Summary Aerial Artwork

By Paul Wightman

At a Look

- Conventional commerce routes, significantly the Asia to Europe route, are experiencing extra frequent disruptions

- The container commerce is projected to develop round 3.6% every year by way of 2028

The container freight market is present process important modifications that might have main implications for international commerce flows.

The newest report from the UN Commerce and Growth (UNCTAD) company estimated that international commerce noticed a document growth to $33 trillion in 2024, a rise of three.7% from 2023. Volatility is rising on the again of the continued battle within the Center East, which is bringing danger administration methods round hedging prices to the fore.

Rising Dangers in an Unsure Market

The container market is an integral a part of the general delivery market, with over 90% of world items shipped by sea. Of this, round 60% is transported in containers. The potential shifts in international commerce are inflicting uncertainty within the container markets, and in lots of instances key shipments are being re-routed to different locations the place potential. These developments are elevating questions round the price of delivery, with the principle commerce lane from manufacturing facilities in Asia to locations just like the U.S. or Europe being a few of the most impacted because of the sheer quantity of products transported on these routes.

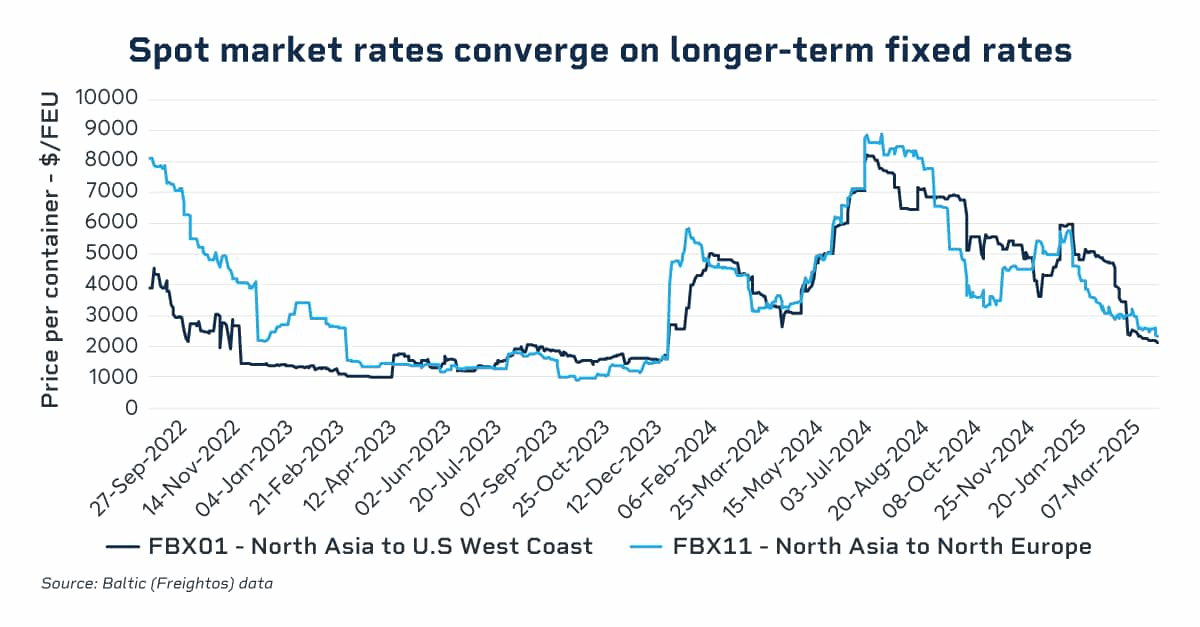

The softening of the spot market charges continues to problem the long-held perception that the longer-term fastened time period contracts are useful to the market. Declining spot charges edging towards the extent of the longer-term fastened costs are prompting some main liners and freight forwarders to re-consider charges which can be extra carefully tied to the spot markets, and indices such because the Baltic Index (FBX) characterize reference worth for this commerce.

