Data shows the crypto futures liquidations have hit $238 million during the last 24 hours as Bitcoin has observed an uplift of 10%.

Bitcoin Liquidations Reach $238 million

Whenever an investor opens a futures contract on any derivative exchange, they first have to put forth some initial collateral called the margin. Such a contract can get liquidated if the holder amasses losses that have eaten away a specific portion of this margin.

By “liquidation,” what is meant here is that the derivative exchange forcefully closes the contract when losses of this specific degree are accumulated (the exact percentage may differ from platform to platform).

One factor that can raise the risk of any contract getting liquidated is “leverage.” The leverage is a loan amount that a holder may choose to take on against the margin, and it is generally equal to many times the initial position itself.

The benefit of the leverage is that any profits that an investor gains would now become multitudes more. However, on the flip side, any losses that the holder incurs will also be more by the same factor as the leverage.

In the crypto market, mass liquidation events aren’t a particularly uncommon sight. There are mainly two reasons behind this; the first is that the general volatility of assets like Bitcoin can be quite high.

The other is that leverage as high as 50 or even 100 times the initial collateral is usually pretty accessible in a lot of the platforms. These two factors combined can mean that uninformed trading with high leverage can be quite deadly in this market.

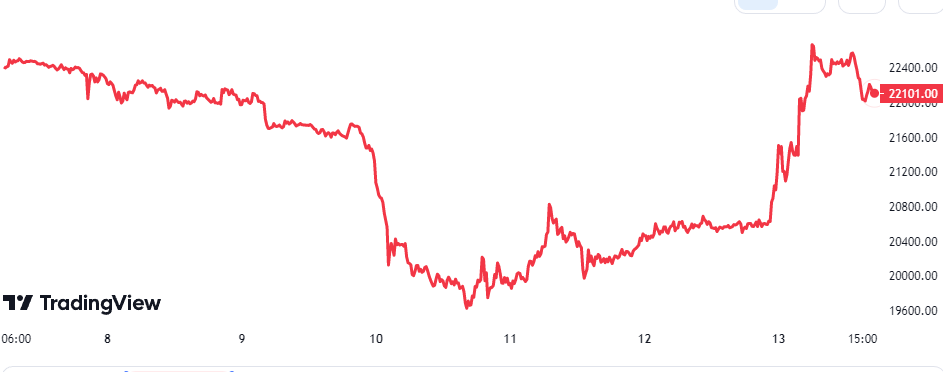

Now, below is the data for the liquidations that have occurred in the crypto futures market during the last 24 hours.

Looks like a pretty high amount of liquidations have taken place today | Source: CoinGlass

As you can see above, a total of $238 million in crypto futures contracts were liquidated in the past day. Around $111 million of these took place in the last 12 hours alone.

About 80% of this futures flush involved short contracts, which is a trend that makes sense as this mass liquidation event was triggered by sharp rises in the prices of assets like Bitcoin.

A mass liquidation event is popularly called a “squeeze.” Since the latest leverage flush involved mostly short contracts, it was an example of a “short squeeze.” A peculiar feature of a squeeze is that liquidations can cascade together during them.

This happens because whenever a large amount of liquidations take place at once, they only end up further amplifying the price swing that caused them to begin with. This extended price move then causes even more liquidations in the market. And so, during squeezes, liquidations sort of waterfall together.

BTC Price

At the time of writing, Bitcoin is trading around $22,000, down 1% in the last week.

The crypto seems to have shot up during the past day | Source: BTCUSD on TradingView

Featured image from Pierre Borthiry – Peiobty on Unsplash.com, chart from TradingView.com