KanawatTH

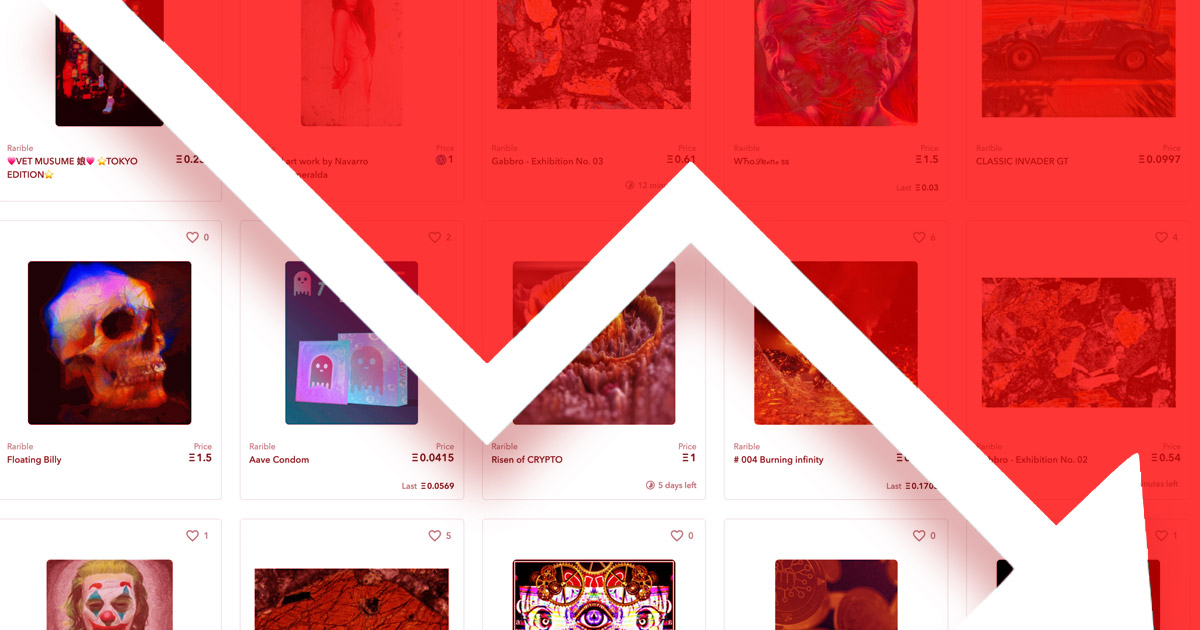

2022 marked one of the most catastrophic years for the cryptocurrency ecosystem, with major tokens such as bitcoin (BTC-USD) and ethereum (ETH-USD) erasing huge multi-year gains in the wake of industry-wide pain.

Seeking Alpha summed up the year in the timeline below featuring the collapses of formerly prominent crypto-related firms. A number of the companies suffered from a liquidity crunch triggered by the sudden drop in bitcoin (BTC-USD) and other coins.

July:

Crypto hedge fund Three Arrows Capital, also called 3AC, filed for bankruptcy protection as the drop in digital asset prices, spurred in part by the abrupt downfall of the Terra blockchain (LUNC-USD) (UST-USD) a month before, led to a number of outsized margin calls from lenders that it failed to meet.

Bitcoin (BTC-USD) dropped 39.4% from the beginning of May to end-July, landing just shy of $23K.

Shortly thereafter, Voyager Digital (OTCPK:VYGVQ) filed for Chapter 11 bankruptcy, which allows a firm to restructure its debts while keeping operations active, a week after the crypto lender suspended customer deposits and withdrawals amid a broad liquidity crisis. The move notably came after 3AC defaulted on an over $660M loan from the company.

Celsius Network, another crypto lender, followed suit when it filed for Chapter 11, listing between $1B-$10B in assets and more than 100,000 creditors. The company paused withdrawals, swaps and transfers from the network nearly a month before seeking relief amid turbulent market conditions.

Singapore-based crypto exchange Zipmex rounded out the demise of crypto firms for the month. It filed applications under Section 64 of Singapore’s Insolvency, Restructuring and Dissolution Act after blocking customer withdrawals.

September:

Compute North, formerly known as one of the largest data center hosting providers, filed for Chapter 11 towards the end of the month as the bear market continued to take its toll across the industry. Of note, the company was bitcoin (BTC-USD) miner Marathon Digital’s (MARA) primary hosting provider.

Between the end of July and the end of September, bitcoin (BTC-USD) cratered 16.7%, ending up at around $19.3K.

November:

Just as some market participants started to call for a comeback in crypto, the industry suffered another major blow: The failure of Sam Bankman-Fried’s FTX (FTT-USD), which at one point was the second largest crypto exchange valued at $32B. The disgraced FTX founder, who faces criminal charges in the U.S., resigned from his CEO role as his empire filed for Chapter 11.

The fallout from FTX rippled through the crypto ecosystem, causing crypto lender BlockFi to also file for Chapter 11 given its exposure to the centralized trading platform. BlockFi was forced to suspend customer withdrawals earlier in the month due to the uncertainty surrounding the status of FTX at the time.

Bitcoin fell to $16.9K at the end of November, a slump of 11.7% from end-September.

December:

The latest in distress, Core Scientific (CORZ), one of the largest publicly traded producers of bitcoin (BTC-USD), filed for Chapter 11 as the market downturn keeps stinging the industry. It, though is not a collapse, as the company expects to receive support from some of its existing holders of convertible notes in a restructuring deal. CORZ started trading at roughly $10 a share on April 8, only to plunge to $0.12 at Friday’s close.

Bitcoin (BTC-USD) changed hands at $16.8K as of Friday at 3:38 PM ET, down over 65% from a year ago.

Seeking Alpha contributor Nathan Aisenstadt labeled bitcoin (BTC-USD) with a Sell rating, arguing the Federal Reserve’s hawkish stance “reduces the investment attractiveness” of the token.