(Reuters) – Shares of CNH Industrial (NYSE:) fell greater than 10% premarket on Friday, after the farm and building tools maker missed third-quarter revenue estimates and reduce its 2024 revenue forecast as a consequence of weak demand and decreased seller stock necessities.

The corporate trimmed its annual adjusted revenue view to the vary of $1.05 to $1.15 per share from $1.30 to $1.40 anticipated earlier, reducing the forecast for the third consecutive quarter.

CNH expects annual gross sales at its agriculture phase to be down between 22% and 23% from a yr earlier, in contrast with a previous view of down 15% to twenty%.

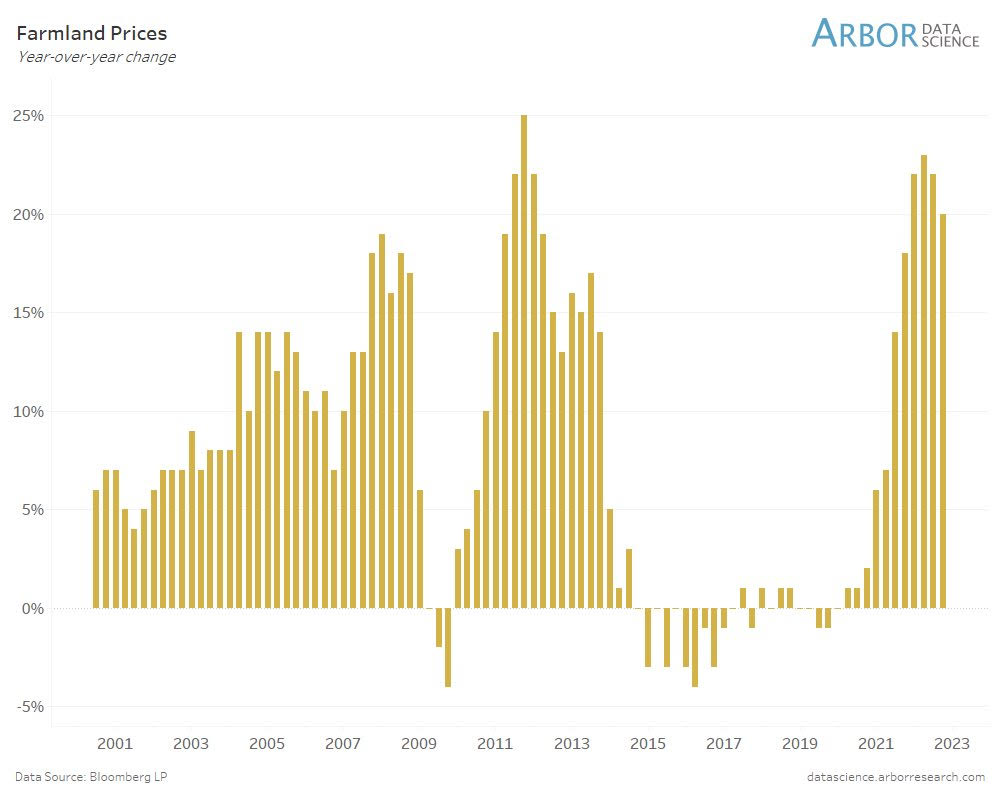

A file crop harvest has saved grain inventories elevated and pressured crop costs, which, coupled with larger enter prices, has prompted farmers to delay their tools buying selections.

This delay, in flip, has compelled sellers to reasonable their product restocking, inflicting tools makers corresponding to CNH Industrial to scale back manufacturing.

Nonetheless, the Basildon, UK-based firm’s quarterly income, although down 22.3% at $4.65 billion from a yr in the past, beat analysts’ common estimate of $4.58 billion, in accordance with knowledge compiled by LSEG.

Persisting weak point in farm incomes world wide has dented the demand for brand new tools in most world markets.

Gross sales for CNH’s tractors declined 12% in South America through the third quarter, whereas falling 20% in Europe, Center East and Africa. Its mix gross sales fell 32% and 50% within the two areas, respectively.

CNH, which is understood for its New Holland model of farm tools, posted an adjusted third-quarter revenue of 24 cents per share that fell wanting the estimates of 27 cents.

Peer AGCO on Tuesday additionally supplied its full-year revenue and income forecasts beneath estimates, damage by weak demand throughout areas as decrease farm earnings persists for crop producers.