buzbuzzer

CrossAmerica Partners LP (NYSE:CAPL) is a limited partnership that conducts business with distribution of fuels to gas stations as its main business and the company also has a side business that owns or operates convenience stores, most of which are located within fuel centers such as major gas stations. This can be a solid addition to the portfolio of an income investor with its high yield and solid history of stable and consistent dividends if you don’t mind those K-1 tax forms that come with limited partnerships.

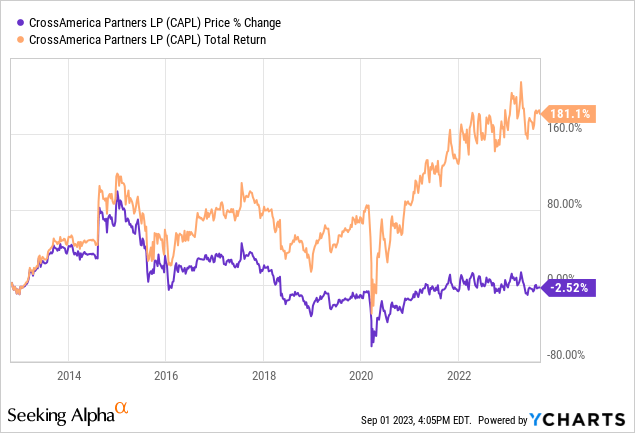

CAPL resulted in total returns of 181% since its IPO a little over a decade ago (in 2012) and pretty much all of its returns came from dividends since the stock price has been virtually flat since then. This should be mainly considered a purely income play with its dividend yield of almost 11%.

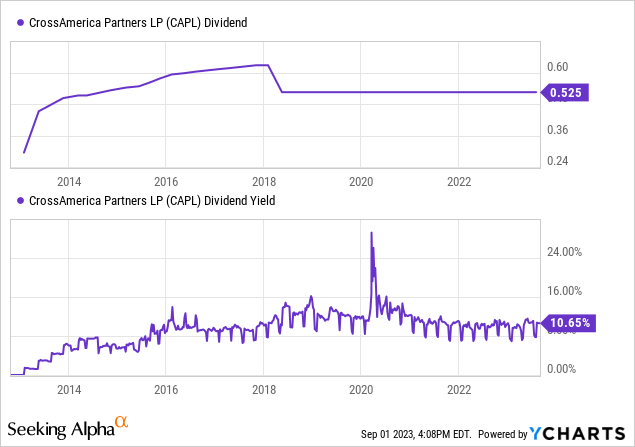

The company has been paying about 52.5 cents per unit annually for the last 5 years or so while its dividend yield averaged just above 10% which is where it is right now. So far the dividend has been stable, consistent and well-covered. There is little reason to expect this to change anytime soon unless the overall economy suddenly takes a dive and doesn’t recover for a long time, and this kind of scenario would basically affect every stock under the sun.

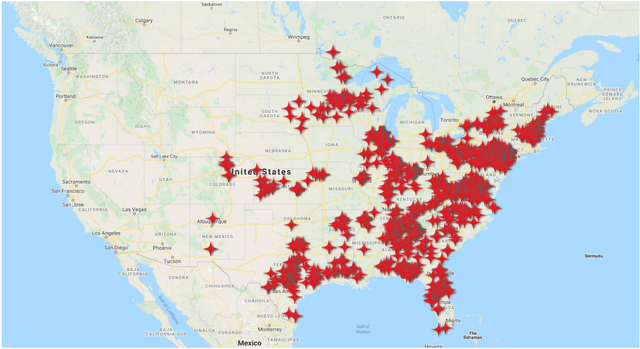

Now let us talk about the company’s business. The company actually owns two types of businesses. One of these businesses is fuel distribution where CAPL buys large amounts of fuel from big companies like Shell (SHEL), BP (BP) and Exxon (XOM) and takes them to more than 1,700 gas stations in the east half of America for a profit as it charges a mark-up. Some of this fuel is sold under a brand name, such as Shell, while others are sold under generic non-brand names. The company makes separate contracts with gas producers and gas stations at different price points and these price differentials determine how much profit it makes, and it can vary from location to location as well as from contract to contract. CAPL’s management has to manage this process very carefully to ensure that the company is making profit and not losing money in thousands of separate transactions it does every year, which can be a lot of work to manage, but so far the company’s track record shows that it’s been able to accomplish this.

CAPL Fuel Station Locations (CAPL)

In addition to wholesale, the company also owns or manages its own network of about 450 gas stations, where it has a bit more flexibility in terms of pricing power and enjoys higher margins. In addition, the company owns or operates a large number of convenience stores located within these gas stations. The company treats this part of its business like a real estate business, similar to how a REIT operates. For the leased properties, the company uses a triple net lease approach with contract durations ranging from 3 to 10 years with rent hikes generally in line with the rate of inflation. This allows for some level of predictability and stability into the company’s earnings that’s independent from wild fluctuations in energy prices and allows the company to have better visibility on its long term prospects.

