Pgiam/iStock via Getty Images

Investment updates

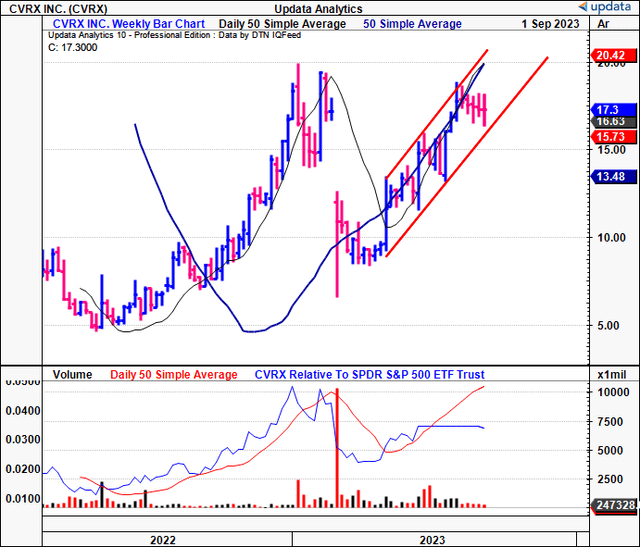

What a year it’s been for CVRx Inc (NASDAQ:CVRX) common stockholders in 2023. A tremendous rally from 2022 rolling into the new year was cut short by the February release of its BeAT-HF trial results. Investors pulled the rug from beneath its market value and saw it sell back at ’22 range. Since the last publication, it has caught a 16% bid.

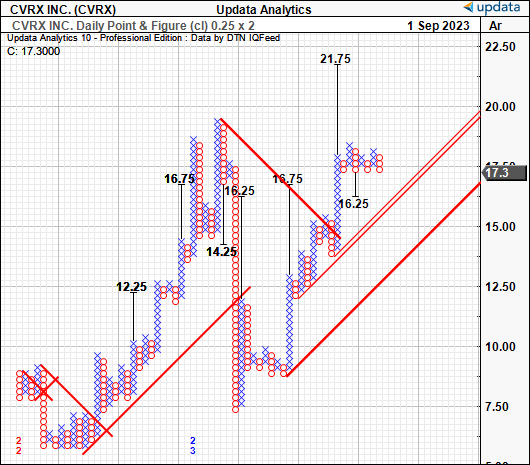

In classic market style, the stock caught a heavy bid at such depressed levels. Now it has rallied again in a stair-like pattern, setting a series of higher-highs and higher-lows along the way.

Critically, CVRX’s business economics square off with this repricing:

- Adoption and utilization of its Barostim product has continued to accelerate, despite the February announcement.

- Barostim unit volumes and average selling prices have increased in tandem over the previous year.

- Market technicals are exuding an attractive price structure, advancing a long-term bullish continuation.

Subsequently CVRX has reclaimed just about all the downside of ’23 and sells near its previous highs, as shown in Figure 1. This report will unpack the latest investment updates, and link this back to the long-term buy thesis. Net-net, I continue to rate CVRX a hold on long-term value, eyeing $20–$21 as the next price band (this is shown at the extension of the 2 red trend lines in Figure 1). Reiterate buy.

Figure 1.

Data: Updata

Updates to critical updates

Brief recall of operations

CVRX’s flagship product is its Barostim device. The device works by providing “baroreflex activation therapy” (you can call this Barostim therapy for short). The mechanism of action sends a transmission of subtle and sustained electrical impulses to the baroreceptors (stretch receptors) within the carotid artery walls. The carotid arteries are located either side of the neck. These impulses in turn trigger responses in the brain that regulate cardiovascular function downstream. This is typically heart rate, short-term changes in blood pressure, and so forth.

CVRX targets medical professionals who specialize in heart-related conditions, including electrophysiologists, cardiologists, and vascular surgeons. These are the primary users of Barostim. Naturally, the patient’s are the receivers of the treatment. However, hospitals are the actual customers, as they are responsible for purchasing Barostim devices. Barostim sales (and costs for the ‘customers’) are typically reimbursed by government agencies and commercial payors, Medicare and the likes. Critically, ~67% of CVRX’s patient population meets eligibility criteria for Medicare in the U.S., as determined by age demographics of patients with heart failure with reduced ejection fraction (“HFrEF”) who can benefit from Barostim therapy. This is relevant for the talks on CMS reimbursement later in the discussion.

