Justin Sullivan

My Original Note: You may read or revisit that original note via the link below:

Chipotle’s Katabasis

There are a number of vantage points from which we could look at Chipotle (NYSE:CMG) and, indeed, we have looked at Chipotle from these vantage points:

- Restaurant count growth and the potential thereof

- Operating margins and their implications for long run free cash flow margin

- The quality of the culinary

- Its moats

- Its leadership

- Its CFO’s strategy

But I think discussing Chipotle’s “Katabasis,” as I call it, would be a productive use of our time together today.

Circa 2015, Chipotle experienced the “ecolapocalypse,” as I call it, which would be synonymous with Chipotle’s “Katabasis,” cited just above.

You may read about the crisis here, but suffice to say it was seen as an existential threat to Chipotle at the time.

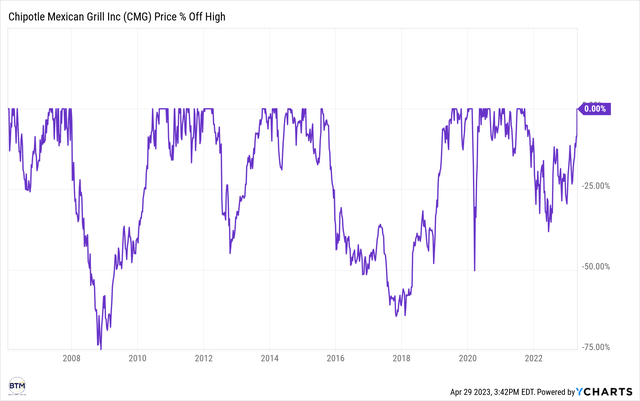

Chipotle’s 2015 Food Safety Scare (Ecolapocalypse) Spawns A 64% Share Price Decline

YCharts

It was, in a sense, Chipotle’s katabasis, from which the business has emerged over the last handful of years. (And we think it’s emerged stronger than ever, which is a key part of the katabasis experience, which I will write about further in a moment).

Let’s now consider this concept of katabasis; specifically as it relates to Chipotle, via a few perspectives:

The First Perspective: Fruitogo

One of the things that makes Chipotle really special is its operational ability to achieve tremendous throughput with unbelievable culinary and unbelievable customization. We got to nail that. And we have to nail it both on the front line and in the digital experience.

CEO Brian Niccol, Chipotle’s Q1 2023 Earnings Call

Real food and real ingredients were not popular consumer offerings prior to Chipotle.

Why was this the case? My belief is that fast food businesses avoid “real food concepts” because they are too hard, or they have been historically too hard to execute.

To highlight this idea, I’ve often shared that I plan to create the concept of Fruitogo (at some point in the decades ahead; for the fun of it purely; because I want this product! But nobody will sell it to me in my little town).

It’s “Fruit To Go”, and it would be pronounced “Froo-toe-go.” (If Google can make its name a verb via consistent, high quality search service, then so too could Fruitogo, in my mind at least!).

When I’ve pitched this business idea to others, they’ve stated universally, “Food waste would be your problem. It just seems too hard to execute when your food goes bad every 24 hours or so.”

And, of course, I agree, but I also think the persisting specter of food waste would also act as the moat.

This is sort of akin to Apple (AAPL) implementing its privacy policy, which legitimately appears to have built a greater moat for Meta (META); simply because it’s become too hard to run a social media business in our modern era and in light of Apple’s privacy policy changes.

The challenge in building the business, e.g., a new social media platform that simultaneously appeases all political factions globally + Apple, would be the moat.

The challenge in building the business, e.g., a fast food fruit concept that does not catastrophically waste fruit, would be the moat.

With respect to Chipotle, I have submitted that this dynamic is a moat that Chipotle possesses, to at least some degree, and Chipotle’s 2015 “Katabasis,” or “crisis,” or “health scare,” (all synonymous) would substantiate this line of reasoning.

I believe this above thinking is one way in which to think about Chipotle’s katabasis in 2015.

