Andy

CRSP’s Gene Modifying Expertise Has Lastly Been Accepted

CRSP’s Gene Modifying Expertise

CRSP

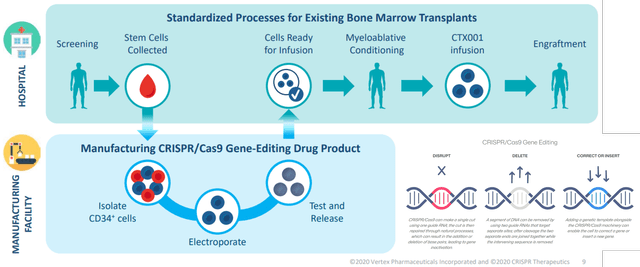

CRISPR Therapeutics AG (NASDAQ:CRSP) is a biotech firm specializing in genetic modifying know-how, specifically the Clustered Recurrently Interspaced Quick Palindromic Repeats [CRISPR]-associated protein 9, CRISPR-Cas9, permitting the exact alteration of particular sequences of genomic DNA.

CRSP Pipeline

CRSP

CRSP’s Casgevy has already acquired the US FDA approval in January 2024 and the EU EC in February 2024, for the therapy of Extreme Sickle Cell Illness and Thalassemia – each in partnership with Vertex Prescribed drugs Included (VRTX).

With a Extreme Sickle Cell Illness market measurement of $12.38B by 2032 and Thalassemia market measurement of $4.2B by 2031, the biotech’s prospects are greater than respectable certainly, because the regulatory approval brings the beforehand pre-revenue firm in 2023 to a brand new promising section in 2024.

This additionally builds upon CRSP’s comparatively strong pipeline, with 5 different therapies already in varied levels of scientific trials, with it triggering additional prime/ bottom-line expansions assuming a profitable regulatory approval.

CRSP’s Funding Thesis Stays Costly, Regardless of The Latest Pullback

The Consensus Ahead Estimates

Tikr Terminal

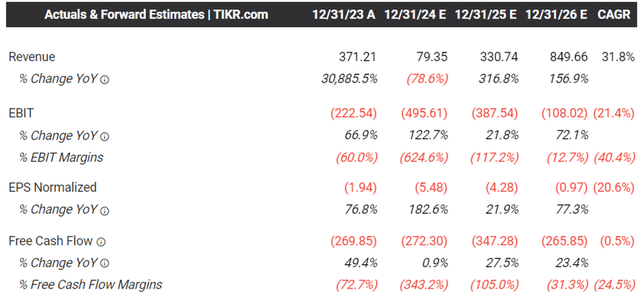

Even so, whereas CRSP’s Casgevy has acquired its regulatory approvals, readers should word that the remedy’s income recognition will solely happen “close to the top of the affected person journey at infusion” throughout the 9 to 12 months course of.

In consequence, whereas the biotech firm is predicted to report its subsequent quarterly earnings name in August 2024 (estimated), readers might need to mood their expectations, since Casgevy isn’t anticipated to be prime/ bottom-line accretive over the following two quarters.

The identical has been noticed in CRSP’s underwhelming prime/ bottom-line progress projections over the following few years, with it anticipated to stay within the crimson – albeit with accelerating gross sales progress.

For now, most of its income recognition is attributed to its collaboration and/ or grant revenues, relying on the milestones achieved for Casgevy and different candidates.

On the identical time, the administration has been elevating money via dilutive capital raises, as noticed within the rising internet money on stability sheet at $2.1B (+24.2% QoQ/ +11.7% YoY) and increasing share depend of 81.79M (+3.2% QoQ/ +3.9% YoY) in FQ1’24.

Transferring ahead, we imagine that CRSP is more likely to additional dilute its long-term shareholders, because the Casgevy monetization is more likely to happen solely from This fall’24 or Q1’25 onwards, with the opposite pipeline approvals probably occurring solely within the second half of the last decade.

On the identical time, the character of investing in nascent biotech shares has all the time been speculative anyway, since solely ~8% of scientific trials have been in a position to obtain the coveted regulatory approval.

