da-kuk

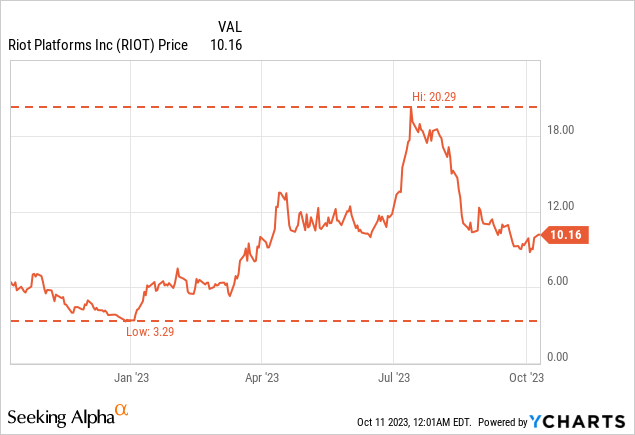

Riot Platforms (NASDAQ:RIOT) finds itself in a consolidation phase after an impressive rally, largely due to the recent shifts in the crypto landscape.

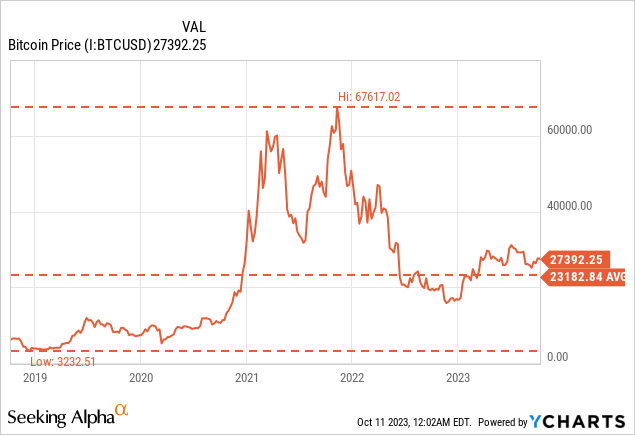

When I wrote this article Riot was, for me, one of the biggest bargains in the market. The stock has since rallied, and I parted with my position before the strong selloff (and regrettably part of the upward move). To many, this seemed like a breather for a crypto sector that’s weathered storms of late. While investors will be encouraged by the recent stability in Bitcoin (BTC-USD) prices, which currently hovers above its 5-year average, many will also be bullish about the imminent halving phenomenon’s potential to push token prices to new heights.

This optimism, however, is juxtaposed against mining giants grappling with escalating energy expenses and less-than-enticing prices for their primary commodity.

Compounding the challenges for miners is the heightened scrutiny on crypto exchanges, accentuated by events like the FTX (FTT-USD) downfall. While there’s a clear demarcation between crypto exchanges and the short-term price action of Bitcoin (and associated mining outfits by extension), adverse news stories inevitably cast shadows on the broader industry. Previously, Bitcoin’s wild price surges overshadowed many of the structural issues within the mining sector. Its recent price stabilization, although a positive sign for its long-term prospects, has taken the shine off many mining equities. This leads to an intriguing investor conundrum: invest in the Bitcoin cryptocurrency or its miners?

Bitcoin Halving: A Primer and its Market Resonance

For those immersed in the Bitcoin world, “Bitcoin halving” is a seminal event. Having taken place thrice since 2009, this procedure critically impacts the quantity of new Bitcoins in the market. Unlike the whims of central banks that can fluidly change money supply, Bitcoin’s inherent deflationary blueprint is unique. The halvings of 2012, 2016, and 2020 decreased miners’ rewards consistently.

As we inch closer to 2024, there are more and more murmurs about the impending halving on April 25th, where the mining reward will decline to 3.125 BTC per block. Though it sounds detrimental for miners on the surface, it’s fundamental to Bitcoin’s longevity and value. Draw a parallel to gold: mining it becomes tougher over time. Similarly, each Bitcoin halving event ensures the cryptocurrency’s increased scarcity. Given its finite supply of 21 million coins, each halving inches us nearer to this ceiling. Historically, such events have often ushered in substantial bullish trends, but these runs can take some time to happen – which some miners may not have.

This dynamic poses a dilemma for potential mining stock investors. Cryptocurrency mining corporations frequently hold substantial amounts of tokens, anticipating higher future prices. While halvings typically signal a bullish trend for Bitcoin, the reduced rewards necessitate miners to ramp up hash rates and, subsequently, energy consumption. Given the historic profitability challenges in the Bitcoin mining domain, the evolving landscape suggests that investors exercise prudence.

Riot Platforms has commendably maintained consistent production figures despite disruptions. The real story here, however, is Riot’s strategy of liquidating most of its monthly production.

Metric | September 2023 | August 2023 | July 2023 | June 2023 |

Bitcoin Produced | 362 | 333 | 410 | 460 |

Average Bitcoin Produced per Day | 12.1 | 10.8 | 13.2 | 15.3 |

Bitcoin Held | 7,327 | 7,309 | 7,275 | 7,265 |

Bitcoin Sold | 340 | 300 | 400 | 400 |

Bitcoin Sales – Net Proceeds | $9.0 million | $8.6 million | $12.1 million | $10.6 million |

Average Net Price per Bitcoin Sold | $26,379 | $28,617 | $30,293 | $26,456 |

Deployed Hash Rate | 10.9 EH/s | 10.7 EH/s | 10.7 EH/s | 10.7 EH/s |

Deployed Miners | 98,694 | 95,904 | 95,904 | 95,904 |

Power Credits | $11.0 million | $24.1 million | $6.4 million | $8.4 million |

Demand Response Credits | $2.5 million | $7.5 million | $1.8 million | $1.7 million |

