While most people accept that business are in the business of pursuing profits, this pursuit nevertheless prompts many complaints. In two previous posts, I have outlined thirty objections to the profit motive, and I tried to counter each in turn. In this post, I offer ten more complaints that allegedly result from the pursuit of profits.

See what you think of this next and final set, and let me know your thoughts in the comments!

31- Play on consumer emotions

See my response to item 20. Also, consider politicians’ constant play on voter emotions (“Do it for the children!,” “Hope and Change!,” “Make America great again!”).

32- Slow progress on new technologies and refusal to embrace change

A thicket of government regulations slows progress on new technologies. As economist Michael Mandel wrote:

[I use] the metaphor of ‘throwing pebbles in a stream’ to describe the effect of regulation on innovation. No single regulation or regulatory activity is going to deter innovation by itself, just like no single pebble is going to affect a stream. But if you throw in enough small pebbles, you can dam up the stream. Similarly, add enough rules, regulations, and requirements, and suddenly innovation begins to look a lot less attractive.

33- Bribery of public officials

Who is more to blame, a businessman who offers a bribe to a public official or the public official who accepts it? As government power grows and regulations reach into every aspect of life, the incentive to bribe—or otherwise influence—public officials grows.

34- Inadequate public disclosure

The government dictates the degree to which companies are required to disclose information to the public.

35- Externalization of detrimental costs

Companies can do this only with the government’s active participation. Perhaps the most egregious example was that of slavery:

- Federal troops were used to suppress potential and actual slave revolts.

- While some slave patrols were financed by slave owners, others were funded by county or state governments through general taxes.

- The Fugitive Slave Acts of 1793 and 1850 required citizens—whether in the North or the South—to aid in the capture of runaway slaves.

- From 1836 to 1844 Southern representatives were able to maintain a “gag rule” against the reading of anti-slavery petitions in the U.S. House of Representatives.

- From 1828 to the outbreak of the Civil War in 1861, U.S. postmasters prevented the delivery of “incendiary publications” (i.e., anti-slavery pamphlets) through the mail.

- Local government officials often stood by while pro-slavery Southerners violently suppressed anti-slavery voices. Newspaper offices and presses were smashed, homes were burned, people were tarred and feathered and ridden out of town on rails, and some were murdered.

- Southern states passed laws prohibiting teaching slaves to read. Literate slaves could read anti-slavery pamphlets, forge passes, and coordinate revolts.

- Government at all levels provided legal support for slavery by passing and enforcing laws that protected slaveholders and the institution of slavery, punished runaways, and criminalized efforts to abolish slavery.

36- Accrual of political power

Companies have no political power that government has not ceded to them.

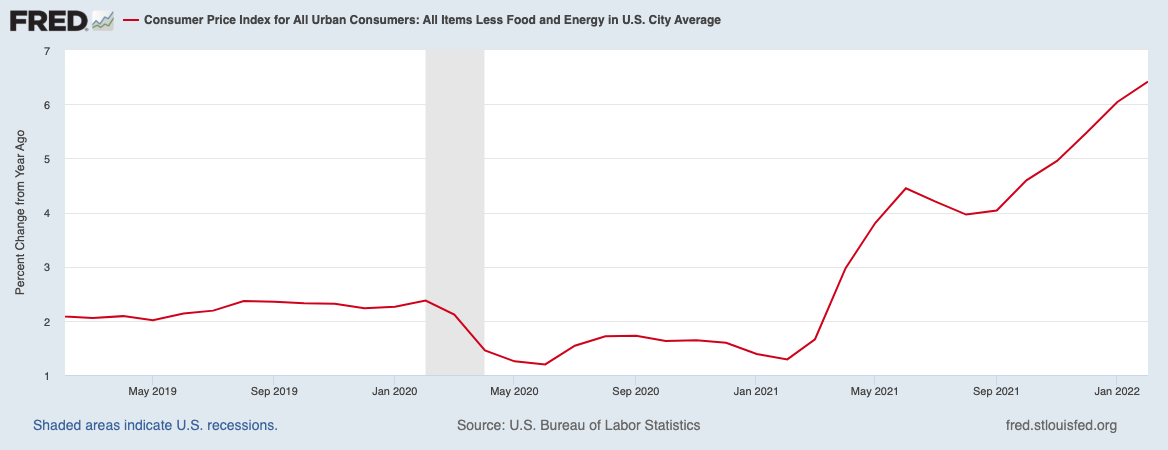

37- Uncertainty in economic markets

Uncertainty, like risk, is a fact of life. As Benjamin Franklin once quipped, nothing is certain but death and taxes. That said, boom-and-bust cycles are usually driven by the government’s monetary policies. Expansion of the money supply leads to booms, which turn into busts when the flow of new money stops.

38- Exploitation of developing countries

The United States is routinely condemned for “exploiting” poor countries through trade and impoverishing other countries (e.g., Venezuela and Cuba) by refusing to trade with them. That said, trading with a dictatorship can help prop up the dictator but so does foreign aid from governments and NGOs.

39- Risk of corporate failure

Corporate failure is a good thing, not a bad one. If a company is turning scarce resources that have alternative uses into goods that are less valuable than the resources, then we want that company to fail. By contrast, failed government programs (e.g., corn-based ethanol subsidies, sugar quotas and tariffs, steel tariffs, the Jones Act, the federal government’s student loan programs, the U.S. Post Office) live on. As Kevin D. Williamson quipped, when government does stupid, it does immortally stupid.

40- Failure to accept responsibility

Whether a company accepts responsibility for its failures or not, if left unaddressed failure ultimately leads to bankruptcy. Failure of a government policy too often serves as “proof” that more resources are needed. In addition, politicians and government officials, rather than taking responsibility for their failures, routinely blame industry for problems that they themselves have created.

Richard Fulmer worked as a mechanical engineer and a systems analyst in industry. He is now retired and does free-lance writing. He has published some fifty articles and book reviews in free market magazines and blogs. With Robert L. Bradley Jr., Richard wrote the book, Energy: The Master Resource