Dilok Klaisataporn

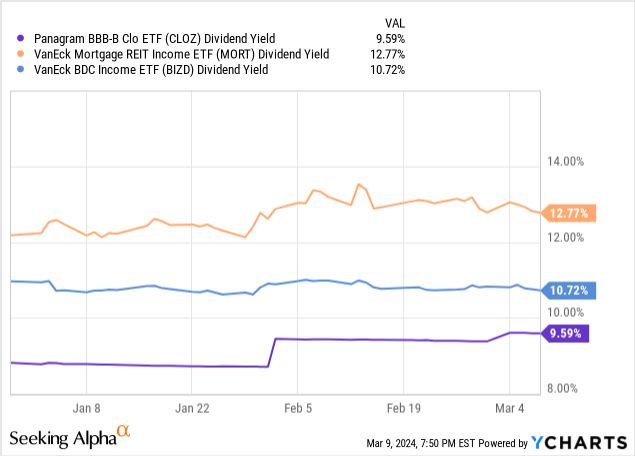

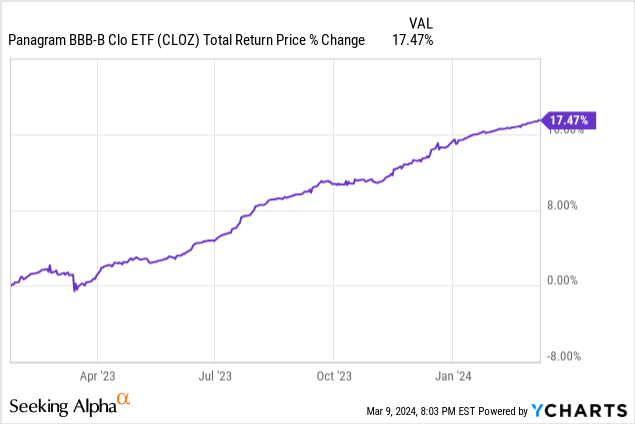

Long-time readers know I’ve been bullish on CLO ETFs since these first appeared on the market, due to their strong yields and effectively zero rate risk. Of these, the Panagram BBB-B Clo ETF (NYSEARCA:CLOZ) offers a particularly compelling 9.6% yield, with strong returns since inception, and since I first covered the fund. CLOZ’s overall fundamentals remain strong, and so the fund remains a strong buy.

Quick CLO Overview

CLOZ invests in CLO debt tranches. A quick overview of these securities before looking at the fund itself.

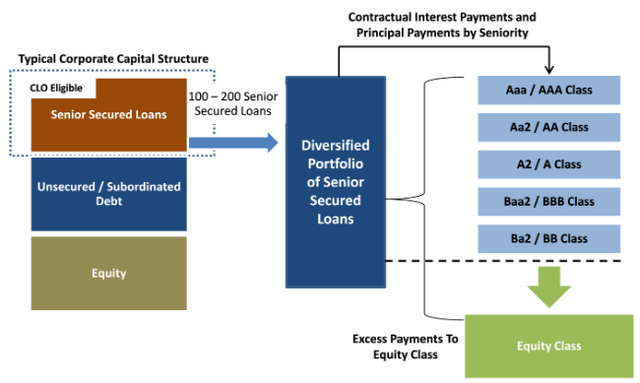

Senior secured loans are floating-rate loans from banks to medium-sized, riskier companies. These loans are senior to other debt and secured by company assets.

Senior loans are sometimes bundled together in CLOs. Each CLO, or bundle of senior loans, is divided into tranches. Income from the senior loans is used to make payments to all tranches. Senior tranches get paid first; junior tranches get paid last. CLO tranches are generally variable rate instruments, whose coupon rates fluctuate with Fed rates.

Investors can buy into these tranches and receive income from the bundle of senior loans. Quick graph of how these are structured.

Stanford Chemist SA Article

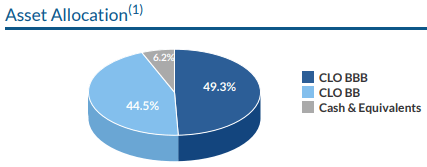

CLOZ itself focuses on CLO tranches rated BBB-BB, with a bit of cash on the side.

CLOZ

With the above in mind, let’s have a closer look at the fund itself.

