bjdlzx

Company Overview

Civitas Resources, Inc. (NYSE:CIVI) is an independent exploration and production company that operates almost exclusively in the Denver-Julesburg Basin in Colorado. Civitas is focused on oil and natural gas production through horizontal drilling in the Rocky Mountain region of DJ Basin. The company lays claim to be Colorado’s first carbon-neutral energy producer and is Colorado’s largest pure-play energy producer. Civitas Resources is dedicated to safety, environmental responsibility, and becoming an industry leader with its lean and efficient business model. In fact, the company lays claim to peer-leading operating costs at approximately $4.21 for every barrel produced.

Before rebranding as Civitas Resources, the company was originally named Bonanza Creek Energy, Inc. before merging with Extraction Oil & Gas, Inc., with the subsequent acquisition of Crestone Peak Resources in 2021. The combined companies rebranded as Civitas Resources where they expect to exemplify the new E&P business model for U.S. producers, with a focus on operational discipline, free cash flow generation, financial alignment with shareholders, and ESG leadership.

Operations

The Civitas Rig is one of the fastest drilling rigs in America. In 2022 Civitas drilled 2-mile lateral wells in an average of just 4.6 days. The company’s fastest rig averaged over 1.3 wells drilled per week with zero lost time incidents over the past year. In fact, Civitas just drilled a company-best two-and-a-half-mile lateral well in just 2.2 days with a total measured depth of 20,600 feet – a feat that is downright impressive when it comes to horizontal drilling and the complexities involved.

Civitas currently has around 500,000 net DJ Basin acres with current production levels around 160,000 boe/d. Production levels should remain mostly flat year-over-year as the 2023 plan for Civitas is to focus on drilling high-return and longer lateral locations. This allows larger areas of shale rock to be accessed while reducing the surface impacts of drilling, which adheres to the company’s sustainability commitment.

Commitment to Sustainability

With an incredibly efficient business model and industry-leading drilling practices, Civitas Resources appears to have an unwavering commitment to sustainability. The company prioritizes responsible production and is dedicated to minimizing its environmental footprint and being an integral part of the community to benefit Coloradans across the state.

Civitas is committed to employee and community safety and touts the title of the first Colorado oil producer to be a Carbon Neutral Company. In 2023, Civitas plans to reduce greenhouse gas emissions by around 35% and methane gas emissions by around 90%. The company has invested $11 million in emission reduction projects in 2023 alone.

They seem to be pushing full-steam-ahead to attempt to head off potential climate change related legislation. It’s not a bad decision in an industry that has seen extreme regulation tightening just in the last 15 years, let alone what we might see in the future. Colorado itself is becoming particularly more hostile to energy as the legislature there slowly shifted over the past decade. These changes on the part of CIVI will help them stay ahead of the game.

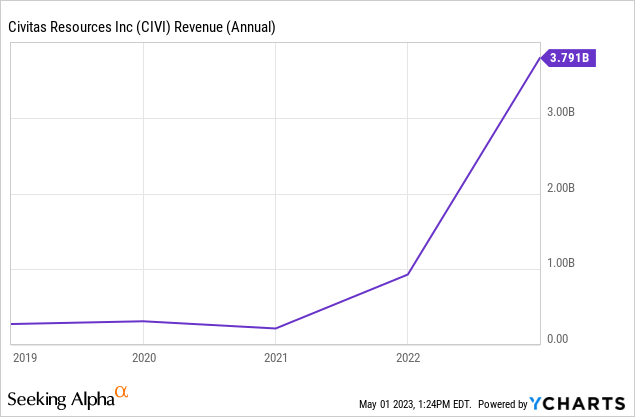

Revenue

As the company acquired Crestone Peak in 2021 their revenue skyrocketed. They then benefitted from high oil prices in 2022, and have continued on that trajectory. The real question is, will this continue?

Let’s look at their revenue estimates going forward on an annual basis:

| FY Ending | Revenue Est | YoY % |

| 2023 | 2.68B | -29.2% |

| 2024 | 2.76B | +2.88% |

| 2025 |

2.49B |

-9.6% |

Source: Seeking Alpha

It’s clear that analysts expect their gross revenue to drop in coming years, again no real surprise as the high oil prices surely benefitted them. The revenue should stabilize moving forward. We’ll discuss their dividend payout strategy in a moment, but all the income focused investor should be worried about is “can they keep paying their dividends?” While I’d like to see this revenue growing, keeping it stable is fine for that purpose.

