WANAN YOSSINGKUM

By Aram Green

Recent Growth Rally Could Be Just the Start

Market Overview

Stocks rose strongly in the fourth quarter, boosted by plunging bond yields and growing optimism that the U.S. economy will pull off a soft landing. Signs of cooling inflation and a slowing labor market not only reversed a two-year climb in yields but also increased the likelihood that the Federal Reserve had completed its tightening cycle, sending the S&P 500 Index (SP500, SPX) 11.69% higher and the benchmark Russell 3000 Index up 12.07%. Easing financial conditions also led to improving market breadth, with the small cap Russell 2000 Index (RTY) rising 14.03%.

With the 10-year Treasury (US10Y) yield declining 70 basis points during the quarter, growth remained in favor among larger cap stocks, with the Russell 3000 Growth Index rising 14.09% and outperforming the Russell 3000 Value Index by 427 bps. Among small and mid-cap stocks that constitute the majority of the ClearBridge Select Strategy, however, value outperformed with the Russell 2500 Value Index advancing 13.76% compared to a 12.59% rise for the Russell 2500 Growth Index.

Amid these shifting market conditions, the Strategy outperformed the benchmark, supported by diversified contributions across sectors as well as categories of growth companies. These results are supported by our pyramid approach to portfolio construction, which creates a balance of growth drivers within the portfolio and promotes consistent results through varying market conditions.

In the fourth quarter, this philosophy was exemplified in the performance of higher-growth disruptors like top performers ServiceNow (NOW), MercadoLibre (MELI) and Shopify (SHOP) as well as durable compounders such as Apple (AAPL) and evolving opportunities like private equity manager KKR and discount retailer Burlington Stores (BURL). These disruptors provided the upside horsepower needed to outperform an ebullient market.

Portfolio Positioning

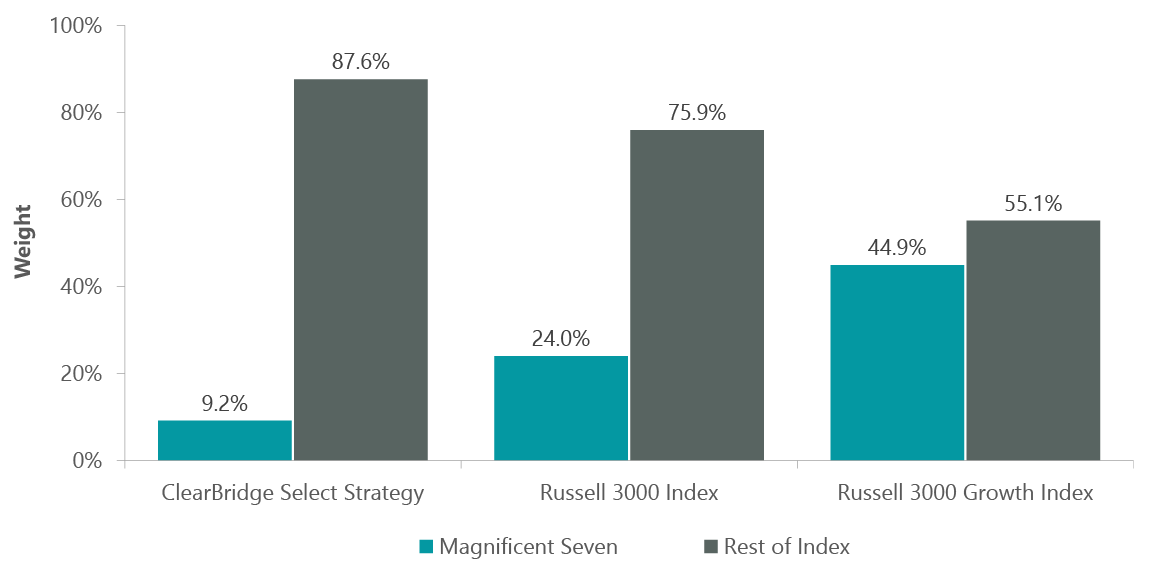

Another goal of the Strategy is to deliver performance through high active share. We have been successful in delivering alpha without being dependent on the market leadership of the day. Over the last several years, this has meant finding opportunities beyond the Magnificent Seven. While we opportunistically initiated a position in Microsoft (MSFT) during the quarter, the Strategy has exposure to just three of the seven stocks (Microsoft, Apple and Nvidia), with Nvidia (NVDA) representing our only active weight.

