Ralf Hahn

Massively inflated during the pandemic, corporate profits are still not normalizing, and bode well for future investments and economic growth.

So I’ll just start with this, and then I’ll follow with the essential nitty-gritty:

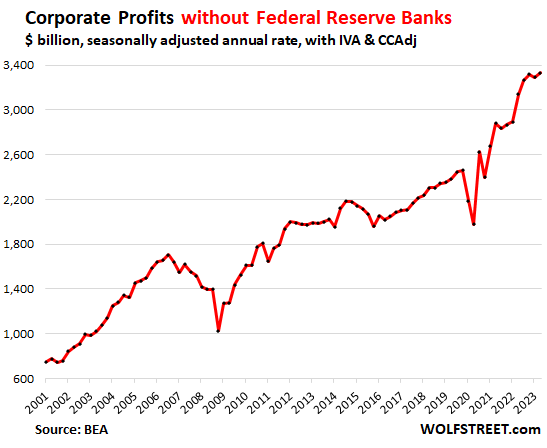

“Corporate profits” (all businesses that file corporate tax returns, including LLCs and S corporations, see nitty-gritty #2 below) before taxes (nitty-gritty #3) and excluding the Federal Reserve (nitty-gritty #1) but with “CCAdj” (nitty-gritty #6) and with “IVA” (nitty-gritty #7)…

… rose 1.3% from the prior quarter and 6.2% year-over-year, to a seasonally adjusted annual rate of $3.33 trillion in Q2, the highest ever, driven by record profits in nonfinancial industries. according to the Bureau of Economic Analysis on Thursday.

Corporate profits: No recession on the horizon

“Profitability provides a summary measure of corporate financial health and thus serves as an essential indicator of economic performance. Profits are a source of retained earnings, providing much of the funding for capital investments that raise productive capacity,” the BEA explains in its methodology.

You can see in the chart above how the Great Recession was preceded for a whole year by a decline in corporate profits that started in Q4 2006. The Great Recession began in December 2007.

The nitty-gritty about “corporate profits”

1. What is the Fed doing in here? Well, the 12 regional Federal Reserve Banks, on whose financial statements the Fed’s profits are accounted for, are private corporations and are therefore included in the headline figures for corporate profits by the Bureau of Economic Analysis.

The Fed has been losing large amounts of money by paying out more in interest to banks and money market funds than it earns in interest on its still vast but shrinking portfolio of securities.

But in terms of profits from current production by US businesses, the Fed’s profits or losses are irrelevant. So I exclude them here.

2. A broad measure of business profits. “Corporations” is the term used by the BEA for all entities that are required to file federal corporate tax returns, including private corporations, LLCs, and S corporations, plus by some organizations that do not file corporate tax returns. So this is a very broad measure of business profits from current production.

3. Before income taxes: By measuring profits before income taxes, it eliminates the effects of changes in tax policies.

4. Before capital gains received & dividends received. By eliminating capital gains and dividends received, the measure shows profits from current production, rather than financial gains.

5. Based on corporate tax return data and financial accounting data. The BEA obtains this data from the IRS and from financial accounting data of public companies, and it combines and adjusts the data.

6. With capital consumption adjustment (CCAdj). Tax return measures of depreciation (based on historical-cost accounting) are converted to measures of consumption of fixed capital, based on current cost with consistent service lives and with empirically-based depreciation schedules.

7. With inventory valuation adjustments (IVA). An adjustment to corporate profits and to proprietors’ income in order to remove inventory “profits” (company buys a widget for $1, and after having it in inventory for a month, the supplier raises prices by 20%, and now the value of the inventory jumps to $1.20, creating $0.20 in profits from inventory, with a related increase in sales price), which are more like a capital gain than profits from current production.

So, OK, now….

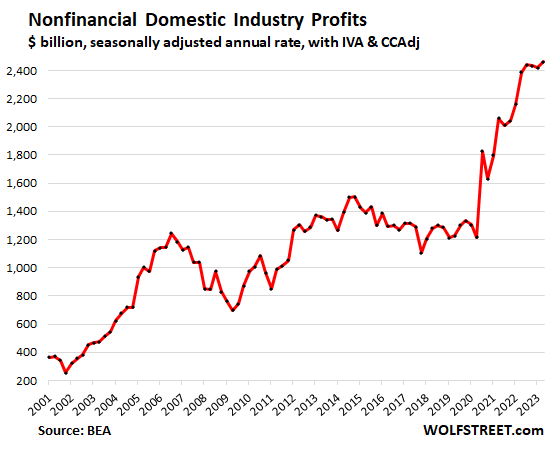

Profits by nonfinancial domestic Industries

Nonfinancial industries include Utilities, Manufacturing, Wholesale trade, Retail trade, Transportation and warehousing, Information, and Other nonfinancial (a huge category we’ll look at in a moment).

Total profits in nonfinancial domestic industries rose by 1.8% for the quarter, and by 3.2% year-over-year, to a record seasonally adjusted annual rate of $2.46 trillion. This does not include foreign profits by US companies.

