Thomas Northcut

The Thesis

Building Companions (NASDAQ:ROAD) continued to ship double-digit topline development because it exited the primary half of FY24, as mission exercise stays sturdy as a consequence of a major quantity of public and authorities funding. This development ought to proceed additional because the mission pipeline stays robust as a consequence of public and authorities investments, which together with wholesome demand within the industrial finish market and robust backlog ranges ought to drive the corporate topline development within the quarters forward. Sturdy quantity development also needs to help the corporate’s margin together with operation enhancements, in 2024. The corporate’s long-term prospects additionally look promising as the corporate continues to put money into rising its market presence organically and thru strategic acquisition. Whereas the corporate’s development prospect is nice, its inventory is buying and selling a major premium to its historic averages and its friends, making me keep away from this inventory on the present ranges.

Enterprise Overview

Building Companions is a distinguished firm in civil infrastructure that’s primarily concerned within the development and upkeep of roadways throughout the Southeastern United States together with Alabama, Florida, Georgia, Tennessee, North Carolina, and South Carolina. The corporate supplies its services and products to private and non-private infrastructure tasks like roads, bridges, highways, airports in addition to industrial and residential developments. The corporate additionally manufactures and distributes scorching combine asphalt (HMA) for inside use and gross sales to 3rd events which might be related to development tasks and paving actions.

Final Quarter Efficiency

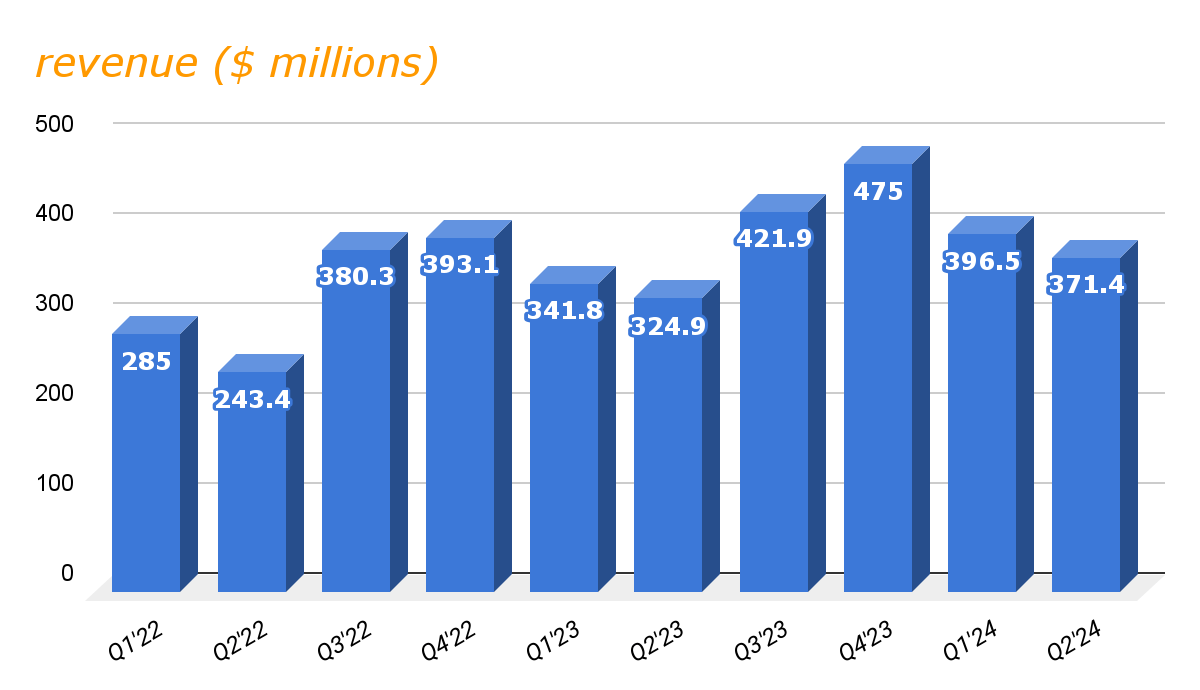

After delivering robust double-digit development in FY 2023 and an honest begin to 2024, the corporate reported one other robust quarter as the corporate’s prime line grew 14.3% year-on-year to $371.4 million through the second quarter of 2024. This development was primarily a results of wholesome mission exercise and a major contribution of roughly $25.1 million from the latest acquisitions accomplished throughout 2023. The natural development year-on-year through the quarter, however, was 6.6% pushed by contract work and gross sales of aggregates to 3rd events.