Exhibit 1: More to Growth Market than Magnificent Seven

| As of Dec. 31, 2023. Source: ClearBridge Investments, FactSet. |

We added Microsoft on weakness early in the quarter before the yield environment improved. The stock had sold off on slower AI monetization but with the public launch of its Copilot AI assistants in November and more rollouts expected in 2024, as well as a bottoming PC/server cycle, we view the company as an improving growth story at a reasonable valuation.

We have chosen to source a significant number of ideas among companies earlier in their business lifecycle by focusing on four secular growth themes: data and analytics, onshoring/reshoring, information security and e-commerce. In addition to Microsoft, three of the four other new positions we initiated during the quarter fit within these focus areas: Trade Desk (TTD), Monolithic Power Systems (MPWR) and Model N (MODN).

Trade Desk, in the communication services sector, is a disruptor in the advertising technology market, operating a cloud-based platform that enables buyers to manage their digital advertising campaigns. We added the shares on a pullback due to recessionary fears and ad buyer cautiousness. Monolithic Power Systems, a company we know from owning it across other portfolios, is a founder-led share taker in the development of power management circuits. Its stock sold off on a broad-based destocking of semiconductors across the industry and we used the decline in value as our entry point. Model N, meanwhile, is a software company providing revenue management solutions primarily to pharmaceutical and medtech customers; it also has a growing customer base in high tech. We took advantage of a pullback in the stock during an uneven migration of customers to its new cloud-based platform.

Complementing those disruptors, we added a position in durable compounder Intercontinental Exchange (ICE), an operator of securities exchanges, fixed income and data services as well as mortgage technology solutions. The company has key franchises in energy and interest rates and has acquired the pieces for an end-to-end technology platform for clients in the mortgage industry. ICE’s business offers diversification across asset classes, high barriers to entry and wide competitive moats, supported by a mix of recurring revenues from data/service subscriptions and transaction-driven fees.

Continually seeking to optimize the risk/reward profile of the Strategy, we closed out of eight positions during the quarter. Our two largest exits, New Relic (NEWR) and Horizon Therapeutics, resulted from the completion of takeouts by strategic acquirers. After reducing the position on earlier signs of weakness, we closed out of SolarEdge Technologies (SEDG) due to excess supply issues in the residential solar market. Nextracker (NXT), a provider of technologies for rooftop and utility-scale solar installations that we bought on the IPO, was sold as the stock approached fair value.

Evolving opportunities give us a chance to purchase businesses that may be experiencing temporary headwinds to their earnings or stock price due to macro, industry or company-specific issues. When initiating positions in companies in this category, we have a specific timeline over which we believe a turnaround or improvement can be accomplished. As long as progress is being made, we will hold these positions, as was the case with Revvity (RVTY), a life sciences tools and diagnostics provider formerly known as PerkinElmer. After trimming the position into strength many times and redeploying the proceeds into fellow health care name ICON (ICLR), we finally closed out the name as the thesis had played out. In contrast, e-commerce retailer ETSY has continued to struggle, while fashion conglomerate Kering (OTCPK:PPRUF) has not shown the progress we expected when we purchased the stock in the first quarter, leading us to sell both positions.

