Igor Kutyaev/iStock through Getty Photographs

Thesis

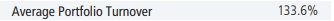

Calamos World Dynamic Revenue Fund (NASDAQ:CHW) is a closed finish fund with a broad allocation mandate. The fund can put capital to work amongst international equities, convertible bonds, fixed-income securities, and different investments because it sees match. CHW employs an energetic buying and selling technique with the annualized portfolio turnover coming in at 133.6%.

The car has a 0.58 Sharpe ratio and an 18 normal deviation (each measured on a 5-year foundation). With a 36% leverage the fund experiences deep drawdowns, with the Covid occasion exposing a -32% most draw. The present yield for the car is 9.92%, and it’s properly coated by its distribution between capital positive factors and dividend revenue.

We like CHW and its analytics, particularly in gentle of very strong long-term outcomes, with the 5- and 10-year trailing whole returns sitting at 11.7% and 10% respectively. Nonetheless, even though CHW has traditionally traded at a reduction to NAV, the fund is now buying and selling at a premium. Coupled with additional anticipated equities weak point on the again of hawkish central banks, we don’t really feel it is a good entry level for the fund. In case you are already lengthy the identify then we fee it Maintain, whereas new cash is finest suited to attend for a extra enticing entry level.

Holdings

CHW accommodates a mixture of equities, convertibles and excessive yield bonds:

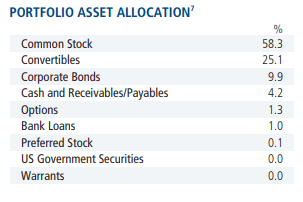

Asset Allocation (Fund Truth Sheet)

Equities at the moment account for about 58% of the portfolio, adopted by convertibles and a modest allocation of company bonds. To notice that, as per the fund’s literature CHW’s administration workforce “has most flexibility to dynamically allocate amongst equities, convertible bonds, fixed-income securities and different investments world wide.” This leads to a dynamically allotted portfolio that may change the asset allocation combine illustrated above fairly abruptly.

We are able to see the dynamic allocation/energetic portfolio buying and selling undertaken by the supervisor within the annual portfolio turnover figures:

Portfolio Turnover (Fund Truth Sheet)

This fund doesn’t exhibit deep worth purchase and maintain traits however is extra of an energetic portfolio buying and selling car.

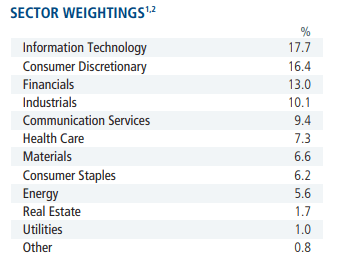

On the fairness aspect of the portfolio asset allocation, the trade sector cut up is as follows:

Sector Weightings (Fund Truth Sheet)

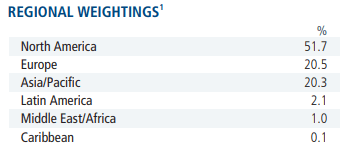

The car has a really excessive allocation to data know-how, intently adopted by client discretionary shares and financials. Many of the equities within the portfolio are North American names:

Geographic Distribution (Fund Truth Sheet)

As per the fund’s reality sheet, “By investing at the very least 40% and as much as 100% of managed belongings in international securities, together with rising markets, the fund blends international securities, endeavoring to take care of an optimum danger/reward profile.” The fund thus has a compulsory international allocation of at the very least 40%, making it a real international fund.

The present prime ten inventory holdings are as follows:

High 10 Holdings (Fund Truth Sheet)

We are able to see that about 70% of the highest holdings are constituted by frequent inventory holdings, whereas the remaining are convertibles.

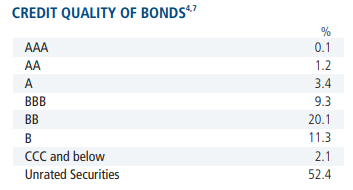

On the mounted revenue a part of the portfolio, the fund invests in excessive yield bonds:

Credit score High quality (Fund Truth Sheet)

Many of the allocation is within the BB bucket and “Unrated” part. Often, unrated bonds characterize smaller non-public placements that don’t garner a ranking company’s curiosity or have the spending energy to cowl the ranking charges. They don’t essentially characterize weaker credit, simply names which aren’t very extensively syndicated.