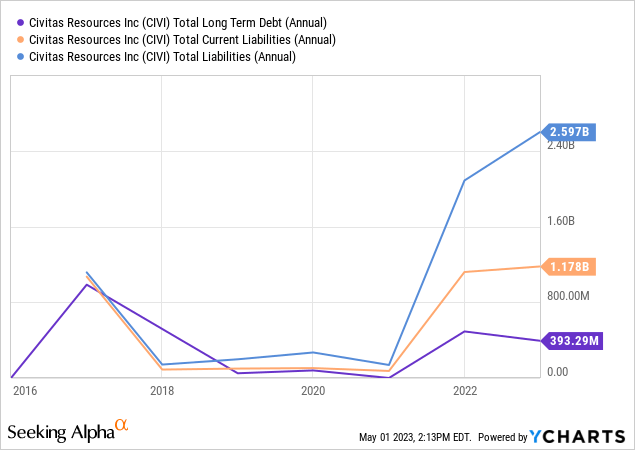

Debt

CIVI carries very little long-term debt at only $393M on their last 10-K. At first glance their current liabilities look high, but a deeper inspection provides some clarity.

Their interest payments were a paltry $32M giving us a tremendous interest coverage ratio of 74x (TTM basis). They’re more than able to service the small amount of debt they currently carry. The rest of the current liabilities are nothing to be concerned about, and only look large in relation to the total long-term debt.

This is putting CIVI in a fantastic spot in case they want to expand operational area by purchasing new land (should it come available). They would easily be able to add to this debt load in a heartbeat. There’s also the potential to acquire more synergistic businesses in the future if they had an eye toward vertical integration.

Returning Value to Shareholders

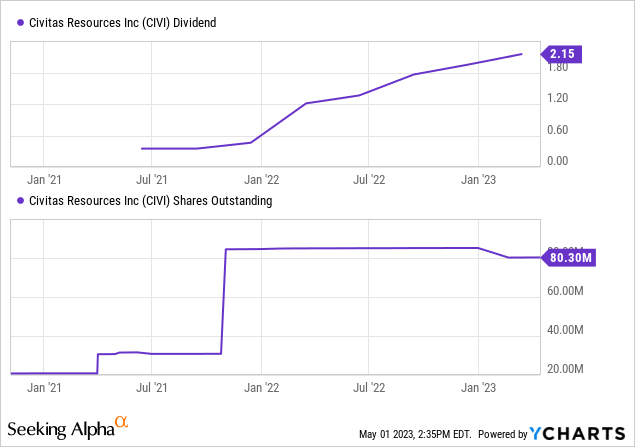

CIVI is currently paying a base dividend of $0.50/share, giving us a forward yield of 2.9%. This forward base dividend comes with only a 43.67% payout ratio, meaning that it’s extremely sustainable. But, this base dividend isn’t all people are interested in, of course.

The big news about CIVI is that variable dividend. According to their latest shareholder presentation they’re planning on returning the majority of their free cash flow in the form of variable dividends. For the FY 2022 that amounted to a blistering 9.17% yield, compared to the price today of $68.46.

Given that the returns are variable it’s impossible to predict with any certainty where they’ll be heading. However, their Q1 variable payment was the highest yet, and they estimate they’ll distribute $600M in FY 2023, vs $530M in FY 2022 (see again their shareholder presentation). Going forward analysts do estimate revenues to remain relatively flat, and they estimate their production to do the same – which in theory means the payments continue.

When CIVI bought Crestone peak they needed to raise some capital, and offering almost 60M shares was a big way they accomplished that in 2021. Due to that the share float became very diluted. Share prices rose tremendously after that purchase, and the markets pretty much ignored the share dilution. Fair enough, since the increase in revenue was enormous.

Now they’ve authorized a $1B share buyback which they’ve already started putting into effect. CIVI is flush with profit after that purchase, so it’s likely they’ll continue buybacks and they’ve stated their intentions to do so. This is a great return for shareholders and could bring additional capital appreciation over time to new buyers of the stock.

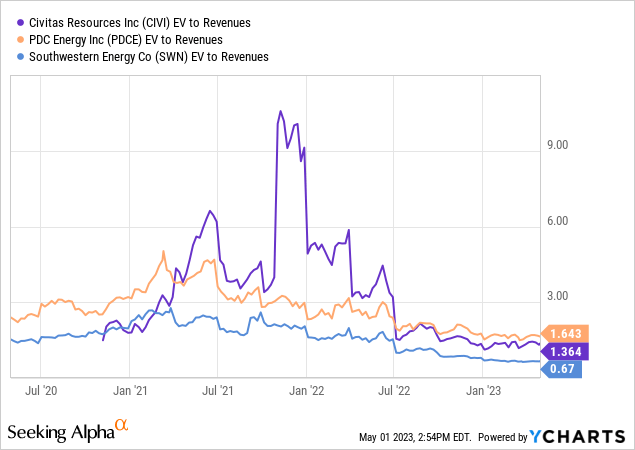

Valuation

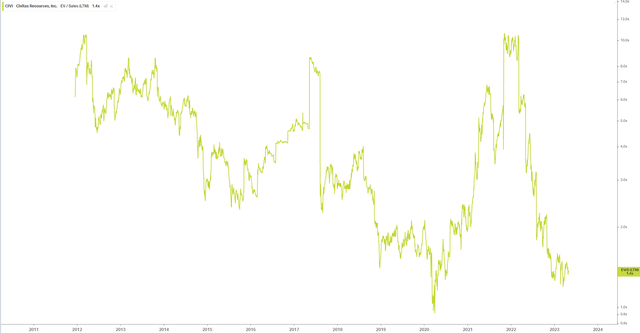

Looking at some of its peers, CIVI comes in middle of the pack currently with its EV/Sales metric. But what’s really interesting here is its historical valuation versus itself.

