imaginima

Investment Rationale

Chord Energy (NASDAQ:CHRD) is in a healthy financial position and reported strong Q32022 results. It is focused on returning value to shareholders through dividends and share repurchases. Strong oil prices are supporting the operational performance of Chord Energy. Also, its attractive valuation shows a favorable investment opportunity.

About the Company

Chord Energy

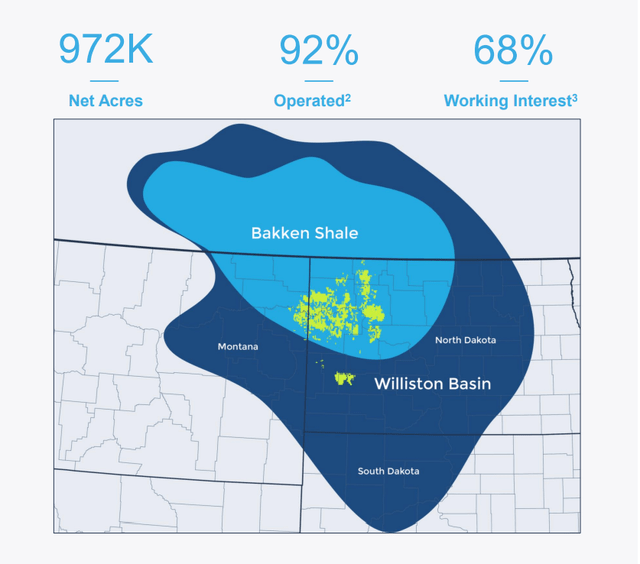

Chord Energy Corporation, headquartered in Houston, is an independent oil and gas exploration and production company. In July 2022, Whiting Petroleum Corporation and Oasis Petroleum Inc merged to form Chord Energy Corporation. The company is primarily engaged in organic drilling activity and the development of previously acquired properties. The company is a premier Williston Basin company and its crude is sold to a diverse network of refiners.

Healthy Financials

The company’s balance sheet, as on September 30, 2022, stands strong showing a cash balance of $658.85 million and a long-term debt of $393.78 million, indicating a 1.6 times coverage of debt by available cash.

In Q32022, the operating income as well as net income soared attractively. Net income included a net gain of $75.093 million on investment in an unconsolidated affiliate. This net gain was attributed to the merger of Oasis Petroleum Inc and Crestwood Equity Partners, completed in February 2022. Likewise, the total revenue got a boost due to a massive increase in oil, NGL, and gas revenues.

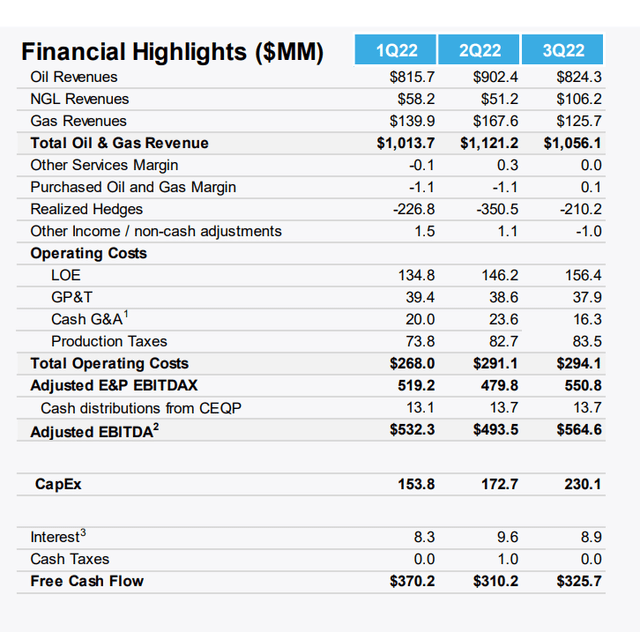

The diluted earnings per share showed an attractive increase from $3.46 to $20.45 on a YoY basis. The following table shows the financial highlights compared for the three quarters of 2022, showing a rise in adjusted EBITDA. The free cash flow number in Q32022 was hurt partially by higher capex, but was above the Q22022 number-