1. Q2 + H1 FY’23 insights

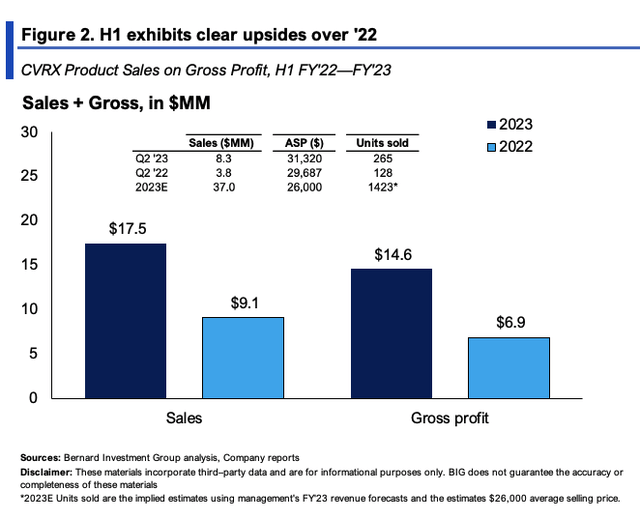

In H1 FY’23, CVRX put up massive growth in U.S. heart failure (“HF”) sales, growing the business 124% YoY. In Q2 alone, the company booked $9.5mm in total revenue, an 89% YoY increase, and U.S. HF brought in $8.3mm of this, up from $3.8mm last year. The major tailwind—gross margins decompressed 800bps YoY to 84%, due to the rapid uptick in volumes (discussed below).

Given the momentum observed this YTD, management revised FY’23 guidance. It now projects sales of $37mm—$38.5mm on gross of 83%—84%. It has booked $17.5mm in H1 and therefore expects $21mm in H2, or $3.5mm ahead of the first half.

The company’s active implanting centres have increased from 71 last year to 140 in Q2, ~97% increase. It is also established in 32 territories vs. 20 last year and 29 in Q1 FY’23.

The growth numbers outlined earlier are a function of pricing, and more importantly, volumes. In my eyes, higher volumes = higher demand. Critically, unit sales were up 100% in Q2 as evidence of this. It moved 265 units compared to 128 units last year, reflecting an average sale price (“ASP”) of $31,320 vs. $29,687, a growth of 550bps. This saw CVRX benefit from economies of scale in production, feeding the economic flywheel for the quarter. That is, higher volumes + higher ASP = strong revenue clip, hence the loosening of gross margin discussed earlier. Growth was underscored by expansion into new sales territories, acceleration of new accounts, and greater utilization of Barostim from existing accounts. It also pushed out 56 revenue units in Europe.

- Regulatory headwinds already accounted for

CMS recently announced its proposed outpatient prospective payment system (“OPPS”) for 2024, along with the proposed physician fee schedule (“PFS”). But the submission CVRX made in March—requesting assignment to new technology APC payment codes—was not mentioned in the proposed changes. I’d also flag that CVRX’s transitional pass-through (“TPT”) payment additions are set to expire at the end of ’23 and were not addressed in the proposal either.

CVRX intends to submit formal comments on the proposed OPPS package and seek inclusion in the final document later this year. But it is running the assumption that CMS’ 2024 proposed rules would cause a reduction in ASP to about $26,000.

The following points are relevant here:

- As a reminder, the current CPT code 0266T accounts for reimbursement of carotid sinus baroreflex activation device procedures, and is pegged at $30,400. Again—this is the current code, and is the reimbursement for both the Barostim device and the procedure.

- Meanwhile the $26,000 expected ASP is just for the device, and excludes the procedure.

- This $30,400 figure also represents the national average, meaning it fluctuates depending on location and so on. For instance, major urban centres may fall under higher reimbursement rates—up to $40,000—while smaller hospitals in rural/isolated areas (with lower living costs) might see rates of <$30,000.

- The TPTs are also set to expire this year, as mentioned earlier. It was receiving an additional $10,000—$15,000 on top of the base reimbursement amount. But I wouldn’t fret here. For one, this was always expected. And secondly, management had run with the $26,000 figure in its breakeven modelling all along. Moreover, we already saw the gross margin it can produce with higher volumes earlier.

Figure 2 outlines CVRX’s sales and gross profit numbers from H1 FY’22—’23. Figures are shown on a comparables basis, including all revenue sources. Running with management’s FY’23 assumptions of $37mm in sales, this gets you to 1,423 units being sold at the $26,000 ASP (37MM/26,000 = 1,420). Noteworthy, this is ahead of the current run rate as of Q2 (265×4 = 1,060).

