, we are able to partially see this taking place quarter after quarter, with one having robust orders and the subsequent one exhibiting stronger gross sales.

Daimler Vehicles Q1 2022 Earnings Presentation

As we are able to see, whereas group gross sales are rising YoY, within the final quarter the incoming orders decreased, particularly for Vehicles North America and Mercedes-Benz. This may increasingly sound a bit disappointing for traders, who might count on weaker outcomes as we head in direction of 2023. When requested about this, Goetz defined his view, by highlighting that, in the meanwhile (daring mine),

the market measurement just isn’t outlined by demand however by provide[…] the markets could be simply 50,000, 60,000, 80,000 increased than what we see. And what mainly occurs, what might occur is that even when the demand just isn’t that robust any longer but when the purchasers weren’t in a position to get the vehicles for this excessive demand, it is nonetheless in line. Subsequently, we see our market steering, nonetheless a case laden with this upside potential […] it is necessary to know, in 2021, the US markets with out restriction on the provision chain could be a spike market, very, very robust market. So what occurs, provide chain constraints restricted the market and demand was postponed to 2022. So now the postponed demand in 2022, meet a nonetheless very robust demand in 2022, however nonetheless can not fulfill due to the restrictions within the contract. So mainly, a portion of 2021 is moved to 2023 and the not fulfilled demand of 2022 is moved to 2023. On the similar time, you see extra environment friendly truck, and also you see an getting older fleet.

I believe this to be a really fascinating comment. To start with, Goetz turns the perspective on provide chain constraints round, by stating that offer in the present day is defining market measurement. Thus, it ought to be recognized that the market’s potential measurement is kind of bigger than what in the present day seems. Then again, the truth that on this atmosphere, a part of the 2021 demand is being fulfilled in 2022 and that a part of it is going to be fulfilled in 2023 units the bottom for a clean upward trajectory that isn’t typically seen in cyclical companies. As well as, whereas demand is being fulfilled at a slower tempo, the prevailing fleet do age and create additional demand within the years forward. I would not be stunned that, as we transfer ahead, an organization like Daimler might preserve its provide below management with a view to unfold demand over an extended time period, retaining management of a continuing stream of orders and revenues. This is able to change lots of the present enterprise mannequin and would improve Daimler’s return on gross sales.

Steering

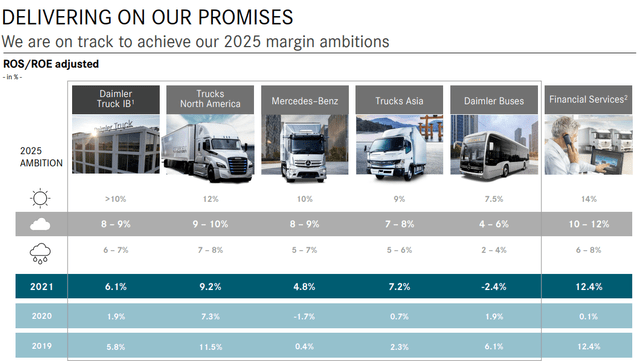

Daimler Vehicles not too long ago reassured traders that its 2025 margin targets will likely be achieved, as declared within the slide proven under, taken from Daimler’s roadshow presentation.

Daimler Vehicles Roadshow Presentation

As we are able to see, Vehicles North America nonetheless hasn’t recovered its pre COVID marginality, whereas Mercedes-Benz and Vehicles Asia are actually bettering. Daimler Buses look like struggling, and this may be understood. Whereas the journey rebound is going down, journey operators nonetheless must get well from latest losses earlier than investing into renewing their bus fleets or increasing them.

When requested about this section, Goetz gave two fascinating details to think about. The primary one is that they’re seeing increased demand for spare components. This results in the conclusion that buses are getting used as soon as once more, and this can result in new orders sooner or later. Secondly, he identified that there will not be many giant operators within the section with big fleets made up of 1000’s of buses. Quite the opposite, journey operators are normally midsize firms that did handle to outlive in the course of the pandemic, by providing their buses for college transportation and different comparable actions. Since most of those firms survived, there may be cause to imagine that the section will choose up pace within the subsequent two years.

Lastly, one consideration which will change the 2021 return on gross sales upwards. Daimler Vehicles famous that the chip scarcity is altering and that now the corporate has modified its manufacturing to grab the reallocated chips utilized in Asia and our different areas to Europe and North America. The corporate is deliberately doing this, anticipating a detrimental impression on Asian gross sales, with a view to help a better margin enterprise in Europe and North America. If we add to this that Daimler Vehicles declared it is kind of offered out for 2022, we must always count on North America and Europe marginality to develop within the subsequent three quarters.

Dangers

Though Daimler has manufactured vehicles and buses for a lot of a long time, now the corporate has to face by itself ft in a historically low margin business. For certain, the latest spin-offs of its rivals will lead all the foremost gamers to discover a worthwhile approach of working the enterprise. Nevertheless, a value warfare might happen with a view to take among the smaller rivals out. Daimler’s robust place in North America, nonetheless, ought to be hedge in opposition to this threat.

Inflation and provide chain constraints do impression on Daimler Vehicles, in addition to on all people else. Nevertheless, I believe Mr. Goetz’s remarks present that the corporate is shifting in the fitting path to benefit from the present state of affairs and acquire time to make each section develop.

Valuation

It’s troublesome to present a valuation of Daimler Vehicles (even Looking for Alpha’s Quant Rankings does not have any accessible valuation metrics). For the reason that spin-off, shares have traded down 8.34%, which is in any case an outperformance in comparison with the foremost indexes. Nevertheless, I believe a ahead PE of 10 remains to be a bit excessive, in comparison with the same auto business that now sees higher margins, increased volumes and decrease multiples. Its ahead EV/EBITDA of seven is, too, a bit excessive, if we expect that some automakers commerce round a 1. Discounting the uncertainty concerning the future strikes of the corporate, I might counsel ready a minimum of yet another quarter earlier than leaping in, with a view to see how the corporate will handle its approach in direction of enhancing profitability, the important thing with out which this funding is not going to go wherever. I see the worth to free money stream ratio additionally a bit excessive, reaching nearly a 17, increased than different automobile producers which have a bigger enterprise than Daimler. To me, it is a maintain that wants a bit extra time to make clear the place it’s headed in direction of.