Chord Energy

Dividend – A Key Differentiator

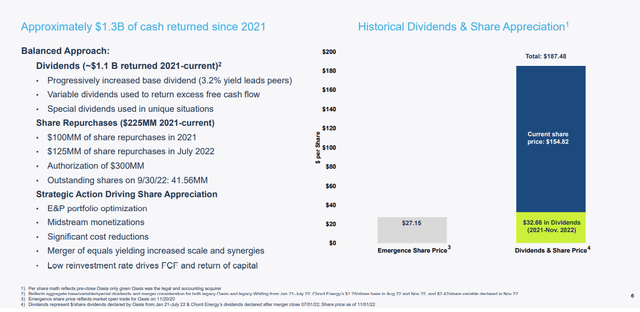

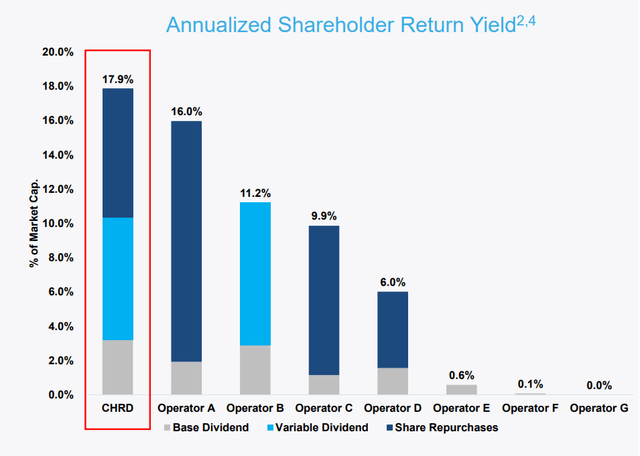

The company has an impressive history of returning capital and has returned around $1.3 billion of cash since 2021 – around $1.1 billion via dividends and $225 million via share repurchases. It uses a balanced approach which includes dividends as well as share repurchases, making it more attractive for the shareholders. The base dividend offered by the company stands at a yield of 3.2%, leading among its peers. It also pays variable dividends in case of excess free cash flows and special dividends in unique situations. In Q32022, the company repurchased approximately $125 million of shares.

Chord Energy

Chord Energy

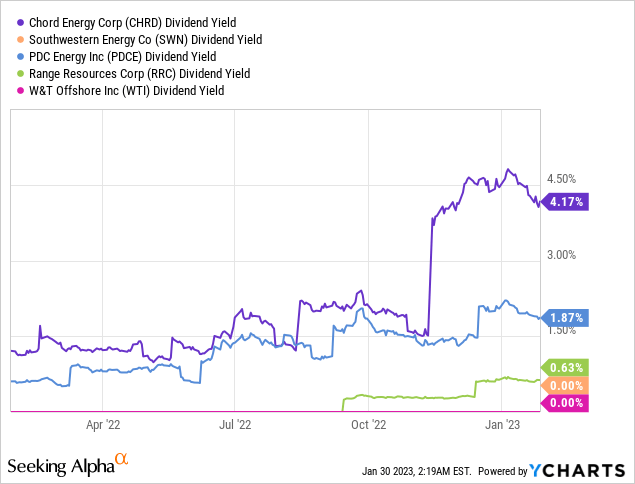

Chord Energy’s stock offers an attractive dividend yield of 4.77%. The yield is higher compared to PDC Energy (PDCE) and Range Resources (RRC), while Southwestern Energy (SWN) and W&T Offshore (WTI) don’t pay dividends right now. Along with the base dividend, the company also pays variable and special dividends. For the nine months ended September 30, 2022, the company paid a base dividend of $2.42 per share whereas a variable dividend of $5.94 per share and a special dividend of $4 per share. These dividend distributions make Chord Energy attractive for dividend investors.

Strong asset base aiding higher production

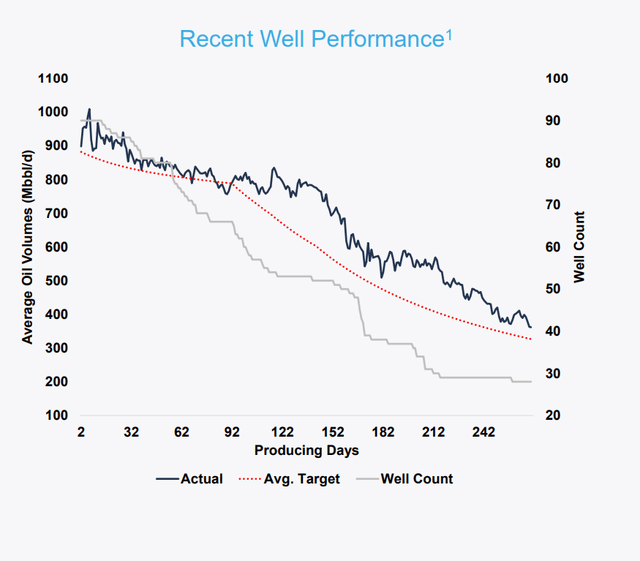

Chord Energy recorded higher volume in Q32022 producing 172.5 MBoe/d in Q32022, which was near the high-end of the guidance released in August 2022. Oil volumes of 96.2 MBoe/d also were above the mid-point of the guidance. The company was able to exceed its Q32022 guidance owing to improved well performance. The company expects the future performance of wells to be driven by long-lived inventory with low breakeven pricing, operational flexibility, and efficiency due to high scale, and a disciplined investment framework.

