The unprecedented fiscal and financial assist to the non-financial company sector throughout the pandemic staved off a deeper recession in 2020. Measures comparable to loans, credit score ensures, and moratoriums on debt reimbursement have been pivotal in stopping widespread company failures and associated employment and output losses (Gourinchas et al. 2021). Nonetheless, the ensuing build-up of corporations’ leverage, which elevated by virtually 10% globally, could have an effect on the tempo of the restoration.

Debt accumulation will not be detrimental per se. But, when coupled with low profitability and liquidity, it might compromise a agency’s capability to take a position (debt overhang), innovate, and develop, slowing down its exercise like a hangover (Haldane 2010). Furthermore, extremely leveraged corporations, with low profitability and liquidity, are extra weak to exterior shocks, such because the Ukraine conflict and the withdrawal of coverage assist measures.

This column attracts on Chapter 2 of the IMF April 2022 World Financial Outlook (IMF 2022a) and contributes to the continued debate on the potential dangers deriving from the beneficiant however mandatory monetary assist granted to corporations (e.g. Puy and Rawdanowicz 2021, Demmou et al. 2021, Cros et al. 2021, Laeven et al. 2020). The findings of the evaluation are threefold. First, present company vulnerabilities are discovered to be far more concentrated than throughout the International Disaster and to be macroeconomically related. Second, traditionally, debt overhang is strongly pushed by weak corporations in hard-hit sectors each in rising markets and superior economies. Lastly, a well-prepared insolvency and restructuring regime can forestall everlasting losses of tangible capital inventory.

Concentrated vulnerabilities

The pandemic hit erratically the non-financial company sector (Puy and Rawdanowicz 2021). Due to lockdowns or supplies shortages, the most important revenue losses are concentrated in a number of sectors, comparable to shopper providers, transportation, vehicles and elements. In distinction, some sectors gained from the structural pivot imposed by the pandemic (semiconductors, software program and data expertise providers, prescribed drugs and biotechnology, and well being care tools and providers). Based mostly on income development in 2020, three sectoral teams emerge: worst-hit, center, and least-hit sectors. This sectoral clustering differs from the International Disaster, when the shock hit all of the sectors thought-about on this evaluation virtually identically.

Leverage, outlined as a agency’s debt-to-asset ratio, has adopted the same uneven sample.1 Whereas corporations in center and least-hit sectors deleveraged throughout the pandemic, non-financial firms (NFCs) within the worst-hit industries elevated their indebtedness with respect to their asset accumulation. As of the second quarter of 2021 (the most recent knowledge level out there on the time of the evaluation), leverage remained nicely above pre-crisis ranges within the latter.

A extremely indebted agency would possibly nonetheless be wholesome if its steadiness sheet displays ample liquid asset holdings and excessive income. Leverage build-up could permit corporations to take a position and develop. Nonetheless, when excessive leverage is coupled with profitability so low that the agency can hardly repay its debt, not solely does the agency turn into extra uncovered to potential asset repricing (Ding and others 2021) and the withdrawal of coverage assist, however it’s also extra more likely to underinvest (Albuquerque 2021). On this evaluation, weak corporations are outlined as non-financial firms with excessive leverage, low profitability, and an curiosity protection ratio lower than one.

Determine 1 exhibits that the share of weak corporations, after reaching a peak on the finish of 2020, declined in latest quarters on the again of upper returns, higher money circulate, and decrease debt. Nonetheless, it remained greater than within the International Disaster and concentrated within the worst-hit sectors. Since this proof is predicated on listed corporations, the precise figures are more likely to be bigger provided that small and medium-sized enterprises, which account for giant labour and value-added shares in a few of the economies, are usually not included within the pattern.

Determine 1 Share of weak corporations by trade

Sources: Customary & Poor’s Capital IQ; and authors’ calculations.

Notice: Susceptible corporations have an curiosity protection ratio of lower than 1 and are within the prime tercile of the debt-to-asset ratio distribution and the underside tercile of the return on property distribution. The determine exhibits a three-quarter transferring common. Shaded areas point out the worldwide monetary disaster and COVID-19. The pattern consists of 71 economies.

