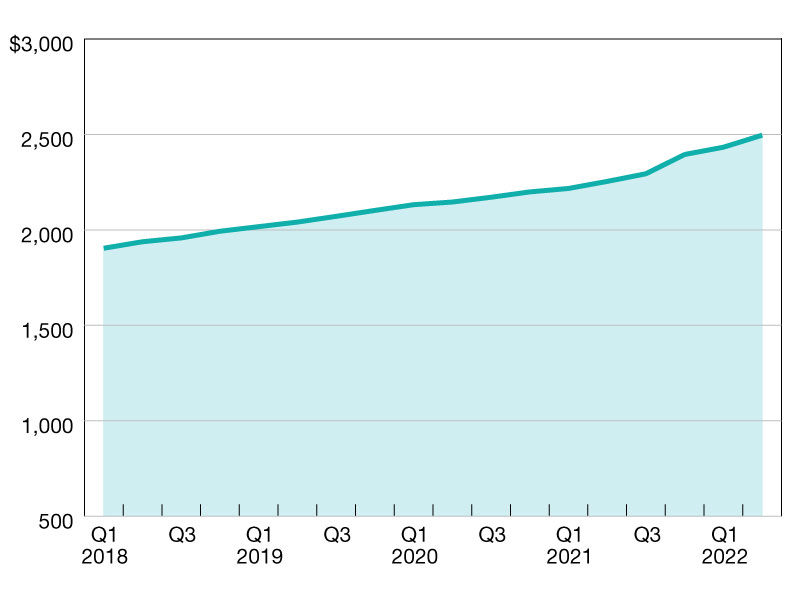

The first half of 2022 saw more commercial and multifamily borrowing and lending than any previous January through June period

Source: Mortgage Bankers Association

$ in billions

The first half of 2022 saw more commercial and multifamily borrowing and lending than any previous January through June period. The second half of the year will be different.

The level of commercial/multifamily mortgage debt outstanding increased by $99.5 billion (2.3 percent) in the second quarter of 2022, according to MBA’s second-quarter 2022 Commercial/Multifamily Mortgage Debt Outstanding report. Total commercial/multifamily mortgage debt outstanding rose to $4.38 trillion at the end of the second quarter. Multifamily mortgage debt alone increased $35.7 billion (1.9 percent) to $1.9 trillion from the first quarter of 2022.

Just how strong were things at the start of the year? The $99.5 billion increase in commercial and multifamily mortgage debt outstanding in the second quarter was the second largest quarterly rise since the inception of MBA’s data series in 2007. The increase in holdings by depositories was the largest on record.

Commercial banks continue to hold the largest share (38 percent) of commercial/multifamily mortgages at $1.7 trillion. Agency and GSE portfolios and MBS are the second-largest holders of commercial/multifamily mortgages (21 percent) at $919 billion. Life insurance companies hold $648 billion (15 percent), and CMBS, CDO and other ABS issues hold $613 billion (14 percent).

MBA now expects a slowdown in the second half as developers, buyers, sellers, lenders and others all adjust to the continuing changes in market conditions.