Andrii Dodonov/iStock by way of Getty Photos

By John R. Mousseau, CFA, President, Chief Govt Officer, & Director of Mounted Earnings, Cumberland Advisors

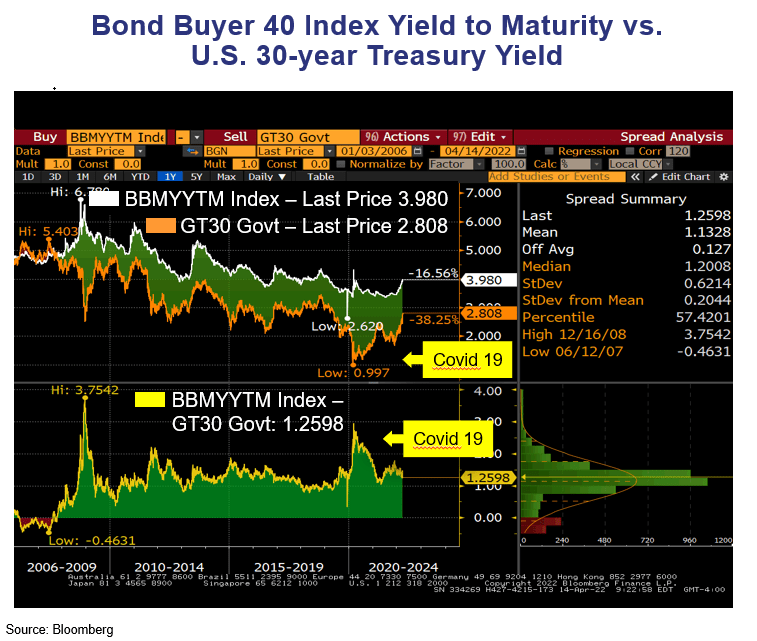

The errant monetary golf ball that’s the municipal bond market has now careened out of bounds and landed – for now – in a spot the place we expect the lie is extraordinarily engaging: 4% on long-maturity tax-free bonds which are insured or high-grade. We noticed that degree very briefly through the Covid-19 meltdown of March 2020. However the market instantly rebounded, and the 4% yield degree was gone in a rush. Previous to that was the bond sell-off following the 2016 Trump election. The ten-year bond has moved from 1.50% to 2.70% for the reason that begin of this yr. Lengthy munis have moved at a a lot quicker price. We don’t know the way lengthy this 4% alternative could also be with us. To grasp how low cost the longer tax-free bond yield is, we use the chart under, which compares the Bond Purchaser 40 Lengthy-Time period Bond Index (BB40) to lengthy Treasuries. You’ll be able to see the current cheapness. The 4% lengthy muni compares to a 30-year Treasury yield of two.80%. That’s over a 140% yield ratio, and it has hardly ever been this low cost aside from the post-Lehman Brothers meltdown of 2008.

How did it get so low cost so quick? Listed below are the culprits sending the muni golf ball careening into the excessive grass.

