wildpixel/iStock via Getty Images

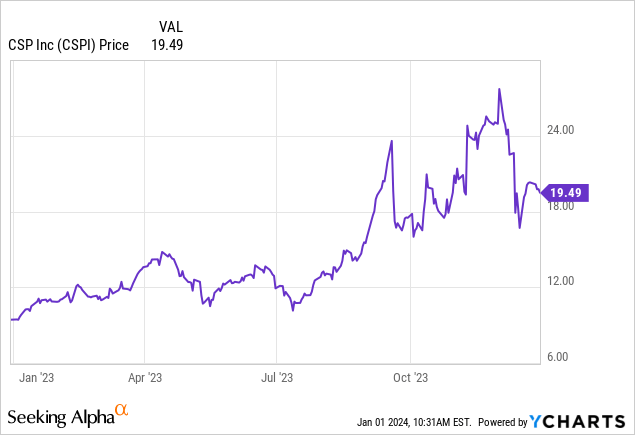

CSP Inc. (NASDAQ:CSPI) is a provider of IT, cloud, security, and computer system products and services. Supply chain issues during the height of the COVID-19 pandemic created a backlog buildup. No contracts were lost. CSPI reported year over year 2023 increased revenues of 19% and increased income of 161%, as the company’s backlog has returned to pre-pandemic levels. The stock price declined almost 30% on the issuance of the annual report, as investors perceived the decline in backlog as a forward weakness.

My investment thesis is that despite backlog returning to normal levels, CSPI’s two business segments are both projecting strong growth. A new product introduction from the company’s smaller business segment, High-Performance Products (“HPP”), appears to be a game changer. The majority of revenue has been generated from the Technology Solutions (“TS”) business segment, which shows no inclination of slowing down.

A Game Changer From The HPP Segment

Revenues from the HPP segment are derived mostly from the Aria SDS solution portfolio, which has been bulked up with the introduction of Aria Zero Trust Protect (“AZT”) in July 2023.

AZT utilizes AI to learn all of a system’s programs and detects any intrusion in real time. While most security software is designed to target specific attacks, AZT is designed to detect any type of attack, even previously unknown types. It is installed with zero downtime in as little time as half an hour, as described in the Q4 earnings call. Many manufacturers have avoided shutdowns by not upgrading the software versions being utilized. AZT is system and version-agnostic. It can be used alongside any existing software, regardless of the age of the software.

Segment | 2023 | % | 2022 | % | |||||||

(Dollar amounts in thousands) | |||||||||||

TS | $ | 57,774 | 89 | % | $ | 50,518 | 93 | % | |||

HPP | 6,873 | 11 | % | 3,843 | 7 | % | |||||

Total Sales | $ | 64,647 | 100 | % | $ | 54,361 | 100 | % | |||

Source: 2023 10-K

A Fortune 500 chemical manufacturer signed on as an AZT customer just a few months after the product introduction, followed by a government intelligence agency shortly thereafter. AZT sales will result in HPP becoming a more significant revenue contributor as early as next quarter forward as these large customers apply the product across their multiple operation end-points and new customer wins continue.

CPI has been introducing its Aria SDS portfolio at trade shows, launched multiple product demonstrations, and partnered with Logi-Tech to enter the Australian market. With the holiday season out of the way, new AZT business developments are very likely imminent.

The TS Segment Remains Bullish

The TS segment is the wholly owned Modcomp subsidiary which is a value-added reseller of third-party reseller of hardware from leading manufacturers such as Hewlett Packard (HPE), Aruba, Cisco (CSCO), Palo Alto (PANW), Nutanix (NTNX), Juniper (JNPR), Citrix, Intel (INTC), VMware (VMW), Fortinet (FTNT), and Microsoft (MSFT). CPI provides customized services to customer specifications for utilization of the third-party hardware it sells.

Supply chain issues drove the backlog up to a record of about $20 M at its height during 2023. The backlog now stands at just under $8 M, which is about the same as pre-pandemic levels.

