Igor Kutyaev

Investment Thesis

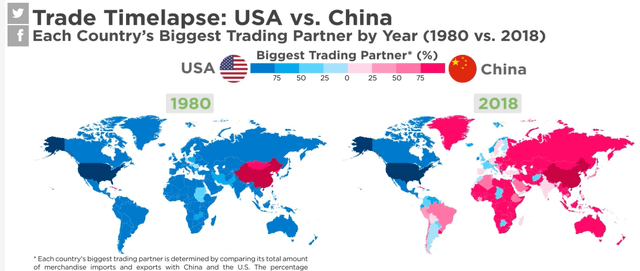

The iShares MSCI China A ETF (BATS:CNYA) offers broad and diverse exposure to the Chinese business sector. It has seen a boost recently due to the news of the post-zero-COVID policy of China, where reopening and re-focusing on economic growth has become the new policy. Going beyond the immediate effects on China’s domestic economy, in other words, what this means for Chinese business activity in China, we have to consider the likely renewed push of the Chinese government to further integrate its economy with the global economy now that China is moving back to business as usual. This is especially the case with the developing world, where China is competing with the West on forging closer economic ties. In this regard, China’s offer is far superior, for reasons that we in the Western World find hard to understand, and as such Chinese firms will be the more likely ones to capture a growing share of the business that fast-growing developing world economies have to offer. This makes for a strong argument for CNYA as a long-term buy & hold investment opportunity.

CNYA profile

iShares

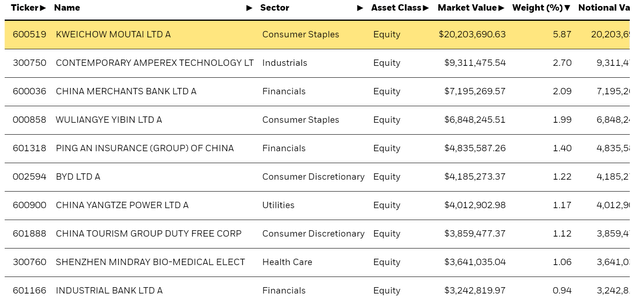

I wanted to start the review of CNYA’s profile by pointing out the top fund holdings, as well as the fact that they are by no means dominant. There are 500 different holdings in the fund, making it somewhat insulated from bad news that may arise from any particular company that is represented. As the top stock holdings show, the fund is also well-balanced in terms of being representative across sectors.

Among the top holdings, some of the more interesting names include BYD (OTCPK:BYDDF). As the world continues to adopt electrified transport technologies, I see BYD as an interesting potential global player. Of particular interest is its electric bus segment, which is penetrating markets beyond China, including the EU, where it has a bus production facility in Hungary. BYD’s car segment is also expanding outside of China. As urbanization continues to take place at a fast pace throughout the developing world, I see BYD as one of the best-positioned EV companies to make inroads with its EV buses as well as personal vehicle EVs.

Another company of interest, which I also see potentially expanding globally, especially in the developing world is China Yangtze Power LTD. It is a renewable energy company, with the operation of the Three Gorges Dam being by far its main project. It is also operating outside of China, with consultancy and other services offered in a variety of countries around the world. With renewable energy projects in higher demand around the world, it is a company that has the right profile to take advantage and expand, especially in the developing world.

China offers the developing world what it needs, precisely because it is also a developing nation, while our offer is ill-suited, based on assumptions that our institutions can also serve the developing world well

It can be argued that until quite recently, the developing world had no choice but to depend on our financial infrastructure, as well as our technological inputs for most of their basic needs. It was most certainly the world in the immediate aftermath of the end of the Cold War. Since then, an alternative emerged and that alternative is China. In a recent article entitled: “China’s 2025 Strategy Emerges As Top 2023 Investment Story Contender” I highlighted the possible emergence of a mostly domestic Chinese semiconductor industry, increasingly independent from our technological inputs.

