jetcityimage

Introduction

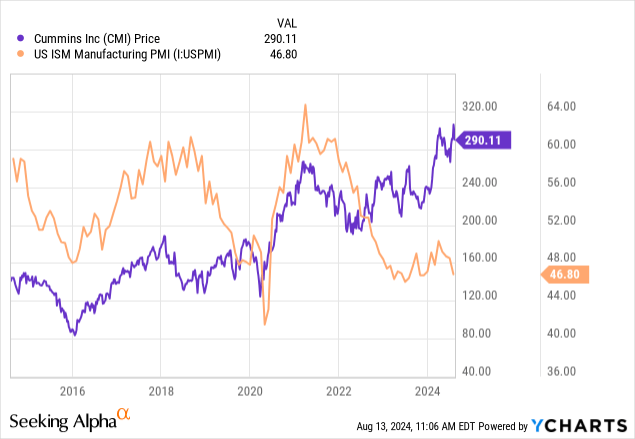

The American manufacturing trade just isn’t in an awesome place – neither are the European nor the Chinese language.

To make use of the phrases of Wells Fargo (emphasis added):

The ISM Index, a long-trusted bellwether for the manufacturing sector, sunk even deeper into contraction territory in July coming in at 46.8, a studying simply spitting distance from its lowest ranges of the previous three years. Solely two parts had been above the 50-line of demarcation between enlargement and contraction: costs paid and provider deliveries. It is a troubling growth because it alerts that greater rates of interest are hurting exercise with out the meant consequence of additional decreasing costs. – Wells Fargo

The final a part of the quote above is essential as a result of it exhibits extra proof of a weakening financial system. Nevertheless, the Fed can’t lower charges aggressively with out risking a second wave of inflation.

Wells Fargo

With that mentioned, it is not as black and white as it could have been in prior financial cycles. Though demand is poor, typically, there are different elements at play, together with financial re-shoring, fueled by the Inflation Discount Act. This has supported multi-billion greenback spending on semiconductor services, auto crops, and plenty of different operations which can be bullish for producers.

That is the place Cummins Inc. (NYSE:CMI) is available in, a diversified engine producer I’ve lined for a few years. On June 9, I wrote an article titled “10-12% Annual Returns? Why Cummins May Be Your Subsequent Dividend Champion.”

Since then, shares have returned 7%, beating the 1% return of the S&P 500 by an honest margin. That’s incredible, particularly if we think about the poor outlook from manufacturing indicators just like the ISM index.

As the corporate very lately launched its 2Q24 earnings, it is time to dive into the main points as I replace my thesis.

So, let’s dive into the main points!

Cummins Continues To Stand Out

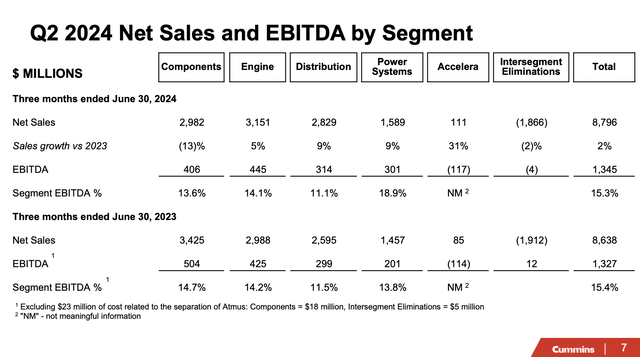

Within the second quarter of 2024, the corporate achieved file revenues of $8.8 billion, which marks a 2% enhance from the prior 12 months quarter. This development was pushed by robust demand in key segments and higher pricing.

EBITDA reached $1.35 billion, up from $1.33 billion within the prior 12 months quarter. The EBITDA margin was 15.3%. Though that is down from 15.4% in 2Q23, it is an awesome margin in an surroundings of elevated inflation.

Furthermore, these numbers embody the Atmus Filtration Applied sciences (ATMU) spin-off, which grew to become an impartial firm in Could of final 12 months.

Cummins Inc.

Now, let me throw some numbers at you that stood out with regard to its segments:

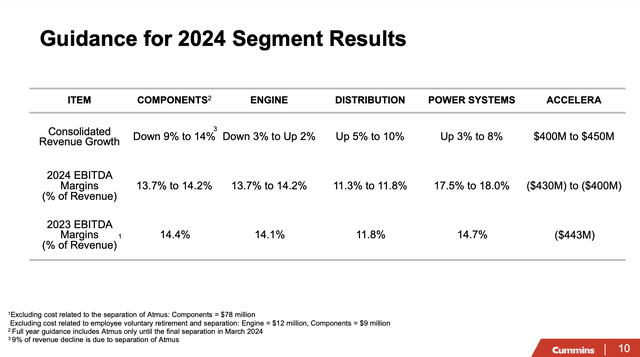

- The Engine section reported a file $3.2 billion in income, which was pushed by robust on-highway volumes and favorable pricing, with EBITDA margins anticipated to extend to 13.7%-14.2% for the total 12 months. As we will see under, income development is anticipated to return in between destructive 3% and constructive 2%.

