Wirestock/iStock via Getty Images

Water solutions company Consolidated Water (NASDAQ:CWCO) has a long runway of growth ahead as desalination gains traction in the U.S., a market with massive growth opportunity. Prospects, however, appear to already be baked in.

Company Overview

Consolidated Water Co. is a water solutions company, primarily serving customers in the Cayman Islands, The Bahamas, the U.S., and the British Virgin Islands. The company has the following segments:

Retail Water Operations: this segment produces and supplies potable water through desalination plants to end users including residential, commercial, and government customers in the Cayman Islands. This segment generates around. In 1H 2023, this segment accounted for 20% of revenues.

Bulk Water Operations: this segment produces and supplies water through desalination plants to government-owned water distributors in The Bahamas and the Cayman Islands. In 1H 2023, this segment accounted for 22.6% of revenues.

Services Operations: this segment designs, constructs, and manages water production and water treatment plants for third parties. In 1H 2023, this segment accounted for 47.7% of revenues.

Manufacturing Operations: this segment manufactures systems and products for commercial, industrial, and municipal water production, supply, and treatment. IN 1H 2023, this segment accounted for 9.7% of revenues.

1H 2023 performance

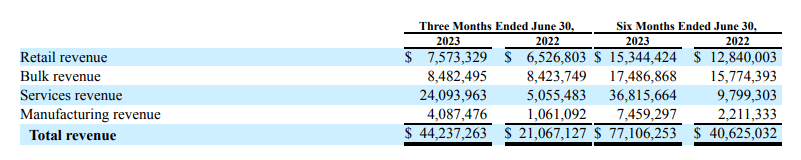

1H 2023 revenues rose 90% YoY to $77.1 million, driven by revenue increases across all operating segments. Gross margin declined to 34% to $26 million in 1H 2023 from 36% the prior year period. Net income rose 2.7-fold to $7.5 million.

Consolidated Water Co. 10-Q, Q2 2023 p.12

Retail segment revenues rose 19.5% YoY in 1H 2023 to $15.3 million driven by a 17% increase in water volumes sold, driven by a recovery in tourism in the Cayman Islands which had been impacted by lingering impacts of the COVID pandemic.

Bulk segment revenues rose 10.8% YoY to $17.5 million in 1H 2023, driven by a 9% increase in water volumes sold.

Services segment revenues were up 275% YoY to $36.8 million in 1H 2023 driven by an increase in plant design and construction revenue (which increased eleven-fold to $26 million) resulting from their water infrastructure construction subsidiary PERC’s progress on its contract with Liberty Utilities for the construction of a water treatment plant in Arizona (for which the company recognized $24.1 million in revenues in 1H 2023). Revenue from operations and maintenance contracts increased 5.2% to $7.5 million.

Manufacturing segment revenues more than tripled to $7.5 million in 1H 2023 driven by an increase in production activity due to improving supply chain conditions which were hampered in 2022 resulting in delivery delays. The segment’s revenue for the half year of 2023 has already exceeded full-year 2022 revenues of $6.3 million.

Near term, Retail and Bulk segment revenues appear to have largely stabilized with revenues in both segments on track to exceed pre-pandemic levels on the back of a continued recovery in tourism near term. Services meanwhile should benefit from their ongoing construction projects (notably the $82 million wastewater treatment plant in Arizona slightly over 40% of which has been recognized so far and much of the remainder expected to be realized by this year, and their $20 million Cayman Islands desalination plant which is on track to be completed by early 2024). The Manufacturing segment also appears to have stabilized with production activity on the rise after supply chain-induced delays.

Good Growth Prospects For A Utilities Player

Looking further ahead, newly awarded construction contracts, strategic expansion into new desalination markets as well as inorganic growth through acquisitions could support growth.

The company’s subsidiary in the U.S., PERC recently clinched a $204 million contract for the construction and operation of a desalination plant in Hawaii. Of the $204 million contract cost, $150 million in construction costs will be generated over 44 months which should support earnings and revenues medium term.

Additionally, management said there are new projects coming up in the next few months, notably a 5 million gallons/day desalination plant construction project in California which PERC may be well positioned to win as the project is “right in PERC’s backyard”. Management has not specified the contract size, however, it appears to be this $140 million project approved by California regulators late last year.

Longer term, through PERC, Consolidated Water is expanding into new water treatment and desalination markets including the U.S. and the Caribbean. The U.S. presents a particularly attractive opportunity; America uses over 300 billion gallons of water a day, most of which is sourced from surface water (like rivers and lakes), groundwater sources, and reclaimed water. However, water supply from natural water sources is depleting faster than it is being replenished and as many as half of America’s water reservoirs may be unable to meet Americans’ daily water needs by 2071). Desalination is being viewed as a solution and with America’s desalination capacity accounting for an estimated single-digit percentage of America’s daily water supply, growth prospects are significant.