It should also be noted that aside from technological constraints that we tried to impose on the Chinese economy, which is starting to show some possible signs of cracking, another important lever of pressure or constraints from the past, namely the availability of some critical natural resources seems to have been resolved. With Russia undergoing an economic divorce from the EU, with both of them eager to reduce or eliminate their dependence on each other, China is arguably emerging as a major winner. Greater access to resources that China needs as an input in its growing economy should be seen as a significant net positive, especially within the current global context of seemingly tight supplies of a growing number of key commodities.

Much has been made of recent US & EU efforts to muster resources and look to counter China’s growing global influence, especially in the developing world. Unfortunately, there seems to be very little understanding of the fact that our way of doing things may not be compatible with the needs of developing nations. We nevertheless tend to push for those institutional adoptions in the belief that these rules, regulations, and ways of doing things are what make us prosper, therefore it will also help others prosper.

To illustrate the difference between what China has to offer, and what we are trying to offer and we seem to be rebuffed over and over, I want to, first of all, highlight the differences between how major projects tend to unfold in China, versus the Western World. In this regard, the French Flamanville nuclear reactor project is indicative of the institutional handicap that Western developers are facing. The project’s cost has quadrupled compared with the original project’s estimate, while the delay so far has set back the commencement of operations by about a decade and a half and counting. By comparison, similar projects in China tend to be on a budget and on time, costing far less, and getting it done about three times faster.

Another indicative sign is the tale of two Eastern EU members, both of which decided to expand their nuclear power generation capabilities, approximately at the same time. Hungary signed a contract with Russia’s Rosatom in 2014, and the work has now started on the project meant to add two new reactors. The delay is mostly a reflection of the difficulties that developing members of the EU in the former communist East have in trying to develop, while burdened by EU institutions. Nevertheless, at least work started about a year ago. By contrast, Romania’s expansion plans, where a contract was signed in 2008 with a consortium of Western companies for new reactors at its existing nuclear power plant, are yet to take shape. It is the difference between working with Western companies, which are mostly geared to working within our institutional framework, and signing with a non-Western entity.

Using the examples above as a reference point, it becomes apparent that our institutions and the companies operating within them, tend to be ill-suited to meeting the needs of the developing world, where population growth is still robust, and the need to urgently develop economically is even greater. Procedural transparency and other institutional procedures meant to seek efficiency and prevent corruption may seem fine and alright in a country like France, where the physical infrastructure is well-developed, while its corporate sector is globally at the top technologically, financially, and in terms of quality of products and services.

France can arguably afford to wait a few decades for a new nuclear reactor to become operational and for the cost of it to run much higher than anticipated. At least, that is arguably the case for the short to medium term. For countries where they expect or hope for double-digit growth in industrial output, while there are still large swathes of their population that still lack basic utilities, a timeline measured in decades for such projects, rather than years, just won’t do. China seems to understand these needs, which is why it has been gaining in terms of global trade and will continue to do so for the foreseeable future.

Howmuch.net

Investment Implications

As China’s private sector continues to expand, improve and build up capacities to offer better, improved and more plentiful goods & services to the world, the trend of growing penetration of Chinese business, trade & investment is likely to continue along as it has in the past few decades. US & EU attempts to counter China in the developing world will be futile, because we do not have the right offer on the table. Our offer comes with demands for our institutional frameworks to be adopted, which are not compatible with the needs of much of the developing world.

Chinese firms that are directly represented in the fund stand to benefit directly from their growing presence throughout the world. The broader Chinese economy stands to benefit, therefore even companies in the fund that are mostly dependent on the domestic Chinese business environment are set to benefit. CNYA is a well-balanced, diverse ETF that offers broad exposure to the Chinese economy and its overall future performance prospects. While the last few years have been challenging for the Chinese economy for a variety of reasons, the main reason I see to be optimistic about its outlook, and therefore that of the CNYA fund is because China is set to see a significant expansion in trade, business and investment with the developing world going forward. They have the model and they increasingly have things to offer that meet the needs of much of the rest of the World, thus prospects of long-term success are encouraging.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.