General, the worst-hit industries represented 18% of value-added and 1 / 4 of the labour drive on common throughout international locations.2 One of many worst-hit sectors – shopper providers (together with tourism, recreation, leisure, and schooling) – accounted for nearly 10% of value-added and comprised about 30% of weak corporations. Each are sizable shares.

Debt overhang

Corporations’ leverage build-up could maintain again funding beneath three circumstances. Excessive excellent debt could improve the service price of future debt, stopping additional borrowing to finance new investments. An exterior shock could negatively have an effect on corporations’ internet price tightening the borrowing constraints of more-leveraged corporations (Bernanke and Gertler 1989, Bernanke et al. 1999). Lastly, fairness holders of extremely leveraged corporations could not have incentives to finance new funding initiatives, for the reason that return on future funding is more likely to go in direction of repaying current debt (Myers 1977).

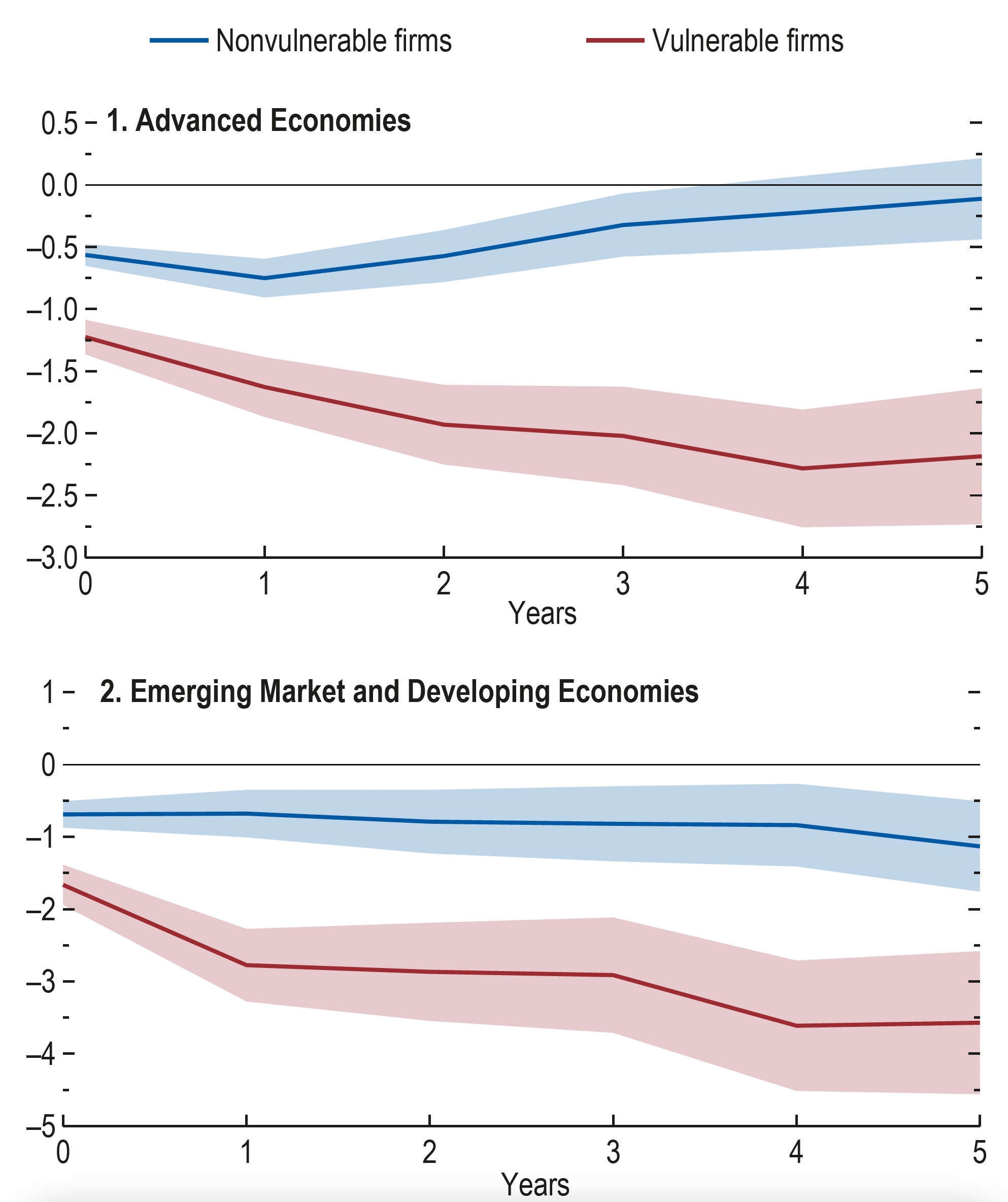

To research the position of weak corporations in driving funding dynamics following leverage buildup, the evaluation depends on a neighborhood projection estimation based mostly on a complete firm-level panel knowledge set protecting 38 international locations.3 As reported in Determine 2, following the build-up of leverage, weak corporations scale back investments essentially the most, producing everlasting losses to the inventory of tangible property. That is the case in superior economies (panel 1) in addition to in rising markets and growing economies (panel 2).

Determine 2 The position of weak corporations

Sources: Bureau van Dijk Orbis; and authors’ calculations.

Notice: The determine illustrates the responses of corporations’ funding ratio following a one-standard-deviation improve within the debt-to-asset-accumulation ratio, conditional on corporations’ being weak. Susceptible corporations have an curiosity protection ratio of lower than 1 and are within the prime tercile of the debt-to-asset ratio distribution and the underside tercile of the return on property distribution. Shaded areas symbolize 90% confidence intervals.

Position of insurance policies

To mitigate these destructive results on funding and pace up the restoration, weak non-viable corporations should be restructured or liquidated with a purpose to unlock productive assets that may be directed to new development areas. Nonetheless, coordination frictions amongst collectors, weak contract enforcement, expensive liquidation procedures, and uneven data could delay the method. To this finish, earlier research have recommended the significance of well-designed insolvency and restructuring regimes (Demmou et al. 2021, Díez et al. 2021, Jordà et al. 2020). Given the big share of weak corporations that will turn into distressed, these frameworks ought to embrace a complete set of authorized instruments and establishments related for widespread restructuring and insolvency proceedings.