CLOZ – Investment Thesis

CLOZ’s investment thesis rests on the fund’s:

- Strong 9.6% dividend yield, higher than most of its peers, bonds, and bond sub-asset classes

- Strong total returns, with the fund outperforming since inception

- Low rate risk, of long-term importance, and of particular relevance when rates are in flux

The above makes CLOZ an incredibly strong investment opportunity and fund. Let’s have a closer look at each of these points.

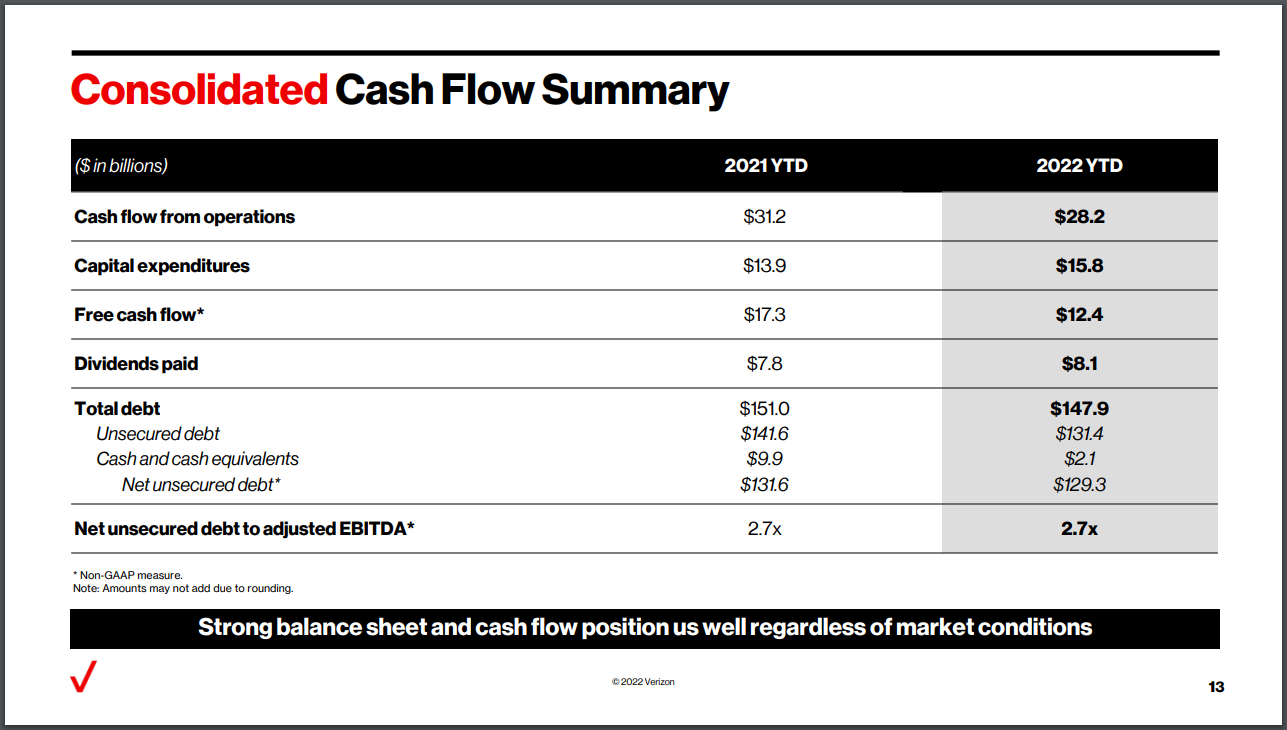

Strong 9.6% Dividend Yield

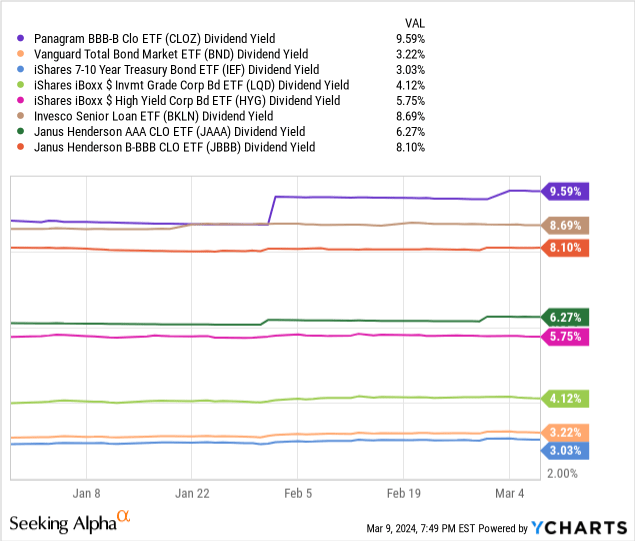

CLOZ offers investors a 9.6% dividend yield. It is a strong yield on an absolute basis, significantly higher than most bonds and bond sub-asset classes, moderately higher than most high-yield bonds and CLO peers, and slightly higher than most senior loans.

