For Anna Li, this year has been the worst she can remember for finding a job in China — harder even than during the pandemic.

“I’ve been applying for jobs for half a year. I’m really exhausted but I’ve not received an offer yet,” the 25-year-old graduate in the country’s wealthy eastern Shandong province said, adding that even if she did land a position, salaries for office jobs were often unlivable.

Five years ago, China’s economy was growing fast enough that many graduates were able to snap up good jobs. Now, their prospects are less certain, as the country’s economic recovery is failing to pick up pace six months after authorities began to roll back President Xi Jinping’s tough zero-Covid regime.

Industrial production and profits, property sales and credit growth have all fallen short of analysts’ projections in April and early May, recent data showed, sapping confidence in the growth prospects for the world’s second-largest economy.

The slowing momentum has already dented markets, with the price of commodities such as copper and iron ore falling, stocks down and the renminbi weakening to more than seven to the dollar. Consumer spending, which initially jumped after the Covid-19 controls were eased at the beginning of the year, has also fallen back on a gloomy economic outlook.

“Confidence is a big problem,” said Hui Shan, chief China economist at Goldman Sachs. “For consumers, there are concerns about the future — you don’t really want to spend. Private investment is also very weak. You talk to entrepreneurs, there is still a reluctance to engage.”

The tremors come just months after Chinese policymakers adopted a conciliatory tone in hopes of bolstering business confidence to restart the country’s economic engine as it emerged from three years of pandemic restrictions that stifled activity.

They also unveiled a cautious growth forecast following a disappointing performance last year, when the economy grew just 3 per cent, the lowest mark in decades, as it was stricken by sporadic lockdowns, a property market collapse and travel curbs. This year started off on a stronger track, with gross domestic product expanding 4.5 per cent in the three months to March on booming exports and retail sales.

But in recent weeks the outlook has weakened, with the property market in particular showing signs of fragility. Sales fell to 63 per cent of their 2019 levels in April, down from 95 per cent in March, research firm Gavekal said.

The property woes have spilled over to industrial production, which declined in April relative to the seasonally adjusted 2019 figures as demand for cement, glass and other goods fell. Household consumption, one of the main intended drivers of the recovery, also lost ground.

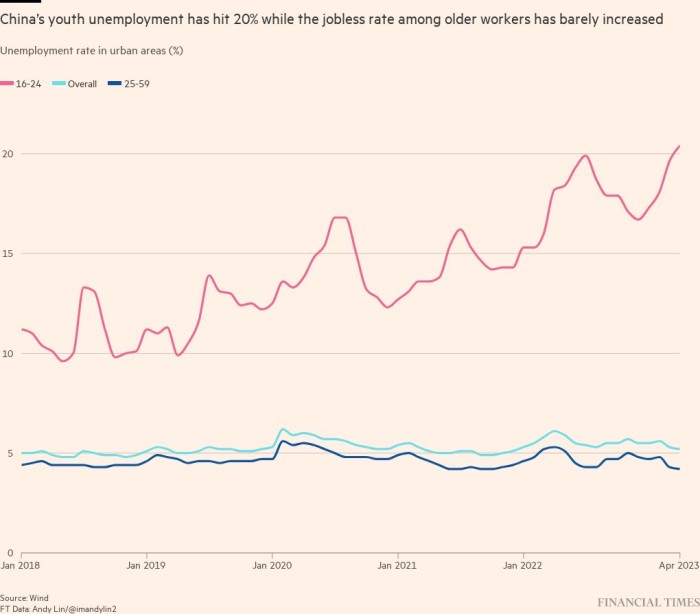

The flagging momentum has driven up youth unemployment, which hit a record of 20.4 per cent last month.

But while youth joblessness has become the poster child for China’s economic woes, the picture in the broader labour market is more nuanced, economists said.

The headline unemployment rate actually declined to 5.2 per cent in April, with employment among migrant workers, who staff China’s factories, up 3.1 per cent on pre-Covid levels in the first quarter, according to Citi.

With the wider job market strengthening, there was still hope that consumption and real estate would find their feet in the coming months, some analysts said.

“The consumption-recovery engine is intact: a tightening labour market will eventually push up incomes and lead to more household consumption in the coming quarters,” said Gavekal.

For Chinese policymakers, the question is whether recent sluggishness is a “hiccup” or if the government will need to step in with more support, said Robin Xing, chief China economist at Morgan Stanley.

Xing said officials would wait to monitor factory activity over the next two months before making a decision. Stimulus measures could take the form of targeted subsidies for vehicle purchases, relaxations of restrictions on property purchases and funding for infrastructure projects.

Beijing’s full-year growth target of 5 per cent for 2023 should still be achievable, given the low base from last year, when authorities shut down Shanghai, China’s biggest city, and other metropolises for months on end, experts forecast.

The government will not let growth decline below that level, which would boost longer-term unemployment and risk causing social problems, according to Xing at Morgan Stanley. “Social stability is the hard constraint,” he said.

Whatever the policy direction, for China’s youth, this year looks bleak. Changes in the government’s priorities, such as a shift towards engineering and electronic hardware manufacturing and away from finance and internet platforms, have already altered the labour market and left many graduates flat-footed, analysts said.

Christina Liu, a student in her 20s from the southern province of Hunan, decided to pursue a PhD after she was unable to find work following her master’s degree. She is studying in Hong Kong but said many of her friends were either struggling to find work or change jobs.

“Some of them wanted to resign but they don’t really dare to do that without another job already lined up,” Liu said.

Additional reporting by Wang Xueqiao in Shanghai