JHVEPhoto

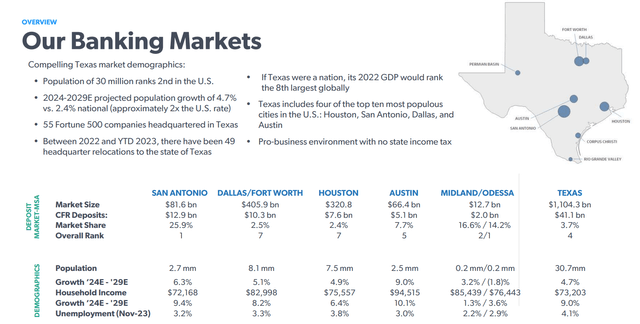

I stated that there was loads to love about Cullen/Frost Bankers (CFR) after I opened on this financial institution final November. The holding firm for Frost Financial institution, this industrial and retail lender is an solely Texan participant that controls one of the best deposit franchises within the business. Its development outlook was stable too. Frost was already the highest deposit gatherer in San Antonio, and was within the technique of constructing out its franchise in different massive markets like Houston, Dallas, and Austin, the place its footprint stays extra modest. Whereas that was coming at a near-term price by way of greater bills, implied market share beneficial properties married with stable Texan GDP development pointed to enticing long-term potential.