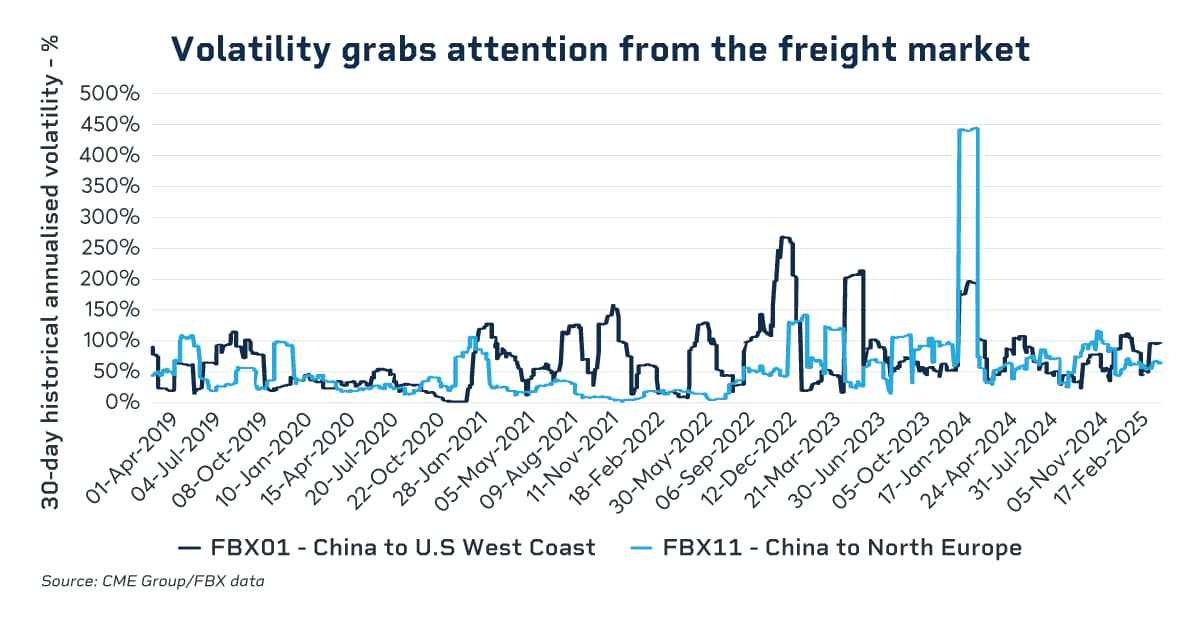

With the continued uncertainty concerning the price of freight, extra corporations – from the liners to the freight forwarders and the cargo house owners – are evaluating their buying and selling methods. Managing the price of freight sometimes brings some extent of worth certainty to the availability chains for transferring items from the purpose of manufacturing to the purpose of consumption. Firms are what they hedge, which may contribute to the continued improvement of the monetary markets in container freight at exchanges like CME Group.

Volatility and Disruptions Proceed

The Baltic (FBX) freight indices, that are a number one business benchmark for the buying and selling of container freight, stays risky throughout lots of the commerce routes. The North Asia to Europe and North Asia to the U.S. West Coast routes are two of probably the most risky amid the coverage shifts, disruptions within the South China Sea and re-routing away from the Suez Canal on the again of extra frequent assaults on delivery off Yemen.

