Pgiam/iStock through Getty Photos

Funding Thesis

Identification of high-probability capital acquire alternatives on this twenty first century requires extra energetic comparability enter refreshments than have been wanted within the slower-moving last-half of the twentieth century.

Know-how advances in communications, primary sciences, info administration, aggressive technique, human biology understanding and worldwide relations, all contributing to higher, extra fast improvement of uncertainty confronting buyers.

This makes important the enter of extra frequent forecasts of probably future-developments. Ones with shorter forecast-time horizons vital to attenuate error-heightening outcomes.

In response, we favor acquiring forecasts from the probably best-informed gamers within the fairness funding sport, the key funds of “establishments”. To keep away from different buyers “front-running” them, they will not inform what they uncover. However vital market-making expertise supplies a “leak” revealing what they anticipate and attempt to accomplish. We exploit that to get attainable benefit for our technique.

The next comparability of Market-Maker expectations for Cleveland-Cliffs, Inc. (CLF) with expectations for these of CLF’s opponents ought to illustrate a few of the potentials.

First, a fast description of the first subject-company.

Description

Cleveland-Cliffs Inc. operates as a flat-rolled metal producer in North America. The corporate provides carbon metal merchandise, and superior high-strength metal merchandise; chrome steel merchandise; plates; and carbon metal, chrome steel, and electrical resistance welded tubing. Additional, it owns 5 iron ore mines in Minnesota and Michigan. The corporate serves automotive, infrastructure and manufacturing, distributors and converters, and metal producers. Cleveland-Cliffs Inc. was previously referred to as Cliffs Pure Sources Inc. and altered its title to Cleveland-Cliffs Inc. in August 2017. The corporate was based in 1847 and is headquartered in Cleveland, Ohio.

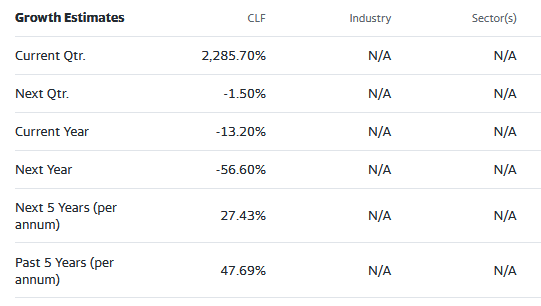

Supply: Yahoo Finance

Yahoo Finance

The aggressive scene

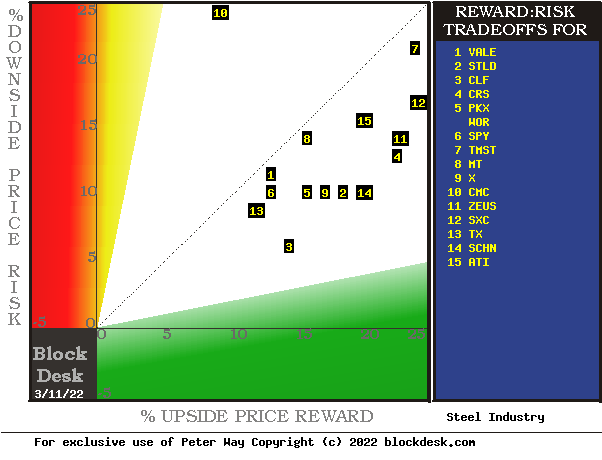

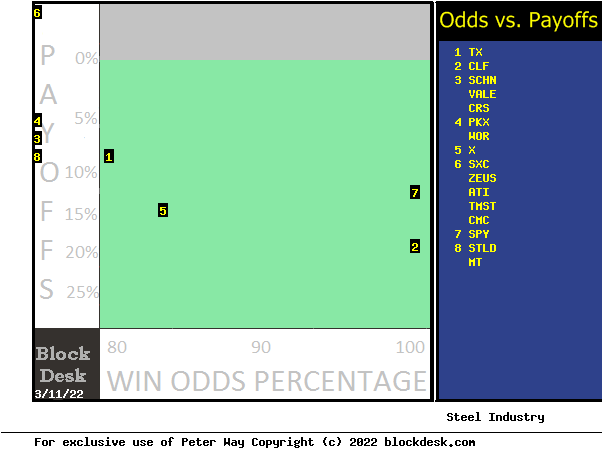

Metal is a world commodity of extensive numerous utility, sturdiness, and transportability, making its costs topic to cyclical provide and demand imbalances on a global foundation. Listed below are the chance~reward inventory publicity/alternatives amongst main opponents within the USA, as seen by institutional buyers this present day.