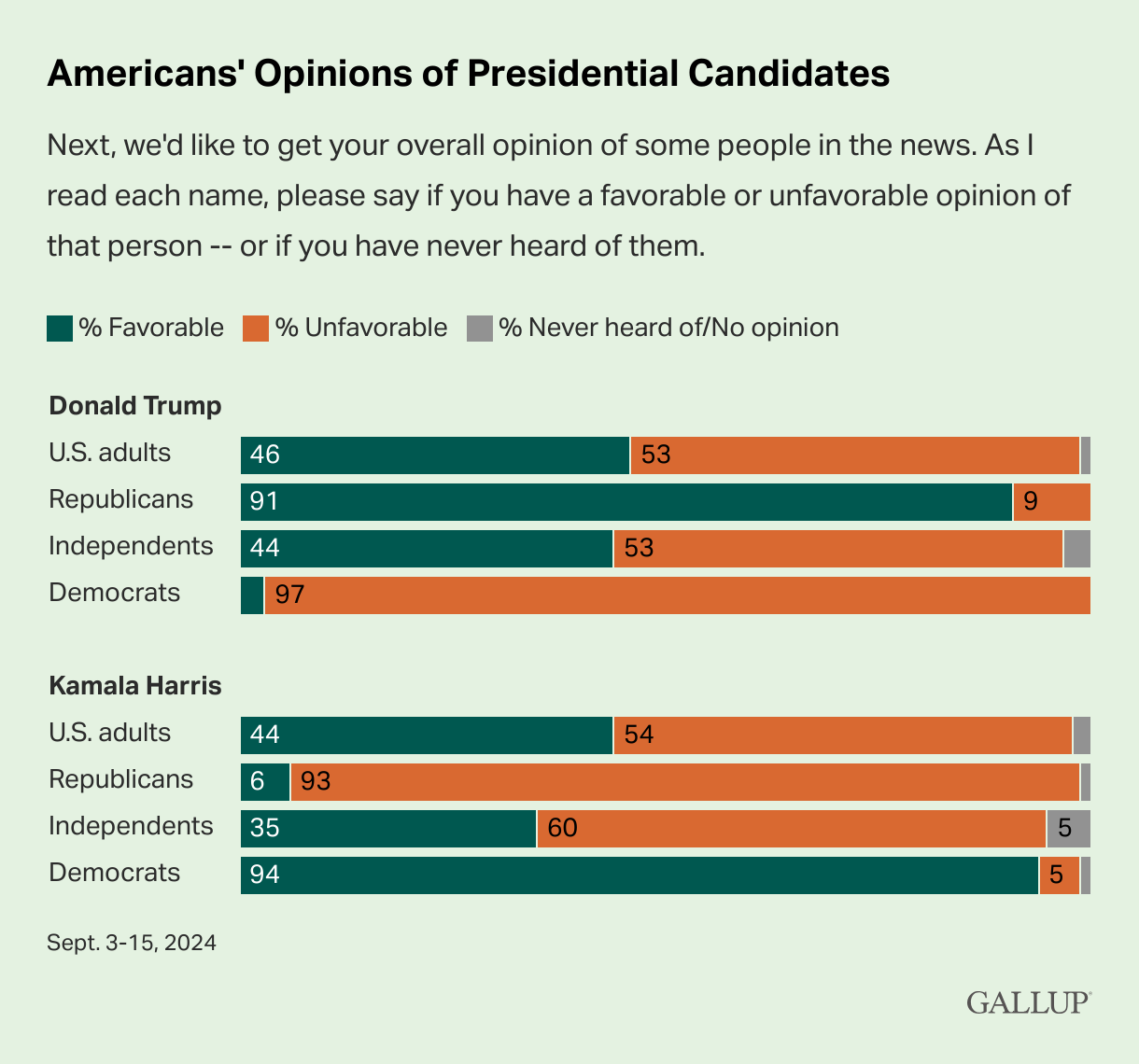

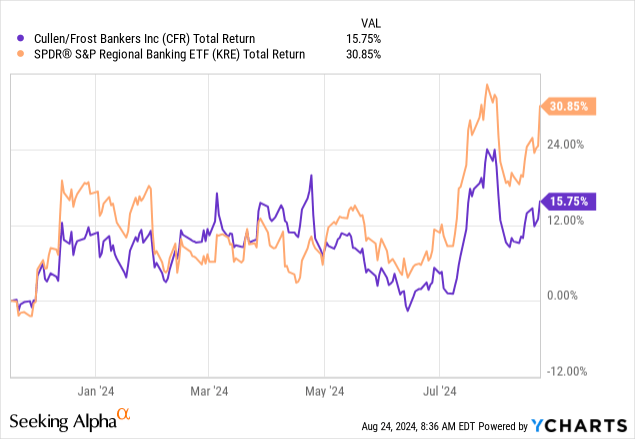

These shares have been a bit so-so in that point, returning round 15% with dividends. Whereas that’s objectively good in isolation, it seems extra pedestrian subsequent to the 30%-plus returns of the broader regional financial institution area.

Operationally, Frost is by-and-large performing as anticipated, with web curiosity margin (“NIM”) bottoming late final yr and web curiosity revenue (“NII”) additionally returning to development. Expense development continues to be outpacing the highest line, and this continues to place downward strain on earnings. As for the inventory, Frost trades for round 13x EPS and round 1.7x ex-AOCI tangible e book worth – and that is still a stable deal given its profitability and development prospects. I go away my preliminary ‘Purchase’ ranking unchanged.

Earnings Stay Subdued

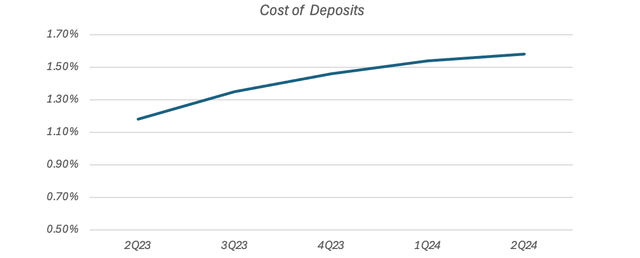

Frost’s revenue assertion dynamics are largely enjoying out as anticipated final yr. Firstly, funding price development continues to ease up, with the financial institution reporting a complete price of deposits of simply 1.58% final quarter. This was up 4bps sequentially, persevering with its pattern of deceleration. The prior three quarters noticed quarter-on-quarter deposit prices rise by 8bps, 11bps and 17bps, respectively.

Information supply: Cullen/Frost Quarterly Outcomes Releases

Frost’s deposit base deserves some additional commentary as a result of it’s by far the very best characteristic of this financial institution. Regardless of rising just lately, a 1.58% complete price of deposits stays distinctive. You’ll not discover many mainland banks with a print this low, actually within the $50 billion-plus asset bracket that Frost is in. What’s extra, Frost is overwhelmingly funded by buyer deposits, with shareholder fairness making up many of the relaxation. There may be little or no debt right here, which clearly attracts wholesale charges and is due to this fact costlier.

