Spencer Platt/Getty Images News

The pursuit of stable income against a stock market and economy that has and looks set to continue to be characterized by relative chaos, volatility, and losses is difficult. Yield traps have ensnarled plenty of income-eyed investors this year with 2023 likely not to bring any respite. The risks posed to REITs next year will especially be heightened if the economy misses a soft landing and falls into a recession. Inflation remains high and the Fed looks set to hike rates and maintain them at elevated levels for longer. This is the macroeconomic context that pushed me to consider CTO Realty Growth (NYSE:CTO) as an investment.

With the need for a stable income in view, CTO Realty’s last declared quarterly cash dividend payout of $0.38 per share, in line with the prior payout, meant an 8.4% annual dividend yield. This year has been a mixed one for the externally managed retail REIT whose primary focus is on grocery-anchored properties. Its common shares are down 7.3% year-to-date on a total return basis a far better performance than the Vanguard Real Estate ETF (VNQ) which is down by 23.4% over the same time period. However, the year also saw its stock price remain essentially flat over a 5-year period with a total return of around 3.84%.

CTO Realty Growth

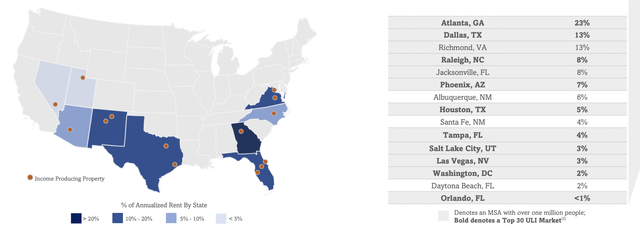

The company is relatively small with a market capitalization of $413 million and with 19 properties comprising around 3.1 million square feet of space across 15 markets. The company has a sunbelt focus with Georgia, Texas, Virginia, and North Carolina forming its top four markets. Atlanta, Georgia at 23% of its annualized base rent was the largest with management flagging it as a priority due to strong underlying long-term growth potential and business-friendly markets.

A Highly Active Asset Management Strategy

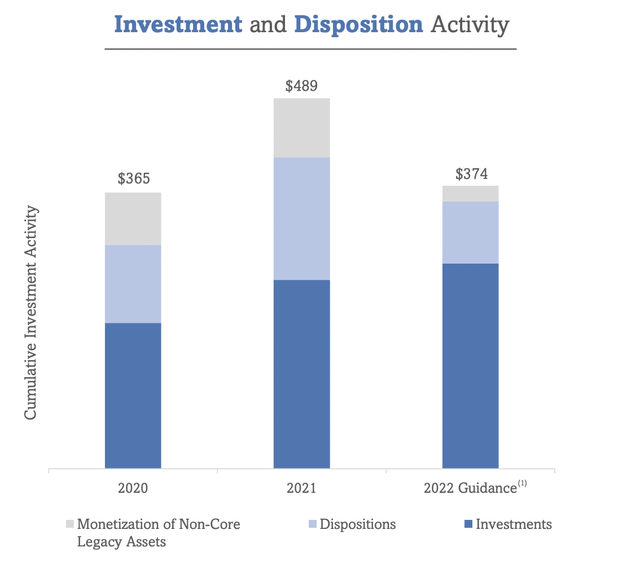

The company is highly active from an acquisition and disposal perspective. Indeed, the company made $249 million worth of acquisitions and $162 million of disposals in 2021. The pace has been maintained in 2022 with the company’s most recent acquisition being a $93.9 million buyout of West Broad Village, a mixed-use and grocery-anchored lifestyle property in Richmond, Virginia. The property will become their first Whole Foods anchored property and comes as cumulative acquisition and disposal activity this year reached $374 million.

CTO Realty Growth

For some context, this amounts to 90.5% of the company’s market cap. The company has funded these acquisitions through a mix of debt and cash on hand, the latter sometimes funded by offering new shares. CTO Realty had to issue 2.5 million shares to fund a portion of its West Broad Village acquisition.

The company last reported earnings for its fiscal 2022 third quarter saw revenue come in at $23 million, an increase of nearly 40% from its year-ago period with leased occupancy at 94%. Growth was driven by income property and structured investment revenue gains with some contribution from mitigation credit and subsurface sales. The REIT has a number of legacy mitigation credits and mineral rights assets that it intends to dispose of for capital that will be redeployed into properties. Core FFO during the third quarter was $0.47 per share, a growth of 38% over the year-ago comp with year-over-year same property NOI growth of 12%.

The financials are healthy with net debt to EBITDA at 6.4x and a debt-to-capital ratio of 45.47%, lower than its peer group median. The company revised its FFO per share guidance to $1.71 to $1.74 per share, an increase of $0.13 per share at the low end of its range.

Economic Disruption And Risks As A Soft Landing Looks Likely

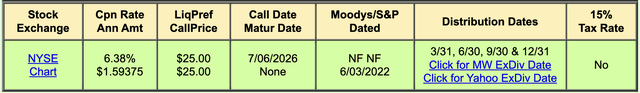

CTO Realty Growth Series A Cumulative Redeemable Preferred Stock (NYSE:CTO.PA) offer an option for prospective longs. These pay out a $1.59375 coupon in quarterly instalments for a yield of 7.96% on the current price of the preferred shares. Whilst the preferreds are safer and rank higher on the capital structure, the dividend payout is around 44 basis points less than the payout available on the commons. It’s also covered by the quarterly FFO.

QuantumOnline

With 2023 set to bring more economic disruption as rates are set to be hiked and maintained at a nearly two-decade high, the preferred could help create a type of certainty for its owners that’s hard to replicate. Essentially CTO Realty has an obligation to buy these for $25 per share on or after their call date, which falls on July 6, 2026. This would represent an extra rate of return of 20% over the next few years till this date on top of the annual coupon.

Overall, whilst grocery-anchored retail is less sensitive to digital disruption and recessionary shocks, CTO Realty’s overdependence on acquisitions for growth is a risk. To be clear, acquisitions for REITs are great when executed at attractive cap rates. But turnover amounting to nearly 100% of your enterprise value every single year creates unique execution risk and leaves management dependent on ever more acquisitions to boost quarterly financials. I’m neutral on the stock here.

Comments 1