Efficiency

CHW is down greater than -13% year-to-date, underperforming the Vanguard Complete World Inventory Index Fund (VT):

YTD Complete Return (Looking for Alpha)

On a 5-year foundation, the fund nonetheless outperforms the index:

5-12 months Efficiency (Looking for Alpha)

We are able to see that the car not solely outperforms the index however has a big time interval when it uncovered an accelerated constructive efficiency as in comparison with the chosen benchmark. This speaks fairly properly to the administration workforce and its potential to supply alpha-generating securities.

On a 10-year time-frame, the fund and the index expose very comparable performances:

10-12 months Complete Return (Looking for Alpha)

We are able to clearly see the impact of leverage within the above graph. On the draw back transfer triggered by Covid, CHW misplaced greater than the index, whereas on the upswing it gained extra. Leverage amplifies returns each on the draw back and on the upside.

Low cost/Premium to NAV

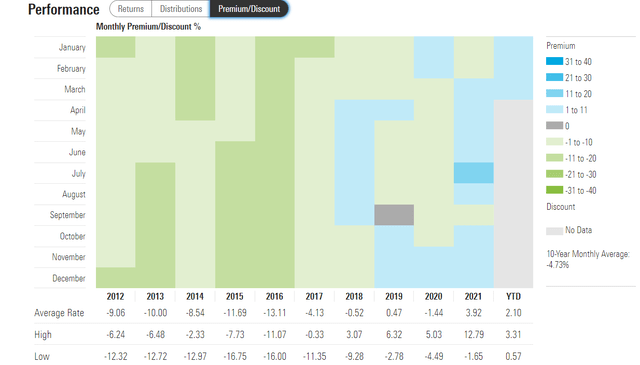

The fund normally trades at a reduction to NAV that may be fairly substantial:

Premium/Low cost (Morningstar)

We are able to see how as much as 2019 the car normally uncovered an approximate -10% low cost to NAV. With the Fed transferring charges to zero put up the Covid pandemic and traders searching for yield, CHW moved into the premium to NAV territory.

We’re stunned to see that the fund continues to be at a premium to NAV even now in 2022, regardless of the large rise in rates of interest. We count on a reversion right here.

Distributions

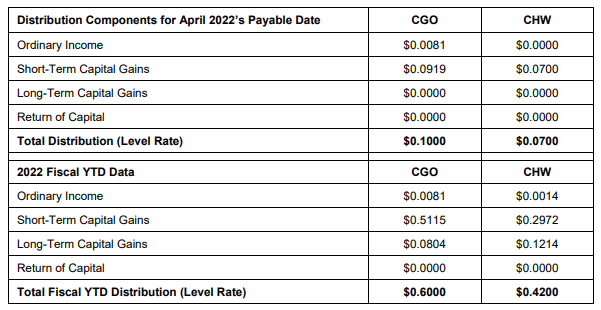

The fund does an excellent job of protecting its distributions from both capital positive factors or dividend revenue:

2022 Part 19.a Abstract (Fund Literature)

We are able to see from the above desk that particulars the April 2022 distribution composition in addition to the 2022 information that the fund covers its dividend properly from capital positive factors (i.e., an excellent efficiency) and extraordinary revenue. A excessive determine for return of capital right here could be worrisome.

Conclusion

CHW is a hybrid CEF that has each an fairness and glued revenue allocation that may range. The fund has a worldwide mandate with a 40% requirement for international securities allocation. The car at the moment allocates 60% of its funds to equities, adopted by convertibles at 25% and excessive yield bonds at 9%. CHW has very strong long-term outcomes, with the 5- and 10-year trailing whole returns sitting at 11.7% and 10%, respectively. The fund experiences deep drawdowns and has a excessive beta of 1.82.

We just like the fund and its analytics, however with CHW nonetheless buying and selling at a premium to NAV and the present fairness weak point atmosphere not a foregone transfer we really feel the identify is simply a Maintain ranking in the meanwhile with a lot better entry factors available.