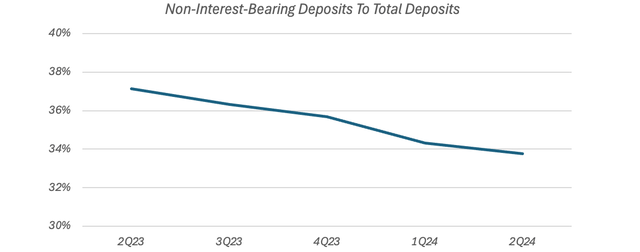

Non-interest-bearing balances proceed to churn. These averaged $13.68 billion final quarter, down from $13.98 billion in Q1 and $15.23 billion within the year-ago interval. Whole deposits have been roughly flat in that point, which means the underlying combine continues to shift to interest-bearing accounts. NIB balances are nonetheless a chunky ~34% of the whole, albeit that is down from round 37% a yr in the past.

Information supply: Cullen/Frost Quarterly Outcomes Releases

NIM has began to grind greater once more after bottoming on the finish of final yr. Whereas funding prices have edged greater, Frost can also be seeing yields on loans and securities tick up as they reprice to the present price surroundings. The financial institution has additionally seen some combine shift on the asset facet of the stability sheet, with maturing securities recycled into greater yielding loans. NII has began to tick up consequently, rising ~3% year-on-year and ~1.7% sequentially final quarter to $396.7 million.

That stated, earnings stay subdued, with Q2 EPS of $2.21 down round 11% year-on-year. That is for a few causes. On the revenue facet, NIM is clearly only one part of NII. The opposite is incomes asset ranges. Now, administration typically makes of level of describing Frost as a relationship financial institution. Whereas some banks prioritize mortgage development after which search for funding (e.g., deposits) afterwards, Frost assaults issues from the opposite course. It seems for deposits first after which thinks about deploying these into loans or securities.

Frost does this as a result of it needs prospects to be primarily banked at Frost. Main banked prospects supply a couple of benefits. Firstly, they’re typically much less delicate to charges on either side of the stability sheet. You may see this clearly right here, as Frost is ready to pay simply 1.58% on its deposits although the money price is 5.33%. Secondly, main banked prospects supply a financial institution better perception into their funds, giving it extra knowledge with which it may possibly worth merchandise and spot potential dangerous debt upfront. On that be aware, asset high quality hasn’t moved right here. Web charge-offs have been 0.2% of loans final quarter, down round 2bps year-on-year, whereas non-accrual loans have been flat at just below 0.4% of complete loans.

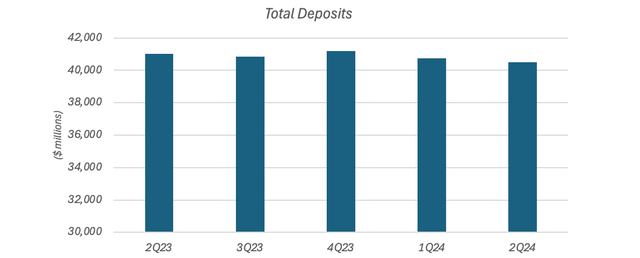

Deposit gathering has a cyclical factor to it, and this isn’t a very good level within the cycle for gaining low-cost deposits. Between 2015 and 2022, Frost grew deposits at a roughly 9% annualized clip, however balances have been flat for some time now. As a result of Frost overwhelmingly funds itself by way of buyer deposits, incomes belongings have additionally flat lined at across the $45.5 billion mark. Development will decide up once more when rates of interest fall, however for now, flat incomes asset balances are clearly a headwind to NII.

Information supply: Cullen/Frost Quarterly Outcomes Releases

On the bills facet, Frost continues to be guiding for 6-7% development in working prices, which is forward of income development. I discussed final time that the financial institution is at the moment increasing its footprint in locations like Dallas, Houston, and Austin, the place its market share continues to be within the single-digits. It will repay down the road when new branches attain scale, however within the quick time period, it’s miserable the financial institution’s earnings.