The Second Perspective: A Serendipitous Delay

Notably, had Chipotle not faltered, we would not have the ability to buy the business so early in its growth journey today and over the last year or so.

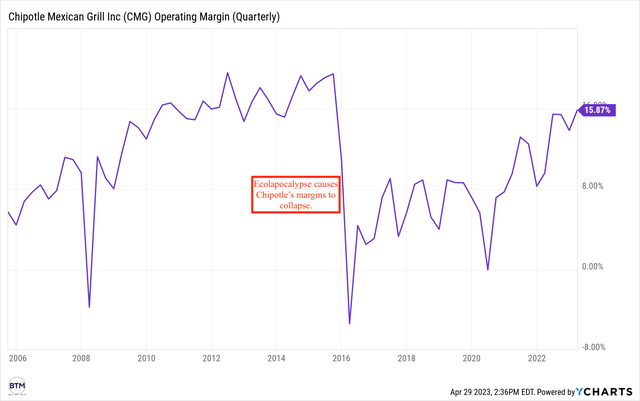

Further, Chipotle’s operating margin collapsed in the wake of the ecolapocalypse, and this has made the company seem “extra expensive” for the last 5 or so years, which has added to our ability to accumulate shares at attractive levels.

This expensiveness, in our estimation, has been illusory. Using the company’s long run free cash flow generation potential, we better understand the true pricing of the business; through this understanding, we divined throughout 2022 that the business was not nearly as expensive as it appeared on the surface.

In short, without Chipotle’s katabasis in 2015, Beating The Market would not have had nearly as much success investing in the business as we’ve had.

The Final Perspective: What Doesn’t Kill You Makes You Stronger

- UPDATE 1-Fidelity Contrafund cuts Chipotle stake by 21 percent

Interestingly, the phenomenon, in which a company or person experiences a katabasis and emerges stronger than before, appears to apply to many of America’s “truly legendary franchises.”

From Apple (AAPL) to Amazon (AMZN) to American Express (AXP) to Meta (META) to WaPo [formerly (GHC), but Mr. Bezos bought it from Mr. Buffett (BRK.B)], many of America’s best businesses experienced “collapses” of some kind, or “katabases,” if you will.

This reality is so ubiquitous that I believe it’s worth asking: Is the katabasis necessary for the business to ascend to the next level of greatness?

For those that have studied this interesting concept of katabasis, you’ll know that those that experience a katabasis are often rewarded with unique knowledge. They are often rewarded with wisdom that allows them to ascend: to experience an anabasis; or an ascent.

From Mr. Jobs being forcibly removed from Apple to American Express’ Salad Oil Scandal to WaPo’s coverage of the Nixon admin’s corruption to Musk being removed from the CEO role of PayPal (PYPL), many of America’s truly legendary enterprises and business leaders went through a katabasis that was as painful as the share prices during those periods would suggest (Apple, for instance, fell 52.9% in one day in the early 2000s. AXP fell 50% in the wake of the Salad Oil Scandal. WaPo experienced a decline of greater than 50% after it went head to head with the Nixon Administration in the early 1970s. The Founders detailed Musk’s painful journey of being removed by his peers from the CEO role at PayPal).

Again, I believe that this may be a key ingredient: a prerequisite for ascent.

We’ve detailed how Airbnb’s katabasis in 2020 begot its “Navy Seals Mindset,” and we remind ourselves of this idea each week in our Top Ideas’ one-liner for Airbnb:

Beating The Market

To close out our exercise of applying the concept of katabasis to Chipotle’s lifecycle, I believe this is an important concept to consider for each business’ journey.

Invariably, every single business on earth will face a katabasis. In some instances, it will be the business’ death knell: its nail in the proverbial coffin.

In others, I contend that the katabasis will act, at least in part, as the raw materials by which an ever stronger business materializes.

With these ideas as our platform, let’s now turn to a brief review Chipotle’s Q1 2023!

