FooTToo

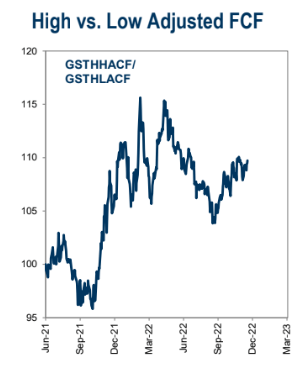

A popular factor play in 2022 has been to invest in cash flow generating companies. Goldman Sachs notes that such firms indeed climbed big on a relative basis from Q4 2021 through early 2022. Recently, though, high vs low adjusted free cash flow stocks have lost some of their luster despite a pickup in the last few months.

Is one ETF focused on this strategy set to move higher again? Let’s take a look at COWZ.

Free Cash Flow Factor: Off the 2022 Highs

Goldman Sachs Investment Research

The Pacer US Cash Cows 100 ETF (BATS:COWZ) is a strategy-driven exchange-traded fund that aims to provide capital appreciation over time by screening the Russell 1000 for the top 100 companies based on free cash flow yield. For background, according to the fund website, free cash flow is the cash remaining after a company has paid expenses, interest, taxes, and long-term investments. It can be used to buy back stock, pay dividends, or participate in mergers and acquisitions.

It’s thought that the more free cash flow a firm generates, the more it can engage in shareholder accretive activities like issuing dividends and repurchasing common stock. Moreover, cash flow means a company can run the business through the good times and bad and pounce on high return on investment growth opportunities. With a tough 2023 in store, many strategists suggest going long high-free-cash-flow companies.

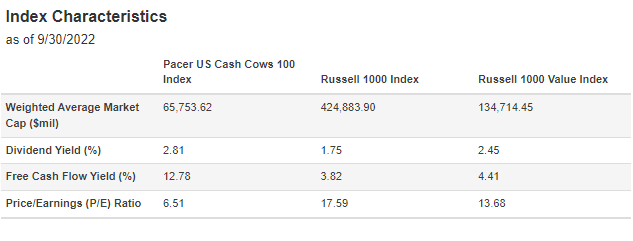

Fundamentals

On valuation, this 5-star rated fund features a forward price-to-earnings ratio of 6.5 as of September 30, 2022, sharply below that of the broad market, as measured by the Russell 1000 large-cap index’s 17.6 estimate earnings multiple. Moreover, COWZ trades for less than half the P/E of the Russell 1000 Value index.

Portfolio Valuation: High Free Cash Flow Yield, Low P/E

Pacer ETFs

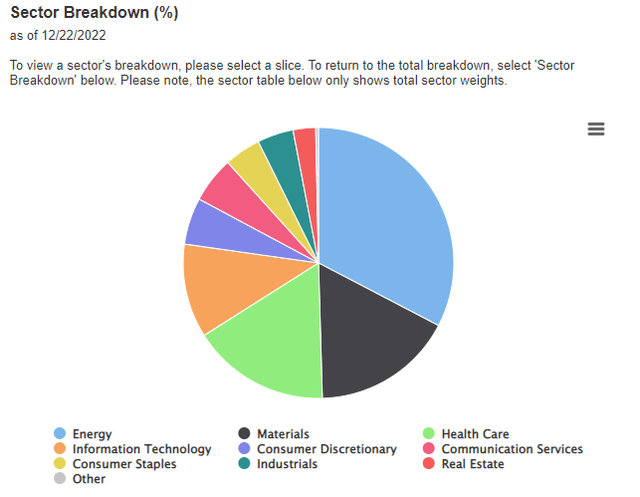

Driving the low valuation is an extremely high weight in the Energy sector. The fund is nearly one-third in this high cash flow, low P/E small group of the market. For perspective, Energy is only about 5% of the S&P 500, so COWZ is a very active bet that oil & gas stocks will continue to produce strong returns as they have in 2022.

Also notable is a high 17% position in the Materials sector – another very small-weighted part of the broad equity market. The high-growth TMT sectors (Information Technology, Consumer Discretionary, and Communication Services) make up just 23% of COWZ compared to more than 40% on the SPX.

COWZ: A Big Wager on Cyclical-Value Sectors

Pacer Funds

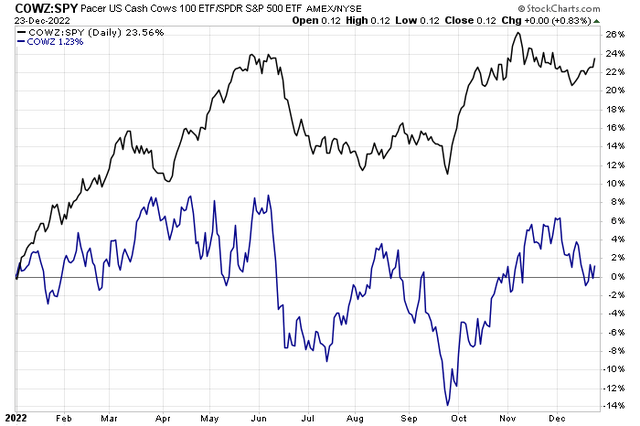

The Technical Take

COWZ is popular for good reason. Notice in the relative chart below that the fund has outpaced the S&P 500 by nearly 24 percentage points on the year. It’s only about flat on a relative basis in the last seven months, though. Volatility in the oil markets obviously plays a role here as the fund will likely be overweight that cyclical-value sector for the coming years unless we see a major downtrend in oil and natural gas prices. The loss of relative momentum is a bit of a concern, but the broad trend is up.

COWZ: Trending Up Vs SPX

Stockcharts.com

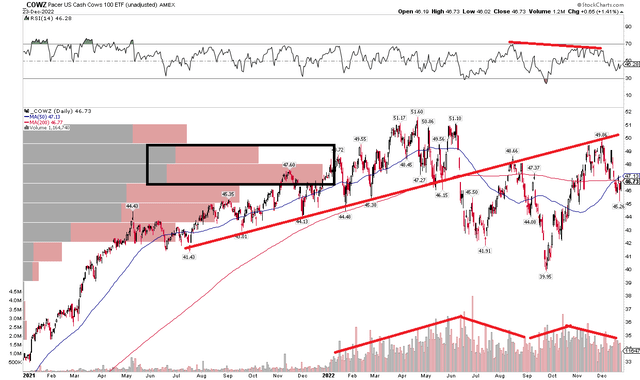

Relative strength can sometimes mask absolute weakness. So, what does the absolute chart of COWZ show? Notice in the graph below that shares broke an important trendline back in June, and then failed to climb above it on a pair of attempts – once in August at the peak of the summer rally in markets and again just a few weeks ago. The latter move higher was actually a minor false breakout as COWZ rose above the August high, but the fund has now traded down.

Also, take a look at the RSI momentum reading at the top of the chart – as price made a new rebound high in December, momentum failed to notch a new zenith – that is a bearish signal. Moreover, there’s a high amount of volume traded in the $46 to $49 zone as measured by the volume-by-price indicator on the left – that could be tough for the bulls to work through.

The volume trends are interesting in that volume came into the ETF as COWZ rose (which is bullish), then fell during the summer retreat before rising again in the Q3-Q4 rally before tailing off lately. I will keep watching that for clues on the strength of price action.

COWZ: More Bearish Than Bullish Signatures

Stockcharts.com

The Bottom Line

COWZ features a great valuation care of a very high weight in the Energy and Materials sectors. If we see a big economic downturn next year, this could get hit hard due to that cyclical exposure. While I like the strategy and valuation, the chart suggests caution.