- The Energy Programs section additionally set a brand new file with $1.6 billion in income and an EBITDA margin of 18.9%. In accordance with the corporate, this displays important enhancements in operational effectivity and pricing. This section is anticipated to see at the very least 3% development on a full-year foundation.

- Moreover, the Distribution section achieved a file income of $2.8 billion, supported by a 9% enhance from the earlier 12 months. Distribution gross sales are anticipated to develop by at the very least 5% this 12 months.

- Income within the Elements section is anticipated to see as much as 14% contraction this 12 months, with a 13% decline in 2Q24. That is because of the Atmus spin-off.

Cummins Inc.

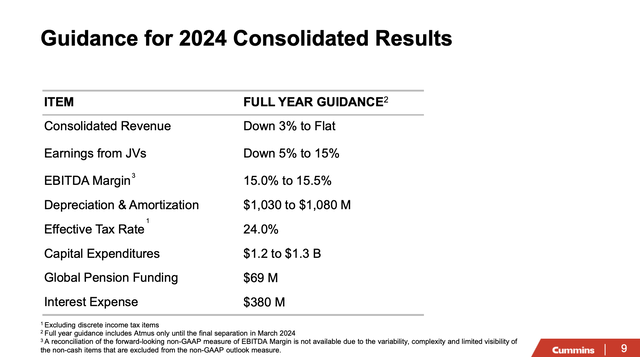

Placing every part collectively, the corporate raised its full-year income and EBITDA margin steerage primarily based on robust outcomes and an improved outlook.

As we will see under, the Indiana-based firm expects income development to be down 3% to flat, with EBITDA margins forecasted to return in between 15.0% and 15.5%. Its earlier income development steerage was down 2% to down 5%.

Cummins Inc.

Along with robust demand, the corporate is increasing its footprint in key markets.

For instance, the corporate has a partnership with Isuzu Motors to introduce a brand new 6.7-liter engine for medium-duty vehicles in Japan and different international markets.

It additionally has a three way partnership with Daimler Truck (previously part of Mercedes-Benz) and PACCAR (PCAR) that created Amplify Cell Applied sciences, which is a key step in localizing battery cell manufacturing within the U.S.

On high of that, the corporate’s Accelera section, which is at the moment too small to be “related,” obtained a $75 million award from the Division of Power to transform roughly 360 thousand sq. toes of current manufacturing area in Columbus, Indiana, for zero-emission parts, together with battery packs and electrical powertrain techniques.

Cummins Inc.

That is a part of the Inflation Discount Act. It is small steps for the corporate, however that is all it wants to arrange its enterprise for the long run. In spite of everything, the power transition is a sluggish course of.

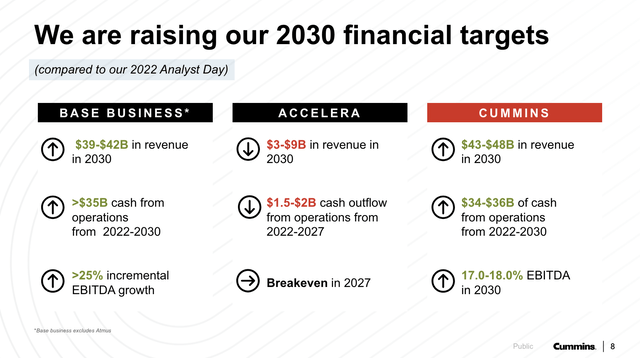

As I wrote in my prior article, by 2030, Accelera could possibly be a enterprise with as much as $9 billion in gross sales, probably reaching breakeven profitability in 2027.

Cummins Inc.

So, what does this imply for shareholders?

Shareholders Stay In A Nice Spot

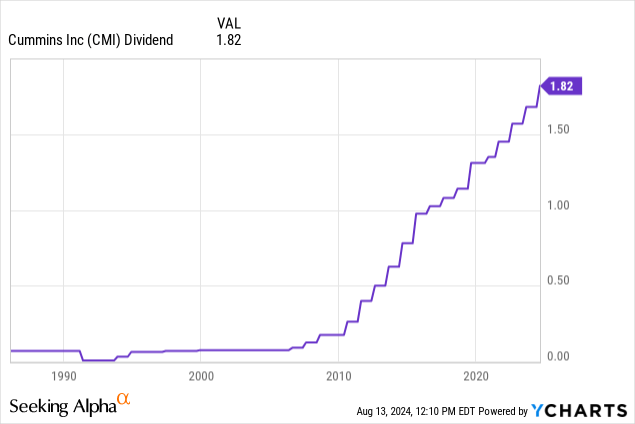

Because the first day I began protecting Cummins, I’ve heard how glad individuals are with its dividends.