Chipotle’s Q1 2023

As we mentioned above, due to Chipotle’s katabasis circa 2015, its margins have been in a nearly decades-long state of “improving.”

We’ve read this each quarter via commentary from Chipotle such as,

- Operating margin was 15.5%, an increase from 9.4%

- Restaurant level operating margin was 25.6% 1, an increase of 490 basis points

Chipotle Q1 2023 Earnings Press Release

And below we can see the evolution of Chipotle’s margin structure:

Chipotle’s Operating Margin

YCharts

Our investment thesis for Chipotle has largely revolved around the expansion of the company’s operating margin over time, and, over the last 2-3 years, we’ve seen material expansion of the business’ operating margin.

And, of course, this margin expansion affords Chipotle the ability to expand its free cash flow margin, and, as the Beating The Market community knows well, FCF/share is the basis of all business value.

I believe it’s worth noting that Chipotle has always seemed vastly more expensive than it’s actually been, and this reality has been the result of the above-illustrated margin dynamics.

From Marqeta (MQ) to Chipotle (CMG) to AWS to Sea Ltd. (SE) to Meta, so many of our investments are “skating to where the puck will be,” from a margin perspective, and Chipotle has been no different.

In short, Chipotle’s margin expansion has been a key component of our thesis for the business, and betting on margin expansion, generally speaking, can be a fantastic way to generate exceptional returns, though, to be sure, one must be quite confident the margin expansion can/will occur.

In the case of Chipotle, we had a point of reference for its margins, but also, we’ve been monitoring the margin expanding effects of “Chipotlanes.”

So between Chipotle’s operating margin returning to its former glory and Chipotlanes actually helping to expand operating margin; possibly above former levels around 20%, there’s been a ton of support for what has appeared to be an “insanely expensive” valuation to the casual observer.

Lessons From AutoZone (AZO)

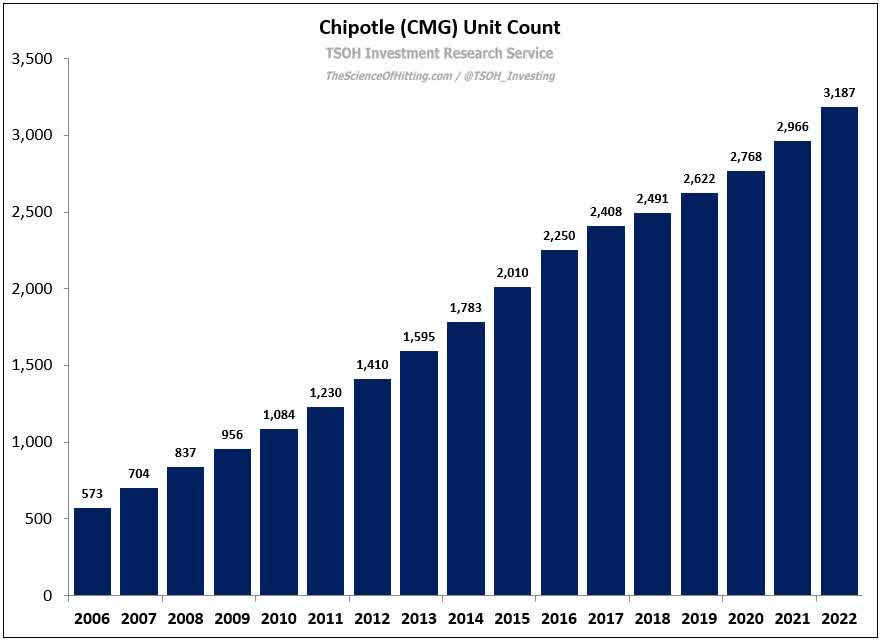

Indeed, operating margin expansion has been a key component to our thesis for Chipotle. The growth of AUV has been another component, and Chipotlanes have helped in that regard. The growth of locations has been another component.

