I’m love photography and art. This is me.

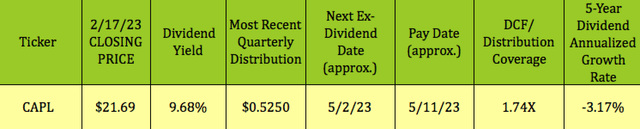

We’ve owned CrossAmerica Partners LP (NYSE:CAPL) off and on for years. Like many other energy-related stocks, CAPL’s fortunes have waxed and waned over the last decade. At one point, back in Q3 ’17, management had raised the quarterly distribution 13 straight times, but then cut it in Q2 2018, to $.525, where it has remained, including the latest payout, which went ex-dividend in early February.

Profile

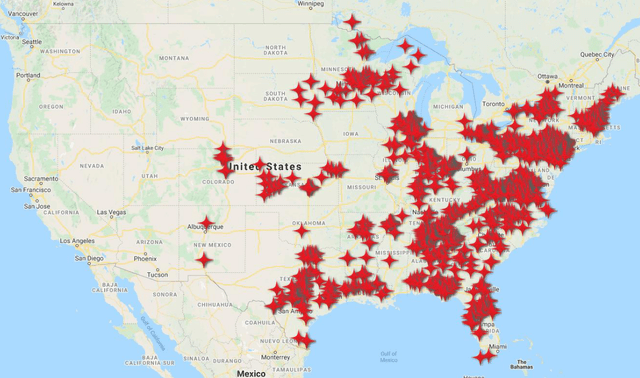

CAPL is a wholesale distributor of motor fuels, convenience store operator and owner and lessee of real estate used in the retail distribution of motor fuels. CrossAmerica Partners distributes branded and unbranded petroleum for motor vehicles in the United States to approximately 1,750 sites located in 34 states; and owned or leased approximately 1,150 sites. (CAPL site)

CAPL site

In 2019, investment entities controlled by Founder and current Chairman, Joe Topper, purchased 100% of the interest in CrossAmerica’s General Partner.

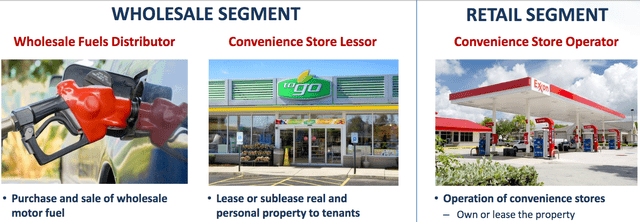

CAPL has 2 main segments:

Its Wholesale segment has 2 areas of focus – it distributes branded and unbranded motor fuel to ~1,750 sites located in 34 states. It provides fuel to several different types of customer sites, including independent dealers, lessee dealers, CAPL company-operated stores (Retail Segment), and commission agents.

The Wholesale segment also leases or sub-leases sites used in the retail distribution of motor fuels. These are usually triple-net leases, and are generally for 3-10 year terms. There are ~900 sites generating rental income. CAPL owns 60% of these properties.

The Retail segment owns or leases convenience store operations, C-stores, with ~253 retail sites. CAPL retains all profits from motor fuel and convenience store operations at these sites.

CAPL site

Earnings

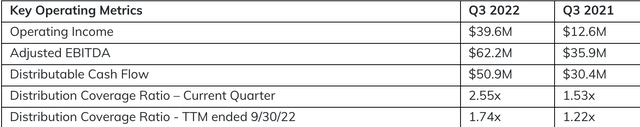

CAPL had a very strong Q3 ’22, during which it had 3-digit growth in Operating Income, Adjusted EBITDA, and DCF. Its Distribution Coverage ratio jumped 67%, to 2.55X, vs. 1.53X in Q3 ’21:

CAPL site

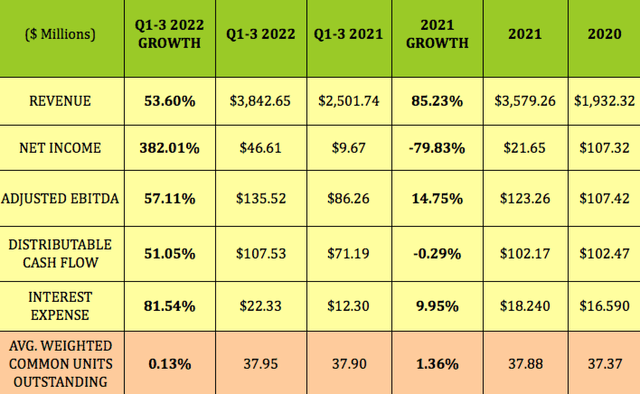

After the pandemic challenges of 2020, CAPL’s revenue bounced back in 2021, rising 85%, as the US reopened. EBITDA was up nearly 15%, while Distributable Income, DCF, was flat.

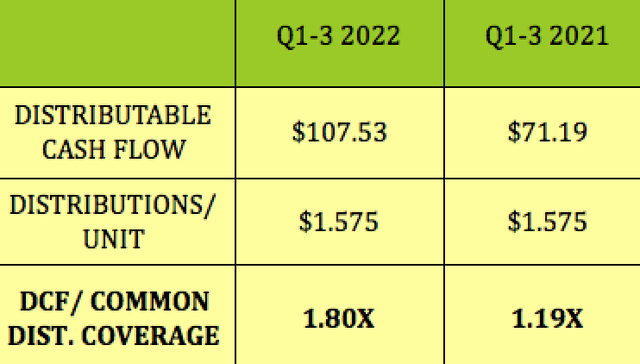

Q1-3 2022 had very strong growth, with Revenue up 53%, Net Income up 382%, EBITDA up 57%, and DCF rose 51%. Like we’ve seen with most other companies, Interest Expense rose significantly, from $12.3M to $22.33M.