Only some of the more niche asset classes and funds offer higher yields, including mREITs, BDCs, some CEFs and covered call funds. Do note that these are generally much riskier leveraged investments.

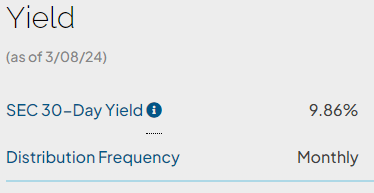

CLOZ’s dividends seem fully covered by underlying generation of income, as evidenced by the fund’s 9.9% SEC yield.

CLOZ

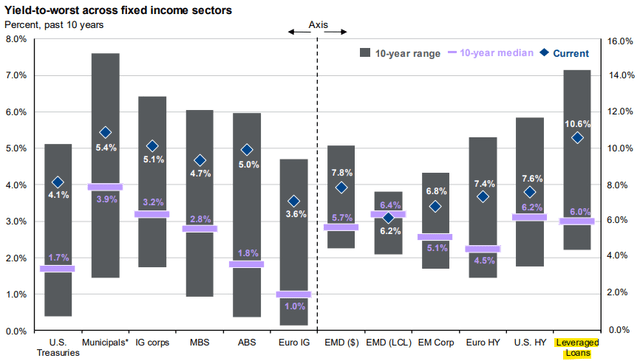

CLOZ’s strong dividends are backed by senior loans, the highest-yielding fixed-income sub-asset class right now. It stands to reason that investments backed by senior loans have strong, above-average yields, as is the case for CLO debt tranches and CLOZ.

JPMorgan Guide to the Markets

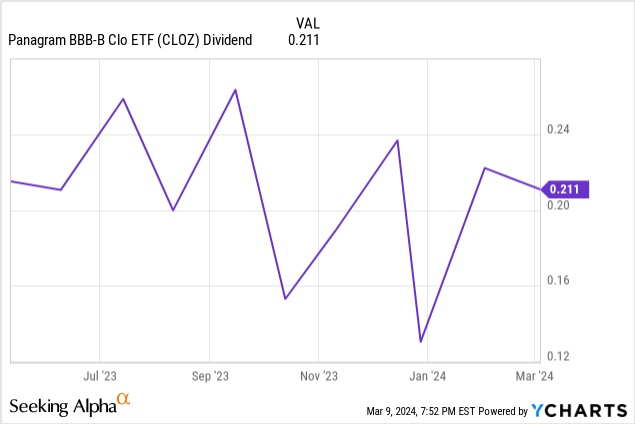

CLOZ is a young fund, with inception in early 2023. Due to this, the fund’s dividend growth track-record is too short to meaningfully analyze. Dividends have fluctuated month to month since inception, with no clear trend since inception. There has been a trend towards slightly lower dividends since around July of last year, coinciding with a shift from BBB-rated tranches to those rated BB. Said trend could simply be due to volatility, however.

On a more negative note, CLOZ’s underlying holdings are all variable rate investments, whose coupon rates move alongside Fed rates. As the Fed is set to cut rates in the coming months, the fund’s dividends should decrease as well. On a more positive note, the fund trades at a very healthy spread relative to most other bonds and bond sub-asset classes, so yields should remain elevated for many years, perhaps for the foreseeable future.

As an example, CLOZ currently yields 3.8% more than the iShares iBoxx $ High Yield Corporate Bond ETF (HYG), the largest high-yield corporate bond ETF. Current Fed guidance is for 2.75% – 3.00% in long-term cuts, which should leave CLOZ yielding more than HYG for the foreseeable future. CLOZ yields 2.1% more than the SPDR Portfolio High Yield Bond ETF (SPHY), another large high-yield corporate bond ETF. Current Fed guidance is for 2.1% in cuts by 2026, so CLOZ’s yield should remain higher than SPHY’s for several years, at least.