Look back to the purchase of Crestone Peak and we see a huge jump in valuation. Clearly it was overvalued there, which is why we can see that number dropping back down to where it is now. Let’s look at a longer timeline.

CIVI EV/Sales (Koyfin)

Now this chart gets me excited. Look at that current valuation. It’s right down near all-time lows, right where it was in COVID. Now certainly there is investor pessimism with regards to the potential future of the economy, but we can take advantage of that.

Personally I don’t believe we’re headed towards a recession, but rather the soft landing scenario. I suppose your interpretation of this section might be different depending on your personal beliefs about the topic, but to me this looks like a great opportunity to purchase a stock at a very, very nice price.

If anything this is a fair value, but in my opinion is probably undervalued due to investor pessimism towards the broader economy and not this stock in particular.

Analysis

Revenue amounts at the company have spiked since the acquisition of Crestone Peak Resources in 2021. In 2021 revenue from crude oil, natural gas, and NGL sales was around $931 million and jumped all the way up to around $3.79 billion in 2022. Civitas is dedicated to maximizing capital efficiencies as shown in the 15% year-over-year total capital expenditure decrease. With a less than 50% reinvestment rate planned for 2023, you can see the company has committed to maintaining production levels with reduced reinvestment rates. This allows the company to return more free cash flow to the shareholders.

Additionally, while other major producers in the region like Chevron and Oxy have large positions in the Permian Basin (which holds a current higher return on drilling than the DJ Basin), Civitas is the largest pure-play oil and gas producer in Colorado, with all of the company’s focus on the DJ Basin. So, while others are lagging on rig counts in the DJ Basin, Civitas is well-positioned to continue setting the standards for drilling practices in the DJ Basin. With year-over-year production expected to remain around 160 mboe/d, the company appears to be in line for continued and unhindered production in the foreseeable future.

Every oil and gas producer across the globe has put a much higher priority on safety and sustainability over the last decade or so, and rightfully so. But Civitas seems to take it to another level with a relentless commitment to sustainability and carbon neutrality across every aspect of its organization. In an age where concerns (right or wrong) over global warming have too often led to expensive and unnecessary regulation in the energy sector, companies from all parts of the supply chain have been forced to implement practices that ultimately cost the consumer more money. At this point, only time will tell what other costly regulations and restrictions might be put on fossil fuel production – which only hinders production and profitability and ultimately drives up costs for the consumer.

Civitas is doing a great job reducing its exposure to the risk associated with climate change regulation by addressing sustainability in each step of the drilling process and actively engaging in local communities before any drilling occurs. Carbon neutrality is all the rage right now and Civitas has done a fantastic job complying with and even exceeding environmental regulations. The company has essentially offset Scope I and Scope II emissions, a big deal within the oil and gas industry.

Overall, investors should be excited about healthy dividend payouts and the company’s commitment to shareholder value. Civitas has a vast amount of net acreage in one of the major shale plays in North America and production levels vs. operating costs should be attractive to investors. Additionally, the company does a good job prioritizing the use of technology for maximum production efficiency. With what seems to be an industry-leading commitment to sustainability, Civitas should also be well-averse to any risk associated with environmental regulation.

CIVI has a strong income and cashflow statement, with a decent balance sheet. There isn’t much standing in the way of them making all of those variable payments back to investors. Their valuation is also very fair, or perhaps undervalued, providing decent upside reward over the long term.

The biggest risks here are a collapse in oil prices due to economic downturn. But even a collapse in oil prices would likely only be a temporary setback, as they’re well positioned to decrease and increase production as necessary. And as we all know, the world isn’t going to stop using oil.

I’ve got to issue a strong buy recommendation here for the dividend focused investor if one needs more oil in your portfolio. I really like CIVI’s industry positioning, financials, and shareholder value return strategy.

About this article: When I research stocks I start with a “bird’s eye view” of the target company. Many of the things I went through in this article are what I’ll look at first.

When this bird’s eye view is complete, I’ll decide if I want to avoid the company for the time being or if it’s a potential candidate for investment. This article that you are reading is the result of my bird’s eye view examination. It is designed to be an overall high level view of the company that you can read to determine if this company is something that you might consider as a candidate for investment. You should not take my final conclusion on the company as your sole recommendation for investment, and you should conduct further in-depth research on your own to come to your final conclusions.

As a result of this, my “buy” recommendations come with an asterisk. And that asterisk is that this is only a high-level examination, and in-depth research that can take many hours, or days, of your time is still required. This is why my articles are short and to the point, with no fluff or filler. Just the facts that you need to know to move forward.