James O’Neil/DigitalVision via Getty Images

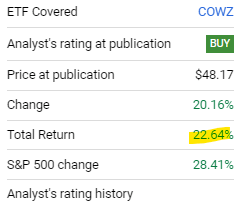

I last covered the Pacer US Cash Cows 100 ETF (BATS:COWZ), which focuses on U.S. stocks with above-average free cash flow / FCF yields, in early 2023. In that article, I argued that COWZ’s cheap valuation and good performance made the fund a buy. COWZ has underperformed the S&P 500 since, owing to weak value and energy performance.

COWZ

On the other hand, COWZ remains a cheaply valued fund with a stronger medium-term performance track-record, outperforming the S&P 500 since my first coverage. As such, and in my opinion, the fund remains a strong investment opportunity and is a buy, recent weakness notwithstanding.

COWZ – Basics

- Investment Manager: Pacer ETFs

- Expense Ratio: 0.49%

- Dividend Yield: 1.80%

- Total Returns CAGR 5Y: 17.7%

COWZ – Overview and Analysis

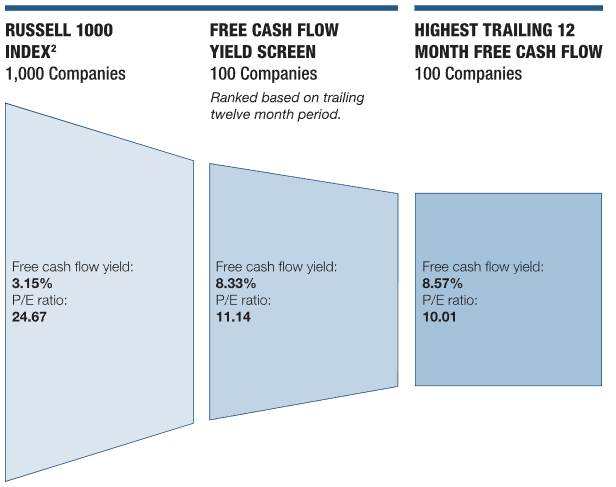

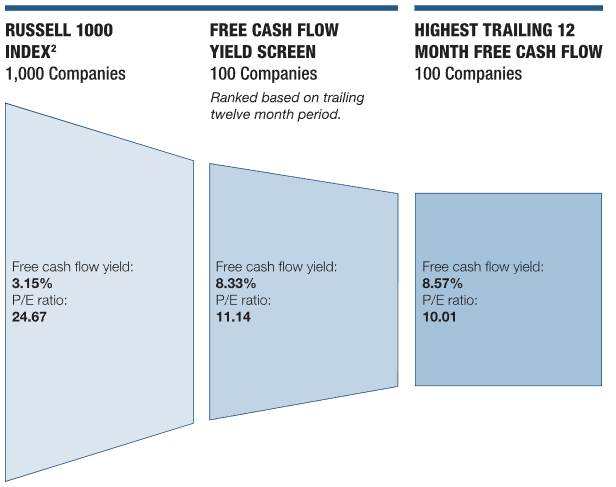

Index and Portfolio

COWZ is an equity index ETF. It is a simple fund, which invests in the 100 companies with the highest FCF yields within the Russell 1000 index, itself a broad-based U.S. equity index. It is a cash flow weighted fund: the higher the cash flow, the greater the weight. Weights are capped at 2.0%, to ensure some diversification. Applicable securities must also meet a basic set of inclusion criteria centered on liquidity, size, and similar characteristics. Quick summary of the fund’s strategy.

COWZ

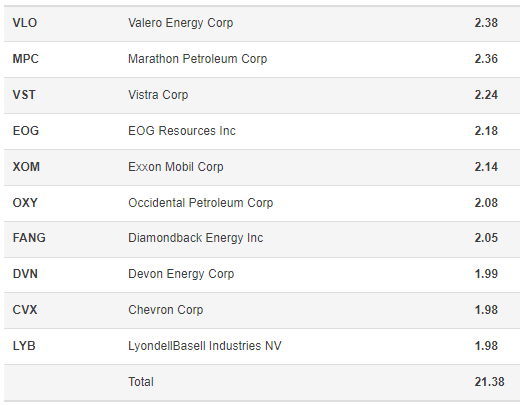

COWZ is a reasonably well-diversified fund, with investments in 100 companies, and with exposure to most industry segments. Largest holdings are as follows:

COWZ

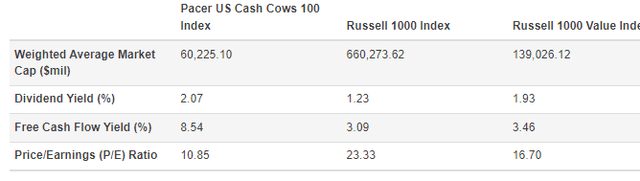

As can be seen above, COWZ focuses on mid-cap and large-cap stocks, unlike the S&P 500 and Nasdaq-100 indexes which focus on mega-cap tech stocks. Average market-caps for the fund are much lower too, in-line with the above.

COWZ

The above is simply due to differences in weighting schemes. The S&P 500 weights by market-cap, so the larger companies have much greater weights. The Nasdaq-100 uses a modified market-cap weighting scheme, overweighting the largest companies much more. Weighting by cash-flows means some of the smaller large-caps have greater weights.

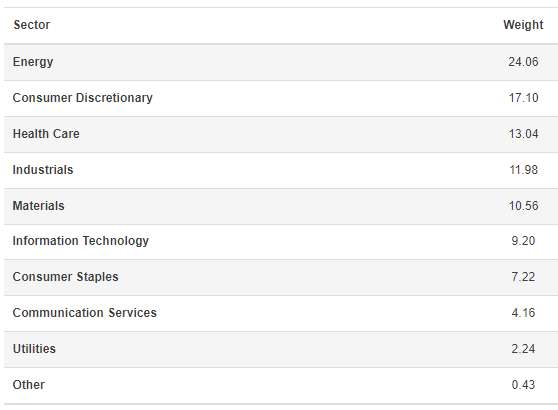

Sector weights are as follows:

COWZ

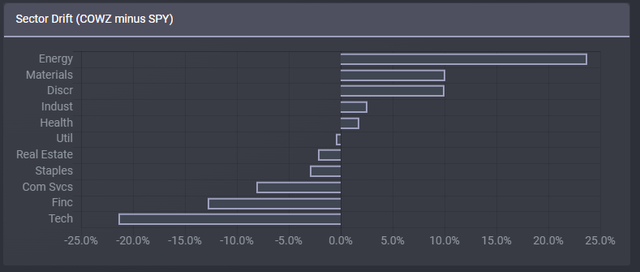

Sector weights do materially differ from those of the S&P 500, with the fund being significantly overweight energy, materials, and consumer discretionary, underweight tech, financials, and consumer services.

Etfrc.com

Industry tilts are reflective of differences in industry FCF yields. FCF yields in the energy industry, for instance, are much higher than average, as the industry focuses on returning cash to shareholders over CAPEX. FCF yields in the tech industry are much lower than average, as tech company share prices and valuations are generally higher, and companies within the industry tend to focus on growth and CAPEX.

Although the industry tilts above are somewhat common for value ETFs, the tilts are much greater, much more aggressive, for COWZ. This is particularly true for energy, with most value ETFs being overweight said industry by 5.0% – 10.0%, much lower than COWZ’s roughly 20.0%. Most value ETFs are market-cap weighted, hence the difference.