CLOZ’s strong 9.6% dividend yield is the fund’s most important benefit and advantage relevant to peers. Although it should decrease as the Fed cuts rates, dividends should remain competitive, under current guidance at least.

Strong Total Returns

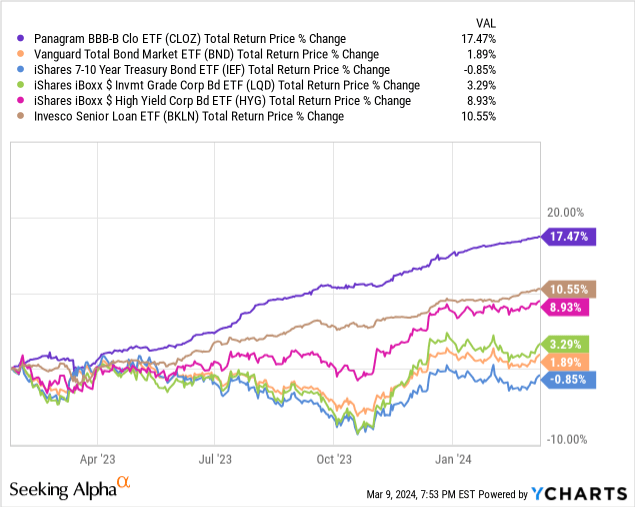

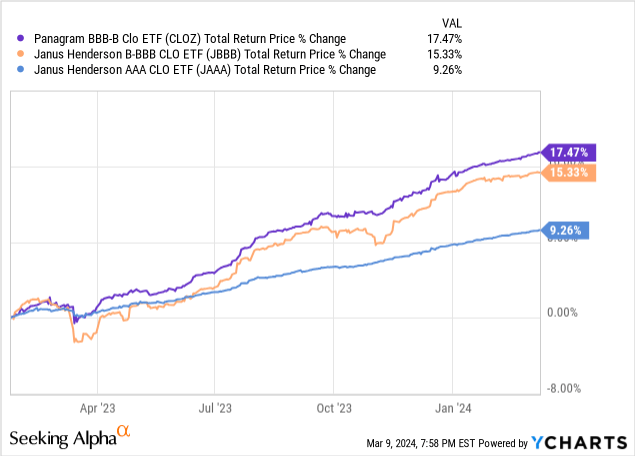

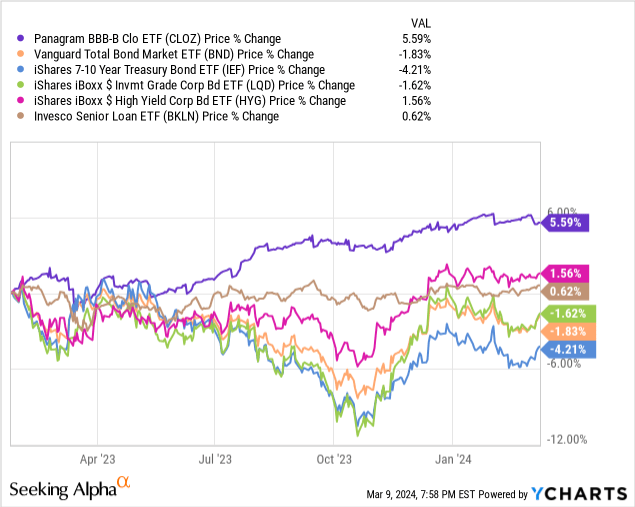

CLOZ’s strong 9.6% dividend should result in strong total returns, as has been the case since the fund’s inception. Returns have been around double those of high-yield corporate bonds and senior loans, even stronger when compared to other bond sub-asset classes.