Valuation

Frost shares commerce for $111.79 as I sort, equal to round 1.7x tangible e book worth per share of $66. Word that that is excluding amassed different complete revenue from the stability sheet. I discussed this final time however to rapidly recap, Frost nonetheless holds over $18.5 billion in funding securities, accounting for round 40% of its incomes belongings. A good portion of this portfolio was bought when rates of interest have been decrease, and this has led to massive unrealized losses as charges have risen. These losses present within the AOCI line on the stability sheet. Many banks have seen the identical factor, albeit maybe to not the identical diploma as Frost.

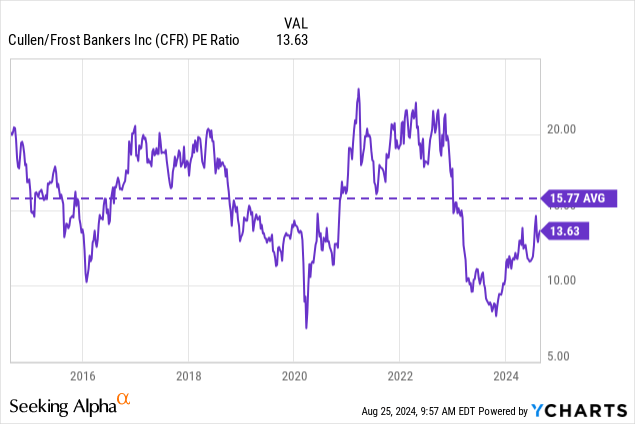

Frost earned $4.27 per share over the primary two quarters, or $8.54 per share annualized. That maps to a return on tangible fairness of round 13%, once more excluding AOCI. Dividing this determine right into a 1.7x TBV a number of implies a price-earnings ratio of roughly 13x, round 15% beneath the inventory’s longer-term common:

One other manner to take a look at that P/E ratio is to show it on its head and inverse it. This produces an earnings yield of ~7.7%. Frost pays out round 45% by the use of its money dividend, equating to a yield of roughly 3.4%. Multiplying the retained earnings by a ~13% ROTE implies longer-term annualized development potential of round 7%, all else equal.

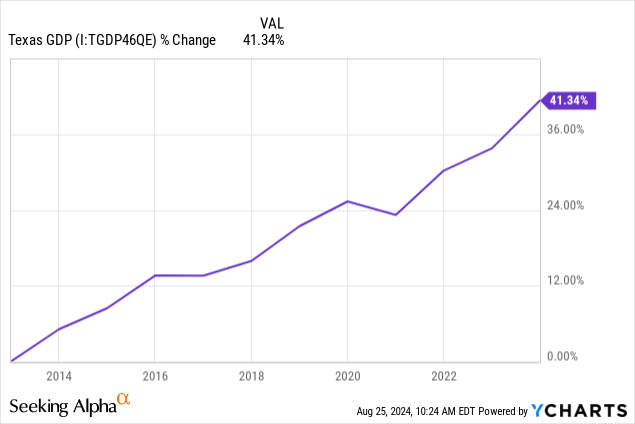

This isn’t unrealistic for Frost. Certainly, it grew deposits sooner than earlier than 2023. Texas can also be rising its inhabitants at twice the speed of the broader United States, which alone ought to energy above-average GDP development for the state.

Supply: Cullen/Frost Investor Presentation

Actual Texas GDP development has averaged round ~3% a yr since 2012, which is extra like 6% in nominal phrases. Given Frost additionally has potential to achieve market share, it should have no drawback hitting excessive single-digit development by means of the cycle. On high of a 3.4% dividend, traders ought to nonetheless compound right here at a double-digit annualized clip.

Summing It Up

Earnings stay considerably subdued at Frost Financial institution. Funding price strain has undoubtedly subsided, however elevated working prices and flat deposits and incomes asset balances are nonetheless weighing on the underside line. That stated, Frost stays a category act, in the end controlling one of many highest high quality deposit franchises within the nation. These shares stay fairly valued at 13x EPS, which is beneath their long-term common and might assist double-digit annualized returns for traders. On condition that, I hold my ‘Purchase’ ranking from final time in place.