sbelov

Last year, Ciena (NYSE:CIEN) looked like it would outperform the S&P 500. Instead, it fell to close to $50. CIEN stock eventually broke out to the peak at over $78, but needed the stock market’s rally for the lift.

The optical networking firm spent much of 2022 on a downtrend. But on Dec. 8, shares rallied from ~ $43 to nearly $52 on heavy trading volume. Look at the numbers. Ciena trounced earnings per share expectations by a wide margin. Markets did not expect the firm to book revenue from its significant backlog. Furthermore, it did not appreciate that the supply chain is gradually improving.

History is repeating itself. CIEN stock is rallying back to the 200-day simple moving average. The short float against the stock is only 2.88%. Since the stock is not rising due to a short squeeze, do fundamentals support the premium valuation?

Strength From Supply Chain Improvements

In the fourth quarter, Ciena’s CEO, Gary Smith, said that the company benefited from favorable supply chain developments. It expects to report revenue growth that exceeds expectations. Ciena will benefit from a strong backlog and supply chain improvements.

Ciena posted Q4 revenue of $971.0 million and earned 39 cents a share on a GAAP basis. Revenue fell from $1.042 billion posted last year. Converged packet optical revenue fell by over $100 million. Still, the company added 15 new customers for WaveLogic 5E. It now has more than 200 global customers, having shipped over 50,000 modems to date.

In 2004, Ciena sold DSL-based solutions. Today, it scaled its business. Its switching and routing technology complement its acquisition of Benu Networks and Tibit Communications. Tibit makes a pluggable optical line terminal. The company intends to grow its fiber broadband and edge networking business with Benu.

2023 Opportunity

Ciena may expand its gross margin by varying its product mix. In 2023, Chief Financial Officer Jim Moylan said that some of its new wins will increase a shift toward line system sales. Assuming operating costs ease from the margin costs of 400 basis points it faced last year.

As mentioned previously, supply chains are improving. Ciena is getting components delivered more reliably. To mitigate unforeseen disruptions, the company sourced alternative design sources for its redesigning product activities. In addition, it is building up manufacturing capacity. This will speed up the completion of finished components and goods for Ciena’s customers.

Investors should expect adjusted EBITDA and EPS to re-accelerate in the next fiscal year. By comparison, full-year results for those line items declined.

Ciena Q4 2022

Chances are high that the supply chain is recovering. After CIEN stock rallied, markets are already pricing in a rebound in sales, as well as research and development activities.

Strong Backlog

Ciena has $4.2 billion in service and product backlog. It expects strong demand for its service business. In maintenance, deployment, and advanced services, the company expects to see stronger than average growth. Healthy advanced services should result in overall double-digit percentage growth.

Ciena said that its backlog will grow by 10% to 12% on average over the next three years. This is slightly higher than previously expected.

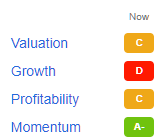

Stock Score

Ciena’s momentum score is a reflection of the recent stock price surge. It earned an A. However, profitability and valuation grades are fair. The stock scores a ‘D’ on growth.

Seeking Alpha Premium

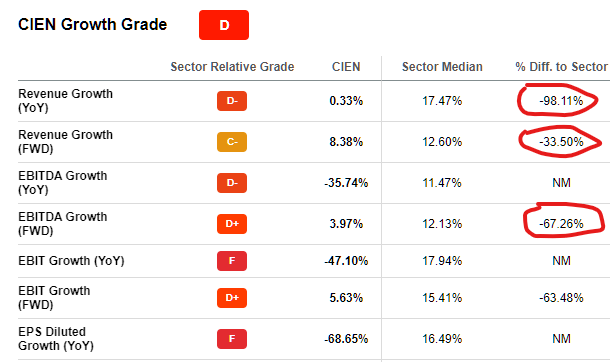

Ciena needs better revenue and EBITDA growth to earn a better growth score:

Seeking Alpha premium

The strong quarterly report suggests that its backlog drawdown will accelerate. This will increase revenue and earnings, lifting the growth score to at least a ‘B.’

Risks

Ciena is relying on the supply chain to recover. The global system is not always predictable. However, investors should assume the supply recovery in the fourth quarter continues into 2023.

Ciena worked down its backlog by $200 million to $4.2 billion. If demand increases, its backlog could grow again. This increases its lead times, frustrating customers. Fortunately, it is building redundancies in its output to ease bottlenecks.

5G is a growth area for Ciena in India. It faced some past slowdowns with mobile infrastructure suppliers. In 2023, investors should expect India’s commitment to 5G to result in growth of at least 10% to 12%.

Conclusion

Ciena’s chart shows periods of breakouts and sell-offs. The stock then trades in a tight range for months. Investors who missed the recent rally could wait for profit-takers to send the stock lower. The communications equipment firm has strong demand ahead. Customers in India and North America require Ciena’s products.

The Seeking Alpha Quant Rating remains a ‘hold.’

Current shareholders could either take profits here or keep holding. The stock trades at fair value and could move in a narrow range until its next quarterly report.