Profits have doubled from 2019! This stuff is just astounding when you look at it:

The three largest nonfinancial categories by profit:

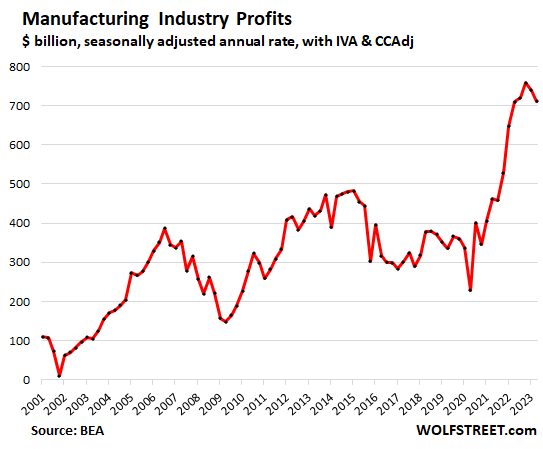

Profits in the manufacturing industries fell 3.7% for the quarter, but still rose a hair year-over-year to $711 billion seasonally adjusted annual rate, the second quarter-to-quarter decline in a row, after the gigantic spike during the pandemic. Profits remain extremely high.

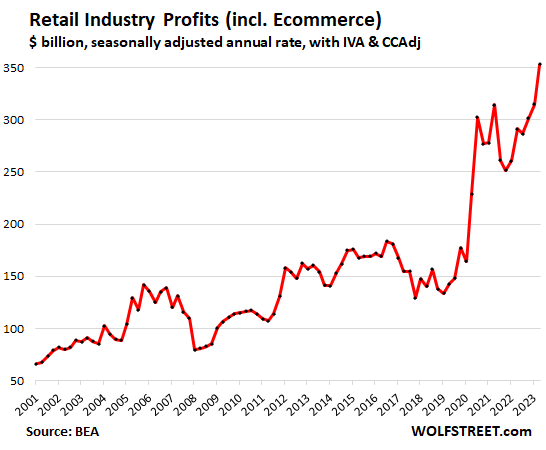

Profits in the retail trade, incl. Ecommerce, spiked by 12.1% for the quarter and by 21% year-over-year to a record $353 billion seasonally adjusted annual rate. Just astounding, in part because retailers’ costs have gone up more slowly (or actually fell) than they’d jacked up their prices:

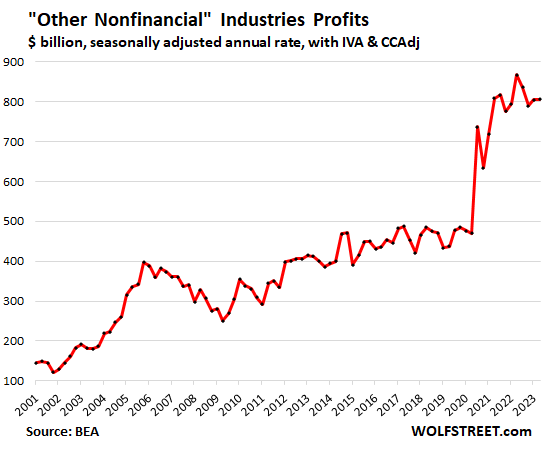

Profits in “Other nonfinancial” industries was roughly flat for the quarter and fell 7.1% year-over-year, after the gigantic spike during the pandemic.

This is a huge category that includes mining; construction; real estate and rental and leasing; professional, scientific, and technical services; administrative and waste management services; educational services; health care and social assistance; arts, entertainment, and recreation; accommodation and food services; agriculture, forestry, fishing, and hunting; and other services, except government.

These kinds of charts show just how distorted pricing and sales were during the pandemic.

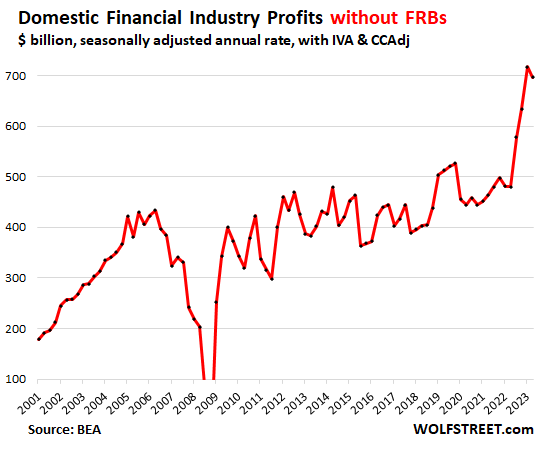

Profits by financial domestic Industries

This includes all financial companies except the Federal Reserve Banks, so domestic profits from banks and bank holding companies, other credit intermediation and related activities; securities, commodity contracts, and other financial investments and related activities; insurance carriers and related activities; and funds, trusts, and other financial vehicles.

Profits dipped by 2.8% for the quarter, but were still up by 45% (not a typo) year-over-year after the huge spike in profits in 2022 and Q1 2023. Remember, this is profits without dividends and without capital gains and losses (nitty-gritty #4), but profits from current production.

Another pandemic-era financial distortion chart:

So what we can see here is that corporate profits were massively distorted during and after the pandemic, with price increases far outstripping cost increases, and that they should be normalizing — meaning, dropping back to trend — but in Q2 were still not normalizing, far from it.

And these profits bode well for future corporate investment and expansion projects – fueling more economic growth from the business end of the economy.

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.