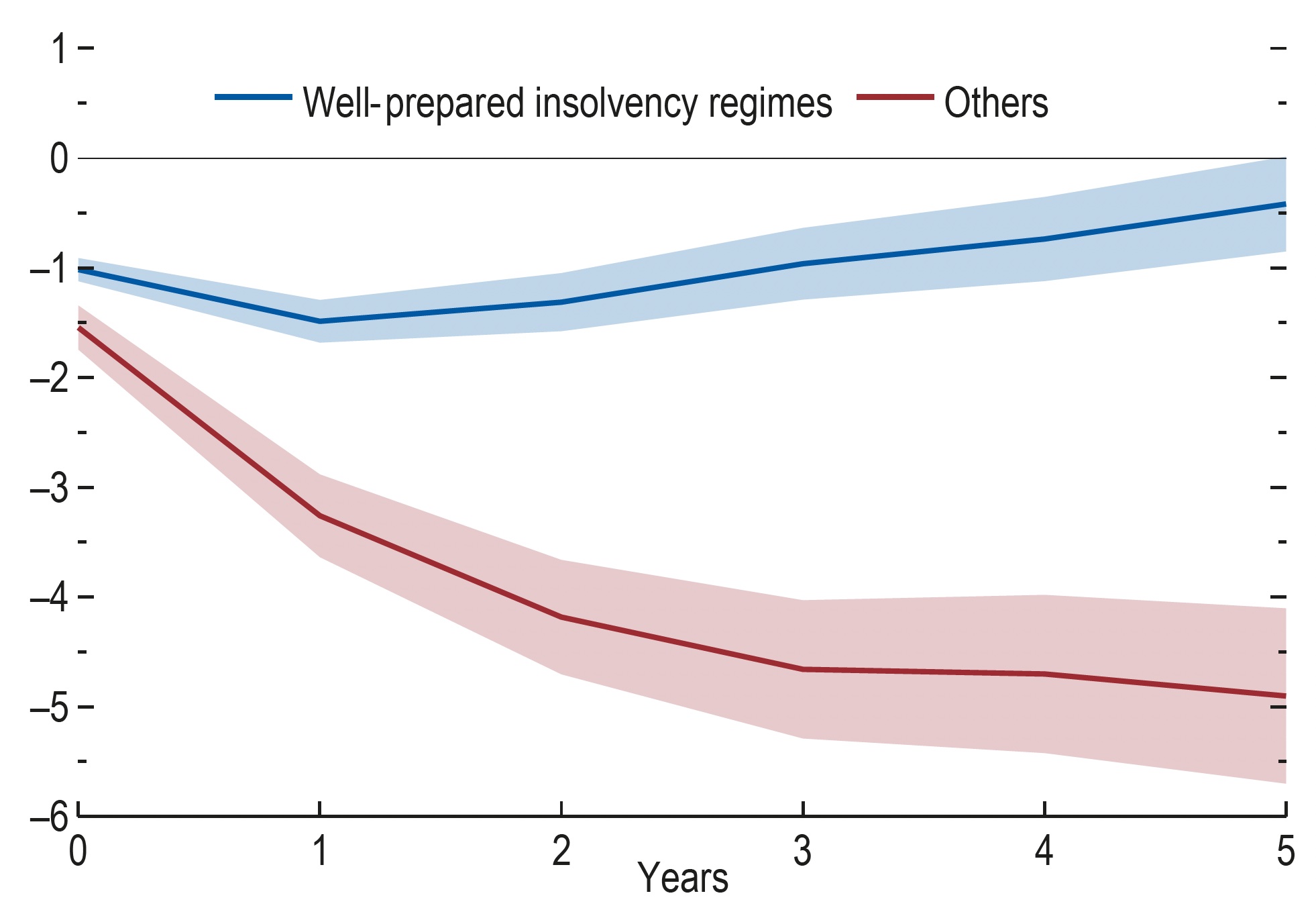

The brand new IMF preparedness indicator (Araujo et al. 2022) captures 4 completely different dimensions: out-of-court and hybrid restructuring, reorganisation and liquidation processes, and the institutional framework. Based mostly on this metric, Determine 3 compares the cumulated response of corporations’ funding ratios to corporations’ leverage build-up in international locations with well-prepared insolvency techniques in place with these in different international locations. The findings counsel that insufficient insolvency proceedings account for a lot of the long-term drag on capital inventory. Due to this fact, the mix of pockets of vulnerabilities and the absence of a well-prepared insolvency and restructuring framework represents an necessary danger issue going ahead, when corporations will not be capable of depend on coverage assist.

Determine 3 The position of efficient insolvency frameworks

Sources: Bureau van Dijk Orbis; IMF, Disaster Preparedness Index; and authors’ calculations.

Notice: The determine illustrates the cumulated response of corporations’ funding ratio following a one-standard-deviation improve in leverage buildup, conditional on a rustic’s insolvency regime. Effectively-prepared insolvency regimes are outlined as these of nations within the prime quartile of the IMF Technique, Coverage, and Evaluation and Authorized Departments’ indicator of disaster preparedness in 2020. Shaded areas symbolize 90% confidence intervals.

Through the post-pandemic coverage normalisation section, fiscal coverage will face a troublesome problem: exiting from the COVID-19 assist measures with out triggering a wave of chapter of viable corporations. To this finish, fiscal consolidation must be calibrated to particular nation circumstances. The place restoration is nicely underway and corporations’ steadiness sheets are wholesome, fiscal assist measures might be withdrawn quicker. In economies that rely closely on sectors hard-hit by the disaster, fiscal assist must be focused to viable corporations, notably in circumstances of clear market failure (IMF 2022b). To establish weak corporations and the well being standing of their steadiness sheets, real-time knowledge assortment is essential. International locations ought to enhance their knowledge assortment and monitoring capability by enhancing collaboration throughout completely different governmental companies and establishments gathering these knowledge, comparable to central banks. Amongst attainable focused assist measures, quasi-equity injections into small and medium-sized corporations could relieve debt misery in international locations with sufficient fiscal area and accountability. The place fiscal sustainability is a basic concern, enhancing income mobilisation and effectivity and reprioritising spending could assist to supply assist with out rising public debt vulnerabilities.

