Allan Baxter/DigitalVision via Getty Images

In light of the banking crisis, there has been quite a bit of talk about the interaction between regional banks and commercial real estate with particular emphasis on office real estate. There are many parties here that will be hurt but also some opportunities. The key to finding which is which lies in understanding the nature of the relationship and the terms of the loans. I believe City Office REIT (NYSE:CIO) is well positioned as one of the opportunities, but let me preface the stock pitch with a hypothetical situation:

5 years ago a REIT bought an office property for $200 million, financing it with $50 million equity and $150 million debt. Office demand has dried up and the property is in an oversupplied location with widespread vacancy. The property is now estimated to be worth $50 million.

Who lost and how much?

Well, the knee jerk answer is that the REIT lost $150 million. That is just simple math of buying for $200M what is now worth $50M. However, the actual answer depends on what type of debt was used. If this was corporate level debt the REIT did indeed lose $150M, but if it is a collateralized mortgage, the REIT only lost $50M while the bank lost $100M.

How does this work?

In distressed situations, property level debt functions a bit like a put option. If the value of the collateral falls below the principal of the loan, the REIT might be wise to intentionally default so as to have the loan erased in exchange for the bank now owning the property.

So in some ways, this caps the REIT’s loss at the equity portion of the investment.

- If loan to value was 80% the REIT only loses 20% with the bank losing the rest

- If loan to value was 40% the REIT loses 60% with the bank losing the rest.

With this in mind, I think there might be some opportunities within the office carnage. In the next few years, defaults might not be bad news for the property owner. It might be an intentional give-back of the property so as to have the entire debt erased.

Let’s look at some recent real-world examples.

- Brookfield Asset Management $750 million default on a pair of 52 story towers in L.A.

- Blackstone defaulted on a $325 million loan on Hughes Center in Las Vegas.

Brookfield (BAM) and Blackstone (BX) are enormous and extremely well capitalized. They could have paid the interest on those loans and it would have just been a drop in the bucket.

This was not a default in the traditional sense. It was the real estate company actively taking advantage of the bank by forcing the bank to take a very low value property in exchange for $750 million and $325 million debt forgiveness for BAM and BX, respectively. It is totally legal and in fact it is baked into the way secured debt works.

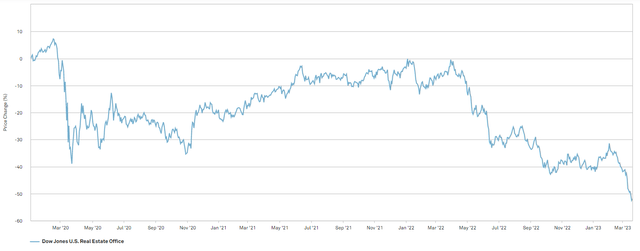

When banks are underwriting a mortgage they use actuarial models to determine what sort of loan to value is appropriate. Loan to value ratios are significantly lower today, but mortgages signed 5 to 15 years ago can have LTVs at the time of underwriting as high as 80%. The data suggested it was very unlikely office property values would fall that significantly but here we are today and the black swan event for office has occurred. The pandemic caused all sorts of disruption but certainly one of the most lasting effects is work-from-home and it has been a killer for office fundamentals. An already oversupplied asset class that was already >10% vacancy had the floor drop out from under it and who knows where vacancy will stabilize. The damage has been reflected in trading prices as office REITs have fallen more than 50% from their pre-pandemic levels.

S&P Global Market Intelligence

At a sector level I think the office selloff has been about right in terms of magnitude, but I do think company specific, and property specific details have been lost in the commotion.

Just about all office REITs have fallen in unison but there is a wide dispersion in fundamentals ranging from completely destroyed to relatively okay. There are 5 factors that significantly affect the actual burden a REIT is feeling:

- Secured debt versus unsecured debt

- Loan to value ratios

- Percentage of asset portfolio in office

- Geographic location

- Duration of debt versus duration of leases

Given the nature of this article I want to focus on LTV ratios and secured versus unsecured debt.

Put options

For REITs that have primarily secured debt, the loan to value ratio caps the downside the REIT can feel before the burden gets shifted to the bank.

City Office REIT is a great example of a company that has this sort of put option. They are in better submarkets so their occupancy is stronger than most office REITs in the first place, but what I find particularly intriguing is their debt structure.

