Natallia Pershaj

Investment Thesis

Cool Company (NYSE:CLCO) is a global company that deals in supplying LNG worldwide. It has recently reported its strong quarterly results and I believe it can sustain this growth in the future as a result of positive industry demand and its recent acquisitions, which can even help it to maintain its healthy dividend payout.

About CLCO

CLCO owns, operates, and manages fuel-efficient LNGCs that offer essential supply chain support to the energy industry globally. It mainly offers LNG transportation solutions with less-emitting forms of energy. The company’s in-house vessel management platform provides commercial and technical management services. In addition, it also manages nine FSRUs and eight LNGCs owned by third parties. The company manages and reports its business operations in one segment: the LNG carrier market. It generates revenue through time and voyage charter and vessel and other management fees. It has managed to grow decently in the previous year despite significant headwinds from geopolitical issues between Russia and Ukraine. On January 26, 2022, the firm agreed with Golar (the “Vessel SPA”) under which it bought eight Original Vessels and The Cool Pool Limited for a purchase price of $145 million per vessel, subject to working capital and debt adjustments. It has also introduced a variable dividend policy which indicates its healthy positioning in the industry.

Financials

The LNG market experienced a significant downturn due to geopolitical issues. Global gas market fundamentals were tight, which was compounded by Russia / Ukraine war concerns, and later by a substantial decline in Russian natural gas exports to the European Union (EU). However, the industry has rebounded in 2023. The LNG demand is constantly rising as it plays an important role in the energy transition. The introduction of new policies to promote energy transition has led to a surge in LNG exports which I think is one of the potential opportunities for the participants in the industry. In addition, North America and Middle East regions are planning to build LNG production facilities to replace coal with liquified natural gas to reduce the carbon footprint which can act as a catalyst to boost the LNG volumes. Identifying these trends, the company has exercised its option for the acquisition of two newbuild 2-stroke LNG carriers for approximately $234 million each. These carriers are expected to be delivered in September and December of 2024. I believe this acquisition can help it to address the growing demand and increase its profitability in the long run as it will be increasing its carrying capacity extensively which can facilitate the transportation of additional LNG volumes. Along with these long-term trends, the short-term trends are also positive as winter is approaching in the Northern Hemisphere. It is estimated that global demand can climb by 6% to 220 million metric tons compared to the winter in 2022. As per my analysis, the company’s strong capabilities of increasing LNG carriers and vessels make it well-positioned to meet these short-term goals as well.

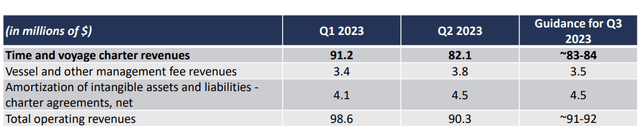

The company recently reported its quarterly results. It reported an operating revenue of $90.31 million, up 71.68% compared to $52.60 million in Q222. This growth was mainly fueled by the acquisition of its initial tri-fuel diesel-electric LNG carriers. Net income surged by 139.71% YoY from $18.13 million to $44.64 million. It reported adjusted EBITDA of $59.84 million. CLCO reported $309.41 million in liquidity and debt stood at $208.0 million.

The company has achieved solid growth through acquisitions. I believe it can sustain this growth for a longer period as the demand is rebounding in the industry and the firm is highly aligned with its strategy of expanding its business through acquisitions which can help it to expand its profit margin by leveraging its increased capabilities to cater to the growing demand. In addition, we can expect decent revenue growth in the coming quarters as demand can increase due to winter in the Northern Hemisphere which can help the company capture additional market share by utilizing its increased LNG and vessel capabilities. The company also has an optimistic view on revenue growth as it expects Q3 revenue between $91 million to $92 million.

Quarterly Operating Revenue Comparison (Investor Presentation: Slide No: 13)

Dividend Yield

In October 2022, the company announced the initiation of a dividend policy for the payment of quarterly dividends. As per this policy, it paid a dividend of $0.40 in Q422. In 2023, it paid a dividend of $0.41 in the first quarter and the second quarter each. Observing the positive growth trends in the industry and the company’s strong cash positions, I believe it can sustain this dividend for the next two quarters as well, which makes the annual dividend $1.64, representing a dividend yield of 11.95%. This appealing dividend yield makes the firm an attractive stock to hold in the portfolio. With the company’s current growth in vessel expansion and the positive long-term demand, I believe it can significantly increase its cash flows in coming years which can further help it to increase its dividend payout.

What is the Main Risk Faced by CLCO?

The company generates its revenues from the single LNG carrier segment. Its performance highly relies on the charting activities. The charter hire rates in the LNG shipping industry are volatile which exposes it to the risk of cyclicity. The charter hire price volatility varies as per the types of LNG vessels. The hire rates primarily fluctuate due to changes in the supply-demand balance which further depends on various external factors beyond the company’s control. If the charter hire rates decline, it can negatively impact the company’s revenue and can contract its profit margin. In addition, it can also lead to oversupply in the LNG shipping market which can cause a reduction in charter hire, affecting the company’s profitability.

Valuation

The company has delivered solid quarterly results and I believe the company’s plans to expand its carrier and vessel capabilities through acquisitions can accelerate its growth by helping it serve a large number of customers and capture the growing demand in the market in the long term. In addition, the positive short-term demand growth can also help it to grow in the coming quarters by leveraging its strong carrier and vessel capabilities. After considering all the above factors, I am estimating sales of $417 million for FY2023 which results in sales per share of $8.81 for a total of 47.3 million shares. It gives the forward P/S ratio of 1.55x. After comparing the forward P/S ratio of 1.55x with the sector median of 1.57x, we can say that the company is undervalued. I believe CLCO might grow in coming quarters as a result of positive demand in the industry and its expanded carriers & vessels which can help it to trade above its current P/S ratio. I estimate the company might trade at P/S ratio of 2.10x in 2023, giving the target price of $18.50, which is a 34.84% upside compared to current share price of $13.72.

Conclusion

The company has experienced significant growth from last year through acquisitions. It has managed to maintain its growth despite macroeconomic pressures. I believe it can sustain this performance in future as it is focused on expanding its transportation capacity which can help it to capture growing demand in industry. However, it is exposed to risk of fluctuating charter hire rates which can contract its profit margins. It has also introduced dividend policy which makes it attractive stock to hold in the portfolio. The stock is currently undervalued and we can expect healthy 34.84% growth from current price levels as result of winter which leads to higher demand for LNG in the Northern Hemisphere and the company’s strong capabilities of vessels and carriers. This growth can be sustained for long time as it has also acquired 2 newbuild LNG carriers. After considering all the above factors, I assign a buy rating to CLCO.