It is noteworthy that overall TS sales had a 22% increase in products while services remained almost unchanged:

September 30, | Increase (decrease) | |||||||||||

2023 | 2022 | $ | % | |||||||||

(Dollar amounts in thousands) | ||||||||||||

Products | $ | 41,674 | $ | 34,172 | $ | 7,502 | 22 | % | ||||

Services | 16,100 | 16,346 | (246) | (2) | % | |||||||

Total | $ | 57,774 | $ | 50,518 | $ | 7,256 | 14 | % | ||||

Source: 2023 10-K

CSPI reported an operating income of $1.8 million for fiscal 2023 as compared to an operating loss of $(40) thousand for fiscal 2022. The increased product sales in 2023 will result in higher service revenue going forward and higher profitability as well as higher margins.

Financial

There are only 4.7 million shares outstanding. Insiders own 36% of the shares and institutions own 28% of the shares. Last reported debt was at about $3M and cash stood at about $25M resulting in a very strong balance sheet. The market cap is $92M and the EV is $70 million.

The stock sells at modest valuations relative to its peer group.

| CSPI | PEER GROUP | |

| PE | 18 | 31 |

| Book Value | 2 | 10 |

| EV/Sales | 1 | 3 |

Source: Compiled by author from data from Seeking Alpha and CSI Markets

Based on comparison to its peer group valuation, CSPI should rerate to at least double its current stock market price.

Leadership

Small companies led by founders who have skin in the game tend to outperform other companies. Director, President, and CEO, Victor Dellovo owns about 17% of the shares. He co-founded Technisource Hardware in 1997. Technisource was acquired by Modcomp, the CSPI subsidiary, in 2003. Mr. Dellovo provides his insight into the company’s inner workings and development having worked his way up the ladder to his current position.

VP and General Manager of HPP, Gary Southwell, has executive experience in digital networking technology and network infrastructure solutions and is a co-founder of a startup cybersecurity company, making him well qualified for his leadership role in developing and marketing CSPI’s security platform.

The Board of Directors is well-rounded with each member providing a unique expertise and each member owning CSPI shares.

Charles Blackmon has been a member of the Board of Directors since 2013. His experience as a CPA, and various management positions including CFO for several public companies, provide the qualifications for serving as the Chairman of the Audit Committee.

Ismail Azeri has served on the Board of Directors since 2016. Mr. Azeri provides his vast experience in product development of software, cloud technology, and services gained from being a technology startup founder, a senior manager at Google and EMC, and working as a venture capitalist.

C. Shelton James is the Chairman of the Board of Directors. Mr. James has vast experience in business consulting and has been employed as a CFO for several companies. Mr. James is considered the go-to person at CSPI for interpreting SEC regulations and policies.

Marilyn Smith has served on the board since 2013. She has served as Chief Information Officer for several large insurance companies such as Liberty Mutual and universities such as George Mason and MIT. Her experience qualifies her for service to the company as an expert in the technology market.

Risks and Concerns

The majority of CSPI’s products are available through other vendors. The value-added technology reseller industry is highly fragmented and populated by thousands of large competitors and smaller companies. The hardware manufacturers for the products that the company sells are also competitors. The company relies on its ability to hire and retain staffing to offer a higher level of value-added services than its competitors.

Several components that the company uses for its HPP segment products are single-sourced from companies such as Nvidia (NVDA).

There are less than five million shares available, with almost half of the shares tightly held by insiders and institutions. The low float can result in a wide price difference between bid and ask, as well as volatile stock price movement even on low volume.

Conclusion

The company’s two business segments appear to be in line for accelerated growth due to increased product sales converting to higher margin service revenue and the introduction of a new product that appears to be a game changer. CSPI has a solid balance sheet and a qualified and well-rounded leadership team. The stock sells at low valuation multiples compared to its peer group and should rerate on continued success in the introduction of the new security product. The recent selloff from the 52-week high created a good entry opportunity for investors agreeing with my assessment.

Editor’s Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.