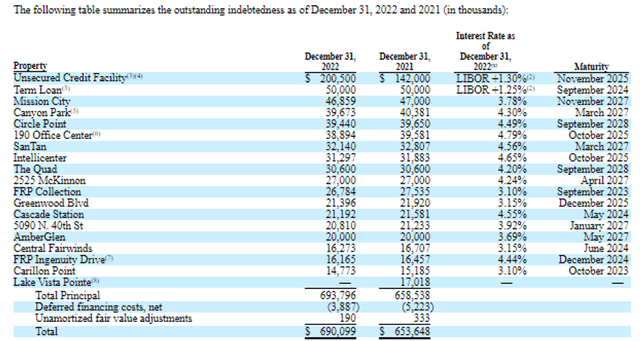

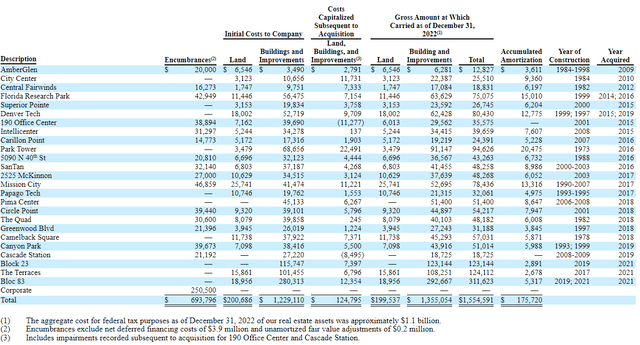

Most of CIO’s debt is mortgages tied to individual properties as per their 10-K.

10-K

This allows them to pick and choose what to do with any given property. If a particular property is performing well CIO keeps it. If a property is performing poorly they can give it to the bank and get the associated debt forgiven.

One of CIO’s properties called 190 Office Center is being given back to the lender. CEO Tony Maretic describes it on the earnings call:

“For 190 Office Center in particular, our best strategic option may be to transfer the property to the lender, given our view of the value of the asset relative to its loan balance. That would eliminate approximately $39 million of debt, and we anticipate would also have a positive impact on near-term core FFO as interest costs for that property are expected to exceed the property’s NOI.”

That is one of their more challenged properties, but I think what might surprise people is how small CIO’s actual loss is on what is essentially a failed office building. In the 10-K we can see that CIO bought the asset for $39.7 million plus $7.1 million for the land. It is financed with $39 million of debt and is currently on the books for just under $36 million.

10-K

When this is given back to the lender, CIO will get that $39 million in debt forgiveness which means their total loss is about $7 million (better than that if you factor in rent collected). That is exactly what a put option is supposed to do. It limits downside.

From a GAAP and going forward perspective it looks even more favorable. The debt forgiveness is greater than the book value of the asset which will cause CIO to record a GAAP gain of about $3 million. CIO will also gain in FFO/share as it will no longer have to pay interest or property upkeep.

Another asset to take a look at here is Amberglen. This is a well performing asset with occupancy still in the high 90s. The cool thing here though is that CIO paid just over $17 million for the asset inclusive of capex since purchase in 2009, but it has a $20 million mortgage on it. Since the asset appreciated between purchase and the signing of the mortgage CIO’s cost basis in the asset is roughly negative $3 million.

They could give the property back to the lender today and book a profit. This profit would be both real and GAAP.

However, they don’t have to. The mortgage goes through 2027 and the property is leased. CIO can put the property to the bank at any time they want. The base case is that the REIT will just keep collecting rent from the fully leased property, but if anything goes wrong they can get the clean profitable exit by handing the keys to the bank.

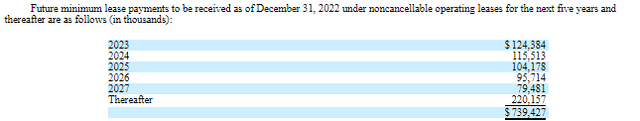

Across CIO’s total portfolio they have about $739 million in lease income that is contractually due to them.

10-K

That is quite a bit for a company with a market cap of $266 million. Of course they also have $693 million of debt and $110 million of Preferred A (CIO.PA) so the in-place income alone is not enough to pay out shareholders, but it is a great start.

With the put option embedded in the debt it is not hard to imagine a scenario in which CIO comes out far ahead of what is being priced in.

Some of the properties are well located and will perform well going forward providing continual lease income. Other properties will be given back to the lender thereby greatly reducing debt loads. My hunch is the sum of debt forgiveness plus the forward value of the performing properties is probably significantly greater than the enterprise value at which CIO is trading.

The bottom line

I remain bearish on office as the asset class is woefully oversupplied, but there are gems within the wreckage. The right property locations, debt structure, cost basis, and valuation make CIO a potential winner even in this challenged sector.