Author’s estimates

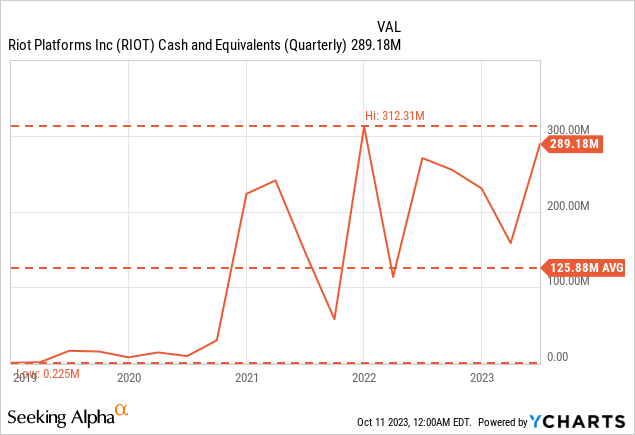

This move significantly bolsters their liquidity stance, a much-needed respite, especially recalling the liquidity issues that plagued the industry not too long ago, culminating in unfortunate episodes like Core Scientific’s (OTCPK:CORZQ) bankruptcy.

Historically, mining entities opted for heavy dilutions to safeguard their Bitcoin reserves. With the recent industry-wide valuation crunch, there’s been a discernible shift towards selling tokens as they’re mined. Yet, Riot has impressively grown its treasury, with production consistently outpacing sales over the past quarter. Furthermore, their average net selling price for Bitcoin has remained robust at around $26,000, even though it pales in comparison to Bitcoin’s peak of $67,000 in recent memory.

Navigating Uncertainties: A Glimpse into Riot’s Future

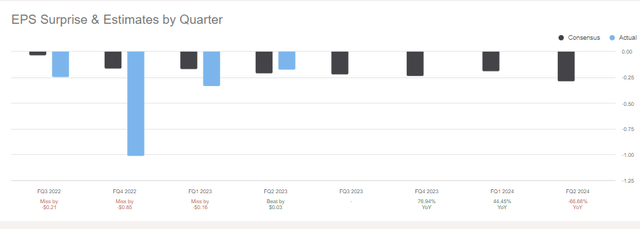

A pressing concern for Riot and the industry at large is the unmistakable vacuum left by Bitcoin’s stagnation. This standstill in Bitcoin prices has allowed the inherent challenges of crypto mining to surface, casting a cloud over the once-bright investment prospects of several mining companies. A cursory look at recent financial data reveals a series of concerning EPS misses for Riot, indicating that this trend may persist unless Bitcoin undergoes another significant rally.

Seeking Alpha

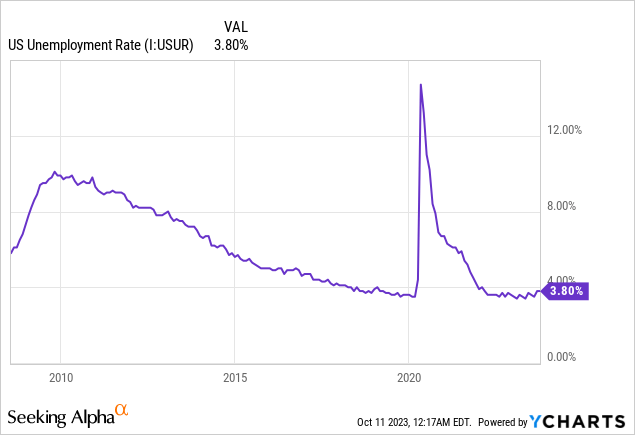

Predicting the next big surge in the crypto domain is akin to reading tea leaves. The trade has taken on a speculative hue, especially as murmurs of an impending recession grow louder, even amid seemingly buoyant unemployment figures.

It’s essential to note that a recession could be particularly devastating for the crypto realm. In such scenarios, investors often liquidate non-essential assets, with cryptocurrencies likely being high on the chopping block. This is to reinforce liquidity in preparation for uncertain economic times. Furthermore, one must exercise caution before heralding a recession’s end. Drawing parallels from the past, peak unemployment rates post the 2008-2009 recession didn’t manifest until 2010, well after the Federal Reserve ceased its tightening measures.

Absent a substantial upward movement, Riot might find itself leaning on external sources such as dilution or financing to bolster its coffers. The issue? In a recessive environment, tapping into these resources becomes increasingly challenging. That said, Riot’s impressive cash balance, a testament to its steadfast leadership, shines as a silver lining. This financial buffer positions Riot favorably to weather economic storms. The crux, however, lies in discerning the valuation at which it emerges on the other side.

The Takeaway

While the broader crypto landscape has been tested by Bitcoin’s price stagnation and intensifying challenges in the mining sector, Riot’s operational strategy offers a promising blueprint. Their decision to regularly liquidate a substantial portion of their monthly production safeguards their liquidity, a crucial move given the industry’s historical liquidity pitfalls. It shows that management is focused on survivability, which I agree with. The problem is that the solution for Riot’s profitability challenges is completely out of the company’s control. This gives a speculative feel that is often acceptable with crypto miners. There are potential tailwinds on the horizon, like the possible proliferation of Bitcoin ETFs, but there are also some notable challenges. I believe we will see some prolonged cooling down in the space for this reason, and will look forward to lower prices to rebuild my position. Until then, Riot Platforms is a hold.