Excessive inflation

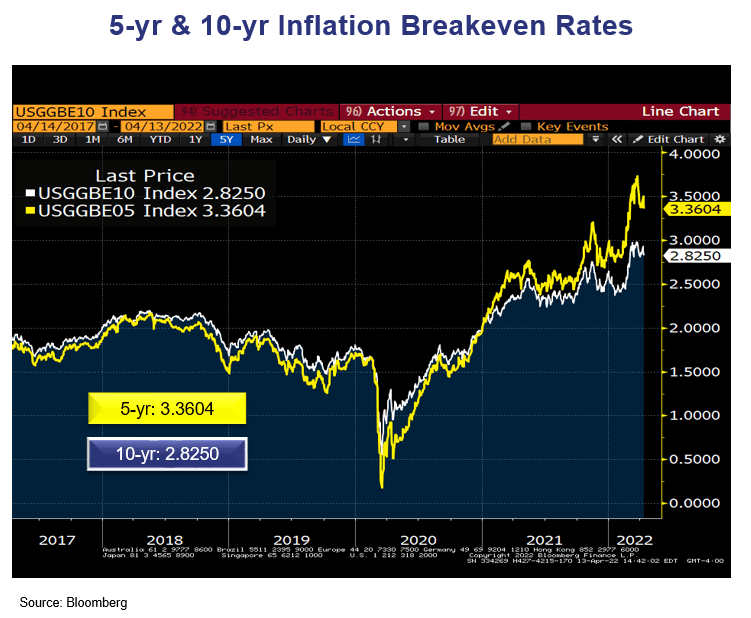

Trailing 12-month CPI (Client Worth Index) was 8.5% on the finish of March. A yr in the past, that quantity was 2.6% however starting to maneuver up quick from a mix of a prodigious quantity of fiscal stimulus and a populace that largely received vaccinated and began to spend cash with a vengeance. Although it has confirmed removed from “transitory,” because the Federal Reserve labeled inflation final summer season, we do imagine there may be anecdotal proof that inflation could also be peaking. The bond market forecasts future inflation expectations by breakeven inflation charges (the distinction in yields between a nominal Treasury safety and an inflation-indexed safety of the identical maturity). Beneath is a chart exhibiting the forecast breakeven charges of inflation for five years and 10 years, and people numbers are 3.36% for five years and a decrease price of two.82% over 10 years. In different phrases, the market believes that inflation will return to decrease ranges over time — to not the extent pre-Covid, however a lot decrease than presently. We imagine that as properly.