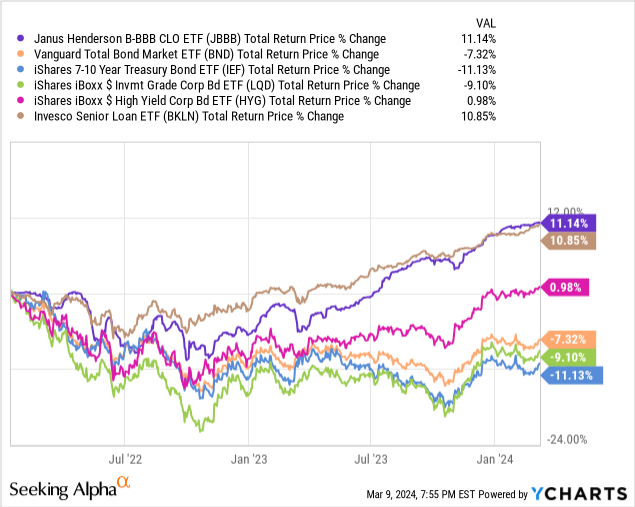

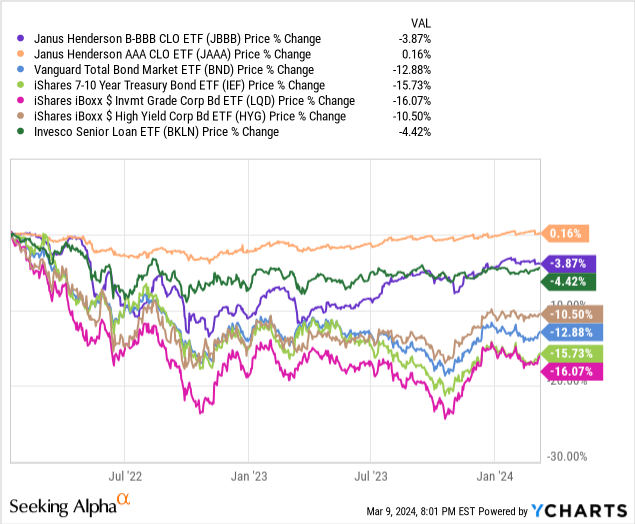

CLOZ’s performance track-record is incredibly strong, but also short, with the fund being created a little over one year ago. Other CLO ETFs have slightly longer track-records, and their performance is still incredibly strong. The Janus Henderson B-BBB CLO ETF (JBBB) has existed since early 2022 and has also outperformed most other bonds and bond sub-asset classes since inception. JBBB is closest to CLOZ out of the CLO ETFs I know.

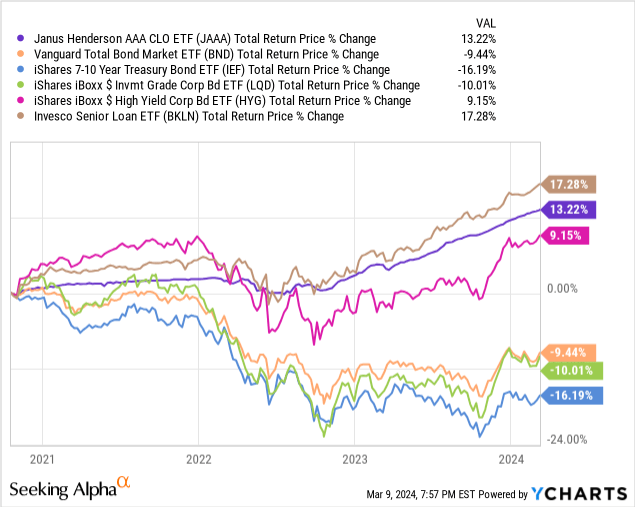

The same is mostly true of the Janus Henderson AAA CLO ETF (JAAA), which has existed since late 2020. JAAA has outperformed most bonds, underperformed senior loans, but at massively decreased risk.

CLOZ itself has outperformed both JBBB and JAAA, due to focusing on riskier, higher-yielding CLOs.

Overall, CLO debt ETFs have outstanding performance track records, if a bit on the short side. Their performance has been due to their outstanding yields and extremely low rate risk, which brings me to my next point.

Extremely Low Rate Risk

CLOZ’s underlying holdings are variable rate investments with effectively zero duration, as is the case for the fund. Expect approximately zero capital losses or reductions in share prices when rates rise, as has been the case since the fund’s inception.

CLOZ was created after the Fed started hiking, and after bonds have spent months circling the drain, so the results above are not terribly informative. Both JBBB and JAAA experienced most of 2022 and have performed incredibly well since. JAAA’s share price slightly declined during early 2022, but has since fully recovered. JBBB’s share price saw significant, but below-average, declines until mid-2023, but has since mostly recovered. Both funds performed much better than fixed-rate bonds during a period of rising rates, as expected.

CLOZ is most similar to JBBB, so should have seen similar, slightly higher, losses since then. Still, these would almost certainly have been below-average, as was the case for JBBB, JAAA, and other variable rate funds.

CLOZ’s extremely low rate risk decreases portfolio risk and volatility, an important benefit for shareholders. As rates are unlikely to decrease any time soon, this is unlikely to bring any short-term benefits to investors but remains a long-term positive.

