Introduction

Traditional finance had two dominant perspectives on cryptoassets as 2022 drew to a close. Some saw bitcoin and the like as merely stand-ins for high beta equity market exposure. Others believed that FTX-related reputational damage had rendered the asset class toxic and uninvestable for the foreseeable future if not for all time.

But crypto’s performance in the first half of 2023 has proven the lie to both these characterizations and revealed an asset class with resilience.

Simplistic Narratives Conceal the Value

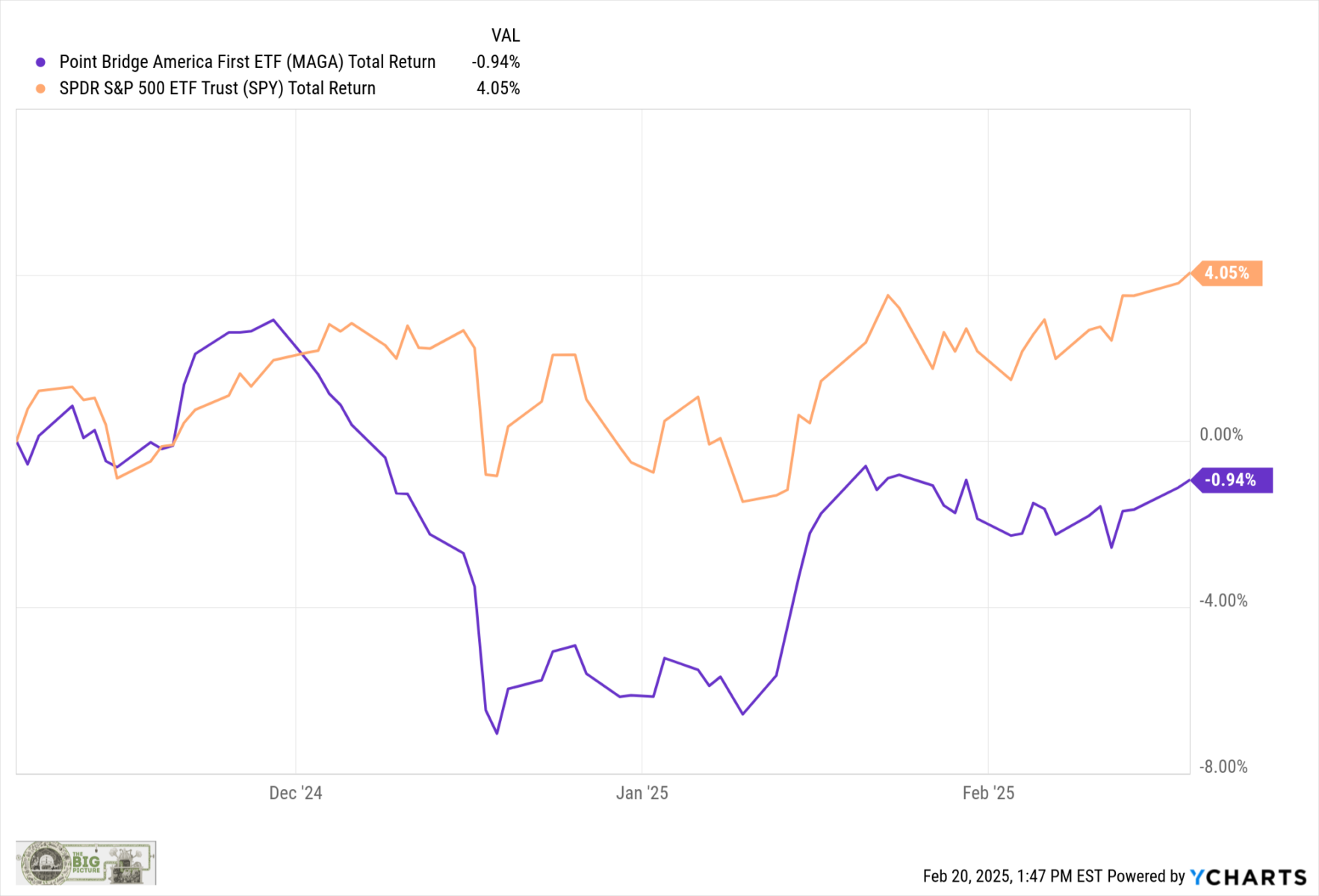

The correlation between bitcoin and the S&P 500, NASDAQ, and other equity market indices has shifted conclusively from positive to negative in 2023. This confirms what we should have already known. Bitcoin and equities are fundamentally different assets. Yes, both are influenced by central bank liquidity. But unlike equities, bitcoin is not so dependent on the whims of the larger economy. It has no dividend payments, income, or yields but functions instead as a pure store of value and an alternative monetary system.

As such, the perception of bitcoin as high beta equity is overly simplistic and ignores its underlying value.