Bond fund outflows

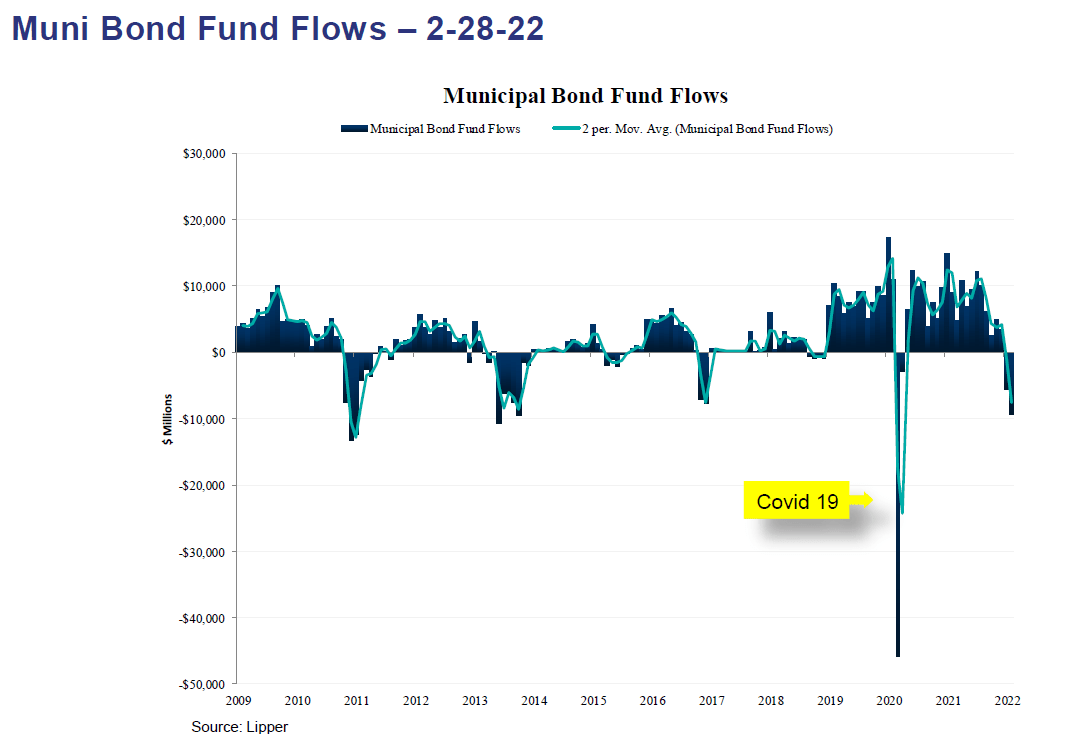

In any massive muni sell-off, that is the frequent denominator, and this yr is not any totally different. Bond fund redemptions have been rising steadily, hitting $3 billion final week. When bond funds get hit with redemptions, they’re pressured to promote, and the funds could not promote what they wish to promote; they promote what they CAN promote, and that’s high-grade bond; and that’s right into a supplier group that will get rapidly overwhelmed with this provide. Durations of huge inflows (like final yr) sow the seeds for large outflows when panic units in (like this yr).

Concern of the Fed

Despite the fact that inflation was rising final summer season, there was little response from the bond market, with yields pretty range-bound. We predict the primary motive was that the Fed was nonetheless concerned in quantitative easing, shopping for $80 billion monthly of Treasuries and mortgage-backed securities. They started to taper this buying within the fall and completed in March of this yr. And that, after all, is after we began to see the RAPID rise in yields, because the 800-lb. gorilla that’s the Fed, was out of the cage. After all, the Fed additionally started its hike of the fed funds price, and now the market is forecasting a sequence of price hikes. However the removing of quantitative easing is enjoying a task right here.

Muni feast and famine

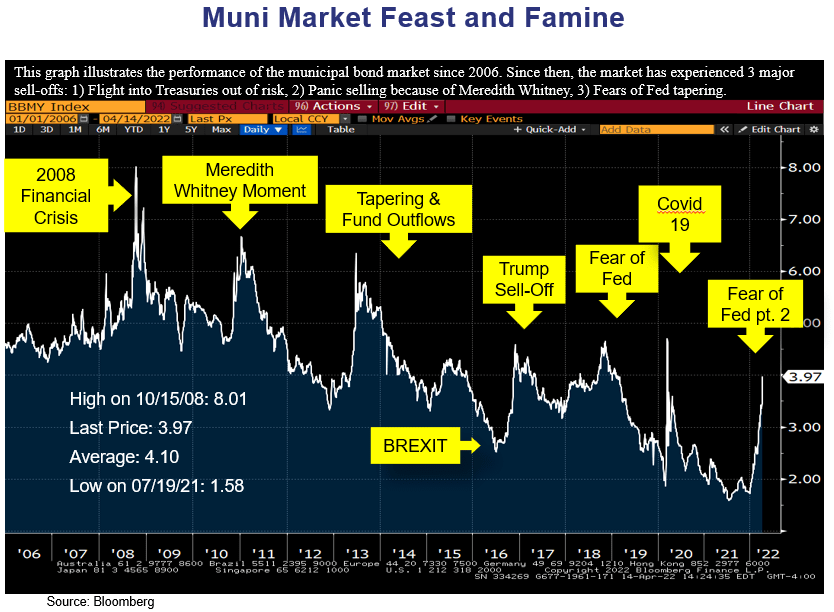

The chart under reveals the assorted sell-offs out there for the reason that Nice Recession, which was kicked off by the failure of Lehman Brothers. All muni sell-offs have one factor in frequent: There may be nothing gradual in regards to the rise in yields. It comes quick and sharp and is characterised by yields rising at an INCREASING price. Promote-offs all share one different factor. They’re all adopted by reversion to the imply, and yields start to retreat. We predict this may occur once more. Are we’re going again to the lows in yields of mid-pandemic? We predict not. However we do imagine {that a} municipal bond yield of 4% with a taxable equal yield of 6.35% will look superb if inflation returns to something approaching the breakeven charges forecast by the market. We’re extending durations and maturities to seize this chance.

Authentic Submit

Editor’s Notice: The abstract bullets for this text had been chosen by In search of Alpha editors.