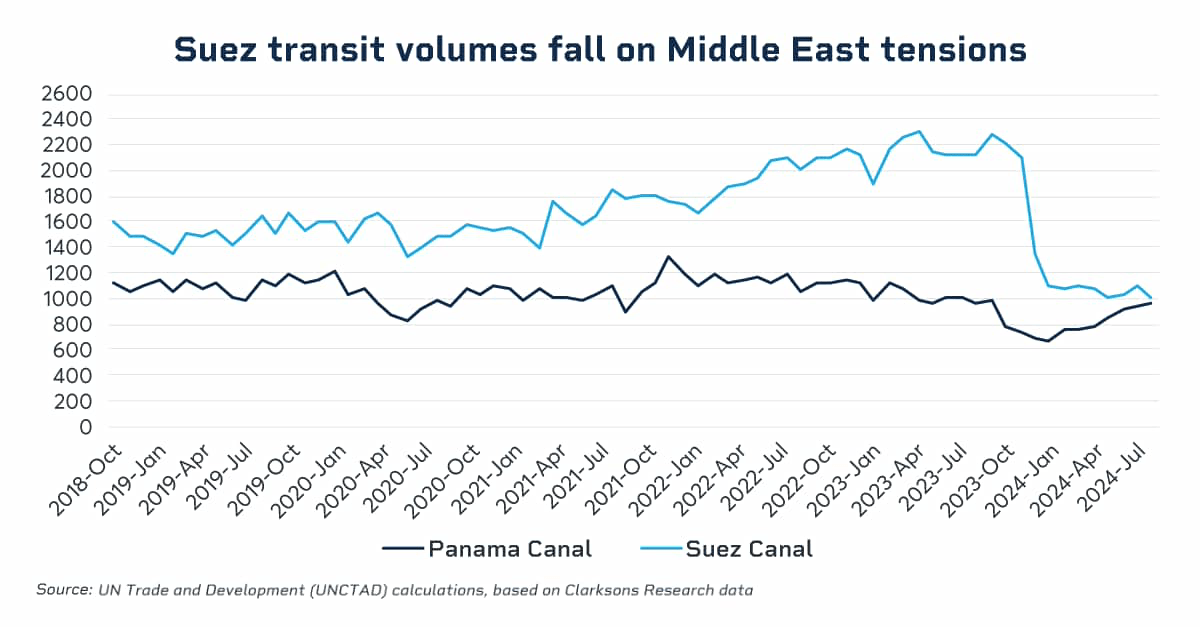

The newest 2024 UNCTAD report exhibits that there was a complete of 23 million Twenty Foot Equal Models (TEUs) traded in 2024 between Asia and Europe, which highlights the essential position that the Suez Canal performs in maritime commerce.

Disruptions to the standard commerce routes, most notably within the Asia to Europe route, have additionally grow to be extra frequent. It is very important notice that the continued battle within the Center East has contributed to a better disruption to freight coming into into and exiting from the Suez Canal, which has compelled house owners to take for much longer diversions to reach in Europe. Companies that depend on imports or export to international markets have needed to plan a lot additional forward, or in some instances, divert items to different markets. This has all been a contributing issue to the general volatility within the freight worth.

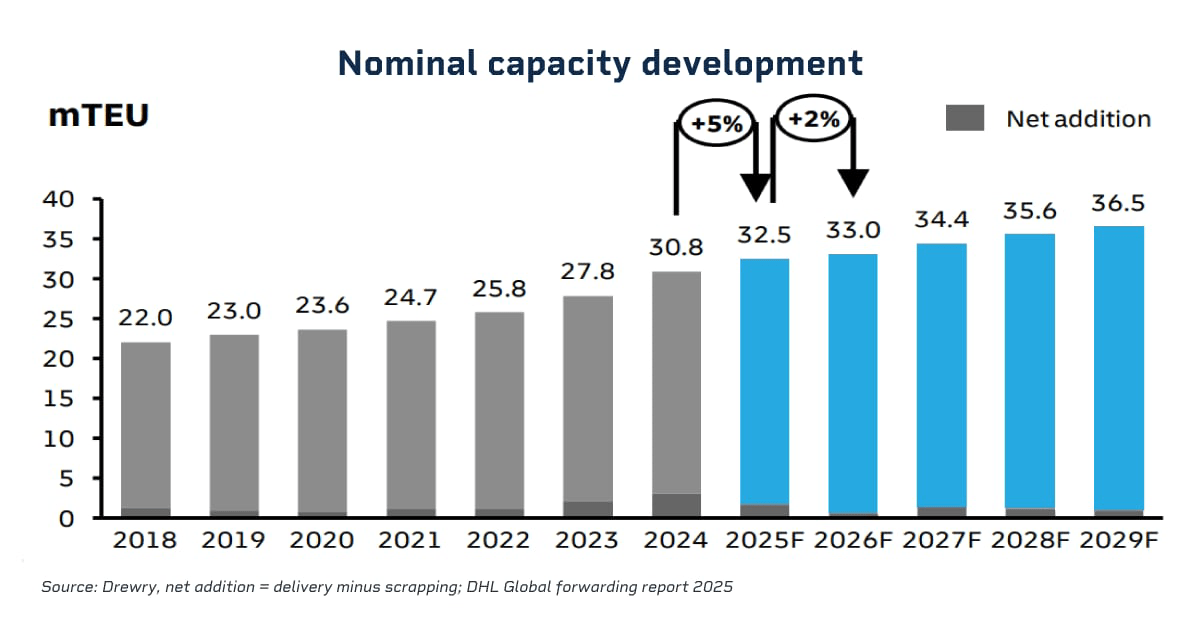

Development Outlook in Containers Seems Strong

The newest report from UNCTAD exhibits that there have been 59.36 million TEUs shipped on the principle East-West routes in 2024, an increase of round 5% on the prior 12 months. The DHL World Forwarding report for 2025 exhibits that on a longer-term foundation, the container commerce is predicted to develop 3.6% on common from 2024 to 2028. In quantity phrases, this is able to imply including an additional 6.1 million TEUs of capability per 12 months.

The volatility within the container freight market appears to be like set to proceed contemplating the variety of geopolitical occasions which can be disrupting provide chains of key items. Freight routes are being diverted, cargoes are taking longer to be delivered, and all of those elements are contributing to heightened ranges of volatility. As corporations alongside the availability chain look to hedge worth danger available in the market, the container freight market may see a better stage of exercise within the months forward.

Unique Submit

Editor’s Be aware: The abstract bullets for this text had been chosen by In search of Alpha editors.