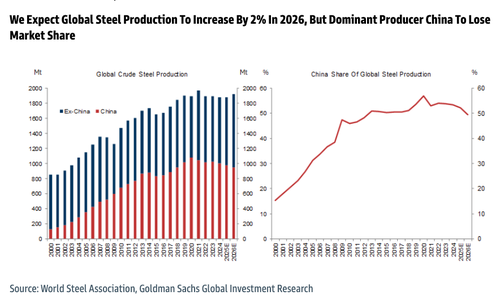

In Goldman’s newest world metal outlook, analysts Aurelia Waltham, Eoin Dinsmore, and others spotlight a key inflection level: China’s share of worldwide metal manufacturing has declined for the primary time in over 20 years, reversing a multi-decade growth interval.

“After greater than 20 years of China rising its share of worldwide metal manufacturing, we consider this structural development has now come to an finish as China’s home demand continues to falter and limitations to metal exports intensify,” Waltham and her staff wrote in a be aware printed on Friday morning.

The analysts famous that their world metal provide and demand mannequin forecasted a 3% and 4% year-over-year enhance in ex-China metal demand for 2025 and 2026, respectively. As Chinese language metal exports are anticipated to say no, ex-China crude metal manufacturing is projected to rise by 3% in 2025 and eight% in 2026.

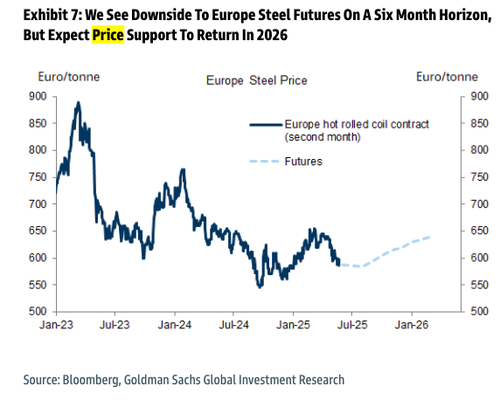

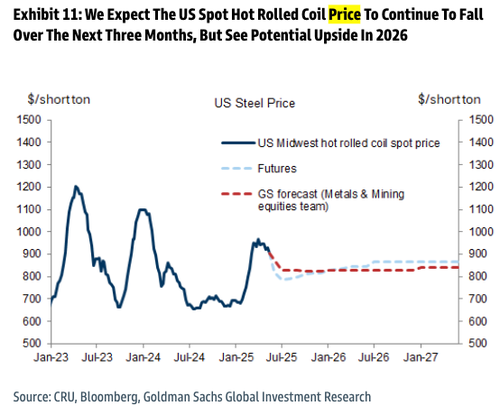

“Whereas we’re bearish on US and European metal costs on the three-to-six month horizon, we anticipate a re-acceleration in demand progress and decrease Chinese language metal exports to offer value upside in 2026,” Waltham mentioned.

They outlined the largest danger to their forecast of China dropping world market share:

We see the most important danger to our name that China will begin to lose market share of worldwide metal manufacturing to the remainder of the world over the subsequent two years being oblique[1] Chinese language metal exports persevering with to climb, pushing down remainder of world obvious metal demand. This is able to doubtless see China metal demand from the manufacturing sector exceeding our present expectations, stopping a decline in Chinese language metal output and obvious home demand, whereas on the similar time which means remainder of world metal manufacturing progress would fall beneath finish use consumption progress. Nevertheless, this could be at odds with China’s coverage to scale back metal output.

Following a 25-year growth that noticed China enhance its share of worldwide metal manufacturing from roughly 15% in 2000 to about 55% by 2020, analysts now forecast a decline to about 50% by 2026.

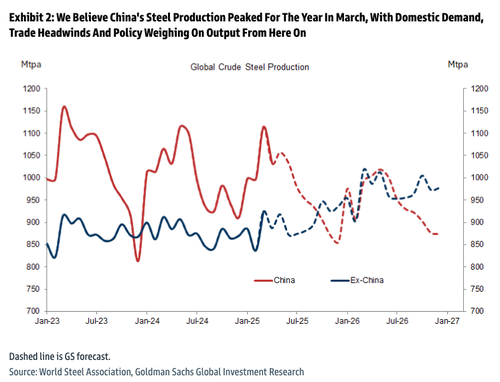

China’s metal manufacturing for 2025 already peaked in March.

Key takeaways about China’s declining affect in world metal markets:

Peak Reached: China’s metal manufacturing doubtless peaked in March 2025 and is predicted to say no by 2–3% YoY by way of 2026.

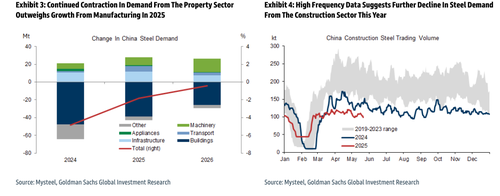

Home demand slowdown: A continued decline in development exercise, particularly new housing begins (forecasted to drop 24% in 2025), will greater than offset features from manufacturing (e.g., autos and home equipment).

Export headwinds: Chinese language completed and semi-finished metal exports are forecast to drop 33% YoY in 2026, from 12% to underneath 8% of ex-China metal consumption.

Coverage danger: If exports or output keep elevated, the Chinese language authorities might impose mandated manufacturing cuts (doubtless by way of emissions controls) in This fall 2025 to satisfy coverage targets.

China’s financial system remains to be a large number. Property sector will proceed to weigh on metal demand.

Nevertheless, the analysts view a rebound in ex-China metal:

Ex-China progress: Manufacturing outdoors China is predicted to rise 3% in 2025 and eight% in 2026, helped by recovering demand and decrease competitors from Chinese language exports.

Regional demand: Demand within the U.S., EU, and India will progressively enhance. Obvious demand outdoors China is forecast to rise 3–4% yearly into 2026.

International Metal Worth Outlook:

Close to-term weak point: U.S. and European costs face additional draw back within the subsequent 3–6 months as a consequence of lackluster demand and excessive inventories.

2026 upside: Costs are forecast to rise in 2026 as Chinese language exports fall and world demand picks up, significantly in Asia and the EU. Anti-dumping measures and commerce friction will assist include Chinese language provide overseas.

European Metal Worth Forcast

US Scorching Rolled Coil Worth Forecast

The long-standing concern over China flooding world markets with metal might lastly be easing—a shift that would pave the best way for Western producers to ramp up output. We anticipate this development can be evident in the united statesamid President Trump’s ‘America First’ period.