And we’ve seen progress in each of these respects:

TSOH Investment Research

The high percentage of Chipotlanes is exciting to us, as investors, because these have higher AUV [how much a Chipotle restaurant makes] and higher margins. While I do not have access to the call’s transcripts presently (and therefore, I cannot quote), Brian Niccol stated as much on the conference call.

As you may recall from our recent Moats & Valuations Series work on Chipotle, margin expansion is absolutely central to our investment thesis for Chipotle.

So it is incredibly heartening to hear that Chipotlanes are boosting AUV and margins.

The State of our Stocks 101 (CMG)

In short, the thesis is humming along nicely, and we’re satisfied with management’s orchestration of the company’s various moving parts.

As I mention so often, Beating The Market stands on the shoulders of giants.

To this end, both AutoZone and Peter Lynch have been key resources in our determining Chipotle to be a worthy investment.

With respect to AutoZone, it is easily one of my favorite businesses of all time, and this is the case because the company has executed brilliantly over the last 20 years or so.

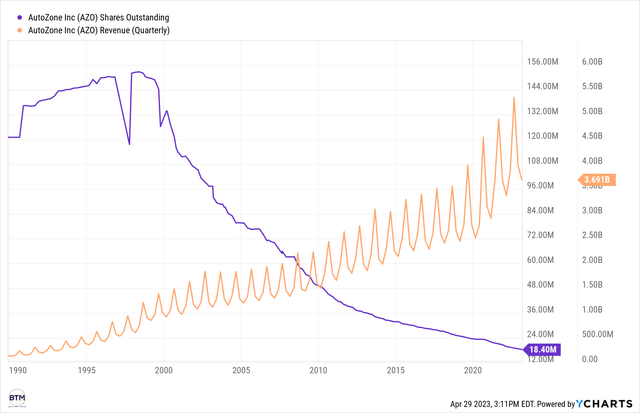

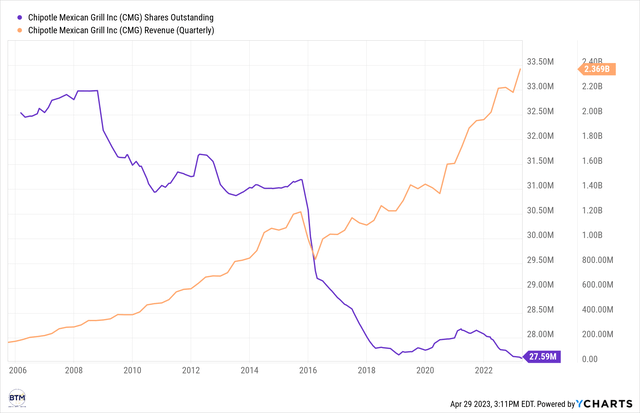

The company’s execution could be aptly characterized by Mohnish Pabrai’s investment concept of “Uber Cannibals.” This concept communicates the phenomenon in which companies aggressively repurchase their “undervalued” (hopefully!) shares. It is this phenomenon that has made AutoZone such an incredible investment over the last 20 years, and it is this phenomenon that has made Chipotle an interesting prospect for us.

That is, both AutoZone and Chipotle serve relatively simple products (burritos and car parts) in a high quality, consistent, and efficient, profitable manner. This efficiency is what affords the businesses the ability to generate robust cash from operations (and after reinvestment via capex, free cash flow).

The businesses use that cash from ops & free cash flow for two purposes:

- Sustainable, steady expansion of location count (Specifically, cash from ops would be used as capex, and, after using that cash, we’d be left with free cash flow)

- Share repurchases (Specifically, we’re using free cash flow to repurchase shares. Whatever is leftover gets placed on the balance sheet. All of this is communicated on the Cash Flow Statement, for those interested in learning more)

We’ve already covered point one in this note, and we’ve illustrated that Chipotle has been doing a good job of growing location count in a sustainable, profitable manner. This acts as a force for propelling the growth of FCF/share. Fantastic.

But, in the case of AutoZone and Chipotle, it does not stop there: These businesses use excess cash to repurchase shares outstanding, which thereby further accelerates the above-mentioned growth of FCF/share.