In consequence, whereas the CRSP administration has been reporting promising early ends in its scientific trials, it stays to be seen when additional regulatory approval and/ or industrial income recognition might happen.

CRSP Valuations

Searching for Alpha

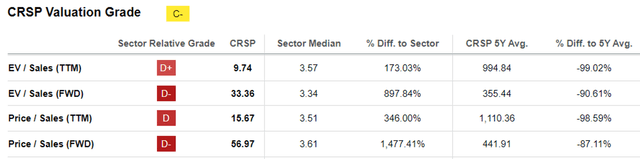

And it’s for these causes that we imagine CRSP stays costly at FWD EV/ Gross sales of 33.36x and FWD Worth/ Gross sales of 56.97x, in comparison with its 1Y imply of 24.98x/ 37.61x, VRT at 4.89x/ 4.52x, and the biotech sector median of three.34x/ 3.61x, respectively, with it providing buyers with a decreased margin of security.

Patent Dispute Might Set off Close to-Time period Headwinds

Most significantly, readers should word that CRSP doesn’t maintain any patent for the CRISPR-Cas9 gene modifying know-how, with these honors presently owned by Editas Medicines (EDIT).

This additionally explains why VRTX has needed to pay $100M in licensing charges for Casgevy, on prime of the annual charges ranging between $10M and $40M previous to the remedy’s patent expiry in 2034.

Even so, the patent dispute for the CRISPR-Cas9 gene modifying know-how has but to finish, regardless of the US Patent and Trademark Workplace ruling in favor of the Broad Institute of MIT/ Harvard and EDIT presently being the unique licensee of CRISPR patents.

With the opposite two inventors (and their analysis establishments), referred to as CVC, interesting the newest choice right here and right here, readers might need to take note of the creating scenario certainly.

That is particularly because the patent courts in Europe, China, and Japan have dominated for CVC – a direct reverse of the US ruling for Broad, with it probably triggering additional uncertainties in VRT’s and CRSP’s prime/ bottom-line efficiency globally.

So, Is CRSP Inventory A Purchase, Promote, or Maintain?

CRSP 6Y Inventory Worth

Buying and selling View

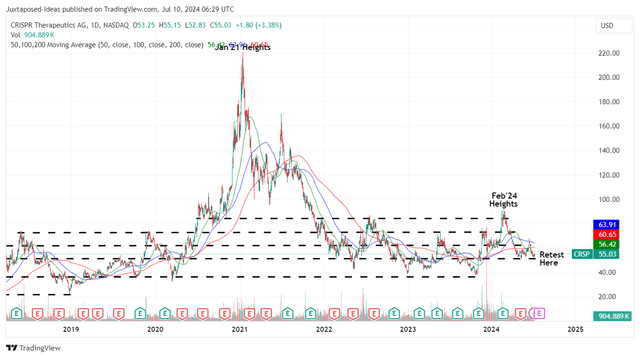

Because of the slower monetary recognition and uncertainty surrounding its patent, we are able to perceive why CRSP has misplaced a lot of its latest positive aspects whereas retesting its earlier backside of $50s and buying and selling beneath its 50/ 100/ 200 day shifting averages.

Because the inventory continues to commerce comfortably between its established assist stage of $40s and resistance stage of $70s since November 2021, we imagine that its intermediate-term funding thesis is probably going tied to its swing commerce potential, earlier than the inventory ultimately grows into its premium valuations.

Lastly, readers should word that CRSP is more likely to stay risky forward, attributed to the elevated brief curiosity of 17.5% on the time of writing, worsened by the $10.6M of insider promoting over the past twelve months (-31% sequentially).

Because of the potential volatility, we favor to provoke a Maintain score for now.

These trying so as to add might achieve this if the CRSP inventory stays effectively supported at $50s. Even so, they need to measurement their portfolios in line with their danger urge for food and investing trajectory, because the Casgevy monetization is more likely to be restricted throughout the preliminary levels.

_4.jpg?itok=oAqM2JVr)