Presently yielding 2.5%, the dividend has a really wholesome payout ratio of 35% and a five-year CAGR of 8.1% – a mile above the common fee of inflation.

The dividend has been hiked for 18 consecutive years and enjoys an A-rated steadiness sheet.

As I’ve written in prior articles, the one motive why I by no means purchased CMI regardless of being so bullish is the truth that I personal Caterpillar (CAT) and Deere & Firm (DE).

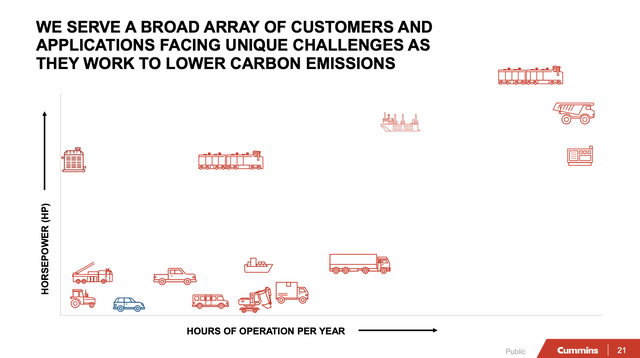

The largest distinction is that these two produce machines. Every with a particular focus. Deere focuses on agriculture, Caterpillar on building and mining.

Cummins is a provider. Though Caterpillar additionally sells engines, Cummins is extra diversified, because it provides an virtually infinite vary of consumers from heavy-duty vehicles to trains and mining dump vehicles.

Cummins Inc.

Valuation-wise, CMI stays engaging as nicely.

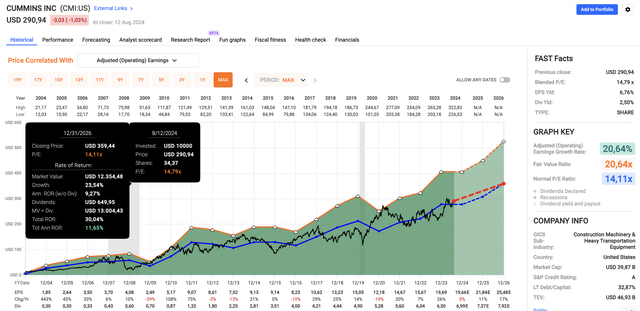

Buying and selling at a blended P/E ratio of 14.8x, CMI trades barely above its long-term common of 14.1x earnings. Nevertheless, utilizing the FactSet information within the chart under, analysts count on 0% EPS development this 12 months to be adopted by 11% and 17% EPS development in 2025 and 2026, respectively.

This paves the highway for a good inventory value goal of $360, 24% above the present value. It is also greater than my prior goal of $343.

FAST Graphs

Evidently, I preserve a Purchase score, anticipating CMI to stay a incredible play for dividend development traders searching for diversified industrial publicity.

Takeaway

Regardless of the broader manufacturing struggles, Cummins continues to impress, delivering file revenues and strong profitability even in a difficult financial surroundings.

With robust demand, strategic partnerships, and enlargement into areas like electrical mobility, Cummins is in an awesome spot for long-term development.

In the meantime, the corporate’s constant dividend development, supported by a wholesome steadiness sheet, makes it a standout alternative for dividend traders.

Whereas I stay bullish on Cummins, it is important to remember the aggressive panorama and the present financial headwinds.

That mentioned, total, Cummins provides a compelling funding alternative, particularly for these searching for diversified industrial publicity with dependable dividend development.

Professionals & Cons

Professionals:

- Robust Monetary Efficiency: Cummins continues to ship file revenues and preserve strong margins, even in a tricky financial local weather.

- Dependable Dividend Development: With an 18-year streak of dividend hikes and a wholesome payout ratio, Cummins is nice for traders searching for dependable industrial dividends.

- Strategic Growth/Diversification: The corporate’s partnerships and investments in future applied sciences, like zero-emission parts, place it nicely for long-term development.

Cons:

- Sector Headwinds: The broader manufacturing sector is struggling, which might restrict upside potential.

- Foreign money Publicity: With a good portion of its income generated in non-U.S. nations (43% in 2023), Cummins faces dangers from fluctuating change charges that would influence revenues.

- Competitors: Cummins faces competitors from conventional engine producers and rising gamers within the electrical and different power sectors. This might stress market share and margins over time.