tadamichi

By Sean Bogda, CFA, Grace Su & Jean Yu, CFA

Fiscal Easing Boosts Worldwide Shares

Market Overview

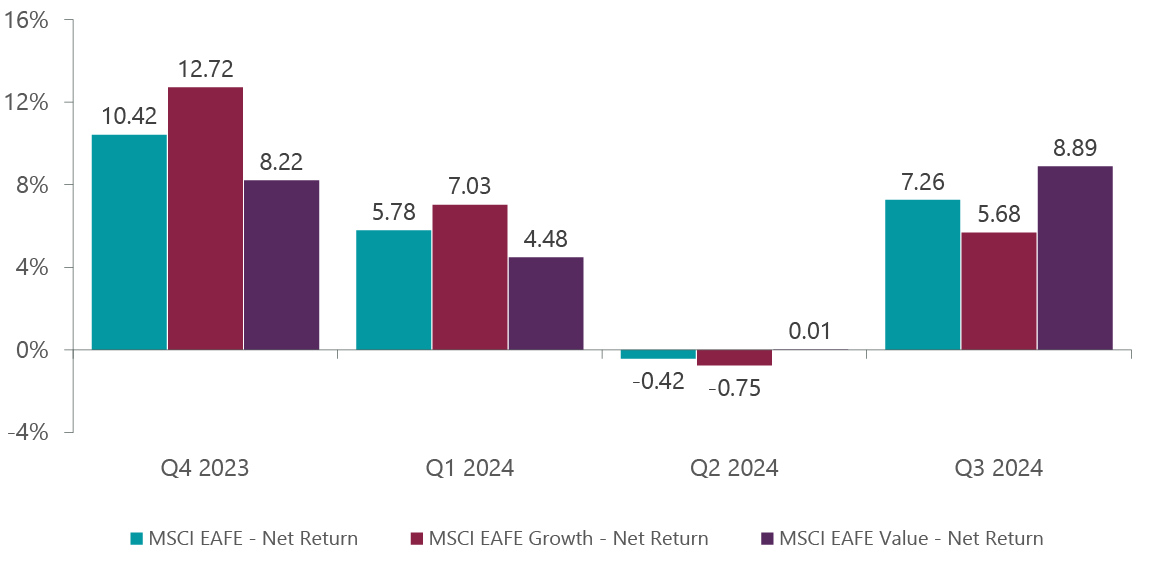

Worldwide markets generated constructive returns within the third quarter as price cuts and monetary easing from international central banks helped spark a rotation into worth sectors comparable to actual property, utilities and communication companies. Moreover, a late-quarter surge by Chinese language shares proved useful to extra cyclical sectors together with supplies, industrials and client discretionary. The benchmark MSCI EAFE Index confirmed constructive returns throughout 9 of its 11 sectors, with solely power and knowledge know-how declining. Worth outperformed development throughout the quarter, with the MSCI EAFE Worth Index returning 8.89% versus the 7.26% return of the MSCI EAFE Index and the 5.68% of the MSCI EAFE Progress Index (Exhibit 1).

Exhibit 1: MSCI Progress vs. Worth Efficiency

Information as of Sept. 30, 2024. Supply: FactSet.

Regardless of the Financial institution of Japan having telegraphed its intention to boost rates of interest for fairly a while, the dimensions of its price hike in August caught traders off guard, resulting in a spike in market volatility on considerations that tightening of financial coverage would stress its nascent restoration. This was additional exacerbated by a violent unwinding of the pervasive yen carry commerce because the forex strengthened throughout the quarter, all of which culminated in Japan being the worst-performing area within the benchmark. Regardless of the rise in market volatility, we’re seeing indicators that Japanese companies have turn out to be extra environment friendly and worthwhile – partly because of enhancing company governance measures – and are starting to share these beneficial properties with staff within the type of the biggest wage will increase in over a decade, which can hopefully translate into higher client confidence and spending.

Worldwide traders weren’t dissatisfied when the Federal Reserve elected to chop price by 50 foundation factors at its September assembly, sparking a robust rally in U.S. markets and a rotation into smaller worth and cyclical shares. With the primary price minimize within the rear view, the query now shifts from “when” to “how a lot,” with policymakers rigorously watching as inflation seems to be coming again consistent with its goal and whether or not the U.S. financial system can certainly stick a comfortable touchdown. Buyers now look towards the U.S. presidential election in November, rampant with hypothesis as to what the permutations of political math would imply on insurance policies surrounding worldwide coverage, commerce and immigration.

“With the primary price minimize within the rear view, the query for the Fed now shifts from ‘when’ to ‘how a lot?'”

The European Central Financial institution (ECB) and Financial institution of England additionally minimize rates of interest throughout the quarter, the second minimize in three months for the ECB and the primary in 4 years for the BoE, because the U.Okay. and eurozone central banks have launched into a extra measured strategy contemplating the gradual development charges of their respective economies. Within the U.Okay., the snap election and landslide victory of the beforehand opposition Labour Social gathering in July has resulted in a major shift in political course in addition to financial priorities and insurance policies. Whereas the U.Okay. financial system continues to carry up extra strongly than these throughout the Channel, this new course has spurred higher uncertainty as to the small print on what these new insurance policies would imply for the financial system and markets.