BIG Insights

2. Market-generated data

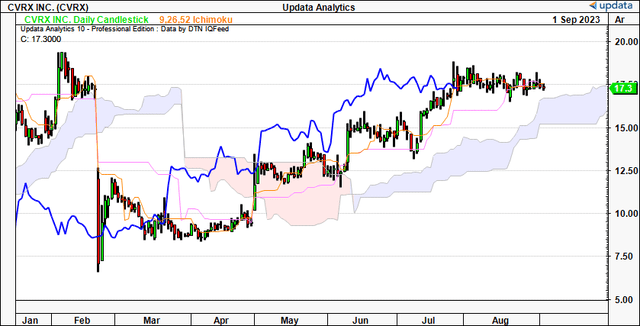

Market studies corroborate CVRX’s long-term pricing structure is currently bullish. The daily and weekly cloud charts in Figures 3 and 4 display this well.

In the daily, that looks to the coming weeks, the price and lagging lines are above the cloud. Above the cloud = bullish, and it crossed in April after its mishaps surrounding the BeAT-HF trial earlier on, having maintained the price structure from then. A pullback to $16.00 could be acceptable for CVRX for a continuation of the uptrend based on this setup. To me this is a bullish point in the debate.

Figure 3.

Data: Updata

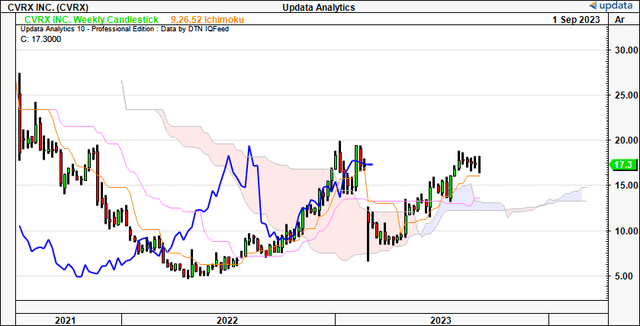

On the weekly chart, that looks to the coming months, the structure is equally as constructive. Both price and lagging lines tested the cloud top in July and broke higher from there, indicating the demand at these levels.

Most critical is the lagging line (in blue) nudging its head above the cloud. This is the bullish confirmation that these charts provide in the first place. That is has pushed above these key psychological levels is a major inflection point, an indication of the long-term market positioning. Again, this supports a bullish view in my opinion.

Figure 4.

Data: Updata

It should be no surprise that we have further upsides to $21.75 on the point and figure studies below. P&F studies go well with the cloud charts as they often line up in strikingly similar fashion to provide key levels.

You can see the P&F eyed the $16–$17 levels well after the sharp selloff earlier in the year. It also provides a cleaner view of the long-term trend by removing intra-trend volatilities and the noise of time. Hence, I am looking to $21.75 as the next technical target.

Figure 5.

Data: Updata

Valuation and conclusion

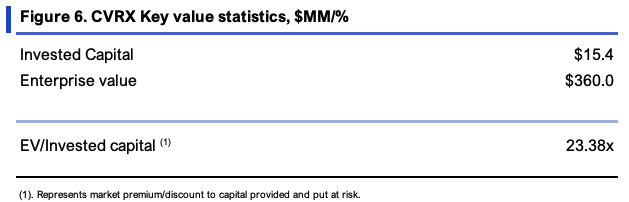

The stock sells at 9.5x forward sales at a $360mm market value. This is in no way a discount to the sector—a 138% premium in fact. To me it’s more important to gauge what value the market has placed on CVRX’s net assets, seeing as it is the combination of Barostim volumes + margins that are driving business growth, Barostim being the key ‘capital’ producing the profits. In fact, stripping cash + marketable securities from the firm’s capital employed, the capital required to run the business is only $15.4mm.

To suggest investors are pricing in tremendous growth potential off this capital base I’d expect CVRX to sell at tremendously high multiples of EV to invested capital (“EV/IC”). This appears to be the case, as shown in Figure 6. CVRX trades at 23.4x EV/IC, implying the market values its operating capital exceptionally high.

Presuming the market is also a fairly accurate judge of fair value over time [Ben Graham’s, “in the long run, it is weighing machine” argument, and so forth] this implies CVRX has immense growth potential when looking at sales + profits produced off the resources employed into operations. To me, this supports a buy rating. Moreover I am eyeing $51mm in sales for CVRX in 2024, and align with the $38mm print for FY’23. I had laid the case for CVRX to trade at 11x forward in the last publication, getting us to $418mm market value or ~$20/share. I am reiterating this posture today. This aligns with the technical targets outlined above as well.

Source: BIG Insights, Bloomberg Finance

In short, CVRX continues to ratchet up the value chain, setting higher growth percentages in both unit economics and top-line sales. Gross profitability is a standout with 84% gross margins, having growth with additional volume growth and more attractive pricing. Based on the culmination of factors presented here today, I reiterate CVRX as a buy, still eyeing the $20—$21/share mark as the next price band. This is a c.20% margin of safety, and compelling value at the same time. Net-net, reiterate buy.