Chord Energy

Value Creating Expected Synergies

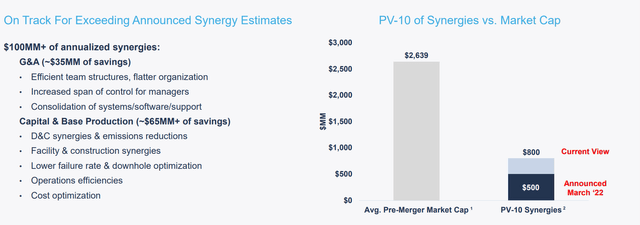

Post the merger with Whiting, Chord Energy’s expected synergies have increased from $65 million to $100 million plus. The following image highlights the company’s expectations regarding value creation through synergies –

Chord Energy

Favored among peers

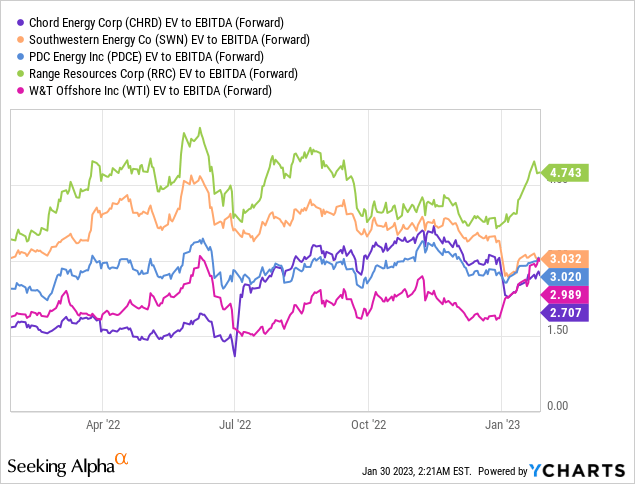

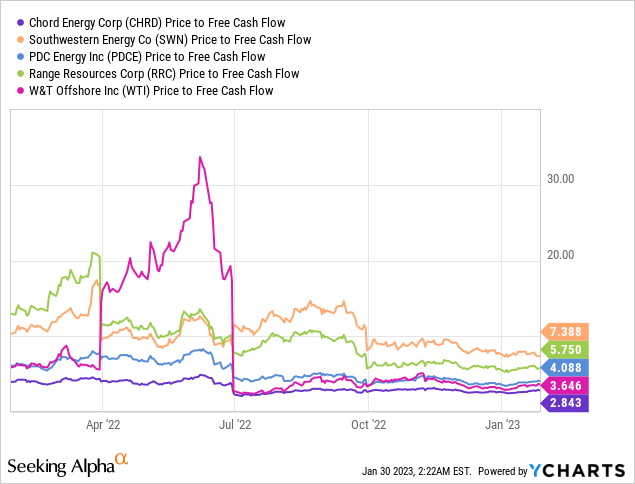

From the valuation perspective, CHRD’s stock appears to be relatively undervalued according to the forward EV to EBITDA and price to free cash flow ratios.

Seeking Alpha’s proprietary Quant Ratings rate Chord Energy as ‘hold.” It is rated high on growth but low on revisions factor.

Risks

Even if the dividends paid look attractive, it’s important to consider that Chord has been paying dividends for only two years. Considering the short span of time for dividend payments, there remains some cautiousness regarding continuity of dividends depending on the company’s future performance.

Being a crude oil and natural gas producer, Chord Energy’s profitability and growth is affected by the prevailing and future prices for crude oil and natural gas. These prices rely on numerous factors beyond the company’s control such as economic, political, and regulatory developments as well as the competitiveness of other energy sources. Energy markets tend to be volatile and crude oil and natural gas prices are prone to wide fluctuations in the future.

Conclusion

Chord Energy’s financials are in a healthy position and it is adopting a balanced approach to return value to its shareholders. The company’s robust asset base and expected synergies should create more value. Additionally, the company’s dividend payments and undervaluation of its stock compared to its peers make Chord Energy stock attractive for long-term investment.