Building companions income (Analysis Sensible)

The corporate’s gross margin additionally expanded considerably by roughly 230 bps year-on-year to 10.1% through the quarter, due to robust income development and operational execution. Basic and administrative bills, as a share of income, had been flat versus the prior 12 months’s identical interval. Adjusted EBITDA, however, noticed an enchancment of 130 bps year-on-year to 7.9% through the second quarter of 2024. Whereas the corporate’s EBITDA expanded notably through the quarter, the corporate’s backside line was detrimental as the corporate reported a loss per share of $0.02 through the quarter. Nonetheless, when in comparison with the identical quarter within the earlier 12 months, this marks an enchancment from a loss per share of $0.11, as the corporate had been reporting a web loss within the first half of the fiscal 12 months primarily as a consequence of decreased profitability throughout that interval, which was impacted by unfavorable climate circumstances.

Outlook

Whereas the expansion fee has moderated in 2024 as in comparison with the prior 12 months, I count on this development to proceed additional because the mission demand stays sturdy, primarily as a consequence of elevated federal and state infrastructure funding. The demand setting within the industrial market additionally stays wholesome throughout the area, which together with a powerful backlog stage of $1.79 billion and contribution from acquisitions ought to proceed to drive top-line development in the remainder of FY2024.

Speaking in regards to the firm’s finish markets, the market circumstances stay favorable for the corporate in each the infrastructure and the industrial aspect. For my part, the corporate ought to proceed to learn from important public funding for restore and new development throughout numerous sorts of infrastructure tasks starting from highways and bridges to airports, railroads, and navy bases. A big quantity of funding from the Infrastructure and Jobs Act (IIJA) also needs to act as a key issue for the corporate’s demand within the quarters forward because the funding is being transformed into precise work executed within the discipline. These sustained public and authorities investments are offering a powerful pipeline of tasks and offering a secure move of tasks for the corporate sooner or later, which ought to help the corporate’s topline development for the corporate past 2024.

Transferring to the industrial market, this finish market can also be exhibiting energy with a gradual move of tasks and letting alternatives in many of the personal markets throughout numerous states. Nonetheless, the precise areas with explicit energy had been Manufacturing, company website growth, residential, and huge financial growth tasks, indicating a various vary of alternatives in these areas of the industrial market significantly, which ought to additional assist the corporate in its income development within the coming years.

