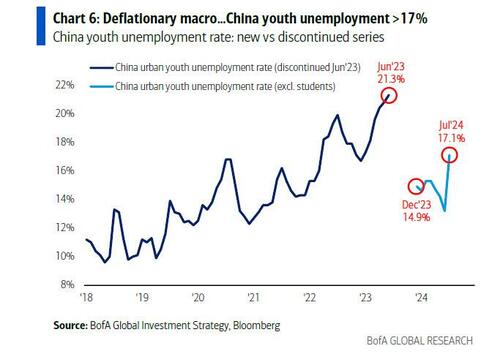

A number of weeks in the past, we warned that the whole Chinese language experiment was on the snapping point as a result of whereas on one hand the welfare state was crumbling on account of Beijing’s cussed insistence to not stimulate the financial system at any value (usually, it might be admirable to be so stubbornly insistent on austerity however when austerity threatens social collapse, it could be time to reassess), this was accentuated by an explosion in social unrest as youth unemployment soared, and employee strikes surged throughout the nation.

Whereas we detailed the varied causes that had pushed China to the sting of the abyss, one part was particularly notable: our preview of what was the logical subsequent step in China’s belt-tightening methods – elevating the retirement age – and the apparent blowback storm it might generate.

In a key socioeconomic planning assembly concluded final month, the federal government vowed to enhance the social safety system by addressing the restrictions confronted by migration staff. In response to the nation’s getting old inhabitants, it added that the statutory retirement age — presently 60 years for males and between 50 and 55 for ladies — could be raised steadily and voluntarily.

To this we added that there’s, in fact, zero historic report of a “centrally-planned civilization that has managed to boost the retirement age both “voluntarily” and with out clashes, violence, and collapse in social cohesion, exactly the three issues that Beijing fears essentially the most.”

We concluded by quoting Yun Zhou, a social demographer and household sociologist on the College of Michigan, who warned that “for China’s city staff, the speak of elevating retirement ages is felt as a delayed, if not damaged, promise of social welfare protection” to which we counteded:

Which is exactly why Beijing may have no alternative however to blink in the long run, and that may imply unleashing a a lot delayed stimulus bazooka that likes of which haven’t been seen but.

Quick-forward to at the moment, when Beijing did simply as we anticipated it might and, in a final ditch try to delay the “stimulus bazooka”, introduced it might increase the retirement age for the primary time since 1978, a transfer that may assist stem a speedy decline within the labor drive however threat angering staff already wrestling with a slowing financial system.

Prime lawmakers endorsed a plan to delay retirement for workers by so long as 5 years, Xinhua Information Company reported Friday. Males will retire at 63 as an alternative of 60. Ladies will retire at 55 as an alternative of fifty for atypical staff, and 58 as an alternative of 55 for these in administration positions. Come to think about it, it’s completely insane that in China 50 is the retirement age for ladies. However now that China has lastly discovered the brutal actuality of its demographic implosion, the cash printer comes subsequent.

The retirement change will happen over 15 years beginning January, and can permit extra individuals to work longer. This might increase productiveness to handle the challenges of an getting old inhabitants, though it’s more likely that each one at the moment’s resolution will do is spark public anger, and add to the ire from an financial system rising on the worst tempo in 5 quarters.

“The timeline of elevating the retirement age is fairly gradual. Policymakers most likely have taken under consideration the potential detrimental impression and calibrated that rigorously,” mentioned Michelle Lam, China economist at Societe Generale. Truly sorry Michelle, however no one in Beijing has calibrated something as the approaching violence will exhibit.

Shares of corporations offering well being and aged care jumped, with Shanghai Everjoy Well being rising by the each day restrict of 10%. Chalkis Well being Trade and Youngy Well being each gained greater than 6%.

“Folks could face extra well being issues if the retirement age is raised. And the stress of supporting dad and mom could require extra aged care establishments to share the burden,” mentioned Shen Meng

China’s retirement age had been among the many world’s lowest – even under that of socialist paradise France – regardless of considerably elevated life expectancy over the a long time. A much bigger tax base and delayed entry to advantages will relieve the stress on the federal government to fund pensions because the aged inhabitants quickly expands.

The retirement age hike is geared toward “adapting to the brand new scenario of demographic improvement in China, and absolutely creating and using human sources,” in keeping with the choice by the Standing Committee of the Nationwide Folks’s Congress.

The approval adopted the beforehand reported July announcement by the ruling Communist Occasion that the retirement age will rise in a “voluntary, versatile method.” Versatile? Perhaps. Voluntary? No likelihood in hell: earlier efforts to boost the brink had failed within the face of public opposition.

The Friday resolution left numerous individuals fuming over working into an older age, in addition to those that concern larger competitors within the job market.

“Are you asking me, after I’m 60, to compete with younger individuals for jobs?” a Weibo person mentioned on the X-like social media platform, the place the information was the highest trending merchandise and garnered greater than 530 million views as of Friday afternoon.

Some additionally complained about employers’ discrimination in opposition to older job candidates, an issue that the federal government has lengthy vowed to handle. Authorities acknowledged the potential short-term stress on the job market at a press briefing on Friday. Li Zhong, vice minister on the Ministry of Human Sources and Social Safety, mentioned the gradual tempo of the change ought to result in a “muted” impact on youth employment, which as everybody is aware of China stopped reporting final 12 months, solely to switch it with a brand new, “revised” knowledge collection… which additionally simply hit a report excessive.

Simply to ensure the outraged staff are even angrier, China’s high legislative physique additionally dominated that beginning 2030, staff might want to contribute to their pension accounts for an extended interval earlier than they’re eligible to obtain payout. This requirement will improve steadily from 15 to twenty years, Bloomberg reported.

“The sustainability of the pension system could also be the principle consideration behind the transfer,” mentioned Ding Shuang, chief economist for Higher China and North Asia at Customary Chartered. “Though the transfer will improve stress for the job market, in the long run it helps mitigate the impression from declines within the working-age inhabitants.”

Including insult to harm, lawmakers additionally referred to as on officers to actively reply to the getting old inhabitants, shield staff’ rights and enhance aged care. Moreover, it empowered the State Council, China’s cupboard, to regulate these measures as wanted.

In different phrases, completely nothing will occur, apart from much more authorities staff being thrown at an unsolvable downside, and much more corruption.

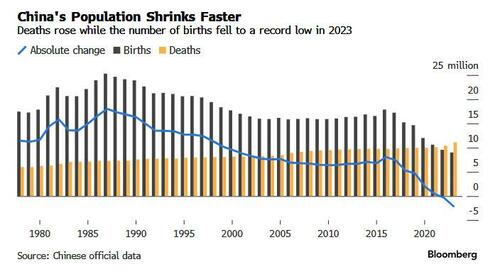

As China’s life expectancy has risen, delaying retirement has grow to be extra essential to offset the demographic challenges from its decades-long enforcement of a one-child coverage, which left a technology of single kids supporting a big aged inhabitants. Right now, the typical Chinese language lives to 78 from 66 4 a long time in the past.

Folks aged 65 and older are anticipated to make up 30% of the inhabitants by round 2035 from 14.2% in 2021, in keeping with a report by state broadcaster CCTV on Tuesday. Authorities’ efforts to encourage births have up to now accomplished little to reverse the demographic shift, with beginning fee falling to a report final 12 months.

“Once I was born they mentioned there have been too many. Once I gave beginning they mentioned there have been too few. Once I needed to work they mentioned I used to be too previous. And after I retire they are saying I’m too younger,” one other Weibo person mentioned.