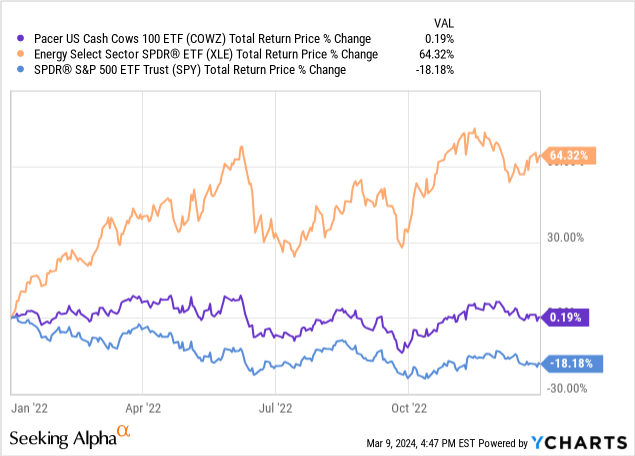

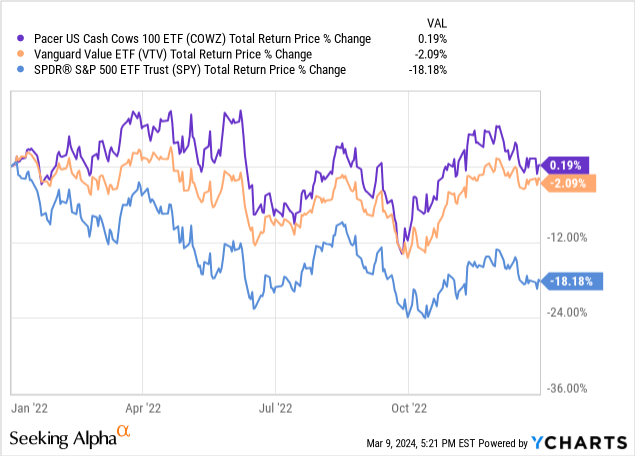

COWZ’s industry tilts have a significant impact on the fund’s performance, especially relative to the S&P 500. Expect significant outperformance when energy outperforms, as was the case in 2022.

Data by YCharts

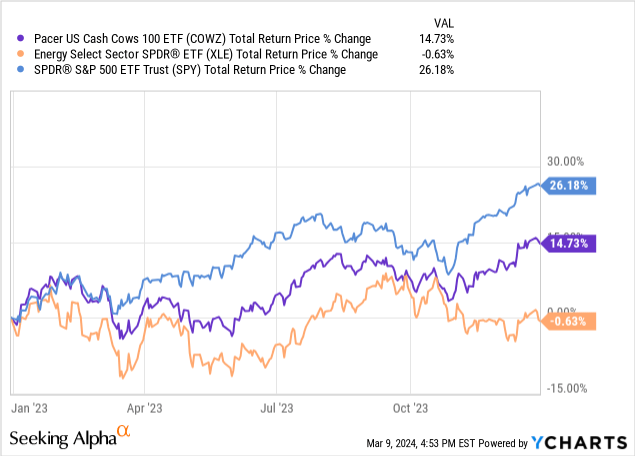

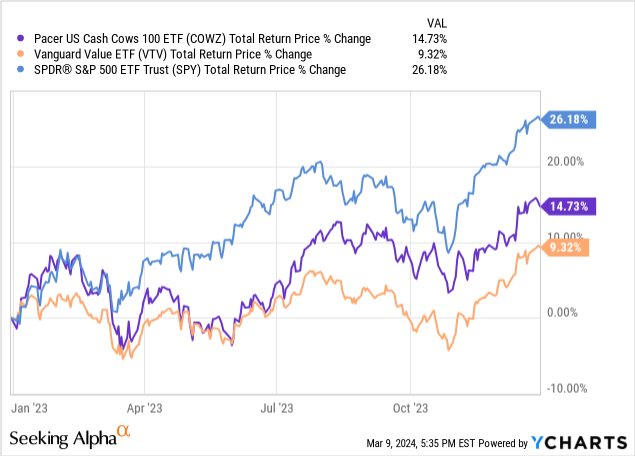

Expect significant underperformance when energy underperforms, as was the case in 2023.

Data by YCharts

In my opinion, COWZ’s industry tilts are neither a positive nor a negative, but they are an important fact for investors to consider. At the same time, investors should take care before significantly overweighting energy in their portfolio, due to risk.

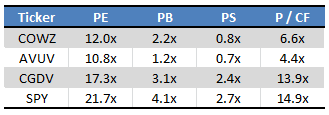

Valuation Analysis

COWZ focuses on companies with strong FCF yields, which results in cheap valuations across the board, relative to both the S&P 500 and most relevant U.S. value equity funds. FCF yields themselves are more than twice those of its benchmark, in-line with expectations.