Whereas companies and customers proceed to painfully regulate to an financial system now not tethered to property growth and globalization, Chinese language shares surged late within the quarter following the announcement of an unusually broad stimulus bundle aimed toward revitalizing the world’s second-largest financial system. The Individuals’s Financial institution of China introduced that it could minimize each coverage rates of interest and mortgage charges and, together with its current plan to decrease financial institution reserve ratios, put aside billions in stimulus funds for loans to brokers and insurers to purchases equities and assist listed corporations finance share buybacks. Whereas the tone of Chinese language authorities officers appears extra decided than in prior iterations of coverage assist, there stays a substantial quantity of skepticism from economists and traders that these preliminary efforts can translate right into a sturdy and sustained turnaround for the broader Chinese language financial system.

Quarterly Efficiency

The ClearBridge Worldwide Worth Technique outperformed its benchmark within the third quarter as sturdy efficiency from our holdings within the client discretionary and financials sectors overcame headwinds from our power publicity.

In client discretionary, the mix of macro tailwinds and robust idiosyncratic drivers helped spur outperformance for Spanish retailer Industria de Diseno Textil (OTCPK:IDEXY, Inditex) and U.Okay.-based catering firm Compass Group (OTCPK:CMPGF). Inditex, a quick vogue, footwear and equipment retailer, continues to indicate sturdy operational execution regardless of softer client traits in Europe. The corporate’s investments in know-how and constructing out each its ecommerce and omnichannel operations, retailer refurbishments and provide chains proceed to reap the rewards of making a differentiated and constructive expertise for its prospects versus its opponents. Compass Group has additionally been capable of present sturdy efficiency, delivering increased development charges relative to its pre-COVID ranges, as a result of firm’s strategic concentrate on rising its outsourcing enterprise and focusing on underdeveloped markets in Europe the place it could possibly profit from its dimension and power.

Financials additionally proved useful, significantly European and U.Okay. banks with sturdy, well-known franchises. Our main contributor within the sector, U.Okay.-based Lloyds Banking (LYG), supplies a variety of banking and monetary companies globally and continues to make use of its well-capitalized steadiness sheet to its benefit regardless of a difficult financial setting. Likewise, BAWAG (OTCPK:BWAGF), an Austrian financial institution, continues to carry out nicely and accomplished two acquisitions throughout the interval – Barclays Client Financial institution Europe and Dutch financial institution Knab – which can develop the financial institution’s sturdy model presence throughout Europe.

Oil costs declined considerably within the third quarter, as indicators of rising stock ranges within the U.S., lackluster demand from China and the prospect of additional manufacturing will increase from OPEC+ members outweighed investor considerations a few widening of Center East conflicts. These broad-based headwinds weighed on the efficiency of our exploration and manufacturing holdings Shell (SHEL) and Noble (NE). Nevertheless, we proceed to have excessive conviction in these names as Shell has been capable of preserve sturdy working metrics regardless of the downturn. Likewise Noble, a number one offshore drilling contractor, continues to have a robust strategic place because the main supplier of drilling ships, which we consider has ramping earnings potential when demand rebounds.

Inventory choice in Japan was additionally a constructive contributor to efficiency, pushed by sturdy year-to-date contributor Hitachi (OTCPK:HTHIY) and comparatively new holding Fujitsu (OTCPK:FJTSF) – a Japanese IT companies agency. Heavy reliance on know-how throughout the COVID-19 pandemic highlighted the necessity for extra funding and modernization in IT companies for each customers and companies, making a multiyear wave of funding that instantly advantages Fujitsu. Hitachi has additionally benefited from calls for for funding and modernization in areas like energy grids. Moreover, the corporate closed the acquisition of Thales’ rail signaling enterprise, which we consider will create synergies that ought to enhance the profitability of its home methods integration enterprise.

Portfolio Positioning

We added a brand new place in utilities firm Nationwide Grid (NGG), which transmits and distributes electrical energy and nationwide fuel within the U.Okay. and U.S. The present investments in AI and information facilities will undoubtably additionally improve demand for power and, with the corporate’s shares at the moment buying and selling at a historic low cost, we consider that the market is overlooking Nationwide Grid’s engaging long-term outlook, improved steadiness sheet and footprint inside favorable regulatory environments.

We additionally added SONY, the Japanese digital tools and units conglomerate. Whereas a cyclical slowdown in demand for the corporate’s picture sensors has weighed on current earnings, it has additionally created a compelling entry value to achieve publicity to its engaging video games and gaming platform segments, together with the PS5 gaming console. Moreover, we consider that the divestiture of its monetary companies enterprise will end in a higher concentrate on core strengths inside its content material companies.

We exited our positions in Inpex (OTCPK:IPXHF), a Japanese power firm engaged in oil and pure fuel manufacturing, and Metso Oyj (OTCPK:OUKPF), a Finnish industrials firm that gives options and companies for aggregates, minerals processing and metallic refinement industries. Inpex reached our value goal throughout the quarter, whereas Metso was bought to fund extra engaging investments.

