Bitcoin and the rest of the cryptocurrency market saw significant gains after Ripple secured a victory against securities regulators on July 13.

As of 8:30 p.m. UTC, Bitcoin (BTC) had gained 4.3% over 24 hours, achieving a $31,594.31 market value and a $613.8 billion market cap. That change represents more than a one-year high, as the asset has not seen comparable prices since June 2022.

Ethereum (ETH), meanwhile, gained 6.9% over 24 hours for a market cap of $239.8 billion. Its price briefly surpassed $2,000.

Those gains were likely influenced by the outcome of a legal case between Ripple and the U.S. Securities and Exchange Commission in which courts ruled that Ripple’s XRP sales are not securities. XRP itself gained 73% over 24 hours to reach a $42.6 billion market cap, making it the 4th largest cryptocurrency at present.

At least two major crypto exchanges — Coinbase and Gemini — have decided to list or are considering listing XRP following Ripple’s legal victory. Those decisions could further support the price of the XRP token.

Three coins named in unrelated SEC cases against Coinbase and Binance are also among the biggest gainers today: Cardano (ADA) rose 19.5%, Solana (SOL) rose 17.3%, and Polygon (MATIC) rose 17.8%. Those gains are perhaps due to more general optimism that is possible for crypto companies to win cases against regulators.

Various other assets have also seen gains. Stellar (XLM), which has early ties to Ripple but is otherwise an independent project, saw gains of 62.4%. The entire crypto market has gained 6.5% over 24 hours for a total market capitalization of $1.3 trillion.

Liquidations reach $236 million

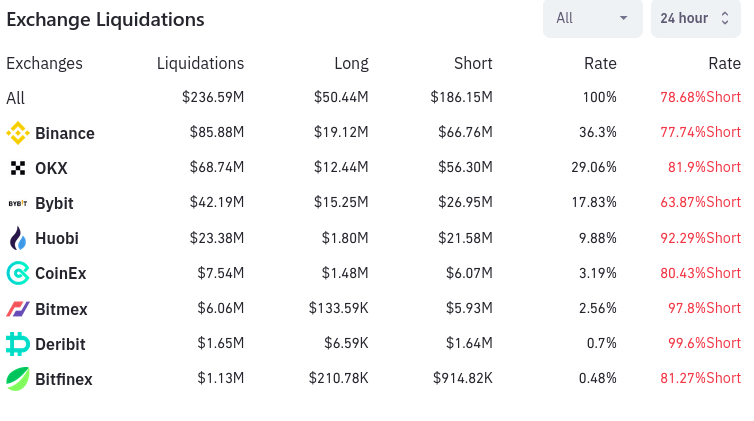

Meanwhile, the crypto market saw $238.37 million in liquidations over a 24-hour period. That total includes $52.01 million of long liquidations and $186.36 million of short liquidations. About 66,800 traders were liquidated in total.

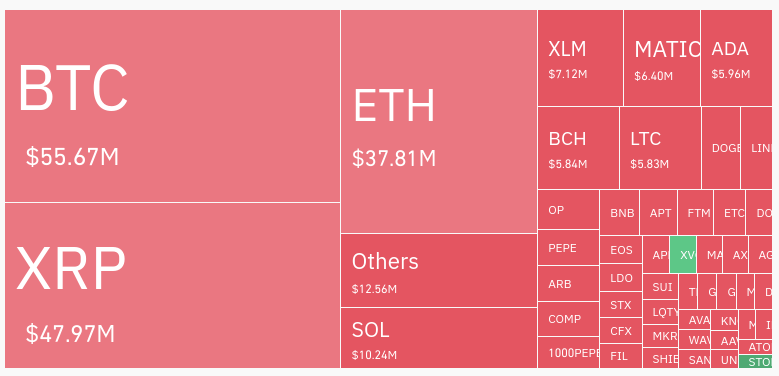

Three assets saw the most liquidations. Bitcoin saw $55.67 million in liquidations, Ethereum saw $37.81 million in liquidations, and XRP saw $47.97 million in liquidations.

Binance was responsible for $85.88 million in liquidations, while OKX was similarly responsible for $68.74 million in liquidations. Together, those two exchanges were responsible for about two-thirds of all liquidations across the cryptocurrency market.

Various other exchanges, including Bybit, Huobi, and CoinEX, were responsible for the remainder of those liquidations, as shown below:

The events of the day represent rare positive news amidst the crypto industry’s latest bear market. Though the broader implications of the Ripple case are still unclear, the latest developments seem to have generated optimism among cryptocurrency investors.