COWZ

COWZ is also cheaper than the S&P 500 and some of the larger value ETFs on most relevant metrics. Differences are particularly large for cash-flow metrics, as expected, but also for PS ratios.

Morningstar – Table by Author

COWZ’s cheap valuation is the fund’s key characteristic, core investment thesis, and benefits investors in several important ways.

Cheap valuations could lead to strong capital gains and market-beating returns, assuming valuations normalize. Valuations are ultimately dependent on investor sentiment, which is not always rational, especially in the short-term. Value had a strong showing during most of 2022, as oil prices and equity prices surged, and as skyrocketing inflation and higher rates caused investors to re-assess the merits of frothier growth and tech offerings.

Data by YCharts

As inflation receded investors shifted back to tech, with value underperforming once again.

Data by YCharts

Performance moving forward will depend on how investor sentiment continues to develop. Outperformance is far from guaranteed, and I’m not seeing any significant catalysts either. COWZ does have strong prospective returns, but these are far from guaranteed, and highly uncertain.

Cheap valuations also benefit investors insofar as these boost the effectiveness of dividends and buybacks. At current PE ratios, COWZ’s underlying holdings could pay 8.5% in dividends, ensuring an acceptable rate of return to shareholders. S&P 500 companies could only pay 4.7%, a much lower rate, almost half that of COWZ. Buybacks would be much more impactful for COWZ’s underlying holdings than for S&P 500 companies too.

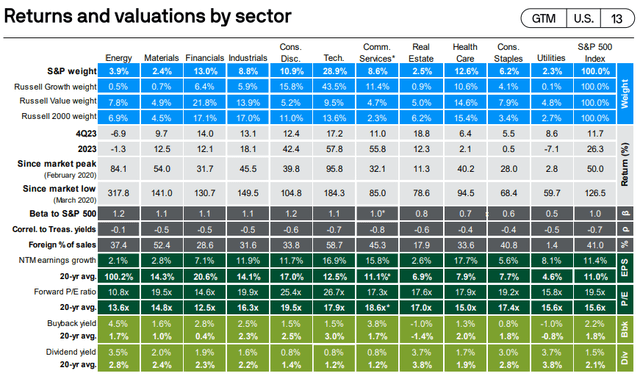

Benefits from the above are dependent on the amount of cash distributed to shareholders. Although COWZ does not directly target companies returning significant cash to shareholders, it does end up doing so for two reasons. First, companies with strong FCF yields are, almost by definition, returning significant cash to shareholders (what else would they do with all that cash). Second, the fund is significantly overweight energy, the industry with the highest buyback and dividend yields in the market.

JPMorgan Guide to the Markets

I also think it is important to mention that these benefits are not dependent on investor or market sentiment. Dividends mean cash in investor’s pockets while buybacks mean higher EPS, regardless of what the market thinks or does. This is of particular importance for the more unpopular companies and industries, including energy.

Finally, cheap valuations can sometimes reduce the possibility of significant losses, as these are enticing towards many investors. As an example, Occidental Petroleum (OXY) can only go down so much before Berkshire Hathaway (BRK.B) buys another chunk of the company. Smaller energy companies can only go down so much before they get acquired by the larger players. This only occurs because energy trades with heavily discounted prices and valuations and would not occur / occur much less if energy traded at +20.0x PE ratios.

Performance Track-Record

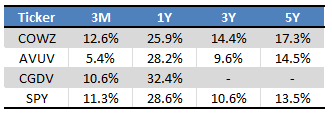

COWZ’s overall performance track-record is reasonably good, with the fund outperforming most value ETFs since inception, matching the performance of the S&P 500 since the same. Returns have been particularly strong post-pandemic, and during 2022. Importantly, COWZ has performed quite well during a period of below-average value returns. The fund has outperformed in spite of tough market conditions, which makes its performance all that stronger.

Seeking Alpha – Table by Author

In my opinion, COWZ’s outperformance was due to the effectiveness of its underlying investment strategy. Focusing on companies with above-average FCF yields should result in market-beating returns, and that has, in fact, been the case.

Conclusion

COWZ focuses on U.S. equities with strong FCF yields. COWZ’s cheap valuation and strong performance track-record make the fund a buy.