CLOZ – Risk and Other Considerations

Credit Risk

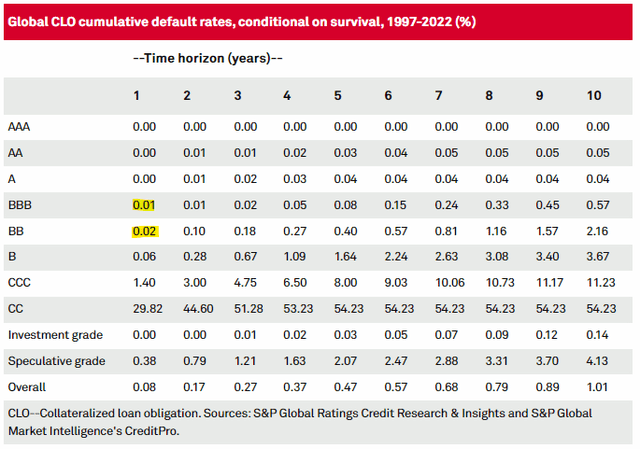

CLOZ focuses on BBB-BB CLO tranches, somewhere on the lower end of seniority. Nevertheless, in practice the credit risk of these seems low, with annual default rates of 0.01% – 0.02%.

S&P

Although the figures above are accurate, I believe they somewhat understate the actual risk of these investments, especially of BB-rated tranches. Remember that senior tranches get paid first, junior tranches last. So, investors in AAA tranches get paid first, then investors in AA tranches, and so on. There are a lot of tranches and investors ahead of BB, and they are supposed to receive a lot in interest before BB investors receive anything. If default rates increase, income should go down, so CLOs would prioritize their most senior investors, and perhaps there will be little left for the junior ones.

Due to the above, I think it would be fair to characterize CLOZ as having some amount of credit risk. Quantifying these issues is outside the scope of this article, but I don’t believe credit risk to be excessive, nor do the figures above imply that (the opposite).

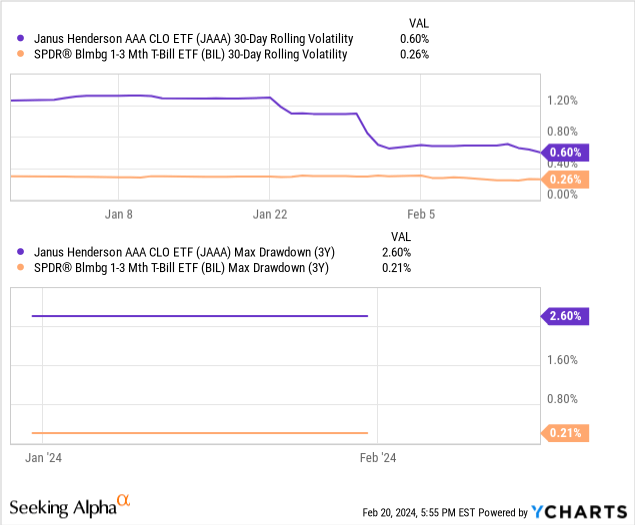

Liquidity, Volatility, and Perceptions of Risk

CLOs are generally more volatile than expected, trading with higher realized volatility than investments of comparable credit and interest rate risk. The reasons for this are not immediately clear, but I believe that illiquidity and perceptions of risk are to blame. Investors treat CLOs as riskier than they are, which means their volatility is higher. Liquidity might dry up during bear markets, magnifying these issues.

The best example of the above is not, I believe, CLOZ, but JAAA. JAAA focuses on AAA-rated CLO tranches, with marginal credit and rate risk. JAAA is, arguably, quite close to T-bills, but the fund is much more volatile, especially during downturns. Drawdowns are higher too, but still low on an absolute basis.

Data by YCharts

In my opinion, the above issues should lead to above-average losses during bear markets, or periods of market stress. Volatility should be higher, too. As the fund has yet to experience a bear market, we can’t really gauge its performance during any such scenario, but I’m confident in my assessment regardless.

As a final point, just glancing at the fund’s total returns should tell you that realized volatility has been low since inception.

As the fund has yet to experience a recession, I wouldn’t place too much importance on this. I don’t believe that CLOZ is actually as stable as implied on the above, the past year was simply a very favorable environment for the fund.

Conclusion

CLOZ’s strong 9.6% yield and performance track-record make the fund a buy.