Regardless of an financial system that always appears to be entering into each course besides ahead, business actual property lending swelled within the first quarter, buoyed by bigger financing volumes and robust exercise from banks, in line with the newest Lending Momentum Index report from CBRE.

Regardless of this presumably shocking rush of lending, the report cautions that federal coverage and financial uncertainty round Treasury yields stay vital components.

The Index tracks CBRE-originated U.S. business mortgage closings, which rose by 13 % from the fourth quarter of 2024 and by 90 % year-over-year.

READ ALSO: Regional Banks’ Quiet Comeback

In that set of mortgage closings, mortgage spreads tightened considerably within the first quarter, averaging 183 foundation factors, which was down by 29 foundation factors year-over-year.

Workplace financing skilled a notable rebound, as a number of main workplace SASB offers reached profitable closures, in line with an organization assertion. In the meantime, information middle building loans stay a focus, supporting a big selection of tenants past typical fashions.

Banks predominated within the non-agency mortgage closings tracked by CBRE, with a 34 % share, versus simply 22 % within the earlier quarter.

The second-most energetic lenders have been CMBS conduits, at a 26 % share, in contrast with simply 9 % a 12 months prior. As of the tip of the primary quarter, private-label CMBS issuance was 132 % larger than the earlier 12 months.

Life insurance coverage firms, in the meantime, maintained their regular 21 % share of non-agency mortgage closings.

Various lenders equivalent to debt funds and mortgage REITs made up the remaining 19 % of non-agency mortgage closings, a serious drop from their 48 % a 12 months prior. The CBRE report commented that “Whereas remaining energetic, debt funds are exercising warning within the present market and going through elevated competitors….”

The typical underwritten cap charge rose by 24 foundation factors quarter-over-quarter to six.1 %, however debt yields jumped by 90 foundation factors to 10.3 % within the first quarter.

Funding, international-style

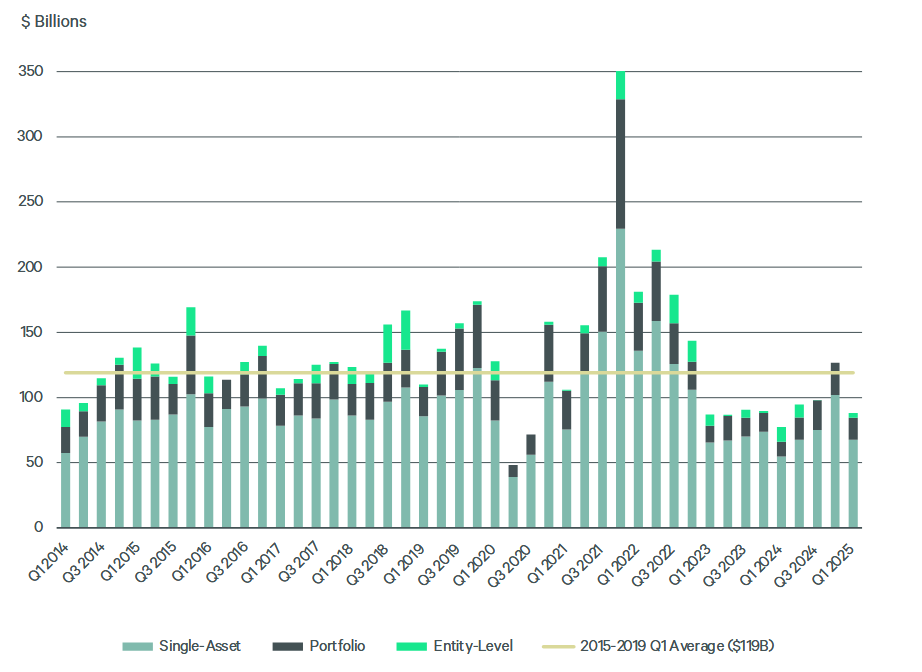

On the funding entrance, CBRE reported that CRE funding quantity rose to $88 billion within the first quarter, a 14 % year-over-year enhance.

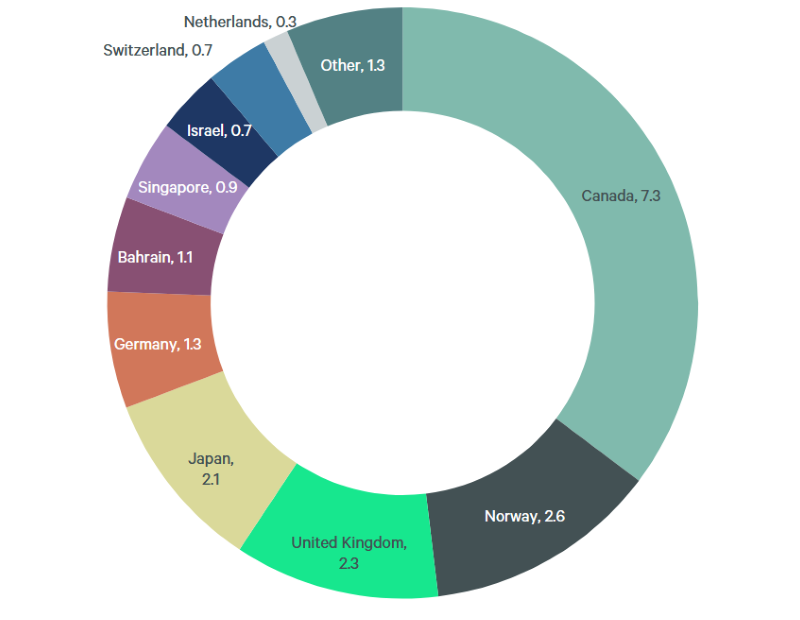

Led by the economic sector, inbound cross-border funding elevated by 7 % within the first quarter, to $4 billion. The outsized deal that drove this was the Norwegian sovereign wealth fund’s acquisition of a $1.1 billion stake within the Canadian pension plan’s U.S. logistics portfolio.

Throughout CRE product varieties, Canada remained the main inbound cross-border investor, at 35 % of the overall, or $7.3 billion throughout 4 quarters.