Determine 1

blockdesk.com

(used with permission)

The tradeoffs listed below are between near-term upside worth good points (inexperienced horizontal scale) in every of the shares, seen price defending in opposition to by Market-makers with brief positions, and the prior precise worth drawdowns skilled throughout holdings of these shares (pink vertical scale). Each scales are of p.c change from zero to 25%.

The intersection of these coordinates by the numbered positions is recognized by the inventory symbols within the blue discipline to the fitting.

The dotted diagonal line marks the factors of equal upside worth change forecasts derived from Market-Maker [MM] hedging actions and the precise worst-case worth drawdowns from positions that would have been taken following prior MM forecasts like right now’s.

Our principal curiosity is in CLF at location [3]. A “market index” norm of reward~threat tradeoffs is obtainable by SPDR S&P 500 index ETF at [6].

These forecasts are implied by the self-protective behaviors of MMs who should normally put agency capital at non permanent threat to stability purchaser and vendor pursuits in serving to big-money portfolio managers make quantity changes to multi-billion-dollar portfolios. The protecting actions are taken with real-money bets defining every day the extent of probably anticipated worth modifications for hundreds of shares and ETFs.

This map is an effective start line, however it could actually solely cowl a few of the funding traits that always ought to affect an investor’s alternative of the place to place his/her capital to work. The desk in Determine 2 covers the above issues and a number of other others, as now seen for the shares in Determine 1.

Evaluating Various Funding Particulars

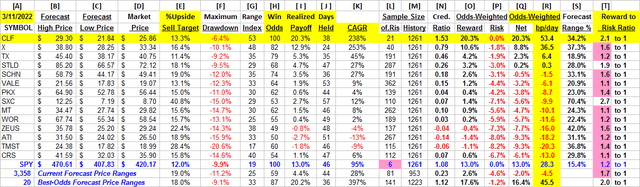

Determine 2

blockdesk.com

(used with permission)

Column headers for Determine 2 outline parts for every row inventory whose image seems on the left in column [A]. The weather are derived or calculated individually for every inventory, based mostly on the specifics of its scenario and current-day MM price-range forecasts. Information in pink numerals are unfavorable, normally undesirable to “lengthy” holding positions. Desk cells with pink background “fills” signify situations usually unacceptable to longer-term “purchase” suggestions. Yellow fills are of knowledge for the inventory of principal curiosity and of all points on the rating column, [R].

Readers accustomed to our evaluation strategies might want to skip to the following part viewing worth vary forecast developments for CLF.

Determine 2’s function is to try universally comparable solutions, inventory by inventory, of: a) How BIG the value acquire payoff could also be; b) how LIKELY the payoff will likely be a worthwhile expertise; c) how quickly it might occur; and d) what worth drawdown RISK could also be encountered throughout its holding interval.

The worth-range forecast limits of columns [B] and [C] get outlined by MM hedging actions to guard agency capital required to be put vulnerable to worth modifications from quantity commerce orders positioned by big-$ “institutional” shoppers.

[E] measures potential upside dangers for MM brief positions created to fill such orders, and reward potentials for the buy-side positions so created. Prior forecasts like the current present a historical past of related worth draw-down dangers for patrons. Essentially the most extreme ones really encountered are in [F], throughout holding durations in effort to achieve [E] good points. These are the place patrons are most certainly to just accept losses.

[H] tells what quantity of the [L] pattern of prior like forecasts have earned good points by both having worth attain its [B] goal or be above its [D] entry price on the finish of a 3-month max-patience holding interval restrict. [ I ] offers the online gains-losses of these [L] experiences and [N] suggests how credible [E] could also be in comparison with [ I ].

Additional Reward~Threat tradeoffs contain utilizing the [H] odds for good points with the 100 – H loss odds as weights for N-conditioned [E] and for [F], for a combined-return rating [Q]. The standard place holding interval [J] on [Q] supplies a determine of benefit [fom] rating measure [R] helpful in portfolio place preferences. Determine 2 is row-ranked on [R] amongst candidate securities, with CLF in prime rank.

Together with the candidate-specific shares these choice issues are offered for the averages of almost 3500 shares for which MM price-range forecasts can be found right now, and 20 of the best-ranked (by fom) of these forecasts, in addition to the forecast for S&P 500 Index ETF (NYSEARCA:SPY) as an fairness market proxy.

The current uncertainties within the equities market at giant are seen within the [T] column of the SPY row, its background shaded in pink the place the Reward~Threat tradeoff of SPY’s columns [E] and [F] are +11% and -10%, an unusually excessive degree of worth drawdown publicity for the broad market index. SPY’s Pattern Dimension of 6 (out of 1,261 market days of the previous 5 years) tells how uncommon is right now’s Vary Index of twenty-two, uncharacteristically low. The excessive degree of world uncertainty from Russia’s invasion of Ukraine is probably going the trigger. In Determine 1, SPY at [3] is situated up near the diagonal, as a substitute of being down normally round and to the left of the place CLF is at [6].

