xxwp

We previously covered Crocs, Inc. (NASDAQ:NASDAQ:CROX) in September 2023, discussing its underwhelming prospects ahead, thanks to the immense pulled forward growth during the hyper-pandemic period and the painful normalization in demand over the next few years.

Combined with the tightened discretionary spending from the elevated interest rate environment and the repayment of federal student loans from October 2023 onwards, we had preferred to downgrade the stock as a Hold then.

In this article, we shall discuss why the CROX stock’s recent recovery is likely to be unsustainable, attributed to the decelerating growth of its core brand and HeyDude’s disappointing performance, worsened by the slowing sales in the North American region.

With it no longer offering a compelling growth story and no dividends to look forward to, we believe that the stock may at best trade sideways ahead, until the management is able to generate convincing growth in sales.

CROX Is No Longer A Viable Growth Investment Thesis

For now, CROX has generated a double beat FQ3’23 earnings call, with overall revenues of $1.04B (-2.4% QoQ/ +6.2% YoY) and adj EPS of $3.25 (-9.4% QoQ/ +9.4% YoY).

Most of the top-line tailwinds are attributed to the robust performance of Crocs Brand sales of $798.8M (-4.1% QoQ/ +11.6% YoY), albeit pulled down by HeyDude’s declining sales of $246.9M (+3.1% QoQ/ -8.3% YoY).

Then again, CROX continues to record exemplary increase in its adj gross margins to 57.4% (-0.7 points QoQ/ +2.3 YoY), implying the robust demand for its Crocs products.

This has allowed the management to partly offset the rising operational costs of $307.7M (+1.6% QoQ/ +13.7% YoY), triggering its somewhat stable adj operating margins of 28.3% (-2 points QoQ/ +0.4 YoY).

While the CROX management has raised its FY2023 bottom line guidance to $11.70 (+7.1% YoY) at the midpoint, thanks to the higher gross margins, it is apparent that the top-line guidance has also been lowered to $3,922.5M (+6% YoY).

This is compared to the previous midpoint guidance of $11.15 (+2.1% YoY) and $3.95B (+9.7% YoY) offered in the FQ4’22 earnings call, respectively.

If readers look closely, CROX also guided impacted adj operating margins of approximately 21% in FQ4’23 (-7.3 points QoQ/ -5 YoY) compared to 27.7% in FY2022 (-2.4 points YoY), implying that HeyDude’s overhead and distribution network costs may remain elevated.

This is worsened by the minimal growth guided for the HeyDude brand, with a Q4’23 guidance of -5% YoY decline in sales, further underscoring why shareholders have remained bearish on the management’s latest acquisition.

The only few bright spots in CROX’s FQ3’23 report is its healthy balance sheet, with the declining long-term debts of $1.91B (-4.5% QoQ/ -26.2% YoY) triggering the reduction in its gross leverage to 1.7x (-0.1x QoQ/ -0.7x YoY).

This is on top of the sustained share retirement thus far, with 61.62M of shares outstanding in the latest quarter (-0.98M QoQ/ -0.75M YoY/ -10.15M from FY2019 levels).

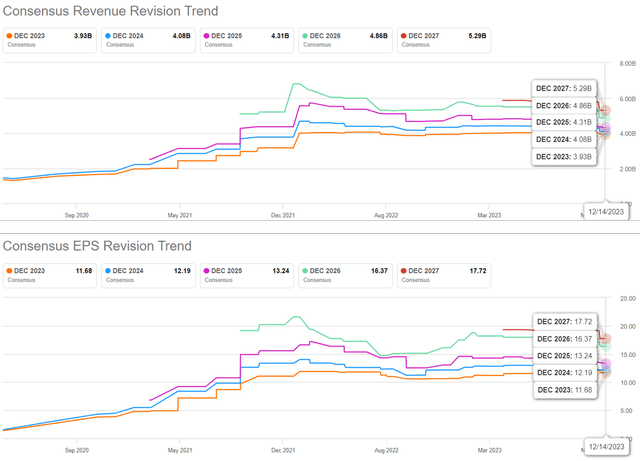

The Consensus Forward Estimates

Seeking Alpha

However, the consensus has lowered the forward estimates, with CROX expected to generate a top and bottom line CAGR of +6.6% and +6.6% through FY2025.

This is compared to the previous estimates of +12.09%/ +10.09% and the historical CAGR of +22.8%/ +65.1% between FY2016 and FY2022, respectively.

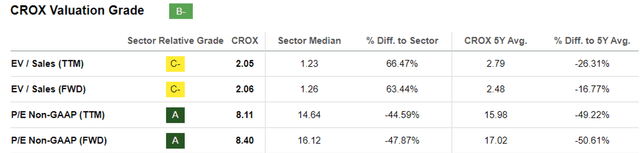

CROX Valuations

Seeking Alpha

With HeyDude being top and bottom line dilutive, it is unsurprising that CROX’s FWD EV/ Sales valuation of 2.06x and FWD P/E of 8.40x have been further discounted from its 1Y mean of 2.24x/ 9.31x, pre-pandemic mean of 1.45x/ 31.47x, and the sector median of 1.26x/ 16.12x, respectively.

Based on the management’s FY2023 adj EPS guidance of $11.70 at the midpoint and its impacted FWD P/E of 8.40x, the stock appears to be trading near its fair value of $98.20.

Based on the consensus FY2025 adj EPS estimates of $13.24, there seems to be a minimal upside potential of +13.2% to our long-term price target of $111.20 as well.

With CROX no longer offering a compelling growth story and no dividends to look forward to, we believe that the stock may at best trade sideways ahead, until HeyDude is able to generate convincing growth in sales.

So, Is CROX Stock A Buy, Sell, or Hold?

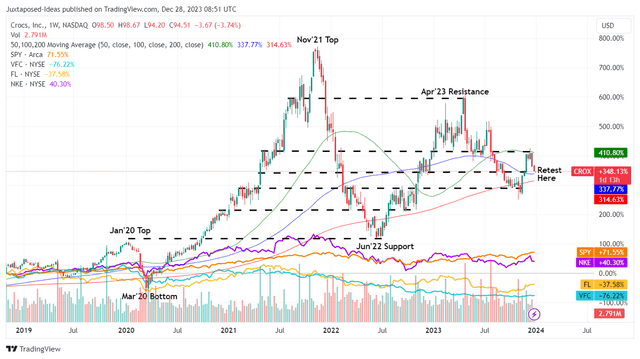

CROX 5Y Stock Price

Trading View

For now, CROX has been lifted optimistically from the November 2023 bottom, thanks to the cooling inflation, robust labor market, and the increased likelihood of a Fed pivot in Q1’24, with a similar recovery observed market wide.

However, it is also apparent that consumer discretionary spending remains tight, with Nike (NKE) already warning “higher promotional activities to counter the slowing sales in North America,” implying impacted margins ahead.

Most importantly, NKE already reports decelerating growth for FQ2’24 footwear sales at $8.6B (+2.2% QoQ/ +1.2% YoY), compared to $8.5B a year ago (+4.8% QoQ/ +25.3% YoY).

While CROX has been able to report growing Crocs sales in the North American region at $480.7M (+1.2% QoQ/ +7.9% YoY), it appears that Mr. Market prefers to be cautious for now, with multiple footwear stocks already plunging in sympathy since NKE’s latest earnings call on December 21, 2023.

As a result of its apparent growth (and potentially bottom line) headwinds as discussed above, we prefer to continue rating CROX as a Hold here, with the pessimistic sentiments likely to trigger the stock’s subsequent retracement to the previous support levels of $85s, implying a painful -13% downside from current levels.