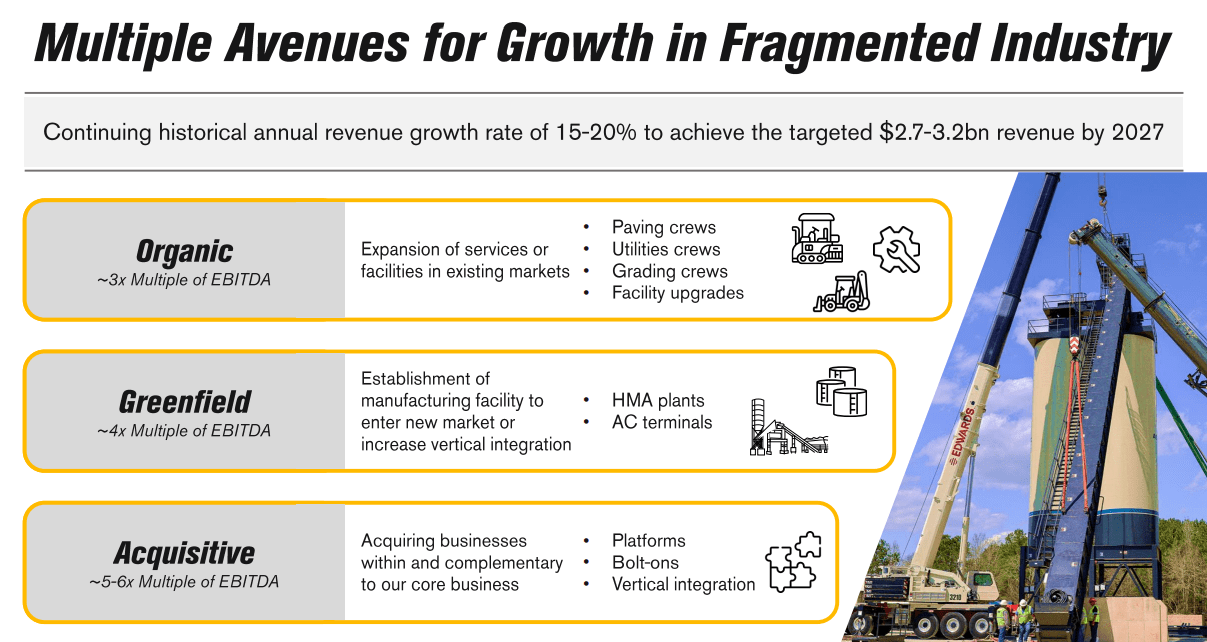

Aside from tailwinds from public and authorities investments, the corporate’s main focus stays on increasing its market share organically in present and adjoining markets. For this, the corporate additionally invested considerably in its fleet tools and paving crews to deal with anticipated robust demand development within the quarters forward. The opposite a part of the corporate’s strategic development mannequin is acquisitions. The corporate has accomplished 5 acquisitions thus far in fiscal 12 months 2024 enabling the corporate to enter into new areas, increasing its market share, and including capability.

ROAD development technique (Firm presentation)

Going ahead, the corporate has introduced one other acquisition of Sunbelt asphalt surfaces in North Georgia and can function as a brand new branded division of the Georgia platform firm, the Scruggs firm. In my opinion, this acquisition, together with many different potential M&As within the extremely fragmented market that the corporate operates in, ought to additional assist the corporate in rising its market presence throughout the area. The corporate is financially sound as nicely, with a debt-to-EBITDA ratio of simply 1.81, inside the goal vary of 1.5 to 2.5 instances, which ought to proceed to help the corporate in its future acquisition, driving the topline development additional in the long run.

Speaking in regards to the ROAD’s upcoming quarterly outcomes, the corporate is anticipated to report its Q3 FY2024 on August 9. As we simply mentioned above, the demand setting stays favorable for the corporate, which together with backlog ought to drive income development within the subsequent quarter as nicely. I’m optimistic in regards to the firm’s upcoming outcomes and anticipating that the corporate ought to ship topline development in excessive teenagers, with an adjusted EBITDA in excessive single digits within the third quarter of FY 2024.

Valuation

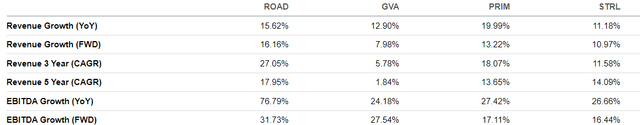

Previously 12 months, the corporate’s inventory has considerably outperformed the market, practically doubling in worth throughout this era. This was primarily a results of robust prime and bottom-line development within the latest quarters. At present, the corporate’s inventory is buying and selling at a Non-GAAP P/E ratio of 40.51, primarily based on FY24 consensus EPS estimates of $1.14. When in comparison with the corporate’s five-year common P/E of 37.29, the inventory seems to be at a slight premium. Then again, in comparison with its sector median of 19.65, the inventory appears to be like considerably overvalued. Whereas the corporate inventory is buying and selling at a premium to its friends which embrace corporations like Granite Building (GVA), Primoris Providers Company (PRIM), and Sterling Infrastructure (STRL), ROAD has additionally delivered above-average development throughout the previous few quarters versus its friends as we are able to see within the desk under.

ROAD and its friends development (Looking for Alpha)

This development can also be anticipated to proceed additional because the demand outlook stays favorable for the corporate, adopted by important public and authorities funding. Backlog can also be robust, additional driving quantity development for the corporate. The profit from quantity development and operation enchancment ought to assist the corporate in margin enlargement within the coming quarter, resulting in bottom-line development and an enchancment within the inventory valuation. Nonetheless, contemplating the corporate’s ahead development versus its friends, ROAD’s present inventory valuation, which is sort of double that of its friends, appears to be like unreasonable to me in the intervening time.

Conclusion

As we mentioned above, the corporate’s inventory is buying and selling at a major premium to its friends. The corporate has outperformed its friends prior to now 12 months and is anticipated to proceed this development additional within the quarters forward because the demand setting stays good for the corporate and margins are additionally anticipated to develop going ahead. Whereas the corporate’s development prospects look favorable, its friends are additionally anticipated to ship EBITDA development in double digits within the coming years, as we are able to see within the desk within the Valuation part. Contemplating the corporate’s overextended valuation, its development prospects versus its friends do not justify its premium valuation, making the inventory valuation unreasonable to me. Therefore, I’d await the corporate’s valuation to chill down, and would give this inventory a “Maintain” score on the present ranges.