For the metal shares, the forecast worth ranges in column [S] common a excessive 32% above every low, indicative of their inherent worth uncertainty. Compared, that common is twice the 15% of the market index ETF, SPY. However volatility can supply reward in addition to threat, so investor notion and angle make the distinction.

Latest Traits in MM Value-Vary Forecasts for CLF

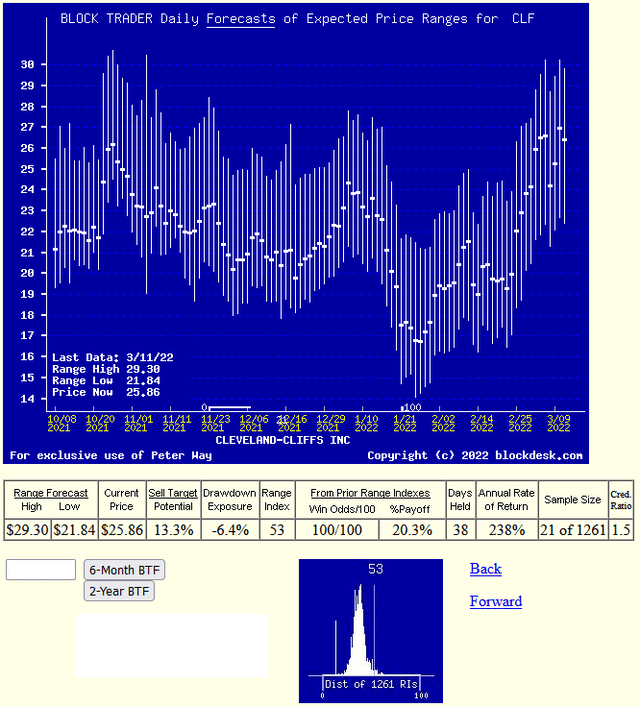

Determine 3

blockdesk.com

(used with permission)

The forecast and forecast historical past on this Determine 3 repeat the info used to check the prospects for metal business opponents. The vertical traces of the graph are vary forecasts of coming costs made every day in the course of the previous 6 months. The heavy dot in every vary is the inventory’s closing worth on the day the forecast was made.

The final 11 days on the fitting aspect of the image are illustrative of the value sensitivity of this inventory and its business, as perceived by the institutional funding neighborhood. The forecasts of the Market-making neighborhood in response to dam commerce orders initiated by consumer establishments. They clarify the short-term alternatives current right here in CLF.

Its worth on Friday was inside $1 of the previous 52 weeks excessive, yet one more +13% rise near-term is seen probably sufficient to be protected in opposition to by debtors of shares wanted to fill these establishments’ orders. Each time prior to now 5 years such an insistent purchase imbalance has occurred, the upside worth goal seen on the time was reached. Now, regardless of the 100% historical past, that’s no assure the long run will likely be just like the previous, however the odds for purchase profitability right here seems fairly good.

The frosting on the cake comes from the prior expertise historical past, exhibiting that these priors averaged payoff good points of over +20%, half once more as a lot as is now being forecast. And people place targets solely took 38 market days – lower than two calendar months – to be achieved. The CAGR (annual charge of revenue compounding) in these prior cases was over 200% a yr.

Potential Odds & Payoffs

Determine 4

blockdesk.com

used with permission

This comparability map makes use of an orientation just like that of Determine 1, the place the extra fascinating places are down and to the fitting. As a substitute of simply worth route, the questions are extra qualitative: “how large” and “how probably” are worth change expectations now?

Our main curiosity is in CLF’s qualitative efficiency, significantly relative to different funding candidate decisions. Right here CLF is at location [2], the intersection of horizontal and vertical scales of +20% acquire and +100% assurance (odds of a “win”).

As a market norm, SPY is at location [7] with a +13% payoff and an 100% assurance of profitability. CLF tends to dominate all of the others on this comparability.

Conclusion

The inventory I first knew 50+years in the past as solely a Minnesota Iron Ore mining participant delivery throughout the Nice Lakes to Cleveland, now has turn out to be totally built-in into a significant business participant seen by big-$ buyers as in a position to successfully compete with the previous Dow Jones Index element United States Metal Company (X) and all different business figures.

The comparisons information introduced above urge perception that buyers in search of a near-term wealth-building alternative have a very good one at hand at this time limit in Cleveland-Cliffs, Inc.