Outlook

The 2 macro shocks throughout the quarter, Japan and China, function good reminders of utmost imbalances out there right now – notably the numerous market focus in a slender sleeve of development mega themes within the U.S. With the prospect of an rising liquidity backdrop, secure financial prospects throughout most main worldwide markets and the potential for Chinese language coverage assist to take away a significant drag from international development, situations stay supportive for a continued rotation to worth and cyclical segments of the market.

Along with elevated market breadth, we even have seen the capex cycle round generative AI broaden out considerably as traders grapple with constraints round energy and infrastructure. We’re optimistic that this may proceed to supply us alternatives to take part on this secular development theme by way of shares which stay neglected and fairly priced.

The enhancing financial and monetary situations however, we acknowledge remaining occasion dangers in mild of the approaching U.S. election and the geopolitical state of affairs. As such, we have now stayed balanced in our portfolio positioning, including to utilities for protection and Chinese language client corporations for offense, with flexibility to pivot as issues develop.

Portfolio Highlights

The ClearBridge Worldwide Worth Technique (MUTF:SBIEX) outperformed its MSCI EAFE benchmark throughout the third quarter. On an absolute foundation, the Technique had beneficial properties throughout 10 of the 11 sectors by which it was invested. The financials and industrials sectors had been the principle contributors, whereas the only detractor was the power sector.

On a relative foundation, total inventory choice positively contributed to outperformance, partially offset by asset allocation results. Particularly, inventory choice within the client discretionary, financials, IT, client staples and well being care sectors benefited returns. Conversely, inventory choice within the supplies sector, chubby allocations to the power and IT sectors and an underweight to the utilities sector weighed on returns.

On a regional foundation, inventory choice in Europe Ex U.Okay., Japan and the U.Okay. and an chubby to North America had been useful. Conversely, inventory choice in North America, an chubby to rising markets and an underweight to Asia Ex Japan detracted.

On a person inventory foundation, Inditex, Fujitsu, Nexans (OTCPK:NXPRF), Hitachi and BAWAG Group had been the main contributors to absolute returns throughout the quarter. The most important detractors had been Samsung Electronics (OTCPK:SSNLF), Shell, Gerresheimer (OTCPK:GRRMF), Marubeni (OTCPK:MARUY) and Galaxy Leisure Group (OTCPK:GXYEF).

Through the quarter, along with the transactions talked about above, the Technique initiated new positions in Willis Towers Watson (WTW) within the financials sector, Toho (OTCPK:THOOF) and Tencent (OTCPK:TCEHY) within the communication companies sector, THK (OTCPK:THKLY) within the industrials sector and Akeso (OTCPK:AKESF) within the well being care sector. The Technique exited positions in Bayerische Motoren Werke (OTCPK:BMWYY) and Galaxy Leisure within the client discretionary sector, Nihon M&A (OTCPK:NHMAF) and Julius Baer (OTC:JBPCF) within the financials sector and Japan Airways (OTCPK:JAPSY) within the industrials sector.

Sean Bogda, CFA, Managing Director, Portfolio Supervisor

Grace Su, Managing Director, Portfolio Supervisor

Jean Yu, CFA, PhD, Managing Director, Portfolio Supervisor

| Previous efficiency is not any assure of future outcomes. Copyright © 2024 ClearBridge Investments. All opinions and information included on this commentary are as of the publication date and are topic to alter. The opinions and views expressed herein are of the writer and will differ from different portfolio managers or the agency as an entire, and are usually not meant to be a forecast of future occasions, a assure of future outcomes or funding recommendation. This info shouldn’t be used as the only foundation to make any funding choice. The statistics have been obtained from sources believed to be dependable, however the accuracy and completeness of this info can’t be assured. Neither ClearBridge Investments, LLC nor its info suppliers are chargeable for any damages or losses arising from any use of this info. Efficiency supply: Inside. Benchmark supply: Morgan Stanley Capital Worldwide. Neither ClearBridge Investments, LLC nor its info suppliers are chargeable for any damages or losses arising from any use of this info. Efficiency is preliminary and topic to alter. Neither MSCI nor another get together concerned in or associated to compiling, computing or creating the MSCI information makes any categorical or implied warranties or representations with respect to such information (or the outcomes to be obtained by the use thereof), and all such events hereby expressly disclaim all warranties of originality, accuracy, completeness, merchantability or health for a specific function with respect to any of such information. With out limiting any of the foregoing, in no occasion shall MSCI, any of its associates or any third get together concerned in or associated to compiling, computing or creating the info have any legal responsibility for any direct, oblique, particular, punitive, consequential or another damages (together with misplaced earnings) even when notified of the potential of such damages. No additional distribution or dissemination of the MSCI information is permitted with out MSCI’s categorical written consent. Additional distribution is prohibited.

|

Unique Publish

Editor’s Word: The abstract bullets for this text had been chosen by In search of Alpha editors.

Editor’s Word: This text discusses a number of securities that don’t commerce on a significant U.S. alternate. Please concentrate on the dangers related to these shares.