CAPL had a $1.2B, (54%) increase in its wholesale segment revenues primarily attributable to a 52% increase in the average daily spot price of WTI crude oil to $98.96/barrel for Q1-3 ’22, vs. $65.05/barrel in Q1-3 ’21.

There was an $800M, (84%) increase in its retail segment revenues in Q1-3 ’22, primarily attributable to a 43% increase in the average retail fuel price.

Hidden Dividend Stocks Plus

Dividends

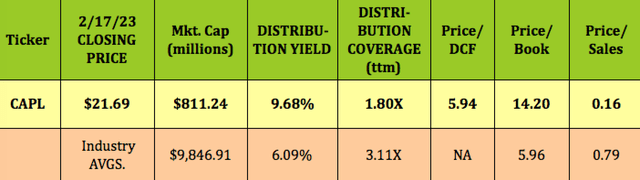

At its 2/17/23 $21.69 closing price, CAPL yields 9.68%. As noted above, management has kept the quarterly payout at $.525, after cutting it in Q2 2018, hence the -3.18% 5-year dividend growth ratio.

Hidden Dividend Stocks Plus

With the big jump in DCF, and the steady distributions in Q1-3 ’22, CAPL’s Distribution coverage factor surged to 1.8X, vs. 1.19X in Q1-3 ’21:

Hidden Dividend Stocks Plus

Taxes

CAPL issues a K-1 tax form to unit holders.

Profitability & Leverage

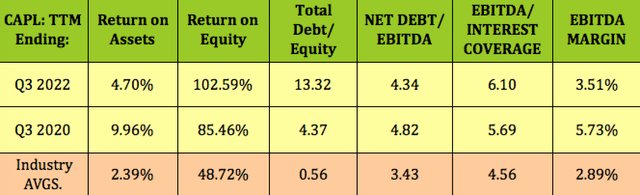

ROA and ROE flip-flopped in Q3 ’22 vs. Q3 ’20, but remained above average. Net Debt/EBITDA improved to 4.34X, very close to management’s 4.0X to 4.25X Target Leverage Ratio.

The Equity base was ~$57M as of 9/30/22, vs. $120M at 9/30/22, hence the big increase in Debt/Equity. EBITDA/Interest coverage improved to 6.1X, higher than average, whereas EBITDA margin decreased to 3.5%>

Hidden Dividend Stocks Plus

Debt & Liquidity

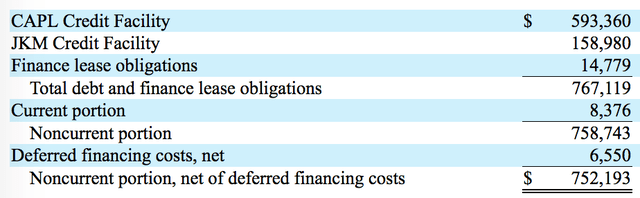

CAPL has a $750M credit facility, which matures in April 2024, and a $ JKM credit facility, which matures July 2026. The JKM facility was issued March 2022 to affiliates of Topper Group and Reilly entities.

Taking the interest rate swap contracts into account, the effective interest rate on the CAPL Credit Facility at September 30, 2022 was 3.9%. The effective interest rate on the JKM Credit Facility at September 30, 2022 was 5.2%.

Total liquidity as of 9/30/22 was $189.59M, with $163.6M available in the CAPL facility, and $14.2M available in the JKM facility, and $11.79M in Cash. Management reduced CAPL’s total debt and finance lease obligations by ~$63M in Q1-3 ’22.

CAPL site

CAPL received $24.4M in net proceeds from the issuance of private preferred membership interests during the 9 months ended September 30, 2022.

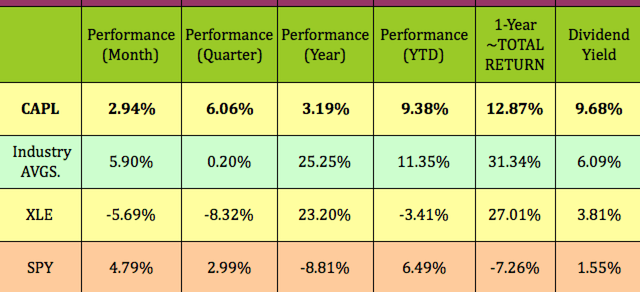

Performance

CAPL’s 1-Year ~total return outpaced the S&P 500, but lagged its industry and the broad Energy sector, which had an outstanding year. So far in 2023, CAPL has outperformed the market and the broad Energy sector.

Hidden Dividend Stocks Plus

Valuations

While CAPL’s yield, Price/DCF, and P/Sales are all attractive, its P/Book suffers from the small equity amount, i.e. book value.

Hidden Dividend Stocks Plus

Parting Thoughts

At its 2/17/23 $21.69 closing price, CAPL is ~7% below its 52-week high, and 18.4% above its 52-week low. You may want to wait for a price pullback before nibbling on some units.

All tables furnished by Hidden Dividend Stocks Plus, unless otherwise noted.