Conclusion

The tempo of the restoration post-pandemic is more likely to be uneven throughout international locations. The beneficiant and mandatory coverage assist to corporations throughout the pandemic has created pockets of vulnerabilities. Abruptly lifting these measures and rising borrowing prices could scale back future corporations’ funding, notably amongst weak corporations. Furthermore, by rising corporations’ enter prices and rising the probability of financial coverage tightening quicker than anticipated, the Ukraine battle could exacerbate chapter dangers. Governments ought to forestall and mitigate downturn dangers by designing a well-targeted assist technique and enhancing the preparedness for probably widespread non-financial company sector misery.

Authors’ word: The views expressed herein are these of the creator and shouldn’t be attributed to the IMF, its Government Board, or its administration.

References

Albuquerque, B (2021), “Company Debt Booms, Monetary Constraints and the Funding Nexus”, Financial institution of England Working Paper 935.

Araujo, J, J Garrido, E Kopp, R Varghese, and W Yao (2022), “Coverage Choices for Supporting and Restructuring Corporations Hit by the COVID-19 Disaster”, IMF Departmental Paper 2022/002.

Bernanke, B S, and M Gertler (1989), “Company Prices, Internet Value, and Enterprise Fluctuations”, American Financial Evaluation 79(1): 14–31.

Bernanke, B S, M Gertler and S Gilchrist (1999), “The Monetary Accelerator in a Quantitative Enterprise Cycle Framework”, Handbook of Macroeconomics 1(C): 1341–93.

Cros, M, A Epaulard and P Martin (2021), “Will Schumpeter Catch Covid-19? Proof from France”, VoxEU.org, 4 March.

Demmou, L, S Calligaris, G Franco, D Dlugosch, M A McGowan and S Sakha (2021), “Insolvency and debt overhang following the COVID-19 outbreak: Evaluation of dangers and coverage responses”, VoxEU.org, 22 January.

Díez, F J, R Duval, J Fan, J Garrido, S Kalemli-Özcan, C Maggi, S Martinez-Peria and N Pierri (2021), “Insolvency Prospects amongst Small and Medium Enterprises in Superior Economies: Evaluation and Coverage Choices”, IMF Workers Dialogue Notice 2021/002.

Ding, W, R Levine, C Lin and W Xie (2021), “Company Immunity to the COVID-19 Pandemic”, Journal of Monetary Economics 141(2): 802–30.

Gourinchas, P-O, S Kalemli-Özcan, V Penciakova and N Sander (2021), “COVID-19 and SMEs: A 2021 Time Bomb?”, NBER Working Paper 28418.

Haldane, A G (2010), “The Debt Hangover”, speech at a Skilled Dinner, Liverpool, 27 January.

Worldwide Financial Fund (2022a), “Non-public Sector Debt and the International Restoration”, World Financial Outlook, Chapter 2, April.

Worldwide Financial Fund (2022b), “Fiscal Coverage from Pandemic to Struggle”, Fiscal Monitor, April.

Jordà, Ò, M Kornejew, M Schularick and A M Taylor (2020), “Zombies at Giant? Company Debt Overhang and the Macroeconomy”, NBER Working Paper 28197.

Laeven, L, G Schepens and I Schnabel (2020), “Zombification in Europe in Occasions of Pandemic”, VoxEU.org, 11 October.

Myers, SC (1977), “Determinants of Company Borrowing”, Journal of Monetary Economics 5(2): 147–75.

Puy, D and L Rawdanowicz (2021), “Covid-19 and the Company Sector: The place We Stand”, VoxEU.org, 22 June.

Endnotes

1 The evaluation is predicated on a pattern of listed corporations from 71 international locations. Supply: S&P Capital IQ.

2 Worth-added and employment figures are based mostly on the OECD STatistical ANalysis Database (STAN) and can be found with an in depth sector breakdown just for Austria, Colombia, the Czech Republic, Finland, Greece, Iceland, Mexico, the Netherlands, New Zealand, the Republic of Korea, the Slovak Republic, Sweden, Turkey, and the US in 2018.

3 The evaluation is predicated on Bureau van Dijk Orbis and includes 2.5 million listed and unlisted corporations from 1998 to 2018.