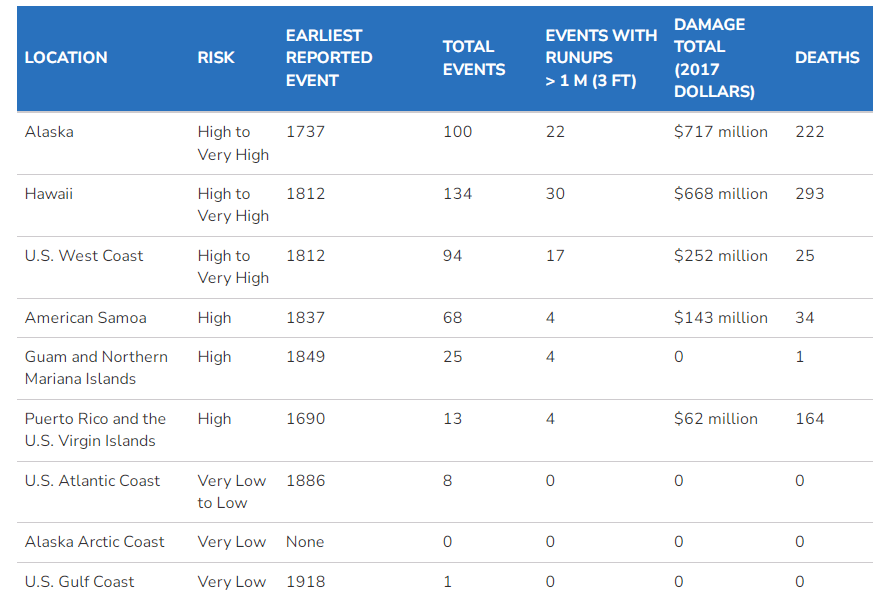

In addition to a sizable opportunity in terms of volume, it is also worth noting that construction contracts in the U.S. (particularly in the Southwest) appear to have bigger ticket sizes due to higher resiliency requirements. Consolidated Water’s $20 million desalination construction project in the Cayman Islands has a capacity of 2.64 million gallons/day. Over in the U.S., PERC’s new $204 million desalination contract in Hawaii has a capacity of 1.7 million gallons/day and the $140 million project in California will have a capacity of 5 million gallons/day. The Hawaiian project’s heftier price tag is because the plant will be rendered tsunami-proof which will result in higher civil costs. West Coast states like California, PERC’s home market, have a “High to Very High” tsunami risk according to the U.S. National Oceanic and Atmospheric Administration (NOAA). PERC, with its strong presence in the Southwestern U.S. (where water supply challenges as well as high natural disaster risks suggest potentially lucrative contract opportunities), and vertical integration advantages (which enable them to offer customers turnkey solutions translating into shorter construction times and lower costs) is positioned to benefit in what is potentially a tremendous long term growth opportunity.

U.S. National Oceanic and Atmospheric Administration

Acquisitions could further bolster growth going forward; the company is currently evaluating a potential acquisition transaction which if completed would be complementary to PERC water (potentially strengthening their competitive position and therefore supporting market share gains). The company currently has a good financial position with virtually no debt (debt to equity of less than 1.5, net debt of negative 45.3) and a solid current ratio of 3, leaving them well positioned to lean on acquisitions to support growth in the future.

Risks

The Cayman Islands license has not been expressly renewed

Consolidated Water’s license with the Cayman Islands government (first issued in July 1990) was not expressly extended after January 2018. The company continues to supply water under the terms of the 1990 license and license negotiations are ongoing. The Cayman Islands government, however, has indicated intent on restructuring the terms of the license that could significantly reduce operating cash flows and income historically generated from their retail license. If so, this could potentially have a material impact on performance with the company’s retail segment accounting for about a fifth of revenues.

Environmental concerns over desalination may stymie growth

Apart from cost concerns (desalination is still among the most costly options for addressing water supply challenges), there are also environmental concerns related to the technology which may limit adoption and therefore growth prospects while other options such as water reclamation (cheaper and less harmful to the environment) find favor.

Conclusion

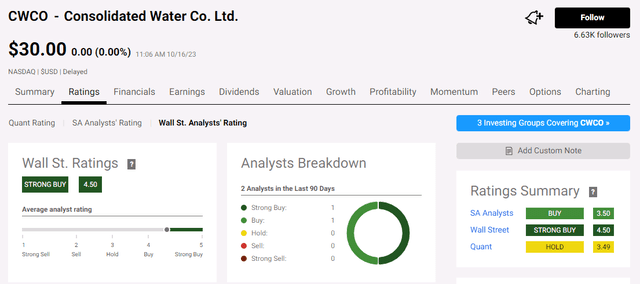

Consolidated Water has a buy analyst consensus rating.

Seeking Alpha

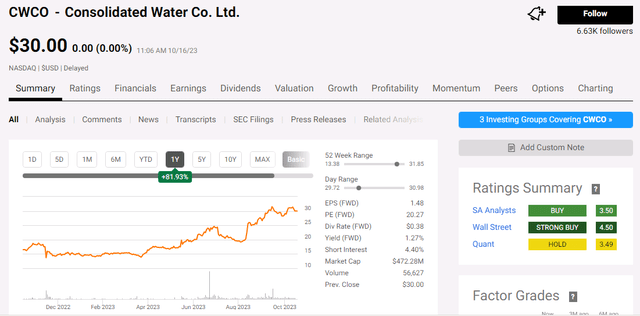

Consolidated Water’s stock price has appreciated 82% over the past year and currently trades at a forward P/E of 20, higher than the sector median of 16. Seeking Alpha’s Quant system rates the stock an F in terms of valuation.

Seeking Alpha

While the company has a long runway of growth ahead, growth is still likely to remain in the single digits (for context, the company’s revenue grew at a CAGR of 4% over the past decade helped by the PERC acquisition in 2019). Factoring in the bigger addressable market opportunity in the U.S. (Consolidated Water has historically heavily focused on the Caribbean market and their Hawaiian project marks their first desalination plant in the U.S.) offset by competition from rivals who may have size advantages and alternative water sources which have cost and sustainability advantages (such as reclaimed water), as well as potential growth from acquisitions, a medium-term revenue growth rate assumption in the mid to high single digits could be appropriate.

At this stage, there is little reason to see a material improvement in profitability so it is fair to assume earnings would roughly expand at single digits as well. For a company growing in the single digits, a forward P/E of 20 suggests the company’s prospects are likely already baked into the stock.