Outlook

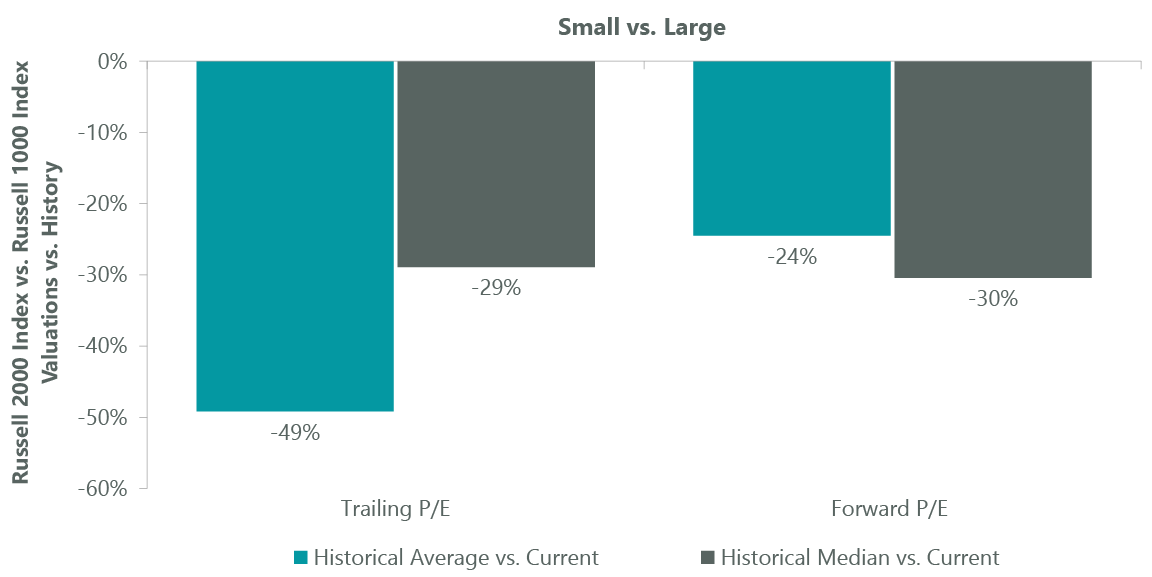

Last quarter, we discussed becoming more constructive on small caps due to the valuation disconnect with mega cap market leadership. It was encouraging to witness the broadening participation in the fourth quarter, with both small and mid-cap companies keeping pace or in some cases outperforming large caps. Even with the rebound, these segments remain cheap relative to the overall market and history. Rapidly cooling inflation, with the Fed at the end of its campaign to raise rates, suggests financial conditions should continue to loosen, removing a major headwind to both growthier and smaller cap stocks.

Exhibit 2: Smaller Cap Stocks Historically Attractive

| Average and median P/E ratios calculated for Russell 2000 Index (small) and Russell 1000 Index (large) from Dec. 31, 1997 through Dec. 31, 2023. Source: FactSet. |

Improving liquidity should also unfreeze the IPO market, which briefly started to thaw this fall post a protracted and precipitous decline in deal activity. While 2023 IPO filings showed a solid increase from the prior year, they remained well below the 10-year average . Given our focus on and relationships with private companies, we have always viewed the IPO market as a fertile source of idea generation and are encouraged by the prospect of continuing to derisk fundamentally-sound businesses as they approach the road to going public in the year ahead.

Portfolio Highlights

The ClearBridge Select Strategy outperformed its Russell 3000 Index benchmark during the fourth quarter. On an absolute basis, the Strategy posted gains across nine of the 10 sectors in which it was invested (out of 11 sectors total). The primary contributors were the IT, industrials and consumer discretionary sectors while the energy sector was the lone detractor.

Relative to the benchmark, overall stock selection contributed to performance. In particular, stock selection in the IT, consumer discretionary, consumer staples, real estate, health care and energy sectors and an overweight to IT were the primary drivers of results. Conversely, an underweight to financials, an overweight to consumer staples and stock selection in the industrials sector detracted from performance.

On an individual stock basis, the leading contributors were positions in ServiceNow, MercadoLibre, Shopify, KKR and Apple. The primary detractors were Shoals Technologies (SHLS), ON Semiconductor (ON), Fox Factory (FOXF), HealthEquity (HQY) and argenx (ARGX).

In addition to the transactions mentioned above, we exited a position in Morgan Stanley (MS) in the financials sector.

Aram Green, Managing Director, Portfolio Manager

Past performance is no guarantee of future results. Copyright © 2023 ClearBridge Investments. All opinions and data included in this commentary are as of the publication date and are subject to change. The opinions and views expressed herein are of the author and may differ from other portfolio managers or the firm as a whole, and are not intended to be a forecast of future events, a guarantee of future results or investment advice. This information should not be used as the sole basis to make any investment decision. The statistics have been obtained from sources believed to be reliable, but the accuracy and completeness of this information cannot be guaranteed. Neither ClearBridge Investments, LLC nor its information providers are responsible for any damages or losses arising from any use of this information. Performance source: Internal. Benchmark source: Standard & Poor’s. Performance source: Internal. Benchmark source: Russell Investments. Frank Russell Company (“Russell”) is the source and owner of the trademarks, service marks and copyrights related to the Russell Indexes. Russell® is a trademark of Frank Russell Company. Neither Russell nor its licensors accept any liability for any errors or omissions in the Russell Indexes and/or Russell ratings or underlying data and no party may rely on any Russell Indexes and/or Russell ratings and/or underlying data contained in this communication. No further distribution of Russell Data is permitted without Russell’s express written consent. Russell does not promote, sponsor or endorse the content of this communication. |

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.