It’s not always easy investing in the face of global uncertainty. Speculation about China is rising as its economy slows. Should that continue, officials worry that the world’s second-largest economy could become unstable.

And although the Chinese government is taking steps to boost the economy, those efforts aren’t working.

China’s economy grew 5.2% in 2023. But according to news reports:

…The recovery was far shakier than many analysts and investors expected, with a deepening property crisis, mounting deflationary risks and tepid demand casting a pall over the outlook for this year. (Reuters)

The government is also trying to stop the decline in the stock market, which is nearly 50% below its 2015 high.

As you can see by the falling Shanghai Composite Index below, these efforts are also faring poorly.

Some analysts speculate that the government’s failing efforts make an invasion of Taiwan more likely. After all, war distracts the public and can boost economic growth.

Facing China’s Economy (and an Uncertain Future)

China could start with a naval blockade. After weakening Taiwan, marines would storm the beaches.

However, I doubt that will happen. Landing a force on well-protected beaches is a challenge. Besides, China doesn’t want a ground war.

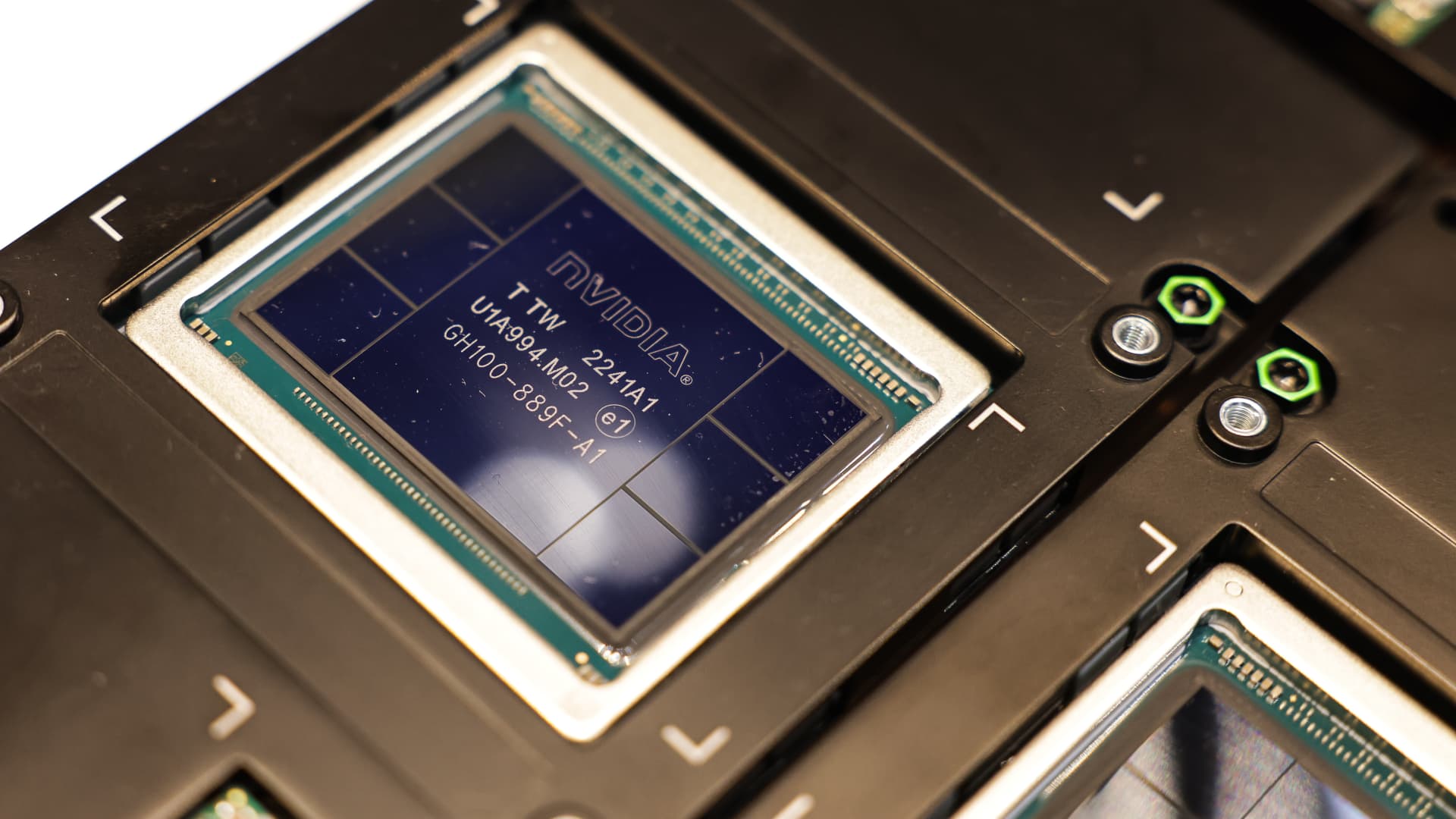

Dropping bombs and fighting on the ground risks destroying economic assets like chip fabrication plants. Benefitting from Taiwan’s growth would be one of the goals of an invasion. That means China will take steps to limit the damage.

Instead of using marines, China may unleash high-tech warriors. It could shut down power grids or communications networks. This would preserve the assets China wants.

This is a different way of thinking about war, and approaching any conflict from a new angle is vital. Even with new weapons, it’s impossible to win the next war using the same tactics that worked in the previous one.

Investors need to think like those generals planning for an uncertain future. Unfortunately, only a few do.

The thing is, investors tend to lock onto past successes. They mimic the techniques of investment legends … and they almost always fail to duplicate their success.

Keep in mind that those legends found unique ways to beat the market. Those tools were new ideas at the time.

So to beat tomorrow’s market, we need ideas that are new now. One such tool is time…

Leveraging the Power of Seasonality

Many don’t think of time as an investment tool. But the truth is, many stocks do better at different times of the year.

Retailers, for example, tend to get a large proportion of their sales in just a few months near the end of the year. Their stocks tend to reflect this pattern.

In the short run, seasonality is a market beater.

Seasonality is the idea that stocks do well at certain times of the year. For example, tech stocks often do well in the summer while other stocks underperform.

While we have many ways to identify seasonal trends, just like with tech stocks in the summer, the reasons aren’t always readily evident. Buying stocks without a clear understanding of why can be risky.

So to reduce the risk of seasonality, we can look at confirming factors. This way, we’re armed with a couple of reasons to confidently enter a stock.

Following this approach, I designed my Apex Alert system to only find trades with the highest probability for profits. It relies on two powerful techniques to find the right stock at the right time — seasonality combined with Adam O’Dell’s Green Zone Power Ratings system.

Simply put, I use seasonals to find the ideal time to buy into the top sector. Then, I use the Green Zone Power Ratings to uncover the best-performing stock to enter.

It’s a unique way of capturing steady winners in our current market environment, and the results have proven to be nothing short of amazing.

Backtesting shows that all trades from our Apex Profit Calendar would have delivered an annualized gain of 64% (while the broad market made a mere 11% annualized gain).

And real-time performance is reflecting our backtests.

Since the launch of strategy, every closed position has delivered profits, rewarding those following the strategy with a 100% win rate so far.

The best part is that we’re just getting started. There are more than a dozen annual trades like these already lined up thanks to seasonality. And now is the perfect time to take advantage of these signals.

This week, I already recommended closing our fifth winner for the strategy with another one likely to be secured tomorrow.

Get the full details of my cutting-edge seasonality strategy and see how to capture my next Apex Alert signal by clicking here.

Regards,

Michael Carr

Editor, Precision Profits