We can see how AutoZone has run this Uber Cannibal playbook in the chart below:

YCharts

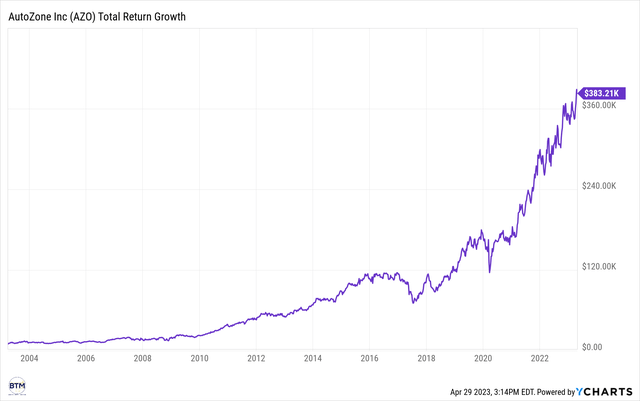

And this steady revenue growth combined with an aggressive repurchase of shares outstanding has led to returns such as:

Growth of $10k in AutoZone (Last 20 Years)

YCharts

And, of course, we’re hoping Chipotle experiences something similar, and there are early signs that it will:

YCharts

- Very importantly, we’ve been hoping for further Chipotle stock price declines, whereby the company can get more “torque,” so to speak, out of its share repurchase program. It is somewhat annoying to me to see its shares go parabolic, as we want the valuation to stay suppressed by which the company can buy back more shares; by which FCF/share grows faster; by which the share price sustainably appreciates faster; by which we “beat the market.”

A big component of our thesis for Chipotle has been the CFO’s quite apparent willingness to run this Uber Cannibal playbook, while operating the business at maximum efficiency, while also growing in a healthy, sustainable way, with an eye towards international expansion over the long run.

Concluding Thoughts: More Lessons From Car Part Companies

Somewhat related to the lessons AutoZone taught us, the Chief HR Officer of Advance Auto Parts (AAP) was recently gracious enough to sit down with the HR heads of Marqeta and Hims & Hers Health (HIMS) to share some of her wisdom in running HR at AAP throughout her tenure.

For those that own Marqeta and Hims (companies on which I have written both publicly and privately in the past; on which I remain bullish), I certainly think this video would be worth your while:

As you know by now, I believe AAP, AZO, and ORLY to be three legendary American franchises, and we’re incredibly, incredibly grateful for what they’ve given us in terms of wisdom from decades of experience/trial & error.

I recently shared some thoughts with these ideas in mind:

This is largely what’s kept us out of AZO/ORLY.

When considering investment in those businesses, it has been somewhat concerning that Teslas last so long with such little maintenance.

That said, we think those businesses are sublime, and we do hope they adapt.

That said, we’re still not buying and instead focusing on names like LULU, ABNB, and CMG.

All three of which are executing similar holistic strategies to that of AZO/ORLY.

1) Measured, though steady expansion

2) Keen focus on efficiency

3) Keen focus on aggressively repurchasing shares

And, of course, keen focus on the customers’ needs (as well as the needs the customer cannot perceive at times).

I was incredibly grateful that AAP’s HR head spent time with some of our other companies as well recently.

Elevating HR in the C-Suite Strategies for Impact and Collaboration

Full circle! I am very grateful that this panel was assembled and their dialogue published.

For those motivated enough, there is a lot to learn in studying AZO/CMG/ (LULU)/ (ABNB) through the lens of the ideas shared above.

Hopefully, these ideas reinforced your conviction in Chipotle, and, as importantly, hopefully, they provided to you a template by which you may make successful investments yourselves.

As always, thank you for allowing me to serve you in building your business of owning businesses!

![[Watch] Jonny Bairstow gets stumped in bizarre fashion [Watch] Jonny Bairstow gets stumped in bizarre fashion](https://staticc.sportskeeda.com/editor/2023/07/6ae3b-16883013198473-1920.jpg)