Bitcoin and Equity Markets Are Uncorrelated

Sources: Glassnode and Sound Money Capital

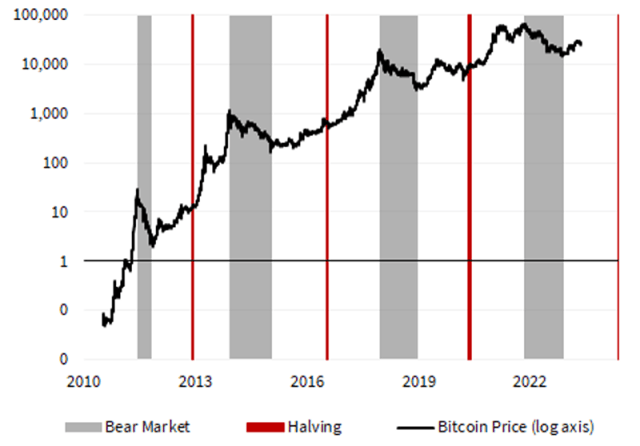

Cyclical Cleanse Cycle Complete

The recent FTX-inspired crypto bear market served its purpose: It flushed out the speculative traders, liquidated leverage, and forced the weak miners to capitulate. As a result, long-term crypto investors consolidated their bitcoin holdings. These are not bubble chasers or “dumb” money; they are investors who understand the technology and are less prone to panic selling.

Percentage of Bitcoins Held by Long-Term Investors Tends to Rise in Equity Bear Markets

Sources: Glassnode and Sound Money Capital

This cleansing process is typical of bitcoin bear markets. As the speculators pull back, the currency’s internal fundamentals rather than global activity and risk appetite drive its price movements. This has helped sever the correlation between bitcoin and the equity markets.

Allergic Reaction? Look Closer

The FTX debacle led many conventional investors and regulators to question crypto’s legitimacy. Many long-time skeptics were convinced that vindication had finally arrived. But investment decisions should not be based on sentiment and perception — unless we are using them as contra-indicators.

Rather than initiating a crypto death spiral, the FTX collapse triggered something more akin to an allergic reaction in the investment world. This called for analysis and examination not knee jerk reactions. Those that looked deeper benefited as bitcoin has rallied more than 80% since.

Indeed, given the headwinds and the added regulatory challenges, bitcoin, Ethereum, and other decentralized applications have held up extraordinarily well amid extreme volatility. Now even BlackRock is taking a closer look.

BlackRock Reduces the Reputational Risk of Crypto Allocations

BlackRock’s recent SEC application for a bitcoin exchange-traded fund (ETF) demonstrates that the cryptocurrency market isn’t going anywhere and that the most prestigious investors recognize its potential. Whether it receives approval or not, the world’s largest asset manager is knocking on the SEC’s door. Sooner or later, a spot bitcoin ETF will launch and another avenue for institutional crypto allocation will open up.

FTX cost a lot of investors a lot of money and many VCs were burned by the experience. As a result reputational risk became a key motivator, or de-motivator, in crypto-related investment decisions. The thinking among managers went something along the lines of, “No one will take me seriously if I mention crypto. I could even lose my job. It isn’t worth the risk.” But with BlackRock’s potential entry into the sector, this narrative could reverse. Under the reputational cover of the world’s largest asset manager, a fiduciary obligation may emerge to consider allocation. Perhaps market participants can now focus on crypto’s use cases rather than the noise.

The Use Cases

As the crypto market burned off its speculative froth, the value of these assets revealed itself: Properly secured crypto assets provide a hedge against the inherent challenges and shortcomings of the conventional financial system.

During the 2022 banking crisis, for example, many depositors stared down the threat of near-total capital loss as banks struggled to cover deposits. But such illiquidity risk is a constant with traditional banks: They are eternally reliant on central bank backstops to counter potential bank runs. Bitcoin holders are not.

Sudden value dilution is another threat embedded in traditional financial systems. A centralized authority can always devalue a currency. To “solve” the 2023 banking crisis, for example, the FDIC and the US Federal Reserve stepped in to raise insurance limits and guarantee all deposits. Such actions undermine the dollar’s value relative to real assets over time. Indeed, the bias towards fiscal and monetary expansion in traditional financial markets may help explain bitcoin’s remarkable 70% annualized returns since 2015.

The Next Stage of the Crypto-Adoption Cycle

Whatever the cryptocurrency narrative was following last year’s bear market, the negative correlation between bitcoin and equities debunks the premise that crypto is nothing more than high beta equity exposure. The subsequent winnowing process within the crypto market has renewed the focus on internal fundamentals.

But as investors struggle to value cryptoassets and crypto technology more generally, volatility will remain. The pace and precise direction of crypto’s adoption cycle is uncertain and hard to predict. That’s why investors should heed last year’s lessons and look beyond initial reactions and media narratives and seek to understand the underlying technology and its potential uses.

Next Bitcoin Halving: May 2024

Source: Sound Money Capital

BlackRock’s interest in a bitcoin ETF is not an outlier. Crypto’s integration into conventional finance and portfolio allocation will only gather speed in the months and years ahead.

There will always be skeptics. But amid changing dynamics and greater institutional interest, the value proposition is becoming clearer. As bitcoin’s supply growth is cut in half in May 2024, a more exuberant phase of the crypto adoption cycle will likely commence again.

If you liked this post, don’t forget to subscribe to the Enterprising Investor.

All posts are the opinion of the author(s). As such, they should not be construed as investment advice, nor do the opinions expressed necessarily reflect the views of CFA Institute or the author’s employer.

Image credit: ©Getty Images / StarLineArts

Professional Learning for CFA Institute Members

CFA Institute members are empowered to self-determine and self-report professional learning (PL) credits earned, including content on Enterprising Investor. Members can record credits easily using their online PL tracker.