gawrav

Written by George Spritzer, co-produced by Alpha Gen Capital

(Data below is sourced from the CION Investment Corp. website unless otherwise stated.)

I recently attended the shareholder meeting of the Special Opportunities Fund (SPE). One of the shareholders asked Phil Goldstein to comment on the BDC asset class. Several BDC investments are held in the SPE portfolio. Phil said that most BDCs invest in variable rate loans and their NAVs have held up pretty well this year, in spite of the rapid rise in interest rates in 2022.

He mentioned three names where he thought the management was good and discounts to book value were attractive – Barings BDC (BBDC), CION Investment Corp. (NYSE:CION) and FS KKR (FSK). I’ve looked at these three issues and decided to write about CION in this article.

CION Investment Corp. is externally managed by its RIA and affiliate, CION Investment Management or CIM. CIM has a long track record of success in US direct lending and uses a highly selective investment process. Their targeted investment size is companies with EBITDA of $25-$75 million with an average targeted hold of $25 million.

CION Investment Strategy

Primary Investment Types

- Senior Secured Loans

- First Lien, Second Lien, Unitranche

- Equity Co-Invest

Use of Proceeds From Loans

- Growth Capital

- Acquisitions/ Leveraged buyouts

- Market or Product Expansion

- Re-financings

- Re-capitalizations

According to nasdaq.com, institutions currently own about 28% of the fund’s shares outstanding.

CION was originally non-publicly traded before it had its public IPO in October, 2021.

CION Investment Corporation to Ring Closing Bell at the New York Stock Exchange to Commemorate Its Listing

Some legacy CION shareholders have likely used the publicly traded shares as a source of liquidity which was unavailable to them before. I believe this legacy selling may have added to the large trading discount to book value for CION.

Portfolio Overview

- Total portfolio assets of $1.9 Billion invested in 119 portfolio companies.

- 92% senior secured loans. 82.9% floating rate.

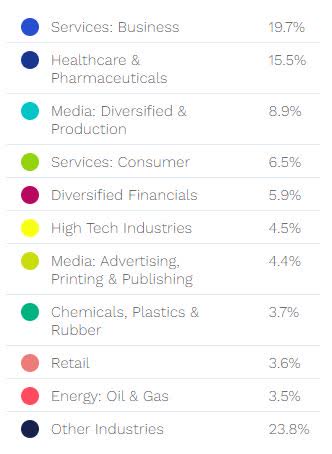

Allocation By Industry

CION Industry Breakdown (CION web site)

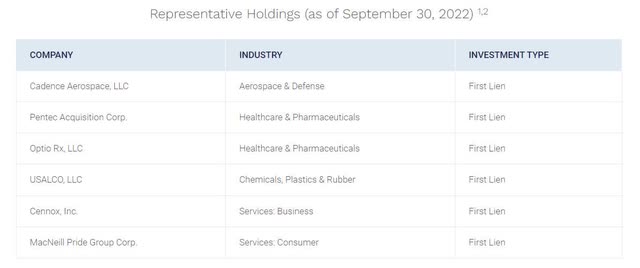

CION Representative Holdings (CION web site)

CION Distribution History

The table below shows some recent quarterly distributions plus two year-end “special” distributions paid by CION after the 1-for-2 reverse split on September 21, 2021. The ex-dividend dates are 1 business day prior to the record dates.

Note that the special cash distribution declared for 2022 of $0.27 is an increase of 35% from the special distribution of $0.20 paid for 2021.

Record Date | Payment Date | Amount |

12/30/2022 | 01/31/2023 | $0.27 (Special) |

12/01/2022 | 12/08/2021 | $0.31 |

09/01/2022 | 09/08/2022 | $0.31 |

06/01/2022 | 06/08/2022 | $0.28 |

03/23/2022 | 03/30/2022 | $0.28 |

12/01/2021 | 12/08/2021 | $0.2648 |

12/16/2021 | 12/23/2021 | $0.20 (Special) |

Share Repurchase Program

Because CION currently trades at nearly a 40% discount to book value, share repurchases are highly beneficial to shareholders. In June 2022, CION increased the amount of shares that may be repurchased by $10 million up to an aggregate of $60 million.

There was also an additional trading plan adopted to permit an affiliate of the investment advisor to repurchase shares of CION stock. This additional plan was to be established along with share purchases by senior members of the CION management team and certain independent directors.

Here are some of the recent insider trades by CION insiders:

Recent CION Insider Buys (InsiderCow)

In the first quarter of the share repurchase program, it was a little disappointing that the fund only repurchased $6.7 million of the totally authorized amount of $60 million. At the last conference call, an analyst asked if they expected to accelerate the pace from here.

Management said this is probably the pace you would expect at this time. If that is true, the fund may only repurchase about $30 million of the allowed $60 million authorization.

CION Investment Corp.

- Total Assets Investment Exposure= $1.9 Billion

- Total Liabilities= $970 Million

- Total Net Assets= $915 Million

- Leverage= 104.7%

- 92% Senior Secured Mortgage Loans

- Dividend Yield on Book Value= 7.63%

- Annual Distribution Rate= 12.34%

- Dividend Frequency= Quarterly

- Current Quarterly Distribution= $0.31 per share ($1.24 annually)

- Net Investment Income 3rd quarter 2022= $0.45

- Distribution Coverage 3rd quarter 2022= 1.45 times

- NAV on 9/30/2022= $16.26

- Price/Book Value= ~0.63

- Average 3 Mos. Daily Trading Volume= 285,000 shares

- Average 3 Mos. Daily $ Volume= $2.9 million

Sources: CION web site, Yahoo Finance

CION shares should do well over the longer term. It may pay to buy a smaller “starter” position here, and then add more shares if it dips back below the $10 level.

CION is fairly liquid and often trades over million shares a day. The bid-ask spread is usually only a penny, although it occasionally widens to two cents when markets get volatile. It is fairly easy to buy CION using smaller market orders or limit orders.

For those in a high tax bracket, it is probably best to own CION in a tax deferred retirement account. In 2021, 100% of the CION dividends were ordinary income and 85.5% was qualified distributions or QDI.