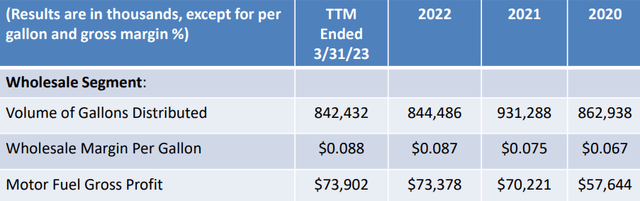

When we look at the company’s Wholesale Segment we see that it delivered fewer gallons of fuel in the last 12 months as compared to 2020 and 2021, but it was able to generate a higher margin per gallon which came at $0.088, up from $0.067 in 2020 and $0.075 in 2021. This resulted in gross profits rising from $57 million to $74 million between 2020 and 2023 even with volumes dropping slightly during this time. The rise in wholesale margin in recent years was most likely driven by a rise in oil and gas prices, which means it may be only sustainable as long as fuel prices stay strong.

CAPL Wholesale Segment Business Trends (CAPL)

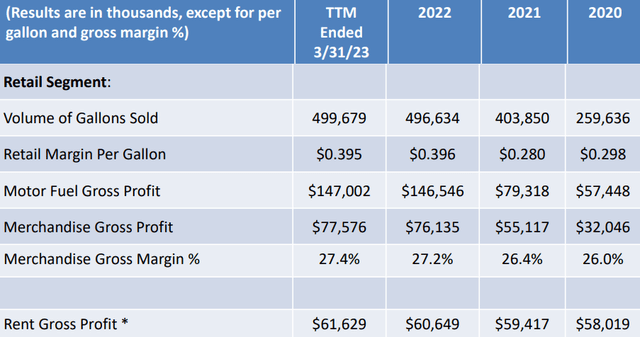

The company’s retail business tells a similar story with some differences. In this particular segment we are seeing a sharp rise in volume where it delivered 499 million gallons delivered up from 259 million in 2020 and 404 million in 2021. Keep in mind that in 2020 volumes were exceptionally low due to pandemic related lockdowns where fuel sales were well below historical averages. In retail the company generates much higher margins (about 40 cents per gallon as compared to 9 cents in wholesale) and its margins are as high as 27.4%. As for rent profits, they have been rising at a slow and steady pace since 2020, up from $58 million to $61 million which didn’t exactly keep up with inflation but then again inflation was exceptionally high in recent years.

CAPL Retail Segment Business Trends (CAPL)

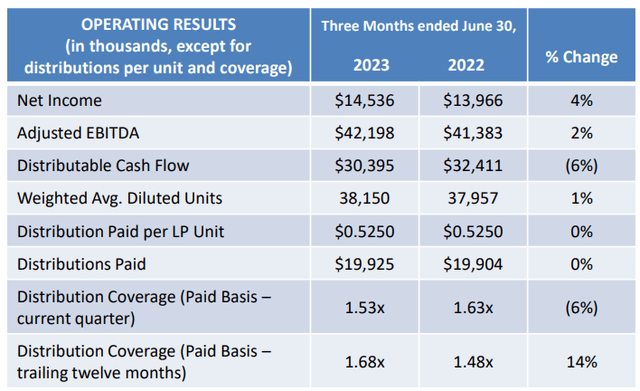

In the last quarter, the company’s net income rose 4% year over year and its adjusted EBITDA was barely up 2%. One thing that seems worrisome was that the company’s Distributable Cash Flow was down -6% from last year, which also reduced the company’s distribution coverage by the same percentage from 1.63x to 1.53x. This means the company currently generates $1.53 of cash flow for each $1 it generates in distributions (dividends). The company’s long term goal is about 1.25x, which means the dividend is not only well-covered and safe, but also it could be hiked soon for the first time since 2018 if its earnings keep growing at the same rate. If the company can keep its distribution coverage rate above 1.60 for a year, I wouldn’t be surprised to see a dividend hike.

CAPL Q2 2023 Results (CAPL)

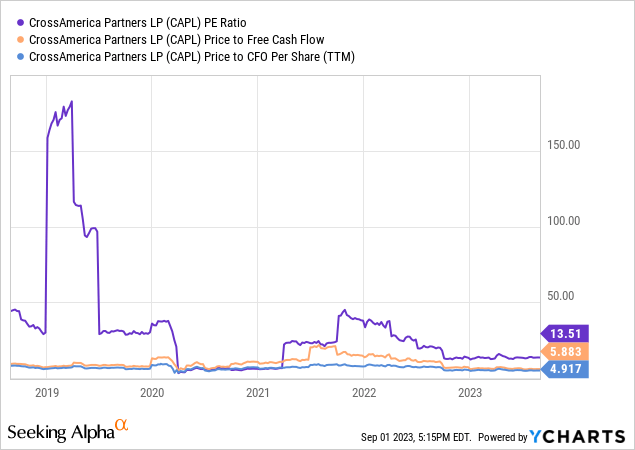

The company’s current valuation looks fairly cheap based on P/E, Price to Free Cash Flow and Price to CFO (cash from operations). The company’s P/E of 13 is about where its historical average has been. Its cash flow based multiples of 4-6 range also appear to be very cheap, but this is also very typical with energy LPs since investors usually don’t like paying a premium price for these types of companies as their growth is limited and many people don’t want to deal with K-1 forms, so these type of companies typically trade at a deep discount for many years. Like I said above, this should be treated purely as an income play.

In conclusion, if you don’t mind those K-1 forms and are looking for a high-yield stock to boost your income using stable, predictable and well-covered distributions, CAPL might be a good choice. If you are looking for growth, share price appreciation or purely clean energy plays, this is probably not the stock for you.