If the UK hadn’t been an inadvertent ‘dead cat’ hogging the market’s attention lately, we think more people would be freaking out about China. Luckily, BlackRock has us covered.

With the 20th Chinese Communist party conference now in progress, the authorities have delayed the release of third-quarter GDP data — economists think annual growth to slow to a new three-decade low of 3.3 per cent — and have clearly drawn 7.2 as the line in the sand for the renminbi-dollar exchange rate.

That may become tougher to defend, as China’s era of hypergrowth is coming to an end, according to a blog post released by Larry Fink’s vanity project BlackRock’s quasi think-tank, the BlackRock Investment Institute.

The Chinese economy grew apace in the ten years prior to the pandemic, by 7.7% on average each year. But it now faces a set of acute challenges that, in our view, mean it’s entering a stage of significantly slower growth.

. . . The big focus on Covid-related ups and downs in activity ignores another underlying issue that, we think, will significantly challenge Chinese growth next year — and beyond.

For now, Alex Brazier and Serena Jiang — a former top Bank of England staffer and a BlackRock economist respectively — expects China’s economy to grow by about 3 per cent this year, because of the country’s zero-Covid policy and fading demand for goods that it produces.

After exports rocketed 10 per cent both in 2020 and 2021 as people splurged out on new TVs, washing machines and other goods largely manufactured in China, BlackRock thinks exports will actually shrink by 6 per cent a year over 2022 and 2023.

The implications for the renminbi are serious. Coupled with higher US interest rates, this “would ultimately warrant a depreciation of twice that seen this year”, BlackRock said in the report. However, this could ramp up the pain for Chinese companies that have borrowed in dollars and stir financial stability concerns.

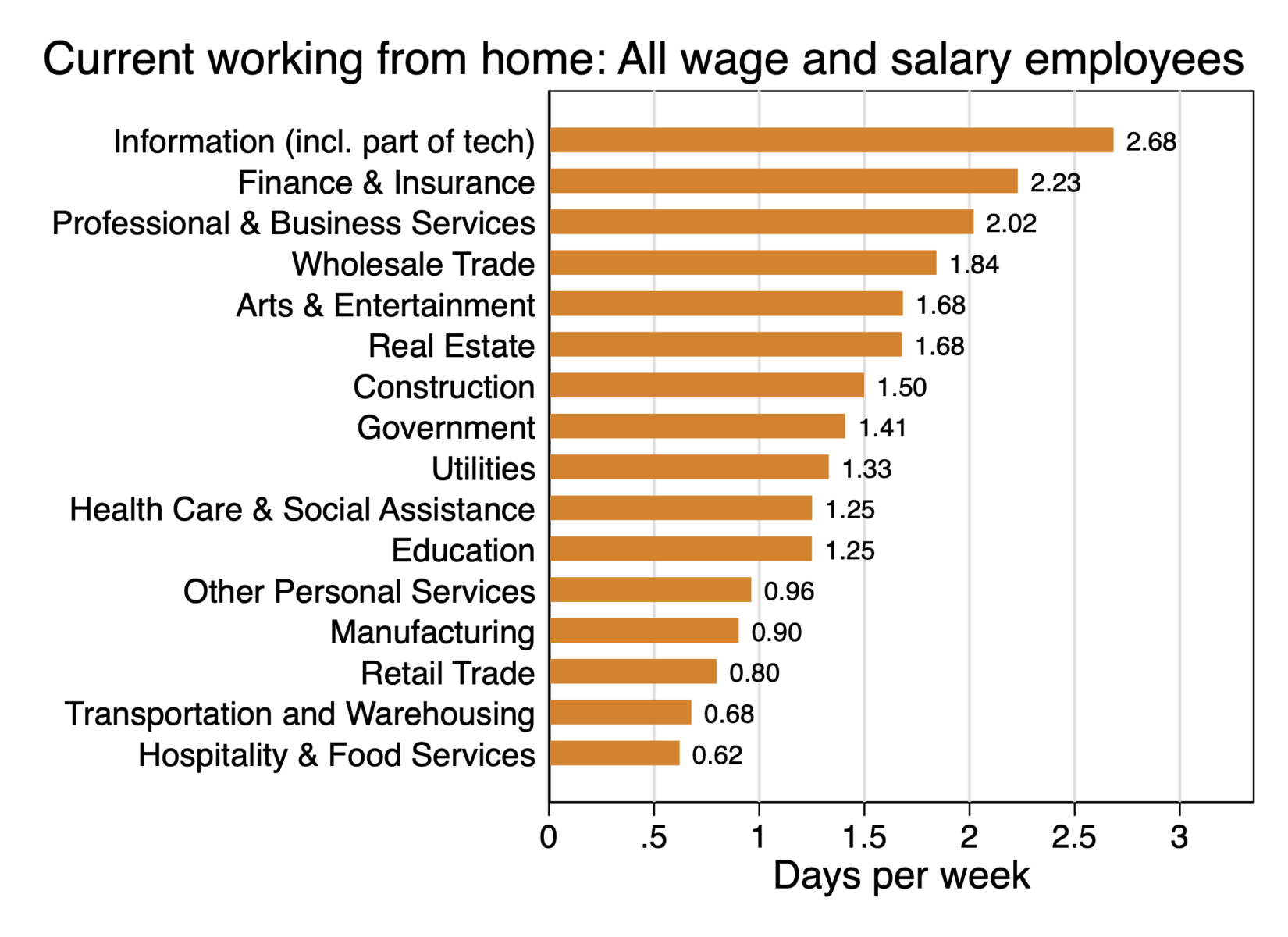

However, a 3 per cent growth rate might be the new normal. Brazier and Jiang argue that longer-term picture is that China’s potential pace of economic growth has fallen significantly, mostly because of an ageing work force. Our emphasis below.

Covid controls are reducing potential output today. While they might be eased, we still think the potential growth rate of the Chinese economy might have fallen below 5% and could fall further to around 3% by the turn of the decade. Why? Most importantly, the working age population, having grown rapidly, is now shrinking . . . Fewer workers mean the economy cannot produce as much without generating inflation, unless productivity growth accelerates. But we think international trade and tech restrictions, as well as tighter regulations on companies operating in China, will dampen productivity growth.

Here’s a chart showing the contracting work force.

Given how essential China’s rampant growth has been to the global economy — remember when Jim O’Neil was telling everyone that would listen that China was adding the equivalent of a Greece every 11 weeks? — the wider implications are . . . not great.

In the past, when countries faced a slowdown, they could still rely on Chinese consumers and companies to buy up their cars, chemicals, machinery, fuel — even as consumers at home tightened their belts. And they could rely on China to continue supplying an abundance of cheap products as China’s rapidly growing working population enabled it to keep production costs low.

Not so anymore. Recession is looming now for the US, UK and Europe. But this time, China won’t be coming to its own, or anyone else’s, rescue.